There Are Always Reasons Not to Invest + Financial Market Update + 10.18.22

There is no shortage of things for investors to be concerned about right now. Multi-decade high inflation, the rapid increase in interest rates, the prospect of a recession, and the war in Ukraine all constitute reasons to be fearful. Evidence of this fear is indeed on full display, both in terms of the decline in asset prices and the extreme pessimism in popular investor sentiment surveys. While the combination of risks behind today’s market volatility may be unique, risk and volatility are quite common in investing.

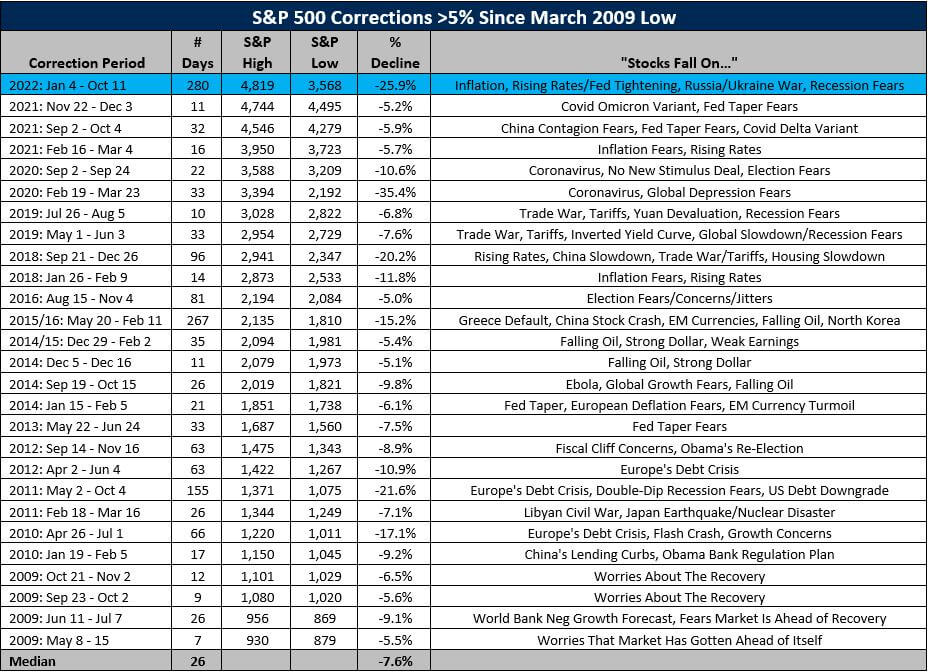

The table below helps to put recent market movements and investor fears, in general, into context. It includes every drawdown greater than 5% for the S&P 500 Index going back to the March 2009 lows following the Financial Crisis. As you can see, the duration, severity, and cause of these selloffs have varied dramatically.

Source: Charlie Bilello & Morningstar Direct, data as of October 11th, 2022

What strikes me is the relatively high frequency in which these drawdowns occur, especially when you consider that most of this table covers a period that is now regarded as a great time for stocks. From the market bottom in 2009 to the onset of the pandemic-related decline in 2020, U.S. stocks experienced the strongest bull market in history, both in terms of its length (roughly 4,000 days) and its cumulative gain (529%, including dividends).

When the current selloff will end is anyone’s guess. Unfortunately for investors, there will not be an alert when the time comes. Notice that all four of the selloffs in 2009 were related to growth fears and/or the stock market getting ahead of itself. Also, note that since market valuations were reasonably attractive throughout 2009, fear the market had gotten ahead of itself was just another way of saying people were skeptical about the recovery. Investors who were waiting for the dust to settle from 3/9/2009 through the end of the year ended up missing out on a stock market gain of 67.8%. The pandemic selloff provides us with another good example. Investors sitting on the sidelines when the market bottomed on 3/23/2020 missed out on a 17.6% rally during the first three days of the market recovery.

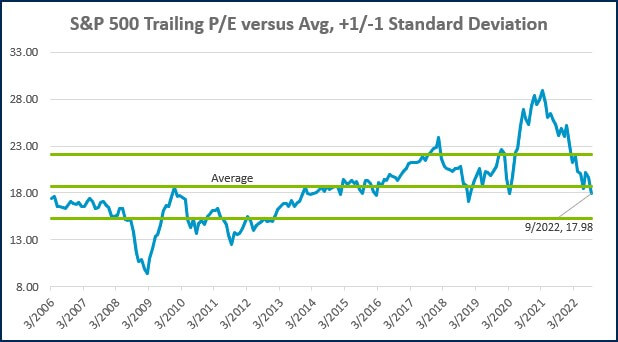

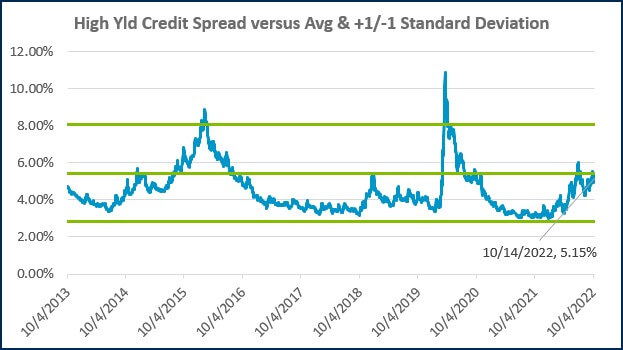

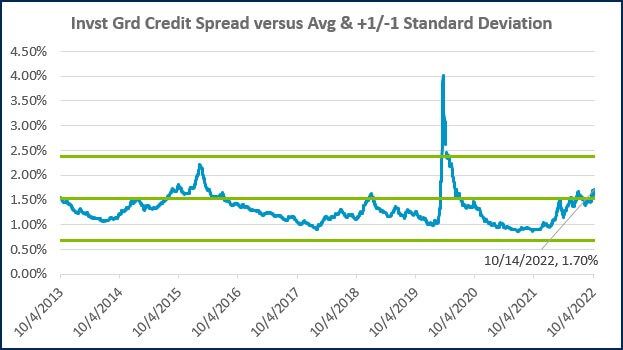

Investors should remember that even during the strongest bull run in history, investor anxiety and bouts of volatility were relatively persistent. Ultimately, this is a normal and healthy feature of the market. The silver lining for investors is that valuations across asset classes have gone from lofty to fairly valued, and as a result, expected returns have increased. Diversified investors would be wise to remain in their seats because there won’t be a warning when the next bull market begins.

WEEK IN REVIEW

- Earnings season officially kicked off last week as some of the nation’s largest banks reported results from the third quarter. As of Friday, with 7% of the S&P 500 reporting, earnings growth is expected to be 1.6% year-over-year. This expectation is based on a blend between the results from companies that have reported and estimates for companies that have not yet reported.

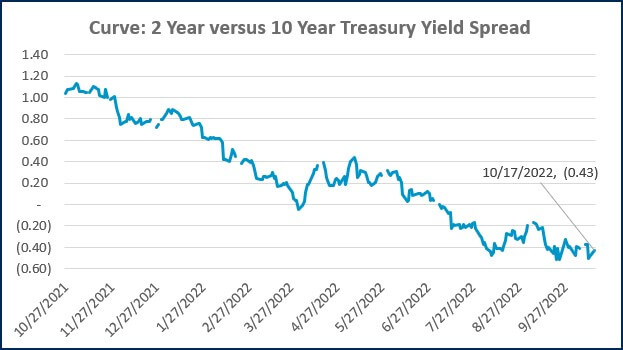

- Last week the Bureau of Labor Statistics (BLS) published the Consumer Price Index (CPI) for September. The headline index came in at 8.2%, higher than the forecast 8.1%. Core CPI, which strips out the volatile food and energy components, came in above expectations at 6.6% and marked the highest reading since 1982. The market initially sold off on the report but ended the day dramatically higher. Following the news, the fed fund futures market moved its expectation for the interest rate hike at the December meeting from 0.50% to 0.75%.

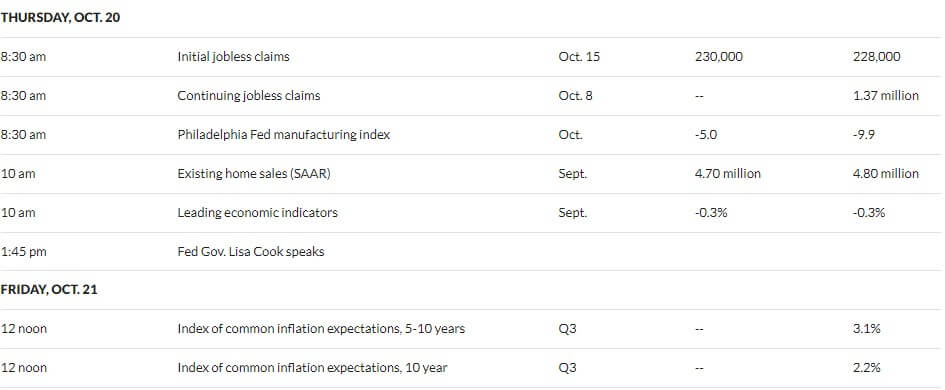

- The economic data calendar is relatively light this week, following two weeks with high–profile releases. Industrial production, published today, came in above expectations. Later this week, we will get the Index of Leading Economic Indicators, jobless claims (a proxy for layoffs), a few updates on the housing market, and inflation expectations.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Consumer Spending Was Flat in September and Below Expectations as Inflation Takes Toll (CNBC)

- After Two Years of Shipping Snarls, Things are Starting to Turn Around (CNBC)

- Inflation Increased 0.4% in September, More Than Expected Despite Rate Hikes (CNBC)

Investing

- What a Stock Market Bottom Looks Like (Ben Carlson)

- Little Rules About Big Things (Morgan Housel)

- Hold Opinions Loosely (Adam Grossman)

Other

- Today’s Strong Dollar Can Save Money on Travel to Europe Next Year (WSJ)

- You Hated Your Cable Package. Your Streaming Services Are Bringing It Back (WSJ)

- Life Time: Your Body Clock and Its Essential Roles in Good Health and Sleep (Next Big Read Club)

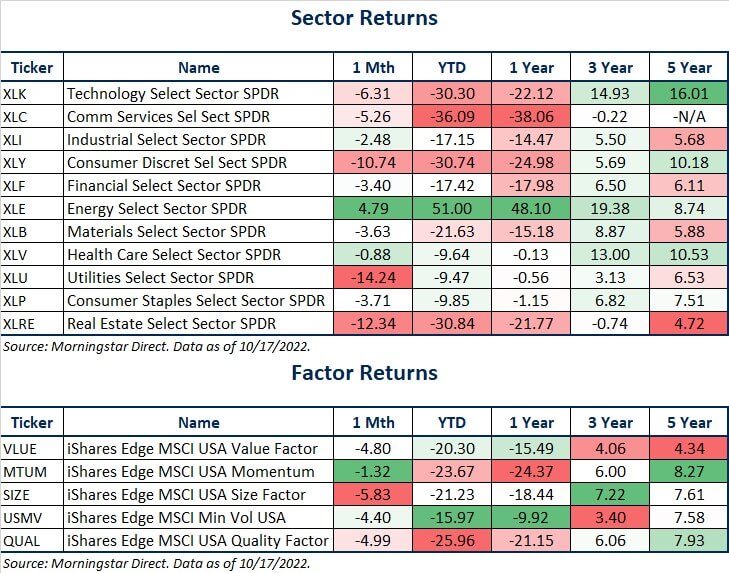

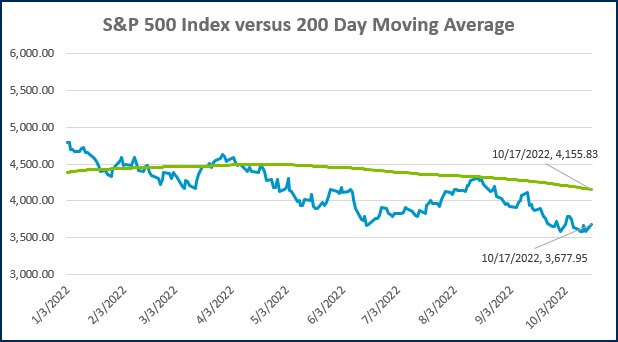

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Implementing Power BI Analytics for Modern Agricultural Operations

Mileage Reimbursements Aren't Always Non-Taxable: Why Accountable Plans Matter

Budgeting Tips for Business Owners & High Earners

Why Consultants & Temporary Talent Make Sense in Today's Market

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)