Being Too Conservative Can Be a Risky Strategy

It is generally accepted that when it comes to investing, there is a relationship between risk and returns. When done intelligently, increasing portfolio risk provides a corresponding increase to expected return. Conversely, by accepting a lower expected return, an investor can reduce their investment risk. By combining a risky asset class (stocks) that carry a high expected return, with lower risk assets like cash and bonds, investors can position themselves on the risk-return spectrum where they feel most comfortable.

The link between risk and return tends to break down at the extremes. On one hand, investors could take large and imprudent risks that are unlikely to be rewarded. On the other hand, they could become so conservative in their investments that they inadvertently amplify a different type of risk within their portfolio. The latter scenario is the focus of this post.

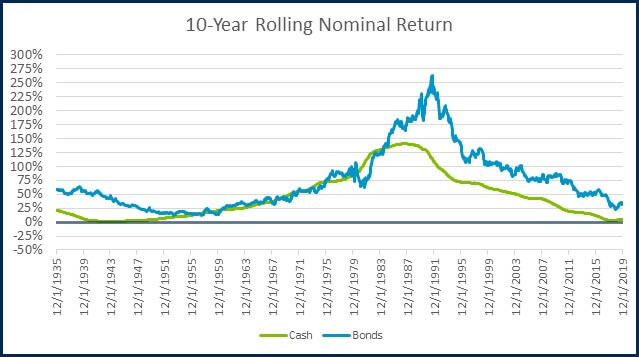

The primary goal of a typical conservative investor is the preservation of capital. They are willing to accept a low expected return to avoid losses. To do this, they may eliminate riskier assets (like stocks) altogether. The chart below illustrates the efficacy of this approach. Going back to the 1920s, there has never been a ten year period where a portfolio of cash investments or bonds have experienced a decline.

Source: Morningstar Direct. Analysis form 1/1/1926 – 12/31/2019. Includes all 10-year periods using monthly returns. “Rolling” means all 10 year periods calculated in 120 month increments. Returns are annualized. Cash is represented by the IA SBBI US 30 Day T-bill TR USD Index, bonds represented by the IA SBBI US IT Govt TR USD Index.

This may appear to be a slam dunk, but the simple analysis is omitting a critical factor: inflation. Inflation measures the rate of price change for a basket of goods and services over time. Historically, inflation has been positive, meaning prices tend to rise over time. The portfolio’s dollar value is, therefore, only half the equation, the future cost of goods and services is equally important. For long term investors, what really matters is the preservation of buying power, NOT the preservation of capital.

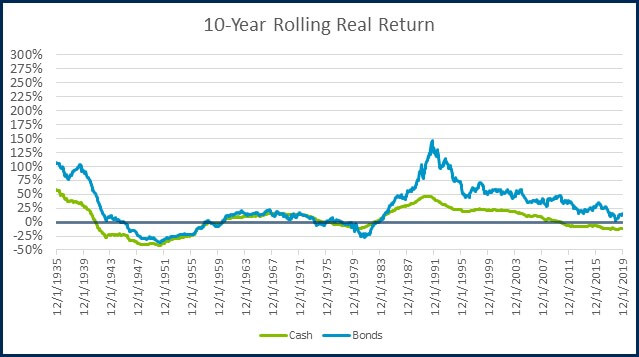

This reality raises the bar for what a conservative portfolio must accomplish. Instead of merely staying above a 0.0% return, it needs to remain above the rate of inflation. The previous rolling return chart can be revised to include the impact of inflation. Doing this transforms the nominal (non-adjusted) returns into real (inflation-adjusted) returns. While conservative investments like cash and bonds stayed positive in nominal terms, the chart below illustrates that there have been long periods of time where they have lagged inflation - the result: a decline in purchasing power.

Source: Morningstar Direct. Analysis form 1/1/1926 – 12/31/2019. Includes all 10-year periods using monthly returns. “Rolling” means all 10 year periods calculated in 120 month increments. Returns are annualized and inflation-adjusted (real). Cash is represented by the IA SBBI US 30 Day T-bill Inf Adj TR USD Index, bonds represented by the IA SBBI US IT Govt Infl Adj TR USD Index.

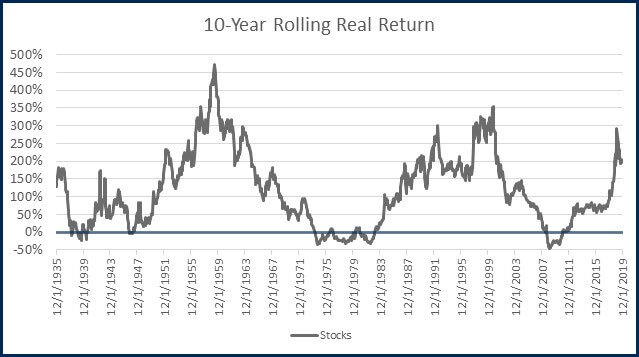

These drawdowns in purchasing power are pretty dramatic, even when compared to an all stock portfolio. The worst 10-year period for cash investments saw a decline in purchasing power of 42.1%! Meanwhile, bonds logged a decline of 36.5% in their worst period. That is a devastating outcome for an investor who thinks they are in a low-risk strategy. The worst 10-year period for an all stock portfolio saw a decline of 45.3%, just a touch worse than cash!

Source: Morningstar Direct. Analysis form 1/1/1926 – 12/31/2019. Includes all 10-year periods using monthly returns. “Rolling” means all 10 year periods calculated in 120 month increments. Returns are annualized and inflation-adjusted (real). Stocks are represented by the IA SBBI US Large Stock Inf Adj TR USD Ext Index.

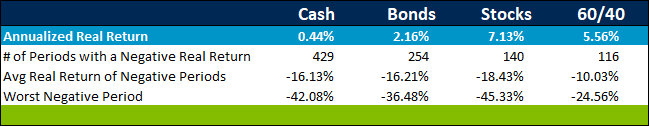

Not only were the declines for cash investments and bonds surprisingly high, they were also relatively more frequent. Of the roughly 1,000 ten-year rolling return periods in the analysis, stocks declined 140 times. Bonds declined nearly twice as frequently (254), while cash declined more than three times more often (429).

Source: Morningstar Direct. Analysis form 1/1/1926 – 12/31/2019. Includes all 10-year periods using monthly returns. “Rolling” means all 10-year periods calculated in 120 month increments. Returns are annualized and inflation-adjusted (real). Stocks are represented by the IA SBBI US Large Stock Inf Adj TR USD Ext Index, cash is represented by the IA SBBI US 30 Day T-bill Inf Adj TR USD Index, bonds represented by the IA SBBI US IT Govt Infl Adj TR USD Index. The 60/40 portfolio is 60% stocks and 40% bonds, rebalanced monthly.

Fortunately for investors, there is a relatively simple approach to balance the risk of short-term stock market volatility and long-term loss of purchasing power. Diversification! Diversification allows you to own bonds to dampen short term fluctuations in the stock market, while also owning stocks to help the portfolio keep up with (and hopefully exceed) the pace of inflation over time. As the table above illustrates, a balanced portfolio of 60% stocks and 40% bonds has historically offered a variety of benefits relative to owning any single asset class. Note: We chose the 60/40 portfolio for this example, but other combinations of stocks and bonds could have similar benefits.

Based on historical experience, the 60/40 portfolio has:

- Achieved a higher real return than an all-cash and/or bond portfolio

- Experienced a drawdown in fewer periods than any of the asset classes on a stand-alone basis

- Lost less in periods of decline

- Lost less in the worst 10-year period

There is obvious appeal in trying to protect your portfolio from price fluctuations, as it’s painful for most people to see their balance decline. While concentrating your assets in “safe” short-term cash and bond investments is a way to prevent red ink from spilling on your portfolio statement, doing so may be simply trading one risk for another. There have been long periods in history where the rate of inflation has exceeded the return on cash and bonds. This less observable risk carries with it the same end result: a loss in the future purchasing power of the portfolio. A better approach for a conservative long-term investor could be a diversified mix of asset classes. A balanced portfolio can help toe the line between dampening short-term price swings, and protecting against the threat of inflation.

- Achiever, Competition, Ideation, Significance, Command

Josh Jenkins, CFA

Recent News & Insights

How Often Does Large-Growth Outperform? + 4.16.24

W-4 Exemption for Taxpayer's Dependents

Tax-Free Roth Strategies: Backdoor Roth IRA & Mega Backdoor Roth

What does the election mean for your investments? + 4.02.24

%20(1)-Jan-02-2024-09-05-00-8712-PM.jpg?width=300&height=175&name=Untitled%20design%20(2)%20(1)-Jan-02-2024-09-05-00-8712-PM.jpg)

%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg?width=300&height=175&name=Untitled%20design%20(5)%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg?width=300&height=175&name=Untitled%20design%20(4)%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg)

-Mar-08-2024-09-03-21-1119-PM.jpg?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-09-03-21-1119-PM.jpg)

-2.png?width=264&height=160&name=Website%20Featured%20Content%20Images%20(1)-2.png)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)