What is a 'Normal' Return for Stocks? + Market Update + 1.30.24

The stock market has taken investors for a wild ride in recent years. With repeated price swings, both sharply higher and lower, it has been a turbulent experience for anyone who has been on board. With a potential degree of stability on the horizon for both inflationary pressures and monetary policy, investors may understandably be looking forward to a more ‘normal’ market environment. They might be shocked to know just how unusual ‘normal’ is for stock returns.

Recent S&P 500 Index Returns (Large U.S. Stocks):

- 2017: +21.8%

- 2018: -4.4%

- 2019: +31.5%

- 2020: +18.4%

- 2021: +28.7%

- 2022: -18.1%

- 2023: +26.3%

- LT Avg: +10.3%

Over the last seven years, the average difference between a given year’s return and the long-term average has been a massive 17%! This probably feels right, given everything the market has been forced to digest over this period. This includes a trade war, a pandemic, elections, a war in Europe, a war in the Middle East, surging inflation, the fastest pace of monetary policy tightening in decades, and recession fears. These events have undoubtedly contributed to volatility within the financial markets.

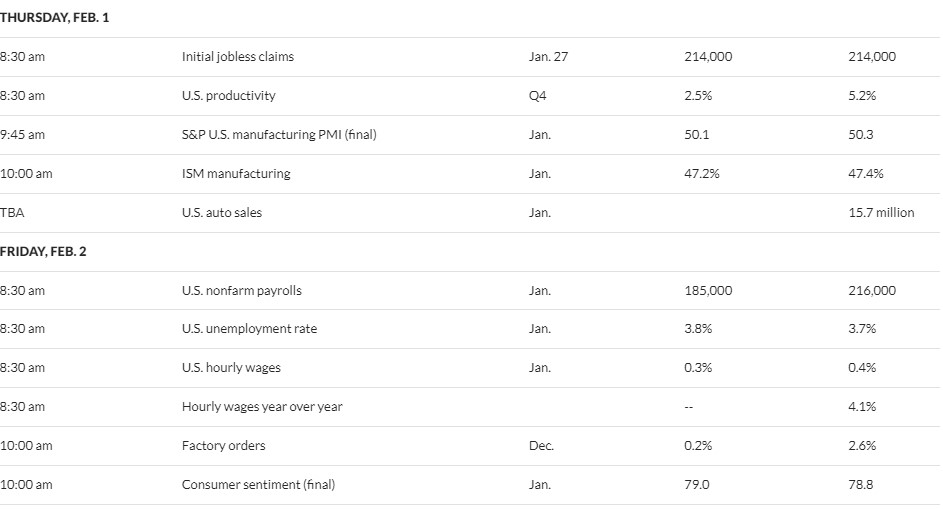

While the recent period might feel unique, as the chart below illustrates, stocks have rarely delivered an annual return that has been anywhere near the long-term average historically.

Source: Morningstar Direct. Data reflects calendar year returns from 1926-2023. Stocks returns are represented by the IA SBBI Large Cap US TR Index.

The green highlight illustrates a +/- 4% band around the long-term average stock market return of 10.3%. In the 98 years since 1926, the annual return has only fallen within that band on 11 occasions! Said differently, ‘normal’ returns only occur about 10% of the time. Most years oscillate between a very high return and the occasional sizable loss.

Relative to falling within the average +/- 4% bucket, stocks are:

- 2.5x more likely to generate a return > 25% (happens about 26% of the time)

- 2x more likely to generate a return < -5% (happens about 20% of the time)

The stock market's tendency to deliver a relatively ‘extreme’ return rather than something near its average has important implications for investors. The seemingly erratic returns we have seen in recent years aren’t the exception; they are the rule. It happens nearly 50% of the time.

Building a stock portfolio with the expectation of receiving a steady average return is a surefire way to set yourself up for failure. An awareness of the historical nature of market returns can instead prevent you from getting caught up in the emotional swings of large market moves higher and lower.

For a diversified stock investor with a long-term horizon, the most pressing risk is needing to access the money during a market downturn. Only when portfolio holdings are liquidated at a depressed level are losses truly realized. Appropriately managing access to cash savings can largely eradicate this risk, however.

Diversified investors with a shorter horizon have other tools at their disposal. For example, using relatively stable high-quality bonds can act as a ballast within a portfolio. Bonds have historically exhibited much lower volatility than stocks and are often negatively correlated. During a downswing in the stock market, it is not uncommon for bonds to appreciate. Incorporating bonds in a portfolio can dampen the expected swings in portfolio value and provide a source of funds if money is needed during a downswing.

While investors may clamor for a more normal environment, the truth is that we already have one. Dramatic and unforeseen global events will continue to arise and influence market prices. Investors who can build a reasonably diversified portfolio and stick to it will be best positioned to take advantage of the long-term wealth-creating power of the stock market. Understanding the nature of market returns, using your investment horizon to your advantage, and incorporating bonds to dampen volatility are all ways to help tune out the noise.

Week in Review

- The initial reading on Q4 GDP was released last Thursday and showed that the US Economy grew at a 3.3% annual rate. With Q3 GDP growing at an annualized rate of 4.9%, these two quarters were the strongest back-back readings since 2014 (excluding the sharp recovery in GDP after the US Economy reopened following the pandemic).

- Data released last Friday showed that Core PCE, the Federal Reserve’s preferred inflation measure that strips out food and energy costs, rose .2% on a monthly basis and 2.9% on a yearly basis. The 2.9% 12-month rate is the lowest core PCE growth rate since March 2021.

- According to FactSet, 25% of the S&P 500 had reported Q4 results as of last Friday (1/26). The earnings growth rate, blended between companies that have already reported with the estimates for those that have yet to report, is at -1.4% year-over-year. Expectations for the earnings growth rate at the onset of earnings season was 1.6% year-over-year. This week, we will see reports from some of the world’s largest companies, including Microsoft, Apple, Amazon, Alphabet, and Meta.

Hot Reads

Markets

- Fed’s Favorite Inflation Gauge Rose 0.2% in December and Was Up 2.9% From a Year Ago (CNBC)

- The U.S. Economy Grew at a Blistering 3.3% Pace in Q4 While Inflation Pulled Back (CNBC)

- Plummeting Inflation Raises New Risk for Fed: Rising Real Rates (WSJ)

Investing

- What I Learned When I Stopped Watching the Stock Market (Jason Zweig)

- Young People Are Doing Better (Financially) Than You Think (Ben Carlson)

- From COW to KARS (Adam Grossman)

Other

- Apple Vision Pro Review: This Is the Future of Computing and Entertainment (CNBC)

- Tesla Cybertruck v Lamborghini Urus: Drag Race (Youtube)

- Here Are The Hotels We Love for 2024 (Nat Geo)

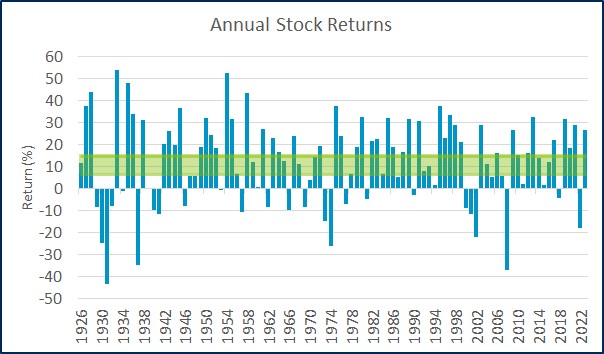

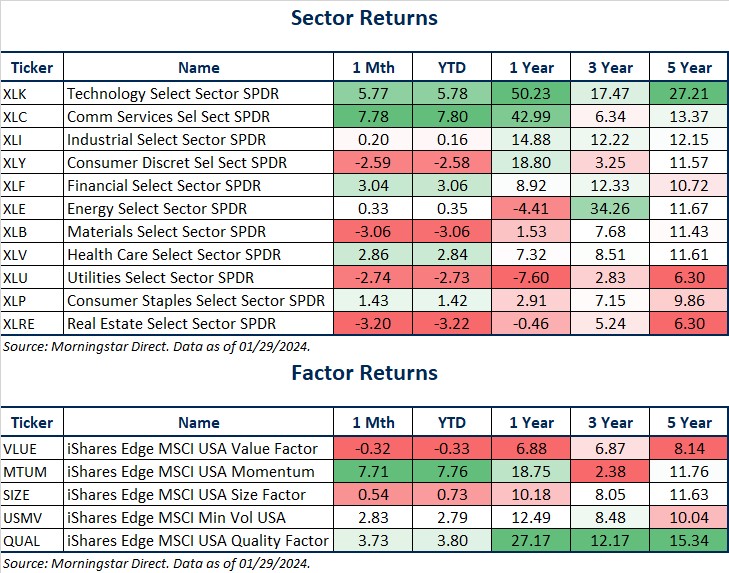

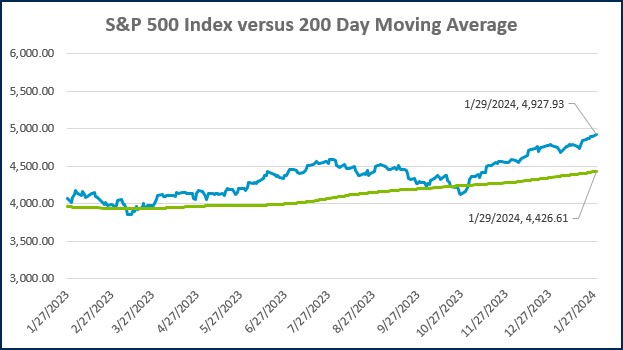

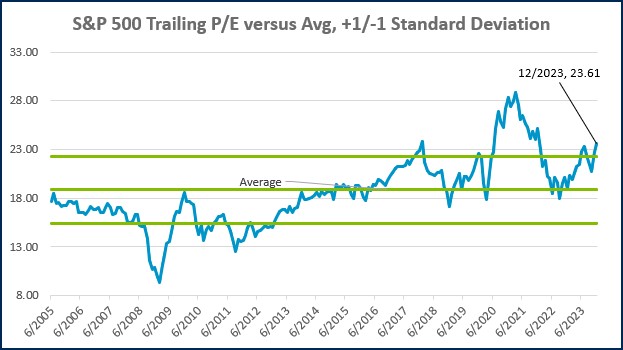

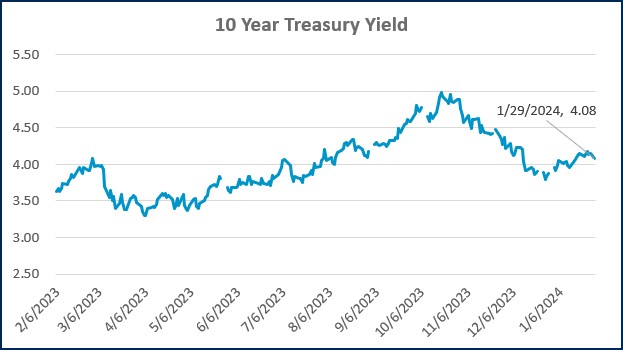

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

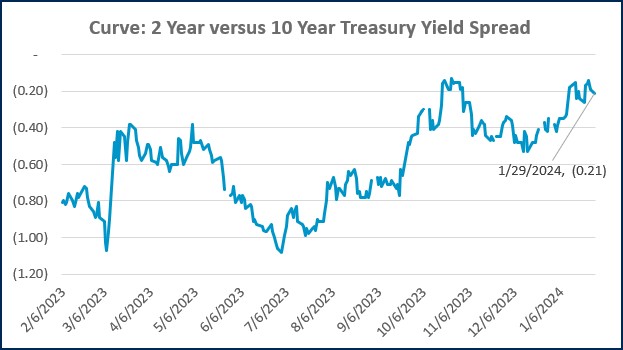

Source: Treasury.gov

Source: Treasury.gov

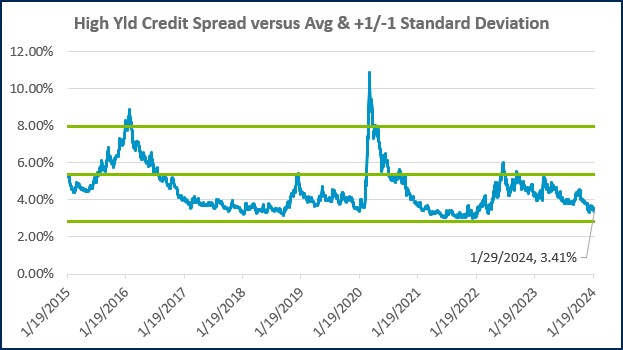

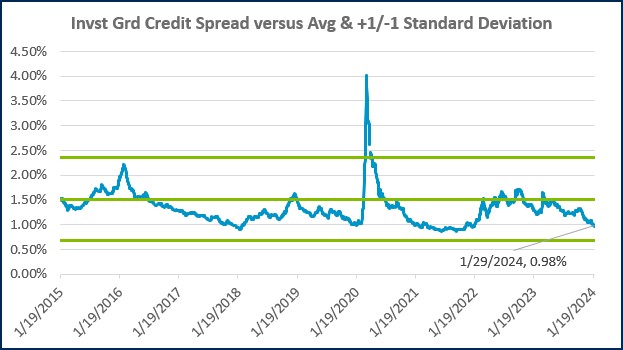

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

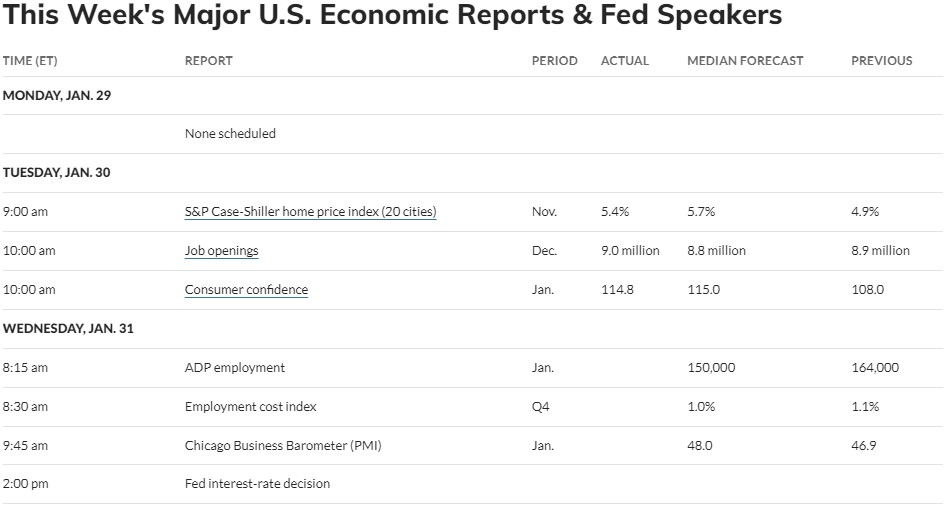

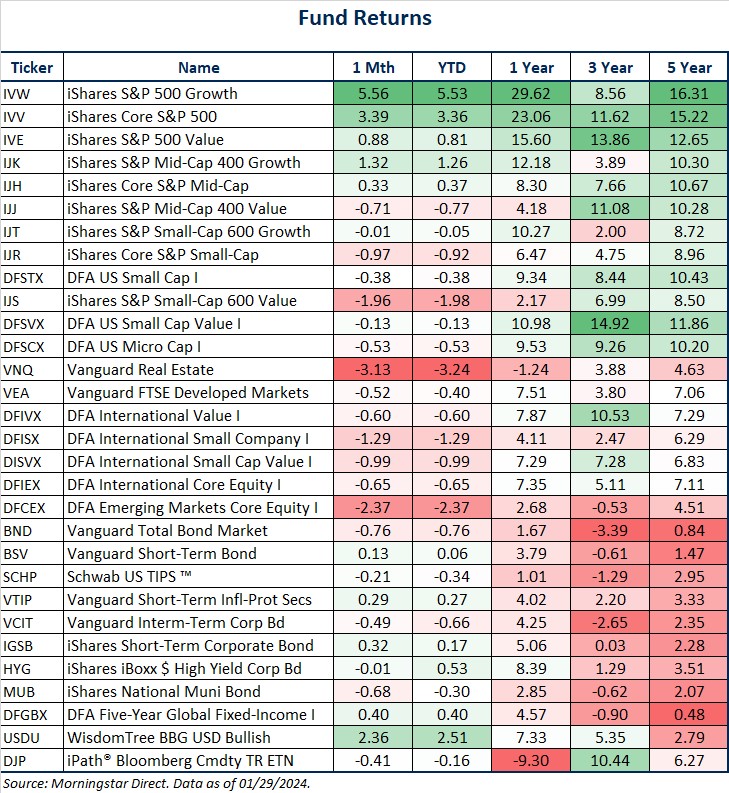

Economic Calendar

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)