Time in the Market + 5.28.25

%20(1)-May-27-2025-09-29-15-4695-PM.jpg)

For anyone interested in following the markets, there has never been a better environment than the one we enjoy today. The sheer amount of information available in real-time is staggering. A smartphone in the average person’s pocket grants access to as much data, analysis, and breaking news as the world’s top money managers exclusively enjoyed just a few decades ago. While I believe this to be a good thing, it creates some challenges as well.

Most financial media outlets have a distinct focus on the here and now. A breaking headline can feel monumental and often move markets in the short term. As time passes, these stories fade into irrelevance. Because of this, long-term investors must resist the temptation to react and instead stay focused on the big picture.

The chart below provides a simple illustration of what matters over the long term. It depicts the growth of a $10,000 investment that earned the long-term stock market return of 10% over the course of several different time horizons. In each case, the outcome is spectacular, a testament to the awesome power of compounding.

Source: Dimensional Fund Advisors

A few observations:

- In just 25 years, a $10,000 investment grows more than tenfold to over $108,000.

- Stretch the horizon to 35 years, and the total grows to $281,000. More than doubling again.

- By year 45, the investment reaches $728,000, highlighting how the later years of compounding have an outsized impact on wealth.

The key takeaway is that it’s all about time in the market, not timing the market. If the market grows at the long-term average rate of 10% per year, an investment will double in value roughly every seven years. This explains why it is so beneficial to begin investing at a young age. The longer the money is invested, the more time there is for compounding to work its magic.

The lesson is simple but easy to forget. Wealth isn’t built by reacting to every twist in the market. It’s built by staying the course. Investors who start early, remain patient, and resist the urge to chase headlines give themselves the best shot at long-term success. In a world full of noise, time remains your greatest ally.

Week in Review

- New-home sales rose 10.9% in April from the prior month to a seasonally adjusted annual rate of 743,000, which is the highest level of sales since February of 2022. On a regional basis, sales rose in all regions except the Northeast, with sales in the Midwest jumping by 35.5%.

- Initial jobless claims in the U.S. fell by 2,000 to 227,000 for the week ending May 17th. The sustained level of relatively low claims this year underscores continued resilience in the labor market, as figures below 300,000 are generally considered indicative of a healthy economy.

- According to FactSet, 96% of the S&P 500 reported Q1 2025 results as of last Friday, May 9th. The earnings growth rate, blended between companies that have already reported with the estimates for those that have yet to report, now stands at 12.9%, which would mark the second-straight quarter of double-digit earnings growth reported by the index.

Hot Reads

Markets

- Private Credit Has a Problem: Too Much Money (WSJ)

- Consumer Confidence for May Was Much Stronger Than Expected on Optimism for Trade Deals (CNBC)

- U.S. Durable Goods Orders Tumble on Lower Aircraft Demand (WSJ)

Investing

- Yes, You Have Too Much Money in That One Hot Stock (Jason Zweig)

- The Dumb Money Isn’t So Dumb Anymore (Ben Carlson)

- Highlights from the Proposed Tax Bill (Lutz)

Other

- Inside OpenAI’s Stargate Megafactory with Sam Altman – Bloomberg Originals (YouTube)

- The AI Revolution is Underhyped – TED (YouTube)

- Tiger Wood’s Long Iron Clinic with Rory McIlroy and Scottie Scheffler (YouTube)

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

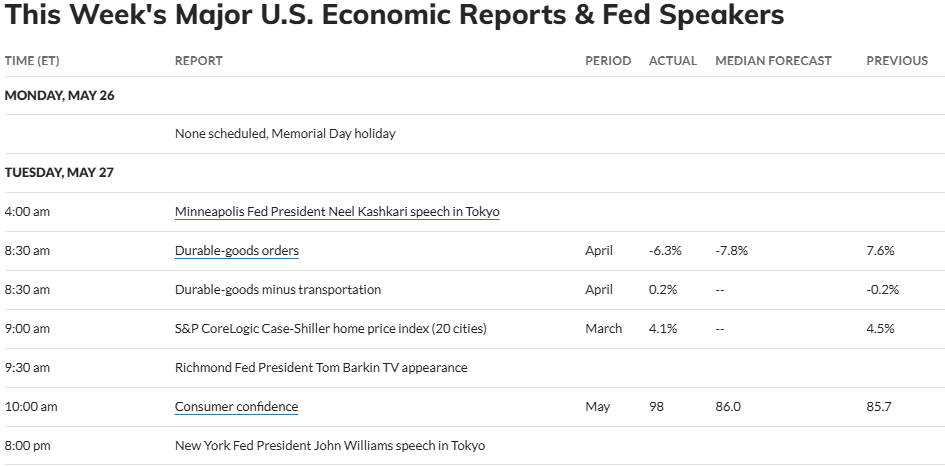

Economic Calendar

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)