Markets Are Forward Looking + Financial Market Update + 12.6.22

Last week the Bureau of Economic Analysis (BEA) published its revised GDP figure for the third quarter. The updated data revealed that the economy grew a little faster than previously thought, with GDP increasing from the initially estimated 2.6% to 2.9%. The outlook for economic growth in Q4 remains solid. The Federal Reserve Bank of Atlanta’s popular GDPNow model is calling for fourth-quarter GDP growth of 3.4%.

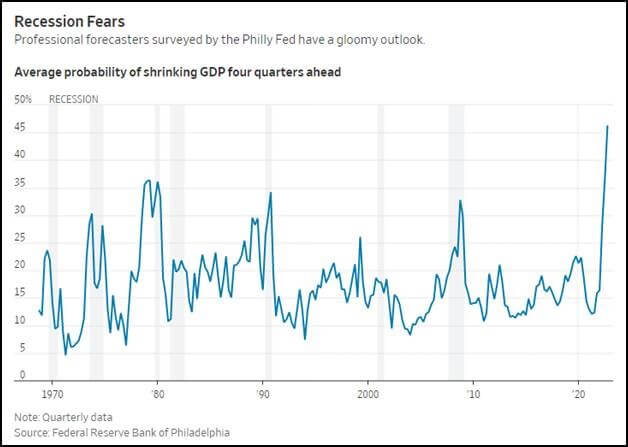

While economic growth is expected to finish 2022 off on solid footing, expectations for 2023 are not as rosy. Many investors and economists expect growth to grind to a halt next year, pulling the economy into a recession. The chart below, from the Wall Street Journal, illustrates a recent survey on recession expectations conducted by the Federal Reserve Bank of Philadelphia. Based on the data, nearly half of the forecasters anticipate a recession to begin next year.

Source: WSJ

As you can see above, there is more of a consensus that we are approaching a recession than at any other time over the last fifty years. Of course, this does not mean that the forecasters are actually correct. Their track record is not exactly inspiring. According to this survey, the forecasters haven’t estimated more than a 1 in 4 chance of a recession ahead of an actual economic downturn since the 1980s.

Still, the expectation of weakness on the horizon is widely held and has likely been incorporated into market prices to some degree. Investors rightfully associate recessions with poor stock market performance, but the connection between the two is not as direct as many people might expect. This is largely because the stock market is forward-looking. Current prices don’t just reflect the reality on the ground today. They also incorporate expectations for what may happen in the future, weighted by the likelihood of those expectations coming to fruition.

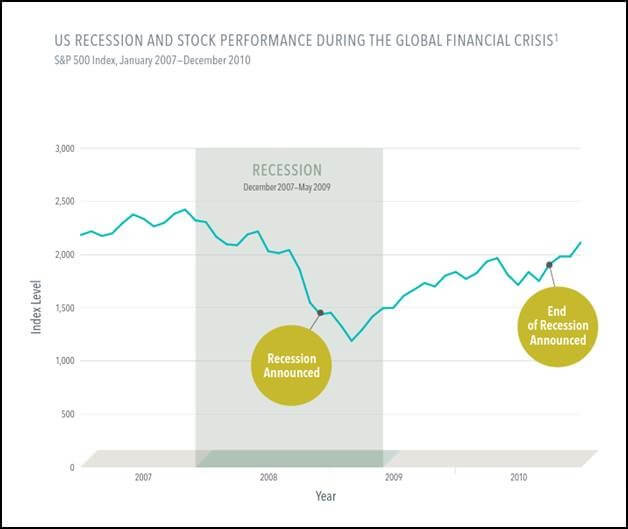

For a good example of how this has played out in the past, see the below chart from Dimensional Fund Advisors. It illustrates the performance of the S&P 500 leading into and coming out of the ‘Great Recession,’ as the 2008-09 Financial Crisis is often referred to. As you can see, the stock market peaked prior to the onset of the recession. Stocks then began to decline rapidly and were near their lows by the time the recession was officially announced. Prices did not wait for the official declaration. They moved as soon as investors began to sense things were deteriorating.

Source: Dimensional Fund Advisors

Source: Dimensional Fund Advisors

Stocks eventually bottomed during the recession and began to rise on the expectation that things were improving. The next bull market in stock prices began while the economy was still contracting, and it began substantially before the end of the recession was officially announced.

The propensity for markets to move based on expectations is the basis for a popular saying amongst professional traders: ‘buy the rumor, sell the news.’ Market prices are continuously handicapping the current environment and potential future developments. At times, the market can move too much in anticipation of an event or announcement. In this case, when the official news breaks, it is not uncommon to see the market movement reverse to some degree.

So, where does all of this leave us? Unlike during the Financial crisis, the market is expecting trouble ahead well before any actual contraction in economic activity. This is reflected in both surveys of forecasters as well as in asset prices themselves. The important questions for investors are:

- Is a recession in the near-term inevitable?

- If one is, how bad will it be?

- And what probability and severity of a recession are currently baked into asset prices?

Unfortunately, these questions are all unknowable in advance. While it is common for the stock market to reach its bottom prior to a recession ending, it has not historically bottomed prior to the recession beginning. The implication here would be the potential for more market volatility if we were indeed heading for a recession. On the plus side, even with the recent rally in the stock market, stocks are still well off their peaks. As a result, some portion of the pain has already been endured.

WEEK IN REVIEW

- The payrolls report, published last Friday, showed continued resiliency in the face of tightening monetary policy. Nonfarm payrolls increased by 263k in November vs. expectations of a 200k increase. The unemployment rate remained unchanged at 3.7%, while wages increased by a higher than expected 0.6%. The stock market has been under pressure since the report was published, as the stronger than expected data suggests the Fed may need to tighten monetary policy more than investors were hoping.

- The Institute for Supply Management (ISM) reported updates on manufacturing and services sector activity. The manufacturing activity index declined to 49 (below 50 signals contraction, while above 50 signals expansion). The services sector, which is a much larger portion of overall economic activity, increased to a robust 56.5.

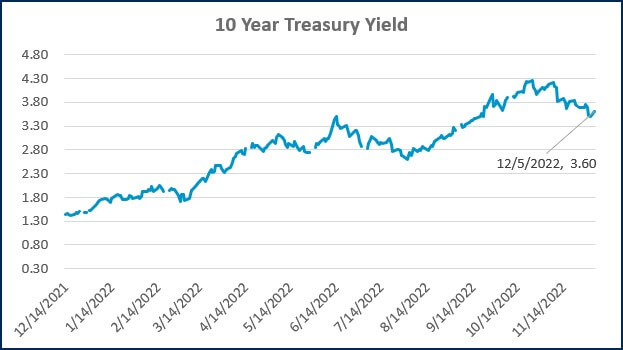

- Next week will arguably be the most important week for the remainder of 2022 in terms of economic data. On Tuesday, we will get the November CPI print. Inflation data has been the most impactful to markets this year, given its influence on the Fed’s monetary policy tightening. Continued cooling in the CPI data could offer a nice tailwind for stocks through the end of the year, while a hotter than expected figure will likely spark volatility across markets. On Wednesday, the Federal Reserve will conclude its last monetary policy meeting of the year. The Fed Fund Futures market is currently pricing a 0.50% hike as the most likely scenario, following four consecutive 0.75% hikes.

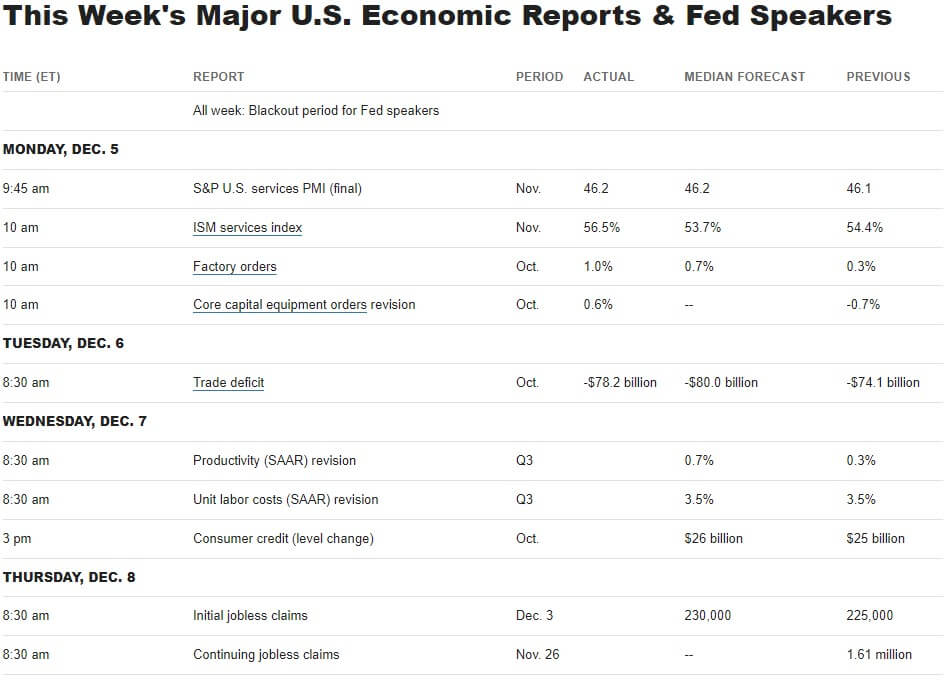

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Payrolls and Wages Blow Past Expectations, Flying in the Face of Fed Rate Hikes (CNBC)

- The Fed’s Path to a ‘Goldilocks’ Economy Just Got a Little More Complicated (CNBC)

- Services Come With a Amile, But the Economy Could Still Be Frowning (WSJ)

Investing

- Stocks Have Historically Been the Best Inflation Hedge (Josh Brown)

- Small-Cap Stocks Are Really Cheap (MorningStar)

- Is Real Estate a Better Investment Than the Stock Market (Ben Carlson)

Other

- Thankfully College Football Playoff Doesn’t Succumb to the SEC-Big Ten Takeover (SI)

- The Incredible Shrinking Future of College (VOX)

- The Best New Cars, Trucks, SUVs, and Minivans (Car & Driver)

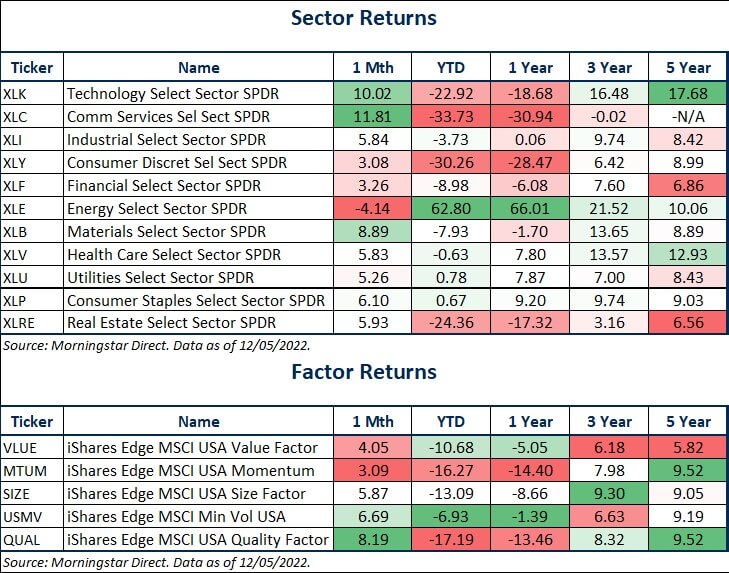

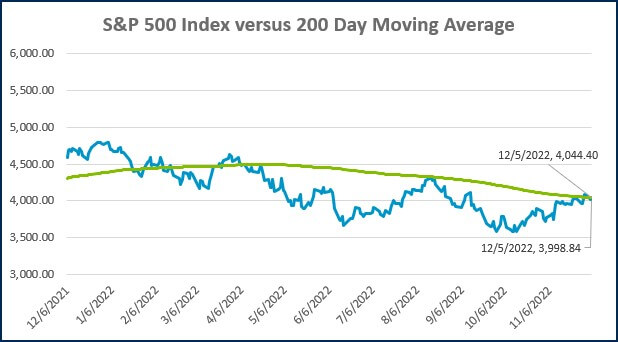

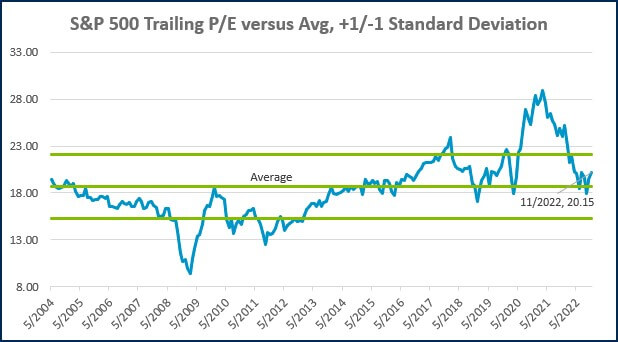

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

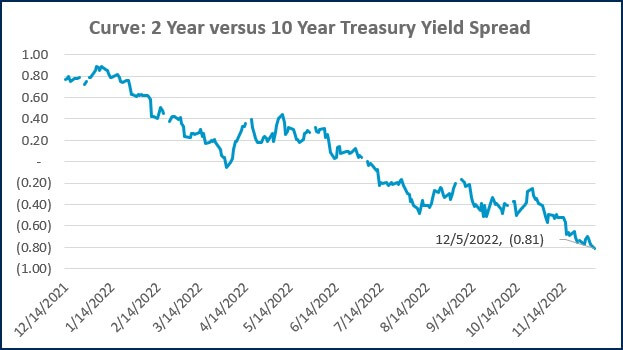

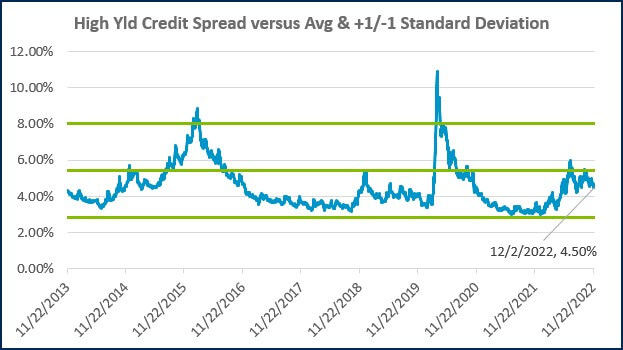

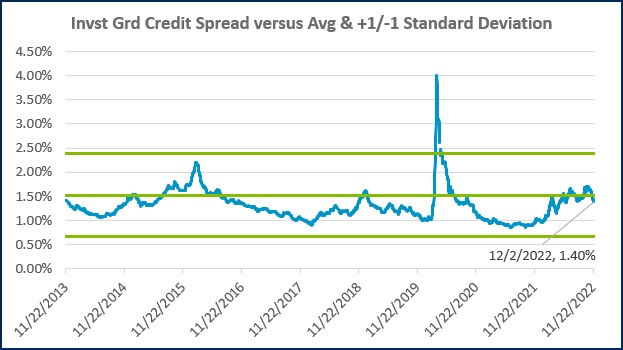

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)