3 Reasons to Own International Stocks | Market Update | 8.23.22

Diversifying internationally has been a challenge this year as the U.S. market continues to outperform. While investor sentiment has been negative globally, it is worse overseas, particularly in Europe. The war raging in Ukraine has generated some harsh fallout for the continent at large. Business confidence has declined, and shortages in food and energy have led to sharply higher prices, hurting consumers. With all these challenges, we frequently get asked whether it still makes sense to invest outside the United States. Here are three reasons we think investors should continue to own international stocks.

1. Relative Performance is Cyclical

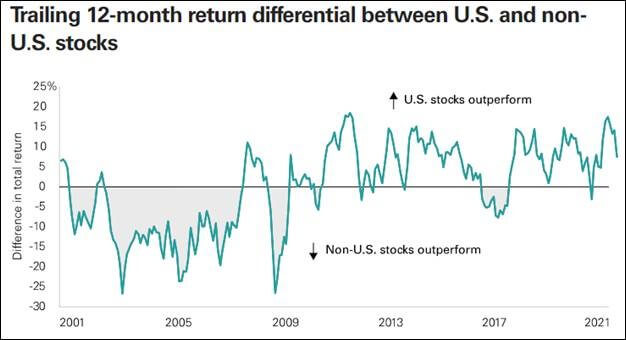

U.S. stocks have outpaced their overseas counterparts for the better part of a decade. This may provide investors with a sense that the U.S. will always be the top performer. A look at some historical data should quickly dispel that notion. As the chart below demonstrates, the performance between U.S. and non-U.S. stocks has historically been cyclical. There have been periods in the past where non-U.S. stocks have outperformed for similarly long stretches.

Sources: Vanguard, Thomson Reuters Datastream, and MSCI. Notes: U.S. equities are represented by MSCI USA Index; international equities are represented by MSCI All Country World Index ex USA. Data as of April 30, 2022.

2. Expected Returns Are Higher for International Stocks

Not all of the outperformance of the U.S. market has been the result of superior operating results by the underlying businesses. A portion of the higher returns has instead been a function of ‘multiple expansion.’ The attractiveness of an equity investment can be judged by the multiple of dollars paid for a dollar of earnings (or a similar fundamental measure). With multiple expansion, the price of the stock increases without a corresponding improvement to the underlying fundamentals of the business. In this scenario, investors are simply willing to pay a higher price. Generally speaking, the higher the price paid, the lower the perspective return. This relationship is evident in the graphic below. It illustrates Vanguard’s 10-Year annualized return expectations for non-U.S. and U.S. stocks. As you can see, the expected return is substantially higher for non-U.S. stocks over the next ten years. Much of this has to do with valuations being lower outside of the U.S. market.

Source: Vanguard Investment Strategy Group. IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of March 31, 2022. Results from the model may vary with each use and over time. For more information, please see below.

3. Improved Diversification

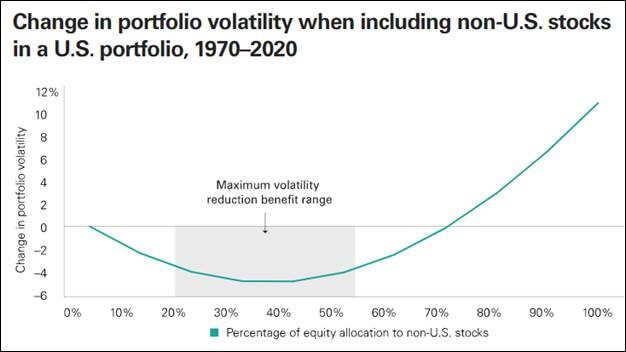

Diversification is often referred to as the only “free lunch” in investing. When an investor can combine stocks from differing geographies that are not perfectly correlated, a reduction in portfolio volatility can be achieved. To the extent the various geographies have a positive expected return, the risk reduction comes with little to no cost.

The chart below illustrates the potential volatility reduction that can be achieved by incorporating varying amounts of international exposure into a portfolio of domestic stocks. Historically, the maximum amount of volatility reduction has occurred when allocating 35% to 45% of the equity portfolio outside of the United States.

Sources: Derived from data provided by Vanguard and MSCI as of March 31, 2020. Notes: Non-U.S. equities are represented by MSCI World Index ex USA and U.S. stocks are represented by the MSCI USA Index from March 31, 1970, through March 31, 2020. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

While the outlook in places like Europe may seem dour, it is important to recognize that the headwinds faced in the region are widely recognized. It is therefore likely that current prices already reflect these challenges. Given how widespread the negative sentiment is, it’s possible that international stocks are being overly discounted. Additionally, recent performance of non-U.S. stocks has been hurt by the strength of the dollar, which has reached the strongest level relative to the Euro and other major currencies in several decades. Any reversal in currency movements would be a positive for international stocks.

There is no way to tell when the cycle of relative returns between U.S. and non-U.S. stocks will once again reverse, though lower valuations outside of the U.S. suggest that it eventually will. The combination of higher expected returns and improved diversification make owning international stocks a wise bet.

WEEK IN REVIEW

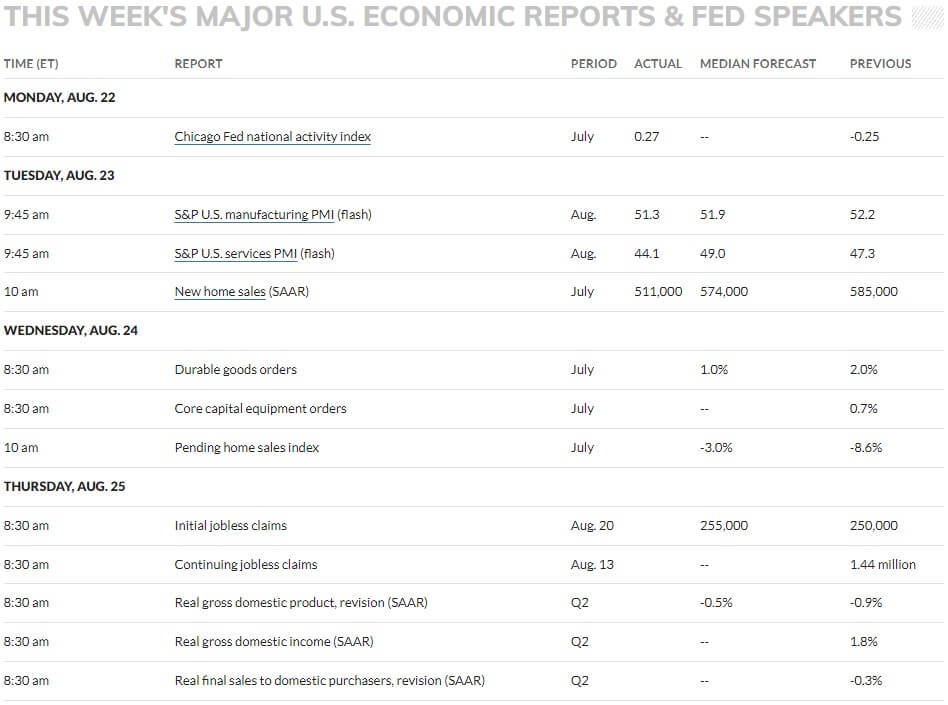

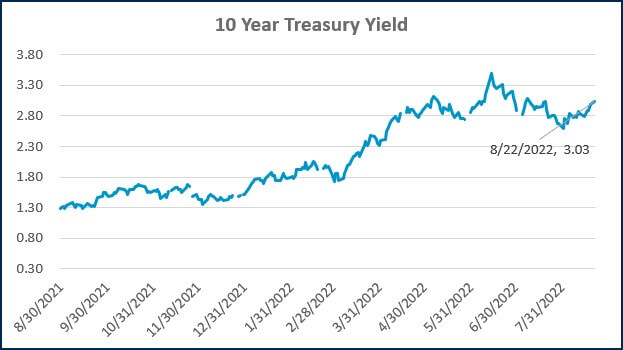

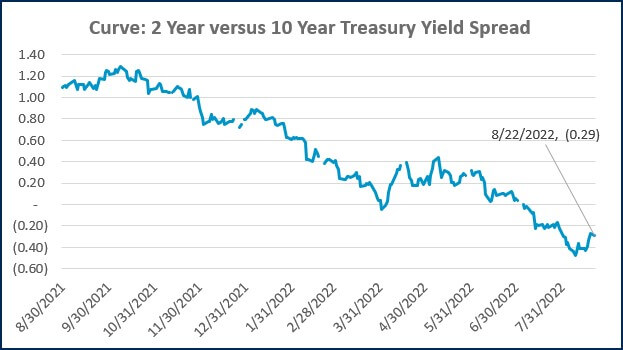

- Chairmen Powell will speak at the Jackson Hole Symposium on Friday. The market will be watching his speech very closely for clues on how aggressive the Fed will be in tightening policy moving forward. The fed fund futures market is currently pricing in another 0.75% hike at the September 21st meeting, which would move the benchmark rate to 3.00%-3.25%.

- Data this morning (Tuesday) from S&P Global showed a sharp contraction in services sector activity for the month, while manufacturing sector activity growth slowed. These were just early ‘flash’ estimates, however, and the more closely watched ISM indices will be published later. Additionally, data on new home sales was published, showing a larger decline than expected.

- There is a large slate of economic data coming out during the remainder of the week. On Wednesday, we will get durable goods orders from July. Thursday includes initial jobless claims (a proxy for layoffs) and the first revision of Q2 GDP. On Friday, we will get Personal Consumption Expenditures (PCE), which reflects the Fed’s preferred inflation measure. Additionally, on Friday, we will get consumer spending and the University of Michigan’s consumer sentiment and inflation expectations surveys.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Inflation Peaking? 10 Common Consumer Items Where Prices Are Falling (CNBC)

- Retail Sales Little Changed in July Amid Fall in Gas Prices and Drop in Auto Sales (CNBC)

- Global Economies Flash Warning of Sharp Slowdown (WSJ)

Investing

- Five Lessons From History (Morgan Housel)

- Narrative Always Follows Price in the Markets (Ben Carlson)

- 6 Widespread Financial Opinions The No longer Hold (Jonathen Clements)

Other

- How to Spot Fake Reviews on Amazon (Wired)

- Inside the Tiger-Led Meeting Looking to Overhaul the PGA (SI)

- Children’s Risk of Suicide Increases on School Days (Scientific American)

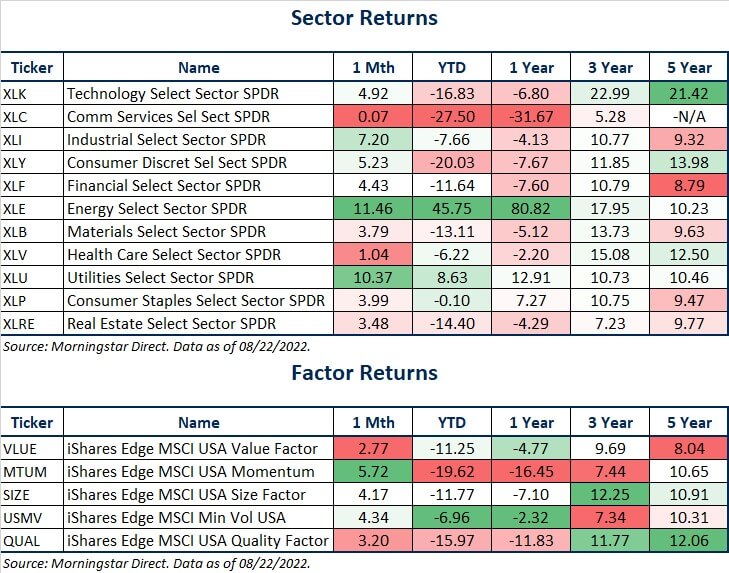

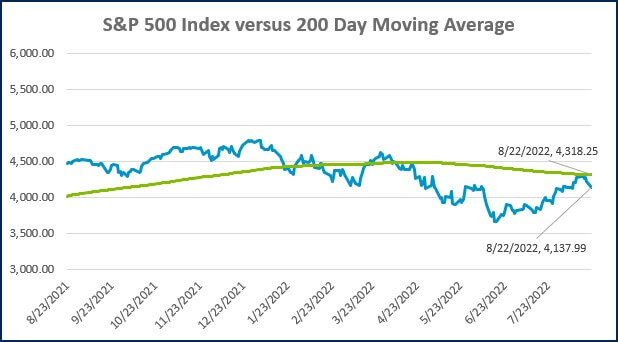

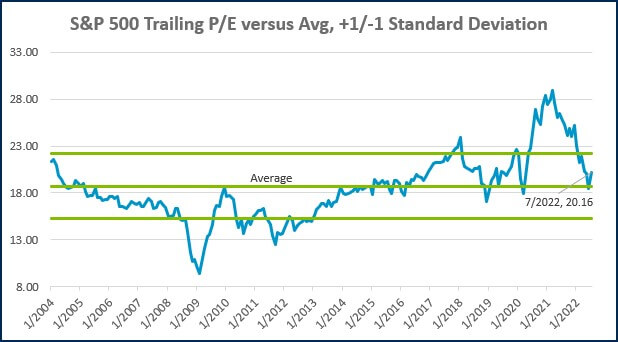

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)