Are We Headed for a Recession?

Each morning I craft a Market Update email that I share with our advisors. This email provides commentary on what is happening in the markets and the economy. It includes data related to asset class performance and economic indicators and links to some top stories that I think are interesting and relevant.

As I review the daily news flow, I consistently come across articles that suggest we are entering a recession. It’s not surprising the financial media focuses on this topic. Their business model is reliant on attracting eyeballs for advertisers. Nobody is going to click on an article titled “We Don’t Know Why This Happened, and it’s Not Important.” Fear sells. You get people’s attention when you tell them the economy is heading for ruin and it’s taking investors down with it.

In light of the barrage of negativity in the financial news, we frequently field questions from our clients related to recessions. “Is one coming? If so, when? And what does this mean for my investments?” One of these questions can be answered with a level of certainty. The other two cannot. I’ll address each question below.

Is a Recession Coming?

Yes, a recession is coming. We know this to be true with some level of certainty. The economy is cyclical, oscillating between periods of expansion and contraction.

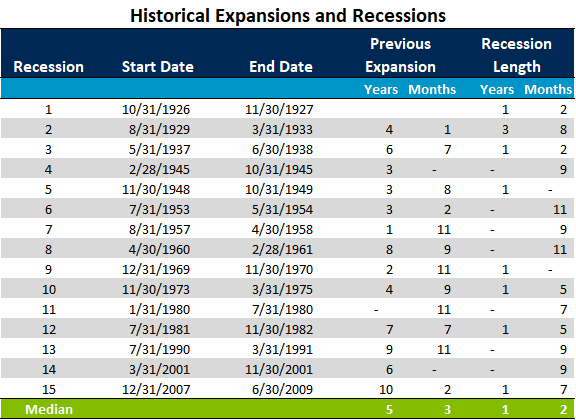

The table below illustrates the 15 recessions the U.S. economy has endured over the last (roughly) 100 years. On average, they have lasted one year and two months. They have been as short as seven months (the early 1980s) and as long as three years and eight months (the Great Depression).

Source: FRED Database. Recession indicators calculated by NBER based on peak through trough. Data from February 1926 through August 2019.

The table also illustrates the average expansionary period has lasted five years and three months. Frequently referred to as “bull markets,” the expansions have varied widely in length. They have been as short as eleven months and as long as ten years (and still going).

Despite the variation among the bull markets, they do share one common trait. At a certain point, every one of them eventually came to an end. One hundred years of data suggests the current expansion will meet the same fate as those that preceded it.

When Will the Recession Begin?

While it is easy to understand that a recession will come, it is much more challenging to accurately predict WHEN it will happen. A few pundits, economists, or investors may correctly foreshadow a large downturn, but it is seldom the same group from one episode to the next. There is little evidence that it is possible to consistently anticipate change in a system as large and complex as the economy or stock market. A common industry tactic is to call for a recession one to two years down the road. Eventually, they’ll be proven right! But how long are they wrong before that happens? Sitting on the sidelines during an upmarket carries a high opportunity cost.

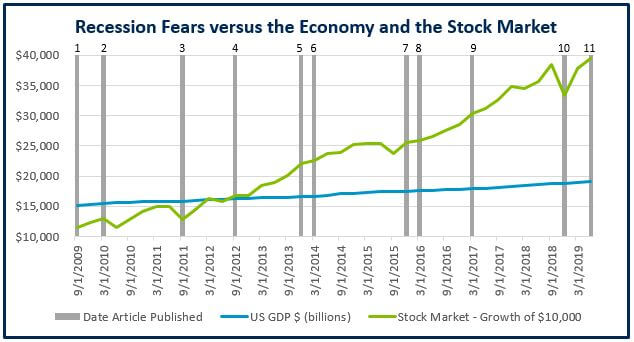

We have already discussed the media’s pension for alarming headlines. As we pulled out of the last recession, they wasted no time speculating on the next one:

- “Dr. Doom Sees Double-Dip Recession Risk, in Remarks Down Under” (WSJ, 8/3/2009)

- “Double-Dip Recession Fears Creep Back Into the Market” (CNBC, 2/25/2010)

- “On the Verge of a Double-Dip Recession” (NY Times, 9/7/2011)

- “Earnings Show Recession May be 'Fast Approaching'” (CNBC, 7/22/2012)

- “U.S. Recession is Nigh… and the Fed Can't Stop It: SocGen's Edwards” (CNBC, 11/28/2013)

- “Can The Fed Stop The Next Recession? Business Can't Bank On It” (Forbes, 2/23/2014)

- “It's Time to Start Talking About a U.S. Recession” (Business Insider, 10/11/2015)

- “A Recession Worse Than 2008 is Coming” (CNBC, 1/15/2016)

- “U.S. Heading for Recession After 2 Years of Unsustainable Growth, Economist Says” (CNBC, 3/28/17)

- “Another Warning that a 2019 Recession is Coming” (Forbes, 12/17/2018)

- “Parts of America May Already Be Facing Recession” (The Economist, 8/31/2019)

Despite the bad news prompted by these stories, both the economy and stocks continued their ascent:

Source: FRED Database and Morningstar Direct. The stock market is based on the growth of $10,000 invested in the S&P 500 TR Index. The Economy is based on the Bureau of Economic Analysis’ Real GDP in Billions of 2012 Chained dollars. Data from July 2009 through June 2019.

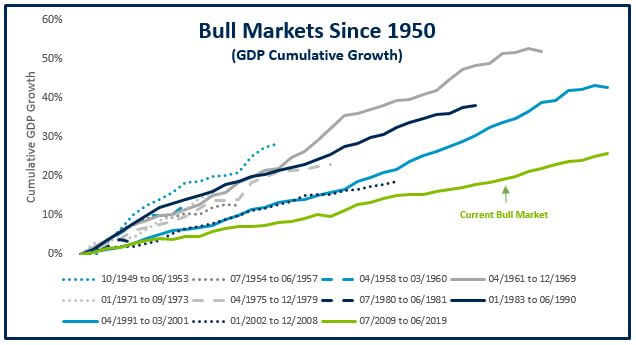

Earlier this year, the current bull market became the longest on record, surpassing the nearly ten-year expansion that spanned the 1990s. The record has sparked a commonly held view the expansion cannot keep going simply because one has never lasted this long before. On the surface, this view makes sense, but it ignores a critical variable. It considers the length of time the economy has been expanding but overlooks the rate of change.

Source: FRED Database. The Length of bull markets was calculated with the NBER based on peak through trough recession indicators. Start and end dates were rounded to the nearest quarter. GDP is based on the Bureau of Economic Analysis’ Real GDP in Billions of 2012 Chained dollars. Data from Jan 1947 to June 2019.

As it turns out, the economy has been growing at a much slower pace than in past expansions. In fact, it has not even cracked the top three in terms of cumulative GDP growth. This steady pace could suggest the economy has more room to grow before the imbalances that contribute to a recession begin to form.

How Will a Recession Impact My Investments?

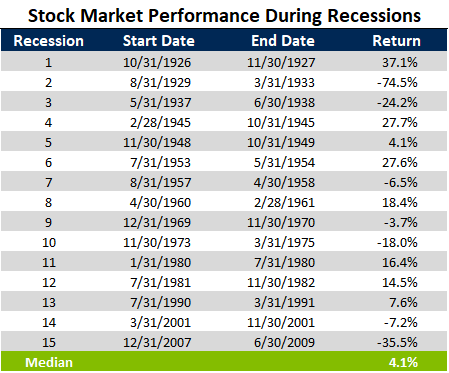

What if I told you that I knew with certainty which month the recession would begin? How much do you think you could profit from this knowledge? I think the typical investor would expect to improve their investment returns dramatically with this information. After all, stock prices plummet during recessions, right? A review of history shows us that reality is not that simple. You may be surprised to see equity returns were positive during eight of the last fifteen recessions, and the median return during these episodes was +4.1%!

Source: FRED Database and Morningstar Direct. Recession indicators calculated by NBER based on peak through trough. Stock market returns were calculated using the IA SBBI Large Cap Index. Data from February 1926 through August 2019.

It is important to understand that the stock market is a discounting mechanism. Stock prices represent an aggregation of all current information, as well as expectations about the future. As a result, market returns can and will deviate from the real economy.

Amid substantial economic growth, the market may anticipate there is trouble ahead, leading to lower prices before any actual contraction in economic activity occurs. Conversely, during the depths of a recession, the market may anticipate better times ahead, leading to higher prices prior to the resumption of growth. In the case of a mild economic downturn, the market may assess that the long-term prospects for businesses may not be so impaired that a large (or any) devaluation is necessary.

While recessions share common features, no two are exactly alike. The playbook that was successful during the last contraction may not work the next time. Selling out at the onset may have allowed you to avoid some pretty severe drawdowns, but it also would have caused you to miss out on significant gains.

A third of the recessions in the above table coincided with the stock market generating double-digit returns. This is illustrative of why market timing is so hard. Not only must you accurately foresee the event, but you must also correctly gauge the market’s reaction to the event. You then need to time your entry back into the market successfully. It does you no good to sell your investments ahead of a 20% drawdown to then miss out on a subsequent 30% recovery.

Preparation is Key

It is critical for investors to prepare for the next recession. Preparation, however, may not entail what you think. It has nothing to do with forecasting when a recession will hit or standing ready to sell out of your investments ahead of the next big drawdown. Preparation means sitting down with a financial advisor, mapping out your goals, and devising a plan you can stick to.

At Lutz Financial, we believe the best approach is to hold a low-cost and well-diversified portfolio that is appropriately calibrated to your goals and risk tolerance. The beauty of this approach is you don’t have to play any guessing games. Although your investments will experience volatility from time to time, you can take comfort in knowing it can weather the storm. While we don’t know when it will begin, the next recession is inevitable. Are you prepared?

IMPORTANT DISCLOSURE INFORMATION

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)