Affordable Care Act Health Plan: Very Affordable in 2022 + Market Update

By this point, much has been written about the Affordable Care Act, which was a comprehensive healthcare reform law enacted about a dozen years ago. The goal was to provide guaranteed healthcare coverage to Americans at a reasonable price. The law provides individuals premium assistance tax credits that lower costs for households with incomes between 100% and 400% of the Federal Poverty Level (FPL). While the law has met its goal of lowering the number of uninsured Americans, albeit much of which came out of Medicaid, it has sometimes failed middle-class income families, earlier retirees, or small business owners without group healthcare plans.

Rising healthcare expenses coupled with insurers being required to accept anyone who applies despite health status left a lot of unhealthy, sick people on the state-run exchanges. Additionally, it led many carriers to drastically shrink networks or even abandon markets altogether because of the high-cost burden. Those carriers or insurers who stayed in the marketplace raised premiums to levels often unaffordable to a vast section of the population whose income was maybe slightly greater than the FPL yet not eligible for the premium assistance tax credits.

Healthcare is one of biggest costs for early retirees

Since ACA coverage began, the FPL was used as a cliff for determining premium assistance credits. If a household’s income exceeded 400% of FPL even by $10, they would not qualify for any assistance. 400% of FPL to begin 2021 for a household of two people was $68,960 of modified adjusted gross income (MAGI). MAGI include sources such as taxable Social Security retirement benefits, IRA distributions, and dividends/interest/capital gains, rental income, etc.

Traditionally, premiums have varied widely depending on the state of residence and plan specifics like deductibles, out-of-pocket maximums, and coinsurance percentage. However, it is not uncommon to see premiums for a household of two 60-year-old retirees cost somewhere around $20,000-$30,000 per year. For a couple whose normal budget is $6,000-$7,000 per month and were likely used to a group healthcare plan that was largely subsidized by an employer, this comes as a huge sticker shock and often deters individuals or couples from retirement altogether before age 65.

Small Business Owners

Much like earlier retirees, small business owners found themselves in a bind when it came to affordable healthcare options for them and their families. Many business owners have pass-through entities where income from a business flows through to the personal return and would be used in a modified adjusted income calculation. A family of four was limited to under $105,000 of MAGI if trying to receive the premium assistance credits. It may be hard to avoid or show less income depending on the nature of the business. The same $20,000-$30,000 premium level is common even for this huge middle-class small business owner group of the population.

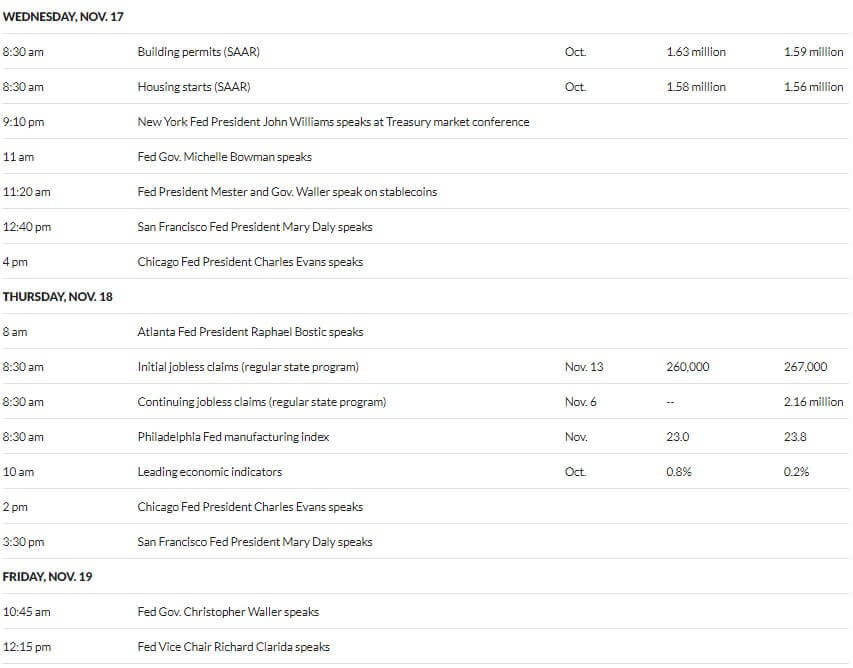

Temporary Enhancement to Premium Assistance Tax Credits

The American Rescue Plan Act enacted in March 2021 altered the maximum amount, as a percentage of income, a taxpayer must pay on a health policy purchased via the state-run ACA exchange before premium assistance tax credits kick in. This law greatly enhanced tax credits for 2021 and 2022 for households with median or lower income. See below for a chart that shows the traditional rates taxpayers usually must spend before qualifying for premium assistance tax credits on ACA policies vs. enhanced rates in 2021 and 2022 under the American Rescue Plan:

Under the American Rescue Plan, households are on the hook for a maximum of 8.5% of modified adjusted gross income before tax credits kick in to pick up the rest. In reality, a 60-year-old Nebraska couple’s anticipated MAGI of $80,000 had them staring at between $20,000-$30,000 of annual premiums (depending on the ACA plan chosen) because the income exceeded the 400% of FPL cliff that sat at around $69,000 for a household of two.

Under the temporary enhancement in 2021 and 2022, this same couple would be looking at premium tax credits in excess of $1,700 per month or over $20,000 per year. If that same couple’s income were instead $110,000, they would still be looking at premium assistance tax credits of over $1,500 per month. Considering normal premiums for bronze and silver plans in the state of Nebraska are regularly over $2,000 per month for a couple of two, these temporary credits virtually cover the entire premium associated with these plans.

COBRA vs. ACA for 2022

Early retirees who have not reached Medicare eligibility are left with a choice to pick up health insurance for the interim period between retirement and age 65. COBRA allows the continuation of current employer plan coverage typically for 18 months following the separation of service. This provision allows the insurance plan to remain the same, albeit without employer contributions likely that were subsidizing much of the cost before that individual(s) retired.

Traditionally, for a lot of the middle class, this temporary option was generally more appealing than going to the marketplace for a state-run ACA insurance policy. However, given the temporary enhancements to these premium assistance tax credits for 2021 and 2022, it may make more sense for a much greater percentage of households to look into a policy on the ACA exchange vs. COBRA.

Planning Considerations

For early retirees who were consciously trying to keep income down under the FPL cliff rules regarding premium assistance tax credits, this temporary enhancement in 2021 and 2022 allows a little breathing room. Intuitively these next two years could be a time to accelerate income with people not beholden to the old 400% of FPL income cliff. We counsel clients who are trying to keep income very low to live off of cash and taxable investment accounts (capital gain assets) to keep ordinary income (and MAGI) down during that gap before Medicare.

With the stock market bounce back over the past 20 months, this strategy may have come at a cost to losing some of the integrity of the targeted asset allocation (stocks vs. bonds) because investors may have been forced to sell more bonds or fewer stocks given the large unrealized gains likely found in stocks in many investors’ taxable brokerage accounts. Not being forced to maintain MAGI under $70,000 could allow for more rebalancing in taxable brokerage accounts this year without harming much of the premium assistance subsidies that these retirees expected to get in the first place.

Another opportunity to accelerate income is via Roth IRA conversions. In the earlier example, a married 60-year NE couple with $80,000 of MAGI would be looking at a subsidy of over $1,700 per month under these temporary rules. If we bumped up MAGI to $110,000, they would still be looking at a subsidy of approximately $1,550 per month for 2022.

Converting $30,000 to a Roth at what would normally be the 12% Federal tax bracket would cost roughly an additional $1,800 ($150/month difference in subsidies for 12 months) or 6% on a $30,000 Roth IRA conversion. For those households with large pre-tax IRA/401(k) balances, getting money out of IRAs to Roth IRAs at 18% on a federal level could still be an attractive hedge against future higher income (SS retirement, RMD, etc.) and higher future marginal tax rates.

Lastly, if a household chooses to move from COBRA or another health plan onto an ACA policy, keep in mind these plans can sometimes qualify as high-deductible health plans. As such, a high-deductible health plan allows for annual health savings account contributions. The maximum contributions for a family to a health savings account for 2022 is $7,300 + a $1,000 catch-up contribution for individuals over age 55. Contributions to a health savings account are considered above-the-line tax deductions and directly reduce income.

With any of these specific suggestions, we recommend investors consult with their tax advisers about tax savings strategies. If you have any questions, contact us or learn more about our Lutz Financial services.

WEEK IN REVIEW

- Data published last week showed the consumer price index increased at a 6.2% YoY rate in October, the fastest pace since 1990. Core inflation, which strips out the volatile food and energy components, increased 4.6%, the fastest rate since 1991. Energy, shelter, and vehicle costs led the gains.

- Data published today showed that retail sales grew 1.7% YoY, which was faster than economists were expecting. The stronger than expected number indicates the rise in consumer prices has not yet begun to dampen consumer demand.

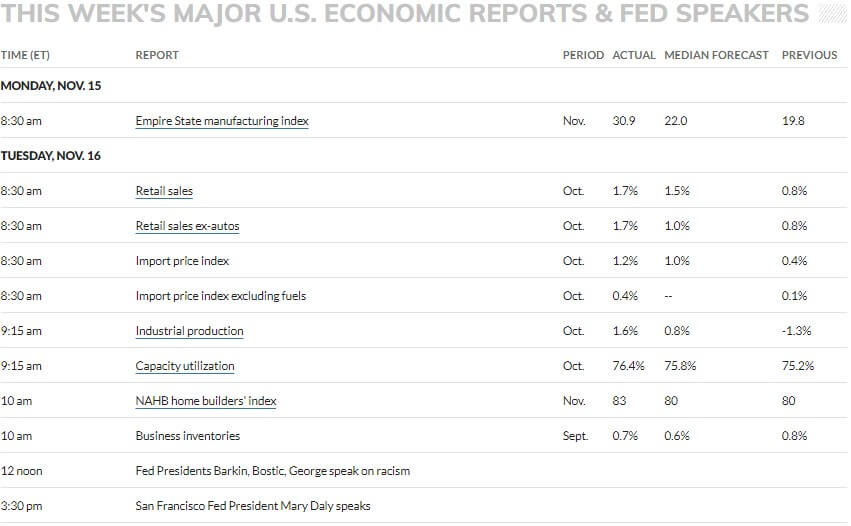

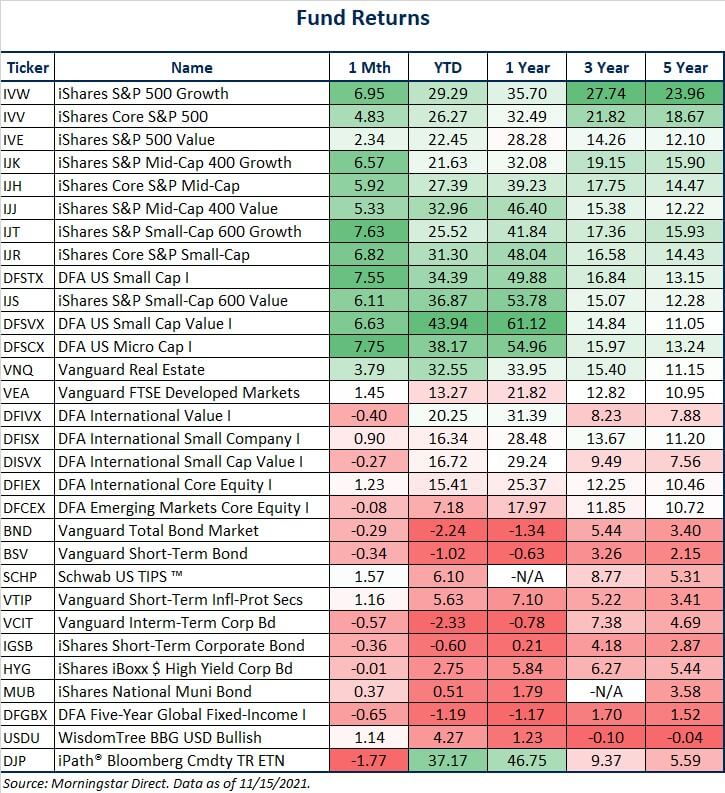

- Other economic announcements this week include a host of Fed Speakers as well as jobless claims and the Index of Leading Economic Indicators on Thursday.

HOT READS

Markets

- Retail Sales Rise Faster Than Expected in October Even as Inflation Pushes Prices Higher (CNBC)

- Homebuilder Confidence Surges Past Expectations, as Buyer Demand Remains High (CNBC)

- Where Inflation Is Highest in the US (WSJ)

Investing

- Experts From a World That No Longer Exists (Morgan Housel)

- You Probably Own Too Much Domestic Equity (Morningstar)

- How Much Does Inflation Cost? (Michael Batnick)

Other

- Quarterbacks Have been Saved By Evolution (SI)

- You Can Buy Stock in the Green Bay Packers for Just $300 (WSJ)

- Netflix Debuts New Streaming Metrics (Axios)

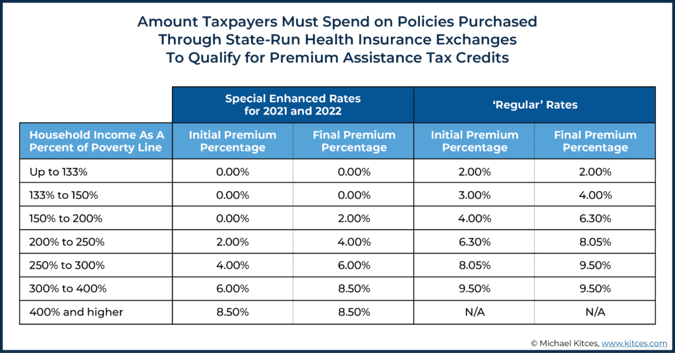

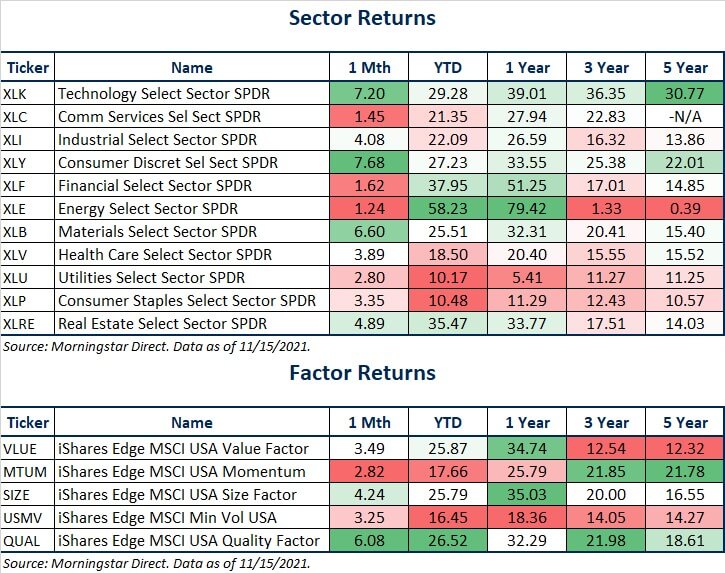

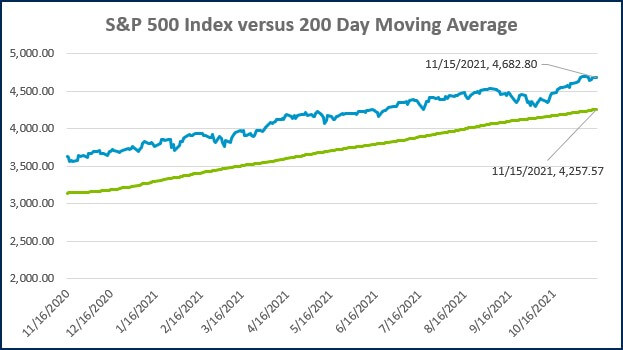

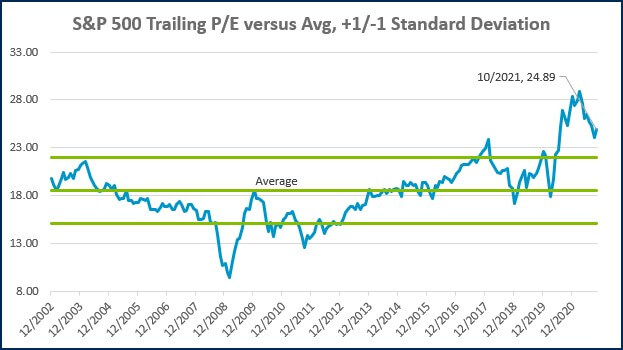

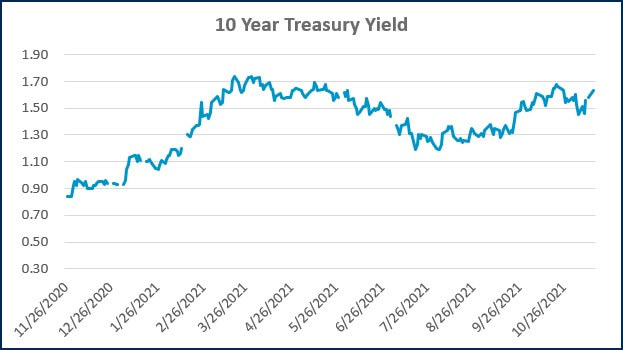

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

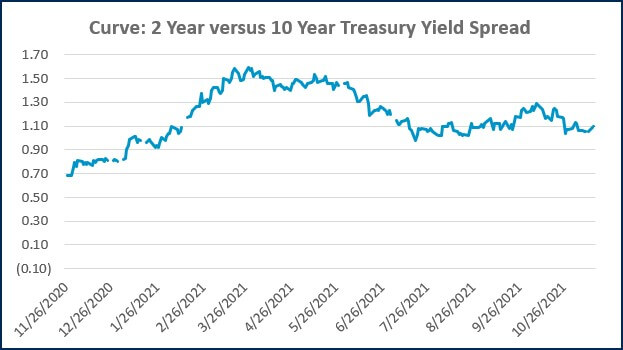

Source: Treasury.gov

Source: Treasury.gov

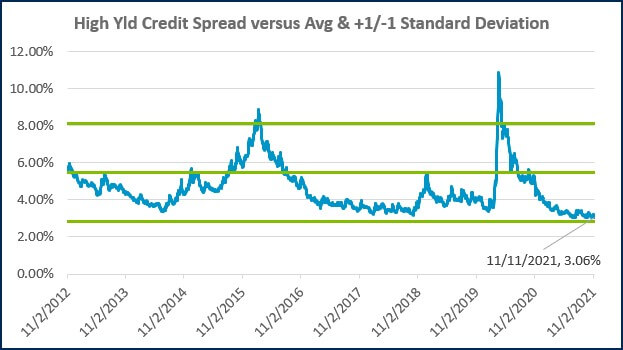

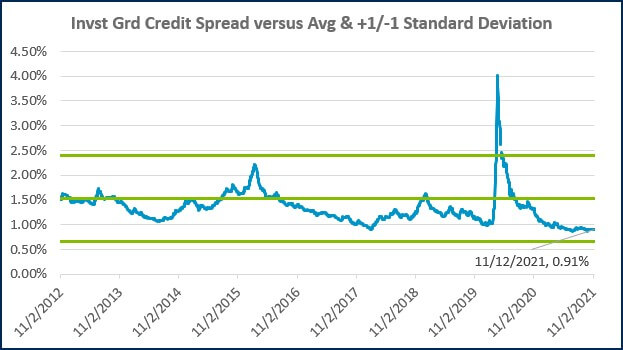

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

ECONOMIC CALENDAR

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)