Lessons From the Dot-Com Bubble

%20(1)-Nov-05-2025-01-47-43-4198-PM.jpg)

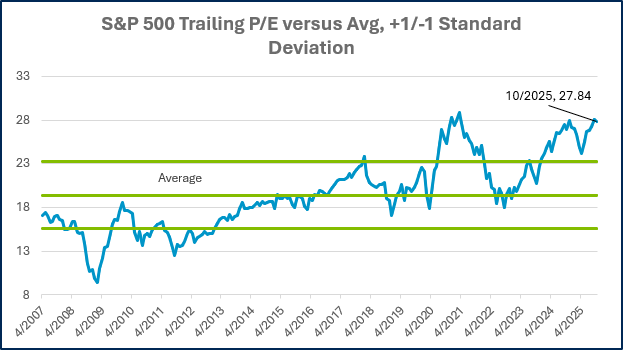

Echoes from the past have been reverberating through the markets recently. A widely followed stock valuation measure just hit the highest level since the turn of the century. Those who remember the late 90s and early 2000s know that stock market comparisons with this era should not create a warm and fuzzy feeling.

At that time, investors were captivated by the broad adoption of a transformative new technology. The “information superhighway,” as the internet was often called, promised to change our lives and make us more efficient.

Bringing the nation ‘online’ required a massive investment in internet infrastructure. Investors poured billions into the fiber-optic cables, data centers, and networking gear needed for people and businesses to travel the web. The logic was simple: if enough traffic showed up, profits would follow.

The prospect of limitless growth created a fear of missing out (FOMO) that permeated across society. People began to throw money at any stock that was even remotely related to the internet. The valuation of these companies became so high that stocks that had absolutely nothing to do with the internet began to use “.com” in their name to instantly boost their stock price(1).

Ultimately, internet traffic did grow, just not as fast as the capacity that was built to carry it. Less traffic than expected meant less revenue than projected. High valuations crashed back down to earth, companies that borrowed heavily ran into trouble, and many internet stocks fell dramatically. The highway system remained and kept getting busier every year, but not every road builder survived; very few thrived, and many investors got burned.

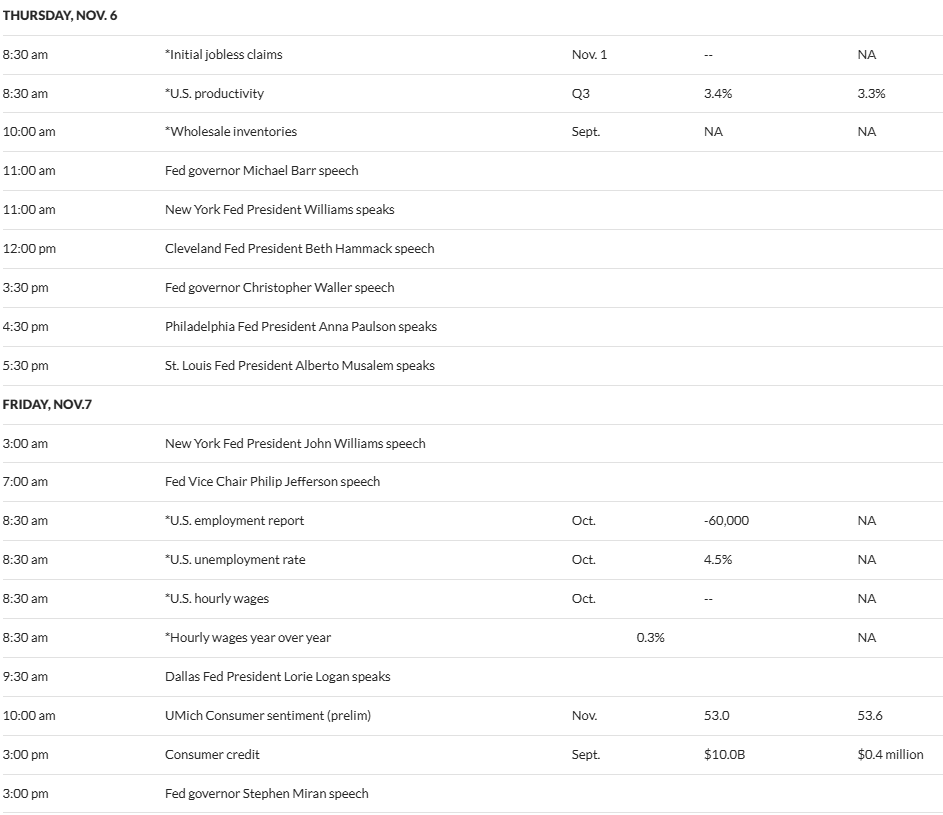

The Dot-Com Bubble and Its Aftermath

The exhibit below captures the bubble and its aftermath at a glance. On the left are the biggest technology sector winners of 1999. These represent some of the names that powered the market higher at the peak of the dot-com boom. The columns to the right track what happened next: the following 5-, 10-, and 25-year annualized returns. Those numbers tell the crash-and-aftermath story. Most of the former stars went on to deliver a decade or more of weak or outright negative results. Several of the companies ultimately disappeared through bankruptcies, fire-sale mergers, or rebrandings. The broader tech sector itself faced a long, patient climb to recover.

Past performance is no guarantee of future results. Source: Dimensional and CRSP, calculated by Dimensional. Top technology stock contributors consist of the 15 largest technology and telecommunications US stock market performance contributors in 1999. For research and educational purposes only.

Ultimately, the technology-heavy Nasdaq Composite peaked on March 10, 2000, then lost nearly 80% of its value before the bear market ended. It didn’t return to its prior peak until 2015. The meteoric rise and subsequent collapse of the dot-com stocks remain one of the most infamous bubbles in market history.

Bringing it back to today

Investors are now excited about the rapid adoption of artificial intelligence. Like the internet decades ago, AI requires massive upfront investment in infrastructure. Companies are spending heavily on chips, data centers, and the electricity required to run AI models. The promise is big: faster search, smarter software, better productivity. It’s easy to imagine AI showing up in nearly every tool we use.

History often rhymes, but will it repeat itself?

Nobody knows if we are experiencing the inflation of another market bubble. While there are many obvious similarities, there are also some key differences between now and the dot-com bubble.

For starters, while valuations are elevated, they haven’t quite reached the extremes of the dot-com peak. We have also not seen the extreme euphoria and/or FOMO that typically captivates the public during a bubble. When the baristas and Uber drivers start giving you AI stock tips, it may be time to get nervous.

Finally, the businesses responsible for most of today’s capital spending are very large, profitable companies with multiple revenue streams. This means there are stronger cash-flow anchors supporting the build-out than we saw with many of the companies in the late 1990s. Still, just like back then, capital can arrive faster than the everyday benefits most people feel. The gap between optimistic forecasts and actual results is where markets can get bumpy.

The lesson for investors is timeless: starting price matters. People were right about the internet; it changed our lives in immeasurable ways. Yet many investors lost money because the flood of capital was simply too great for the opportunity at that moment. Paying any price to own a great story can lead to disappointing returns for a very long time, even if the technology eventually delivers.

Luckily for investors, other areas of the global stock market trade at a more reasonable valuation. International stocks, value stocks, and small caps have not seen their valuation rise as dramatically as the larger, growth-oriented stocks in the US. These areas may offer some shelter if we eventually see the multiples of the AI stocks deflate.

1. Cooper, Michael J. and Dimitrov, Orlin and Rau, P. Raghavendra, A Rose.Com by Any Other Name (November 2000). Available at SSRN: https://ssrn.com/abstract=242376 or http://dx.doi.org/10.2139/ssrn.242376Week in Review

- The Bureau of Labor Statistics (BLS) released its September Consumer Price Index (CPI) report, offering fresh insight into the Federal Reserve's progress on curbing inflation. The headline CPI rose by 0.3% month-over-month and 3.0% year-over-year, both numbers lower than expected. Meanwhile, Core CPI, which excludes the more volatile food and energy categories, edged up 0.2% for the month and 3.0% compared to a year ago, lower than the economists’ estimates of 0.3% and 3.1% respectively.

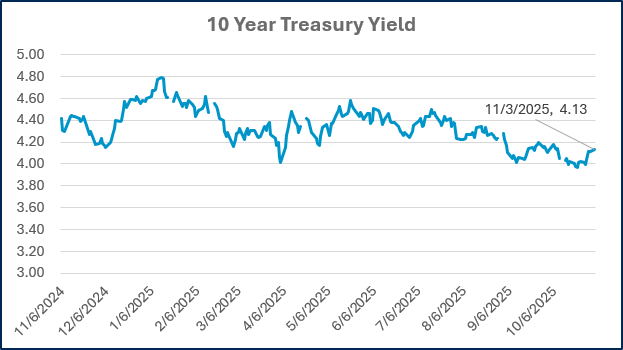

- Federal Reserve officials voted on October 29 to lower the federal funds rate by 25 basis points, setting a new target range of 3.75% to 4.00%. This marks the second consecutive meeting in which the Federal Open Market Committee (FOMC) has opted for a quarter-point reduction. The decision passed with a 10–2 vote, reflecting a rare split among policymakers: Kansas City Fed President Jeff Schmid dissented in favor of keeping rates unchanged, while Fed Governor Stephen Miran preferred a larger 50-basis-point cut. Notably, this was the first FOMC vote since 2019 to feature two dissents for differing reasons.

- With 64% of S&P 500 companies having reported third-quarter results, the blended year-over-year earnings growth rate currently stands at 10.7%, so far surpassing the 7.9% growth expected at the start of the quarter. If the index ultimately posts earnings growth of 10% or more, it would mark the fourth consecutive quarter of double-digit earnings gains, which has not occurred since 2021.

Hot Reads

Markets

- Future Fed Rate Cuts ‘Far From Certain’ After Dividend Meeting

- Fed Divisions Reveal New Caution Over Continued Cuts

- Inflation Rate Hit 3.0% in September, Lower than Expected, Long-Awaited CPI Report Shows (CNBC)

Investing

- Should You Just Buy Stocks Until You Die

- This Famous Method of Valuing Stocks Is Pointing Toward Some Rough Years Ahead

- The Melt-Up (Ben Carlson)

Other

- Dr. Peter Attia on How to Make Your Final Decade of Life as Enjoyable as Possible – 60 Minutes (YouTube)

- Bill Gates, Satya Nadella & Steve Ballmer on Microsoft in the AI Era – Bloomberg Originals (YouTube)

- The AI Rollout is Here, and it's Messy – Financial Times (YouTube)

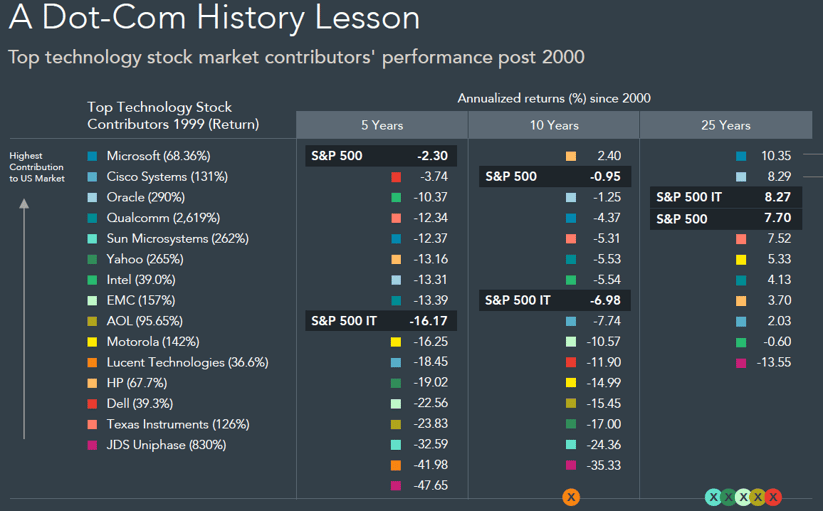

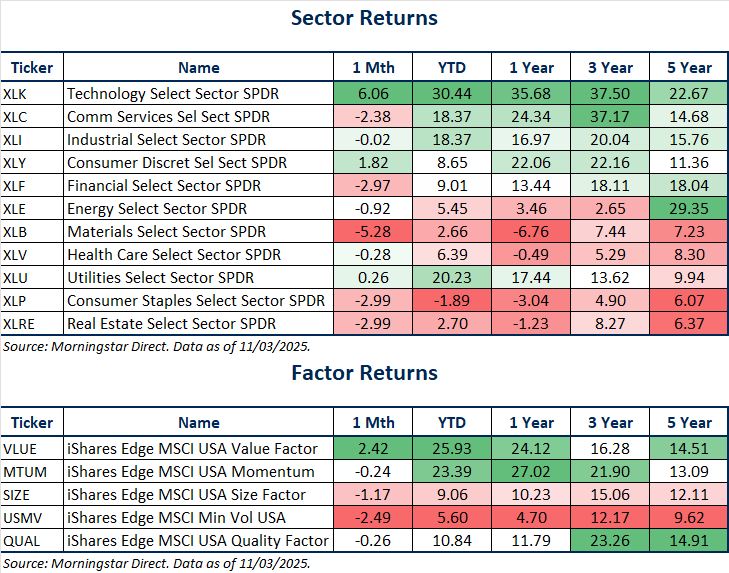

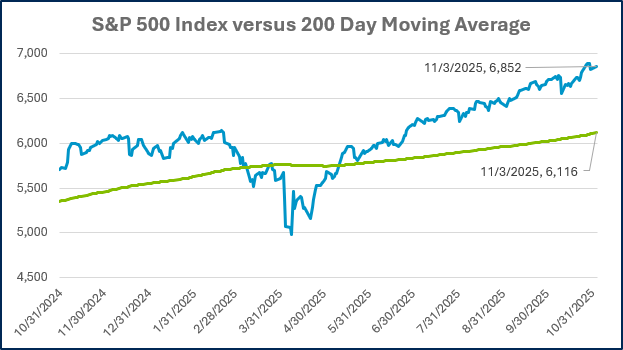

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

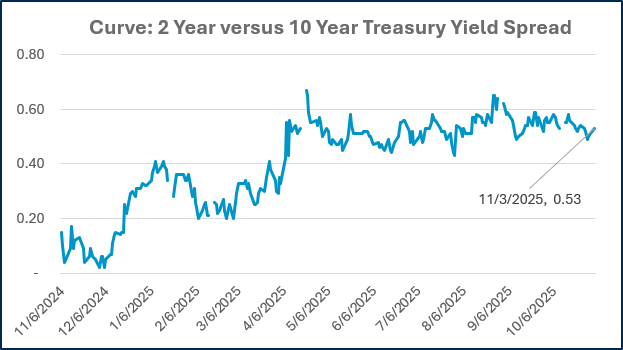

Source: Treasury.gov

Source: Treasury.gov

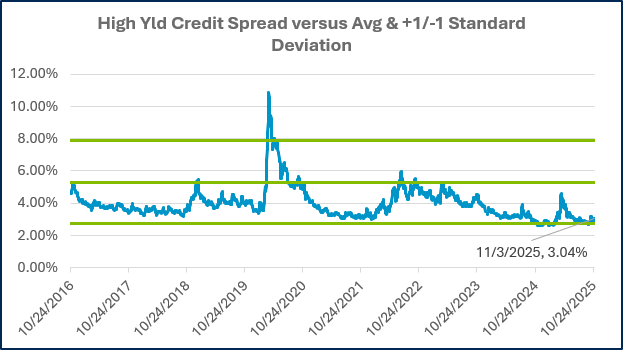

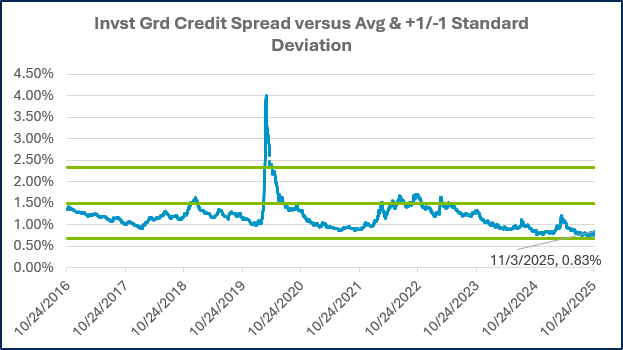

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

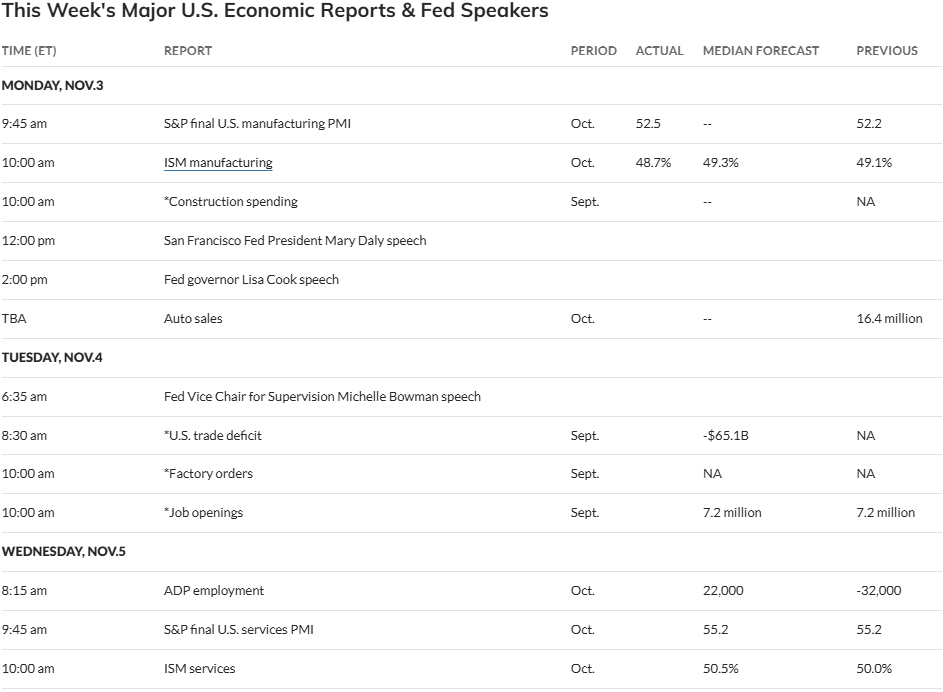

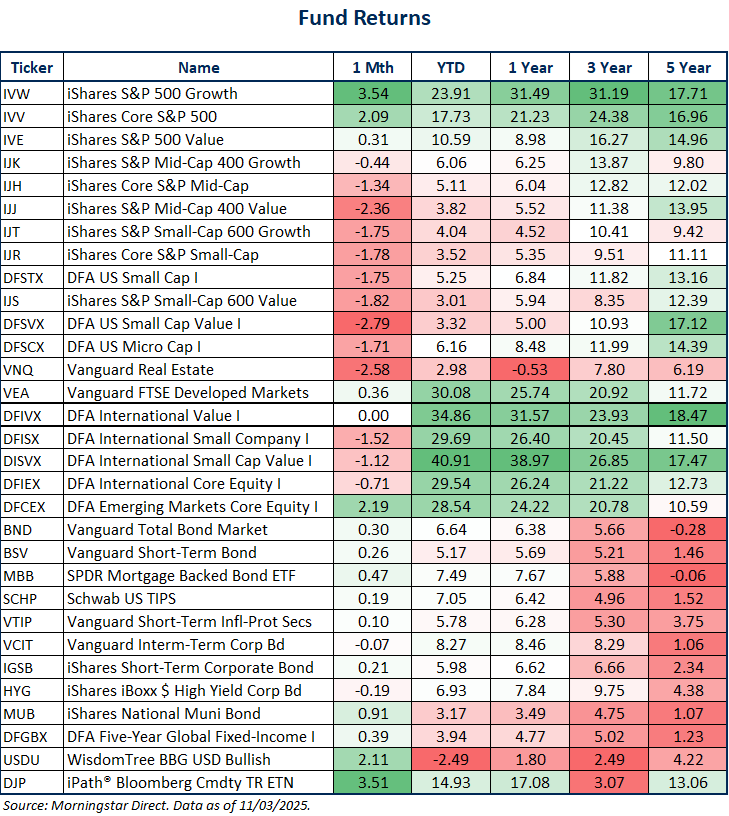

Economic Calendar

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)