Why is the Stock Market Cyclical? + Financial Market Update + 6.28.22

Over the last century, the U.S. stock market has returned roughly 10% per year on average(1). Interestingly, the stock market rarely generates a return near that long-term average. Instead, returns are typically much larger and periodically much lower. These (at times) exaggerated moves up and down are common and reflect the cyclicality that is inherent in the stock market. They are so common, in fact, they bare the widely accepted labels of ‘bull’ and ‘bear’ markets. What is the cause of the market’s cyclicality, and how should investors respond?

Decades ago, the behavioral economist and Nobel Laureate, Robert Shiller, demonstrated that stock prices oscillate substantially more than business fundamentals warrant(2). If investors were more robotic and made purely rational decisions, annual stock returns would probably align more closely with the long-term average. Alas, that is far from the case. Investor psychology can play a large role in the movement of the stock market, with the powerful forces of fear and greed at times exaggerating what would otherwise be benign fluctuations in price.

Famed investor, Howard Marks, has the best and most concise explanation for why prices move so much more than the underlying fundamentals(3):

When investors turn highly bullish, they tend to conclude that (a) everything’s going to go up forever and (b) regardless of what they pay for an asset, someone else will come along to buy it from them for more (the “greater-fool theory”). Because of the high level of optimism:

- Stock prices rise faster than company profits, soaring well above fair value (excess to the upside).

- Eventually, conditions in the investment environment disappoint, and/or the folly of the elevated prices becomes clear, and they fall back toward fair value (correction) and then through it.

- The price declines generate further pessimism, and this process eventually causes prices to far understate the value of stocks (excess to the downside).

- Resultant buying on the part of bargain-hunters causes the depressed prices to recover toward fair value (correction).

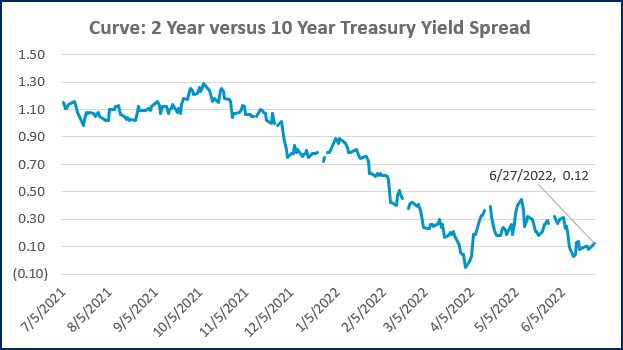

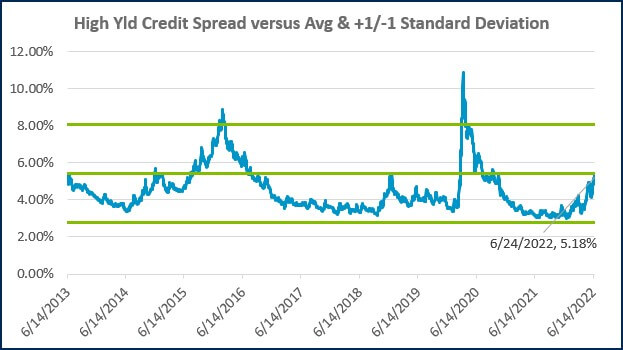

Of course, this is not to say that every trend in stock prices constitutes unjustified investor behavior. The market is currently pricing in the possibility that the Federal Reserve will inadvertently push the economy into a mild recession as it tries to combat inflation. A recession would certainly dampen business fundamentals.

Still, 2021 was bursting with examples of investors behaving as if everything was going up forever and that there would always be a ‘greater fool’ to swoop in and purchase assets at a higher price. Technology stocks, biotech stocks, Special Purpose Acquisition Companies (SPACs), and cryptocurrencies all participated in the frenzied excess to the upside.

Most investors feel more comfortable investing when the market is going up. It is critical to recognize, however, that as prices rise, the bar that the underlying fundamentals must surpass also rises. When the bar is raised to the highest levels, as described in the first bullet above, the seeds are sown for the next bear market. It may be counterintuitive, but risk is generally highest when investors are the most confident and optimistic.

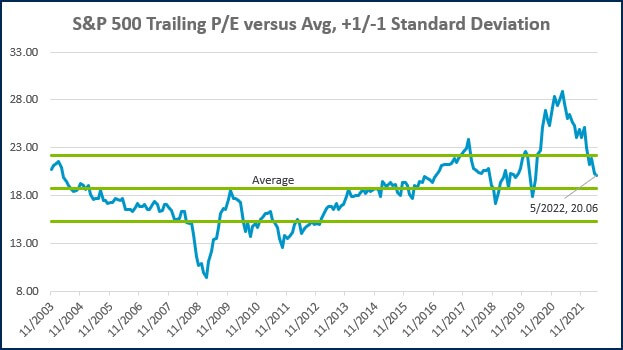

An investor that would not have thought twice about buying in 2021 may now have some reservations, even though the S&P 500 can currently be purchased for a roughly 20% discount from last year’s closing price. It may be tempting to sell investments and wait for the dust to settle or hold cash and try to time the market bottom. Unfortunately, the ultimate location of the market bottom can only be known in hindsight. Although it is uncomfortable to be invested when the market is experiencing substantial volatility, and the potential risks appear the greatest, those who stomach the discomfort have historically been rewarded.

1. Data from Morningstar Direct, based on the IA SBBI Us Large Stock TR USD Index. Calculated as annualized return from 1926 through 2021.

2. Shiller, Robert J. (1981), “Do Stock Prices Move So Much to Be Justified by Subsequent Changes in Dividends?” American Economic Review, 71, 3, 421-36.

3. https://www.oaktreecapital.com/insights/memo/bull-market-rhymes

WEEK IN REVIEW

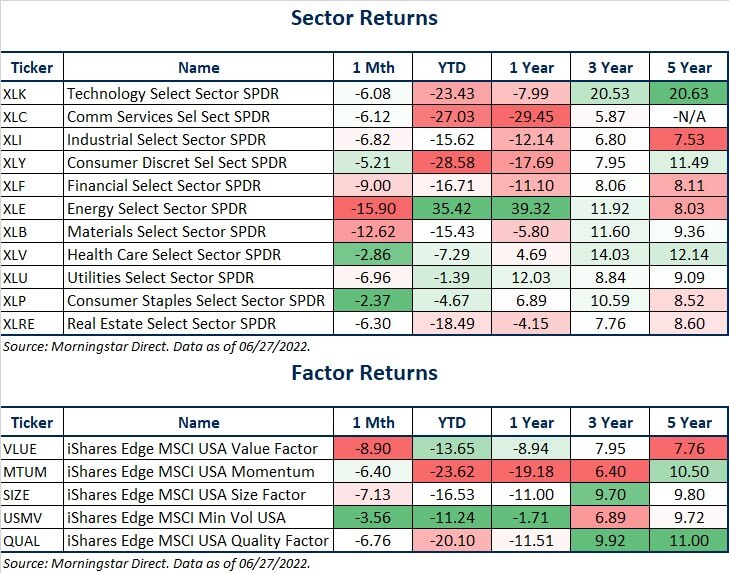

- The U.S. stock market got some relief last week, as the S&P 500 gained about 6.5%. Stocks have resumed their decline this week, however, as the index closed the Tuesday session down nearly 20% for the year-to-date.

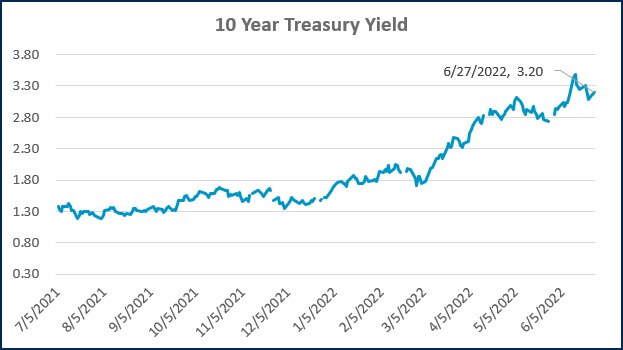

- Bond yields have also come off their highs. After peaking at 3.48% on 6/14, the 10-Year Treasury yield has declined to 3.18%.

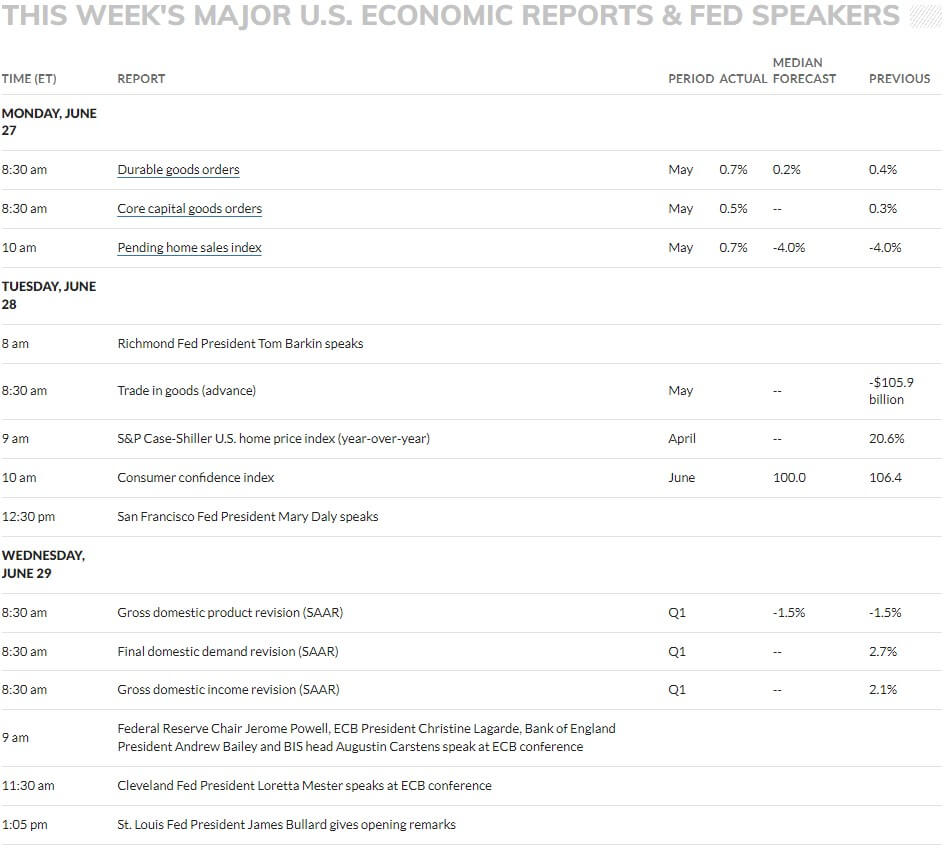

- This week will be busy with economic data. On Monday, Durable goods orders came out well above expectations (0.7% vs. 0.2%). On Tuesday, the Case-Shiller Home Price Index showed a slight deceleration in home price appreciation on a year-over-year basis from the prior month, although prices still increased at a rapid rate (20.4%). On Thursday, look for an update to the Federal Reserve’s preferred inflation gauge (PCE), as well as jobless claims. On Friday, we will get an update on manufacturing sector activity.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Big-Ticket Goods Orders, Pending Home Sales Point to Steady Demand (WSJ)

- Home Price Increases Slowed in April for the First Time in Months, S&P Case-Shiller Says (CNBC)

- New York Fed President John Williams Says a U.S. Recession is Not His Base Case (CNBC)

Investing

- 6 Things To Know About stock Market Crashes and Downturns (Morningstar)

- Unemployment Rates, Interest Rates, Mortgage Rates & Credit Card Rates (Ben Carlson)

- Investor Do’s and Don’ts During a Bear Market (Joe Hefflinger + Lutz Financial)

Other

- 2022 NFL Offseason: Best and Worst Moves, MVPs and More (Sports Illustrated)

- NASA Begins Return to the Moon with Low-Cost CAPSTONE Mission, Launched by Rocket Lab (CNBC)

- Shopping for a Router Sucks. Here’s What You Need to Know (Wired)

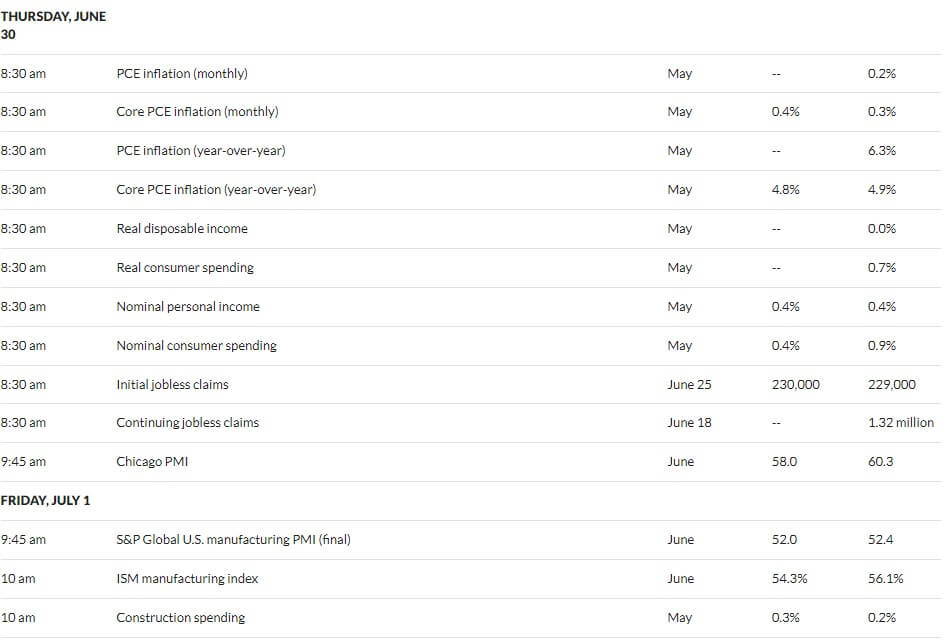

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

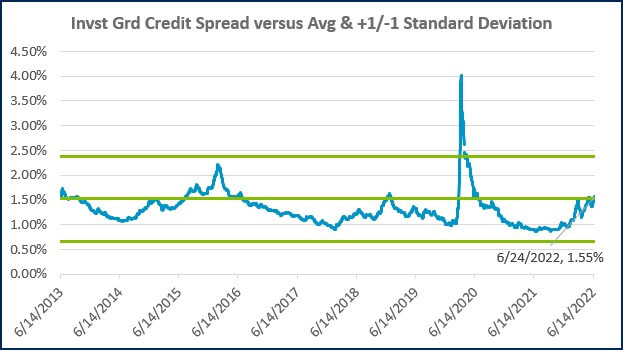

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)