2026 Process Overview

-

Client Resource Associates

These individuals will continue to aid 1040 clients and assist your Lutz Representative in keeping the tax process moving. They will notify you of information still needed to prepare your return. If you use Lutz for services outside of an individual 1040, you may also hear from them.

-

Reminder Communication

You will receive several notifications via email, phone, and/or text regarding upcoming deadlines, outstanding information needed, and reminders to sign documents. These may come from Lutz, Client Resource Associates, ThreadWorks, or your Lutz Representative.

-

Engagement Letter

Lutz utilizes an annual engagement letter process for all accounting services.WHAT TO EXPECT:-

You should have received an email from ThreadWorks requesting your electronic signature. Please sign as soon as possible.

-

Business clients may receive one email requesting one signature for all related business entities.

-

Individual and trust clients will receive separate emails to obtain a signature from each applicable party for each engagement.

- Engagement letters will outline current services. Any additional services throughout the year will fall under these terms. If the engagement letter you receive doesn’t cover other services you’ve engaged in, a separate, service-specific letter may follow.

- A copy of the engagement letter will be available in ThreadWorks to download for your records.

- To request a paper copy, please email clientresource@lutz.us.

-

-

Electronic Information Request + ThreadWorks

For individual clients, an Information Request is provided electronically via ThreadWorks. You should receive an email from notifications@thread.works in January that links to a list of initial items needed to prepare your tax return. If you cannot find this email, log in to ThreadWorks > Requests to locate the message. This is a live page, so you can continually upload documents as they become available. Additionally, you can provide documents via email to cra@lutz.us, mail, or front desk drop-off.

Please submit documents as soon as you receive them - no need to wait until you have everything. For 1040 clients, we must receive your information by March 15th. Otherwise, we cannot guarantee completion of your return by the April 15th deadline.

-

Electronic Portal Delivery

We will continue to use the ThreadWorks portal to deliver your tax returns electronically. Due to AICPA Independence Hosting Rules, you are responsible for downloading and retaining these items for your records.

-

Printed Documents

Upon request, tax forms will be provided as printed documents.

-

E-Signature

This will be used to electronically sign forms. If you haven't opted in already, email adminsupport@lutz.us to request e-sign invites when documents need to be signed. If filing jointly, both spouses will receive separate e-signature requests.

Upload Tax Documents

Important Deadlines

January 15th, 2026

– 4th Quarter 2024 Estimate Payments Due for Individuals

January 20th, 2026

– Annual Nebraska Sales Tax Filings Due

February 2nd, 2026

– W2 and 1099 Filings Due

March 16th, 2026

– S Corporation and Partnership Returns Due

April 15th, 2026

– Individual, C Corporation, and Fiduciary Returns Due

– 1st Quarter 2025 Estimate Payments Due

May 1st, 2026

– Nebraska Personal Property Tax Returns Due

ThreadWorks FAQ

How do I create a ThreadWorks account?

- ThreadWorks accounts are created when your accounting professional shares files, requests information, or sends an eSign request.

- Click the link in the email from notifications@thread.works. ThreadWorks will prompt you to register your account by providing a cell phone number and selecting a password.

How do I log in?

- Locate any email from notificaiton@thread.works and click on the link provided to be directed to the login screen.

- Log in here.

How can I resent my password or change my email address?

- Select the “Forgot Password” link on the ThreadWorks login page.

- Contact your Lutz Representative to request an update to your primary email address.

How do I send files securely to my accounting professional?

- You can upload documents securely by using our secure document upload page.

Where do I find the link to the information requested?

- Personal income tax return requests will be sent in January from notifications@thread.works to the primary email address on your account.

- For business clients, you will receive an information request email from notifications@thread.works to the primary email address on your account once we start your return if we have any missing items.

- Log in to ThreadWorks and select "Requests" from the portal home screen to view active requests.

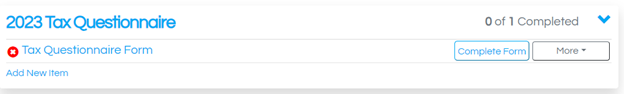

How do I use the information request page?

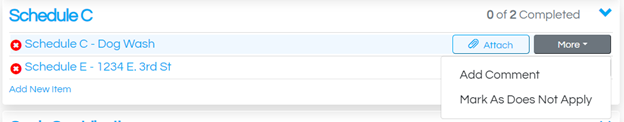

- To complete a form, select "Complete Form" next to the Tax Questionnaire item.

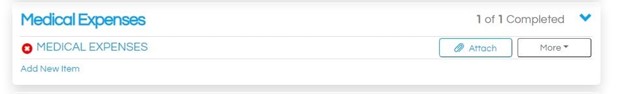

- To upload files securely, select "Attach" next to the item requested

- To add a comment or mark items as "Does Not Apply," select "More" next to the item requested.

Where can I find my 1099?

- Your custodian, such as TD Ameritrade, Charles Schwab & Co., Inc., Robinhood, etc., will provide you with a 1099-B in February.

- You should receive an email notification from your custodian that your tax documents are ready to be accessed. Please upload/attach your 1099 to the request.

- Didn’t receive a digital file? Please scan and upload your paper copy.

How do I complete an e-sign request?

-

Click on the “Sign Documents Now” link in the email notification. New users will be asked to create a ThreadWorks account, while existing users will be asked to log in to sign the requested document.

-

I cannot complete the security questions asked; what do I do?

-

Please contact your Lutz Representative for assistance.

-

How will my tax return be delivered?

-

All tax returns are electronically delivered through your ThreadWorks portal. Due to AICPA Independence Hosting Rules, it is your responsibility to download and retain these items for your own records.

-

News & Insights

Mileage Reimbursements Aren't Always Non-Taxable: Why Accountable Plans Matter

Budgeting Tips for Business Owners & High Earners

What Medical Practices Need to Know for 2026

Understanding Your Options for Selling or Gifting Farmland

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)