9 Tips for Managing Your Accounts in QuickBooks Online

%20(1)-Feb-15-2024-09-33-37-6215-PM.jpg)

QuickBooks Online (QBO) is an incredible tool that empowers business owners and accountants, offering a seamless and efficient way to handle financial transactions and streamline operations. But to truly harness the power of this software and ensure a hassle-free account management experience, it's essential to adopt best practices. In this article, we have gathered valuable tips and strategies to help you effectively manage your QuickBooks Online accounts and optimize your financial processes. Let's discover how to make the most of your QuickBooks Online software.

1. Optimize Your Account and Settings

To start, familiarize yourself with QuickBooks Online's various settings and features. Access the Account and Settings options by clicking on the gear icon in the upper right corner of the QBO screen. Here, you can add your company details and customize settings for customer invoices, vendor bills, outgoing payments, and more. QuickBooks continuously adds and improves features, so review and update your settings regularly.

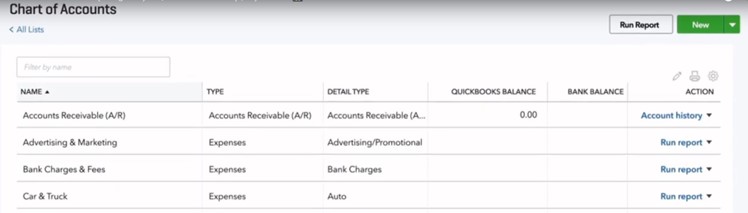

2. Review and Customize Your Chart of Accounts

When setting up your company, a default chart of accounts is provided. It’s important to review this list and make necessary adjustments to meet your specific needs. You can inactivate or add new accounts and edit existing account names to enhance clarity. Consider using account numbers to maintain order and readability and facilitate more organized reports.

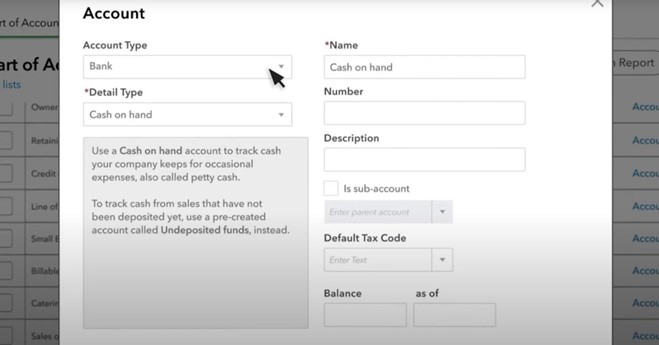

How To Add an Account

- Navigate to Transactions > Chart of Accounts.

- Select New.

- Select the appropriate account type from the Account Type dropdown menu.

- Select the appropriate Detail Type from the dropdown menu.

- Fill in all remaining fields and select Save and Close.

How To Edit an Account

- Navigate to Transactions > Chart of Accounts.

- Locate the account you'd like to edit.

- Select the dropdown arrow next to Account History or Run Report (depending on the account).

- Select Edit.

- Make all desired changes and select Save and Close.

3. Maintain Vendor and Customer Lists

Proper management of vendor and customer lists is crucial. Assign a payee to every recorded expense, enabling you to track amounts paid to each vendor. When tracking revenues, consider entering the customer name in the 'Received From' field when recording incoming receipts and deposits.

4. Store Supporting Documents

The software allows you to upload and store supporting documents, such as bills and receipts, as attachments to specific transactions. This feature promotes transparency and documentation organization. Take advantage of this capability, as it eliminates the need for physical storage space and enables easy retrieval of important documents. Incorporating this feature is highly recommended if you're not already using a separate cloud-based bill payment solution.

5. Reconcile Accounts Regularly

One of QuickBooks Online's most valuable features is its ability to connect to your bank's websites and download cleared transactions. Take advantage of this functionality by reconciling your accounts regularly. Reconciliation helps identify errors, provides a clearer picture of your cash flow, and improves the accuracy and timeliness of reports.

6. Streamline and Clean Up Your Lists

While some lists in QBO are relatively short, others can become unwieldy over time. Lists such as customers, vendors, and products/services may expand significantly, making it time-consuming to navigate through them during transactions. Regularly review and clean up these lists, making them more manageable and efficient. If deleting entries is not possible, consider marking inactive items to declutter your system and optimize performance.

7. Track 1099 Vendors

If your company must provide IRS Form 1099 to vendors, ensure you keep track of them in QuickBooks Online. Mark individuals or companies as 1099 recipients when creating their records within the software. Staying organized and proactive in managing 1099 vendors saves time and prevents last-minute scrambling during tax filing season.

8. Classify Transactions with Care

Accurate transaction classification is essential for maintaining reliable financial records. Take the time to ensure every record or transaction involving categories (such as classes, customers and vendors, and territories) is correctly assigned. Errors in classification can disrupt daily workflow and result in inaccurate reports. Create a meaningful group of Classes aligned with your business needs and consistently use them.

9. Seek Assistance and Support

Don't hesitate to seek help when needed. Contact your accountant, advisor, or QuickBooks support if you require assistance with setup, current feature usage, or exploring available options. Asking for guidance ensures that you maximize the potential of QuickBooks Online and effectively leverage its features. Remember, expert advice and support can save you time and effort in the long run.

How Lutz’s Client Advisory Services Can Help

By following these tips and best practices, you can make the most of QuickBooks Online's powerful features and streamline your processes. Lutz’s Client Advisory Services can assist you with selecting, purchasing, installing, and training for QBO. If you have questions, please contact us.

- Adaptability, Positivity, Developer, Ideation, Relator

Mike Perry

Mike Perry, Client Advisory Services Director, began his career in 2000. Since then, he has gained extensive experience in business consulting and accounting services.

Leveraging his advisory experience, Mike focuses on helping closely held companies optimize their accounting processes. He specializes in software implementation, training, and accounting procedure assistance, guiding clients through the challenges of technological transformation to improve efficiency and scalability.

At Lutz, Mike's adaptability and ideation skills enable him to develop innovative solutions for evolving technology needs. His vision and skill in implementing new processes have helped clients achieve meaningful transformations in their accounting operations.

Mike lives in Omaha, NE, with his spouse Brooke, children Liam and Mila, their dog Nala, and cat Sox. Outside the office, he can be found cheering on the Huskers and the Raiders, golfing, and camping at Lake Mac in Ogallala.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)