Even the Good Years Are Hard

%20(1).png)

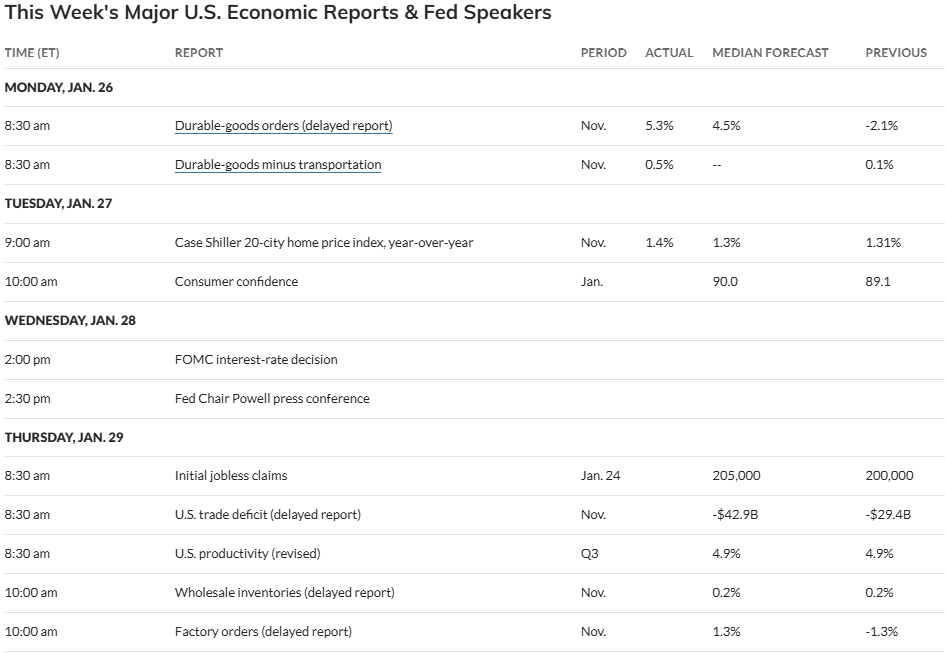

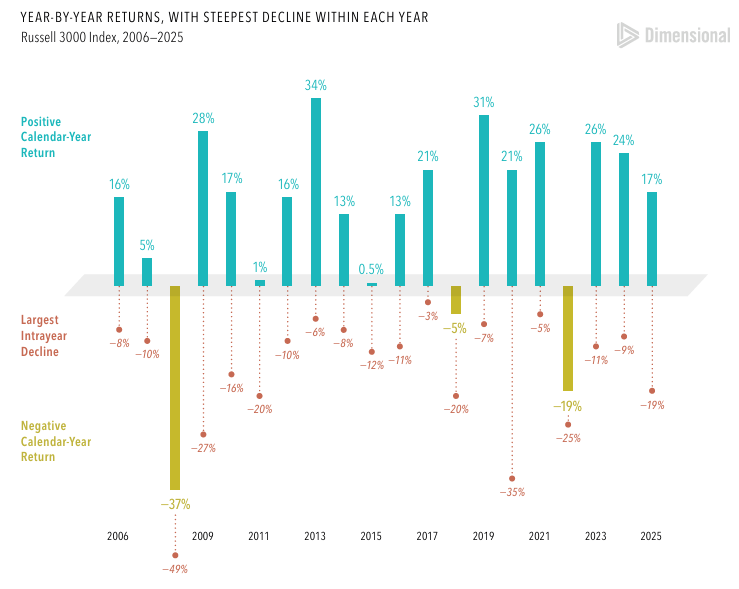

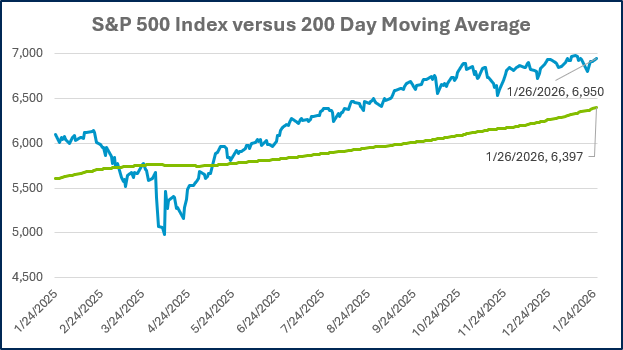

Nineteen percent. That's how far markets fell at one point in 2025 before recovering to finish the year with a strong gain. If you blinked, you might have missed it. If you panicked, you likely paid for it. Sharp pullbacks, unsettling headlines, and sudden spikes in volatility reminded us that markets rarely move in straight lines.

One of the most notable examples came during the spring, when tariff announcements reignited concerns about global growth, inflation, and geopolitics. The market reacted swiftly. Stocks fell sharply in a matter of days, and anxiety rose just as quickly. Eventually, the market regained its footing and marched higher. By year-end, what felt like a major crisis had faded into a small footnote inside an otherwise strong year.

As the chart below reveals, this pattern isn't the exception; it's the rule. Consider: In 14 of the last 20 years, markets delivered double-digit gains. In more than half of those winning years (8 out of 14), investors also weathered double-digit declines along the way. The lesson is clear: earning strong returns and surviving sharp drawdowns aren't separate experiences. They're two sides of the same coin.

Source: Dimensional Fund Advisors

Looking back across nearly two decades of data, one thing becomes clear: the investors who succeed aren't the ones who avoid volatility, they’re the ones who expect it. The challenge isn't predicting when drawdowns will occur, but having the discipline to stay invested when they do. That difference in behavior, repeated over time, is what separates those who capture market returns from those who chase them.

As we look ahead to 2026, there’s no way to know what surprises lie around the corner. Economic data, elections, geopolitics, inflation trends, central bank policy, and AI developments will all play a role, but the exact path markets will take remains unknowable. What matters most is how investors choose to respond. Those able to stick with their plan are best positioned to benefit from long-term growth.

Week in Review

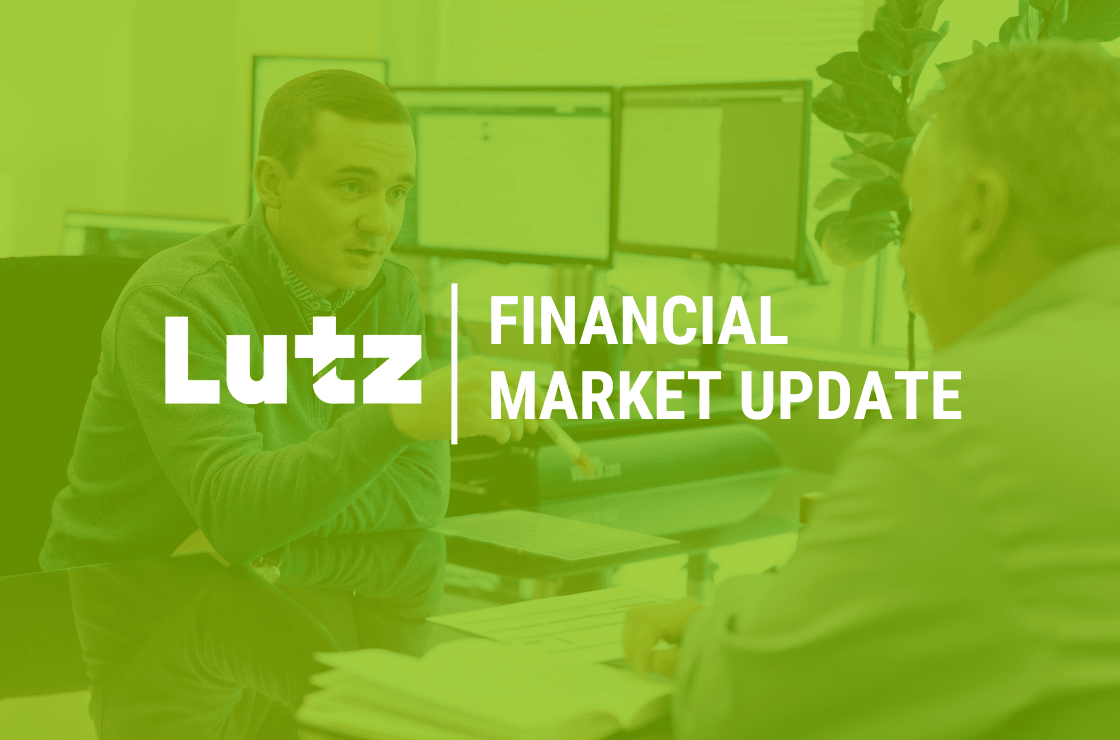

- The FOMC will conclude its first meeting of 2026 on Wednesday, January 28th. Markets broadly expect the Fed to hold rates steady, with Fed funds futures implying just a 2.8% probability of a rate cut at this meeting. Looking ahead to 2026, futures markets continue to price in one to two 25-basis-point cuts, suggesting that any policy easing is more likely to occur later in the year rather than at this meeting.

- The first revision to third-quarter GDP, released on Thursday, January 22nd, showed growth revised slightly higher to a 4.4% annualized rate, up from the initially reported 4.3% and marking the strongest quarter of economic growth in two years. The revised data underscored continued strength in household spending, which accounts for roughly 70% of the U.S. economy, rising 3.5% in the third quarter. Business investment in equipment and software also made a meaningful contribution, reflecting a sustained appetite for spending tied to artificial intelligence and technology investments.

- With Q4 earnings underway, 13% of the S&P 500 have reported earnings results as of last Friday, January 23rd. The earnings growth rate, blended between companies that have already reported with the estimates for those that have yet to report, now stands at 8.2%, which would mark the tenth consecutive quarter of earnings growth reported by the index.

Hot Reads

Markets

- Fed Set to Pause Rate Cuts, With No Clear Path to Resuming (WSJ)

- Tech’s Massive AI Spend is Under Scrutiny Ahead of Earnings. Here’s What to Watch (CNBC)

- Fed’s Main Gauge Shows Inflation at 2.8% in November, Edging Further Away from Target (CNBC)

Investing

- Why This CEO Won’t Let Private Funds Near His Company’s 401(k) (Jason Zweig)

- Earnings vs the Stock Market (Ben Carlson)

- A Few Things I’m Pretty Sure About (Morgan Housel)

Other

- How Circular Deals Are Driving the AI Boom – Bloomberg Originals (YouTube)

- Progress Made on AI-Powered Humanoid Robots – 60 Minutes (YouTube)

- Day 1 Highlights – 2026 FI Barcelona Shakedown (YouTube)

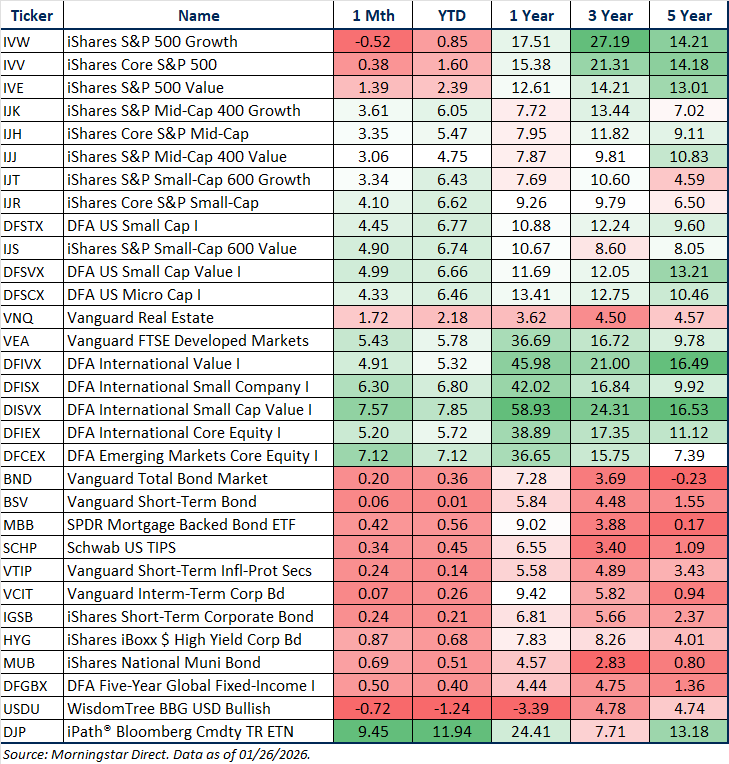

Markets at a Glance

Fund Returns

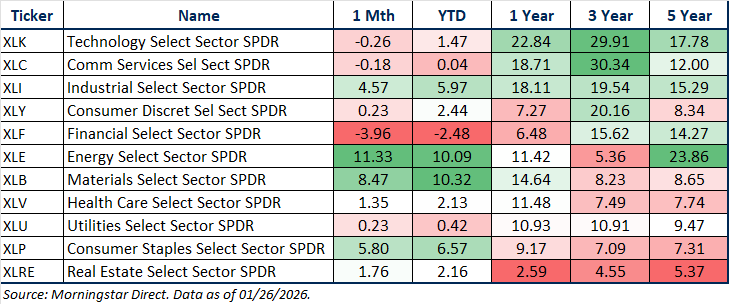

Sector Returns

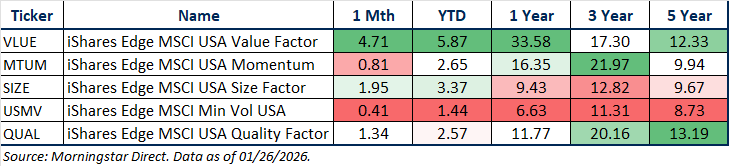

Factor Returns

Source: Morningstar Direct.

Source: Morningstar Direct.

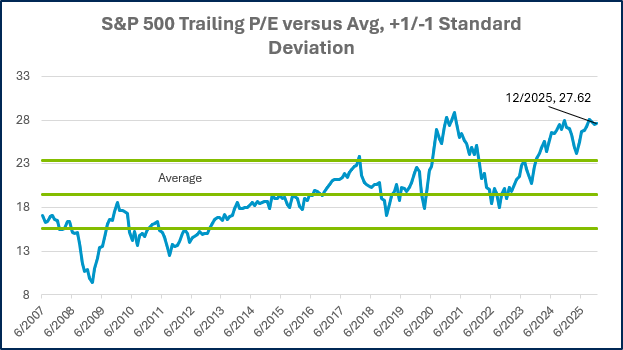

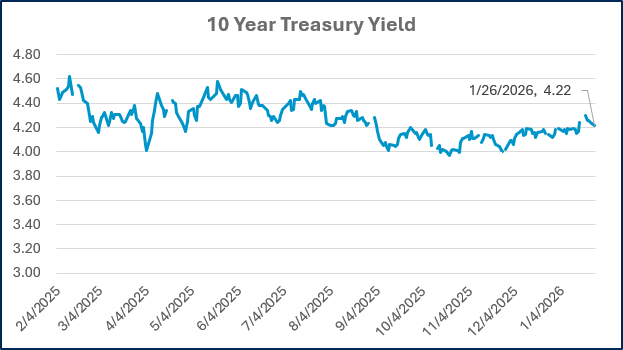

Source: Treasury.gov

Source: Treasury.gov

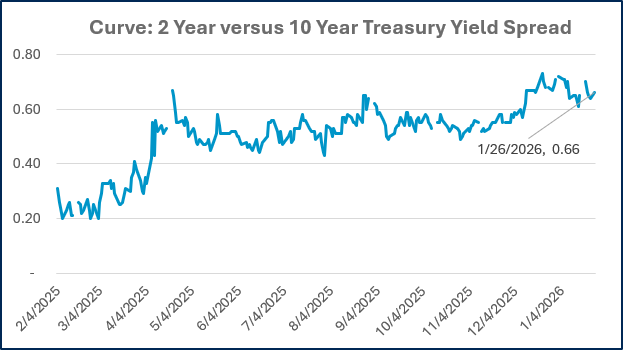

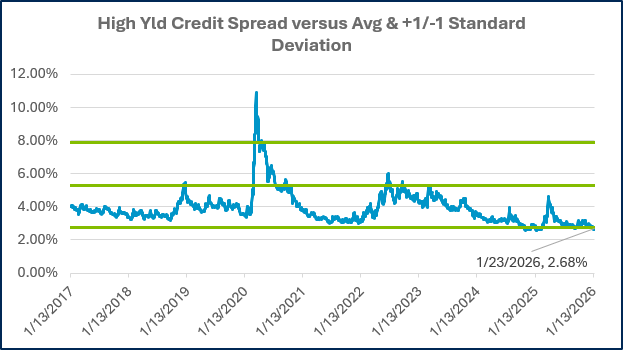

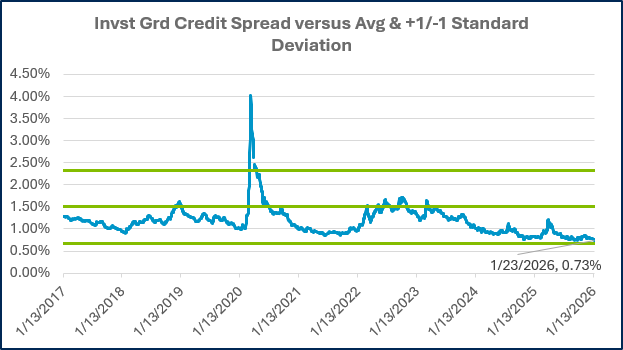

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Economic Calendar

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Even the Good Years Are Hard

8 Tax Smart Strategies for Charitable Giving and Family Gifts

Nebraska Inheritance Tax Explained: Who Pays & How to Plan Ahead

In-House vs. Outsourced Controller: What makes sense for my business?

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)