Isaac Newton and the South Sea Bubble + Financial Market Update + 11.10.21

Sir Isaac Newton is regarded as one of the most brilliant scientists of all time, making significant advancements to mathematics, optics, astronomy, and mechanics. His major accomplishments include the development of calculus, the three laws of motion, the law of gravity, the calculation of planetary movement, and the first reflecting telescope(1). While his numerous academic achievements are well known, many people do not realize that he is also remembered for his track record as an investor. Unfortunately for Newton, he was not nearly as inspiring in that arena. It is believed that Newton got caught up in one of the most infamous investment manias in history, losing an astonishing sum of money in the process.

The South Sea Company was founded in the early 1700s as a public-private partnership tasked with consolidating and reducing the national debt of England(2). The company went from earning a consistent but boring level of return in the early years to something much more exciting by the start of 1720. At that point, some innovative financial engineering and a concerted effort by stakeholders to pump up the stock began to push the share price rapidly higher.

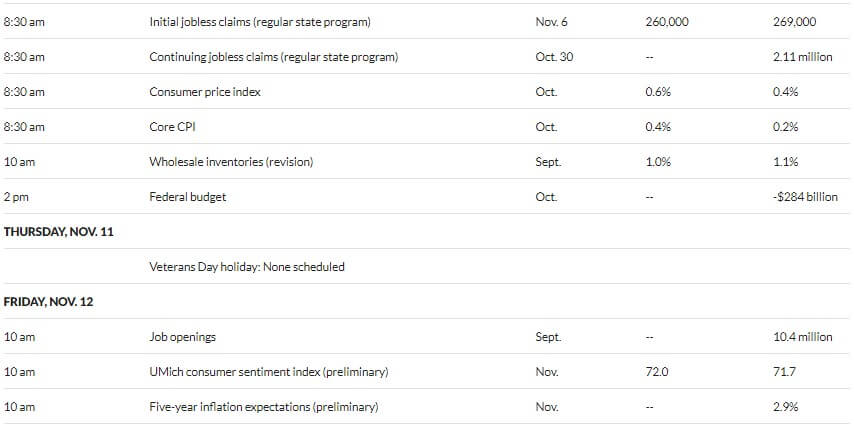

As the chart below shows, the price of the South Sea Company’s shares started 1720 at about $128. By April, it had lurched higher to $320, capturing the imagination of the public and whipping investors into a full-fledged speculative mania. The price would eventually peak a few months later in July, around $950, before collapsing under its own weight and crashing back down to earth.

Source: Harvard.edu Frehen, Rik, William N. Goetzmann, and Rouwenhorst, K. Geert. “New Evidence on the First Financial Bubble.” Journal of Financial Economics vol. 108, Issue 3 (June 2013): 585-607. Available at SSRN: https://ssrn.com/abstract=1371007

It is said that Newton was an early investor in the South Sea Company. After seeing the value of his shares appreciate substantially, he correctly inferred that they were overvalued and sold them at a handsome profit. Unfortunately for Newton, that is not where the story ends. The feverish mood surrounding the company’s shares raged on, and it is believed that he capitulated and bought back in as the bubble inflated. Of course, the bubble ultimately burst, destroying vast amounts of ‘wealth’ in the process. Estimates of his losses in today’s dollars are as high as $20 million(3)! After the price crashed back down to earth, Newton is famously rumored to have said, “I can calculate the motions of the heavenly bodies, but not the madness of people.”

The point of this story is not to label Newton as a bad investor or to poke fun at another person’s misfortune. Instead, it is to demonstrate how powerful emotions can be when investors begin to herd together and act based on greed. Even an intellectual as gifted as Newton was unable to resist the temptation to get rich quick.

The South Sea Bubble isn’t the oldest example of a speculative craze. In the mid-1600s, Holland experienced ‘Tulipmania,’ where at its peak, a rare tulip bulb fetched the equivalent of six times the average person’s annual salary(4). It also would not be the last example. In the 1990s, optimism surrounding the widespread adoption of the internet led to the dot-com bubble. In the 2000s, innovation in the parceling of financial risk through instruments like collateralized debt obligations (CDOs) led to a bubble in real estate.

There are, of course, countless other bubbles that have occurred throughout history. People simply cannot stomach the sight of others getting rich quickly, and the fear of missing out (FOMO) has repeatedly demonstrated its ability to override rational judgment. Even today, there is evidence of bubbles in some obscure pockets of the market, particularly within cryptocurrencies and non-fungible tokens (NFTs). Dogecoin, for example, is a cryptocurrency that was developed as a parody of a popular meme featuring a dog. According to Cointmarketcap.com, its total value is currently $36.3 billion. More recently, Shiba Inu, a crypto that was developed to parody Dogecoin, has a total value of $30.1 billion.

Somehow the NFT space offers an even more egregious example of excessive speculation. Enter the CryptoPunks, where you can purchase digital ownership rights to a pixelated cartoon face. These images, which look like they were created on Microsoft paint, have been selling for millions of dollars!

Source: https://www.larvalabs.com/cryptopunks/forsale

Source: https://www.larvalabs.com/cryptopunks/forsale

The only possible way to make money on something like Dogecoin, Shiba Inu, or CryptoPunks is if a greater fool comes along to pay a higher price than you did. Investors should be fearful of being the one holding the bag when the price of this stuff crashes back to reality. To avoid that risk, learn a lesson from Newton’s past mistake. Avoid buying into an inflating bubble.

Sources:

1. https://en.wikipedia.org/wiki/Isaac_Newton

2. https://curiosity.lib.harvard.edu/south-sea-bubble/feature/the-founding-of-the-south-sea-company

3. https://royalsocietypublishing.org/doi/10.1098/rsnr.2018.0018

4. https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

WEEK IN REVIEW

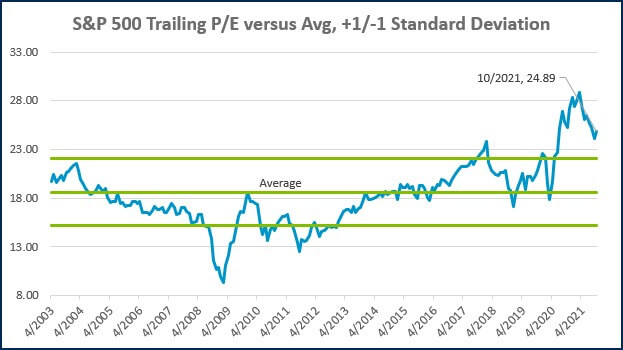

- According to Factset, 89% of the S&P 500 has reported earnings for the third quarter. The earnings growth rate of companies that have reported results, blended with the estimates from companies that have not yet reported, is at 39.1% year-over-year. This compares to the initial growth estimate of 27.4% as of 9/30. The stronger-than-expected earnings have been credited as one of the primary catalysts for the strong market performance thus far in the fourth quarter.

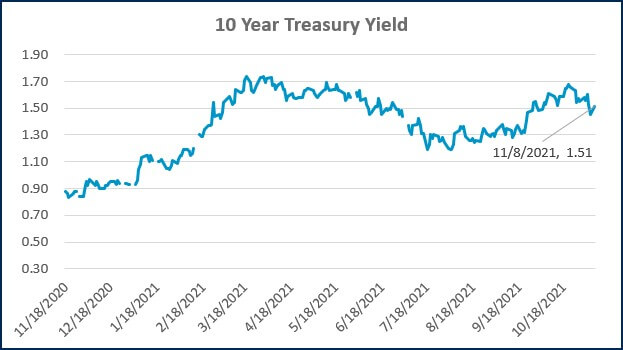

- Major developments from last week include the formal announcement by the Federal reserve that tapering of the asset purchase program will begin this month. Additionally, a stronger-than-expected jobs report showed the economy added 531k new jobs in October, relative to forecasts of just 450k. The job figures from the two prior months were also revised upward.

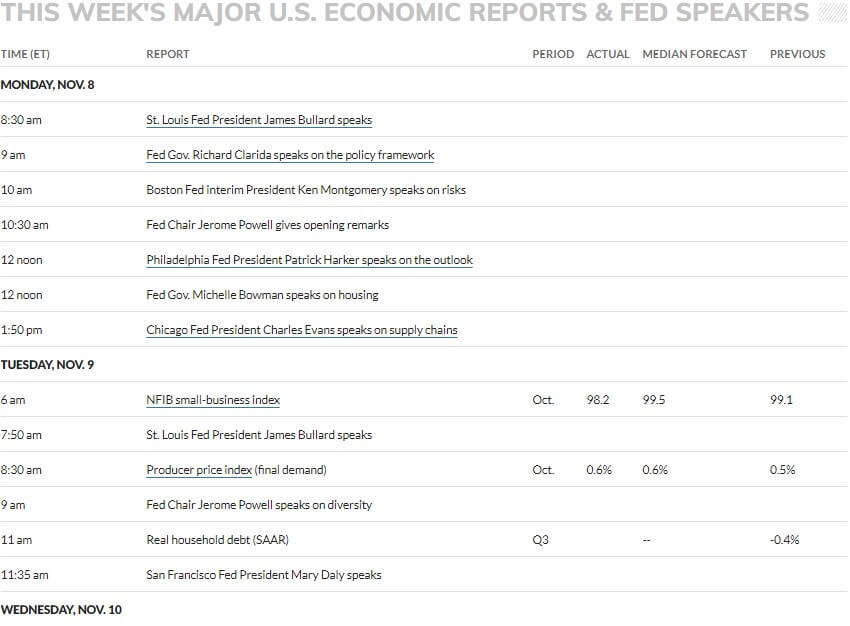

- Headlining this week’s economic calendar is the consumer price index to be published on Wednesday. Other economic data of note include initial jobless claims on Wednesday and the University of Michigan sentiment surveys on Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Strong Jobs Report Shows Economy Back on Track For Stronger Growth (CNBC)

- Fed Decision Taper Timetable as it Starts Pulling Back on Pandemic Era Economic Aid (CNBC)

- Whoelsale Prices Rose 8.6% YoY in October, tied for Highest Ever (CNBC)

Investing

- The Same Stories Again and Again (Morgan Housel)

- The 3 Levels of FOMO (Ben Carlson)

- Keeping It (Adam Grossman)

Other

- The Boom of Dead Money in College Sports (ESPN)

- Overused Words and Phrases that Make You Sound Weak Less Confident According to Grammar Experts (CNBC)

- Why Your Car Will Become Even More Like an iPhone (WSJ)

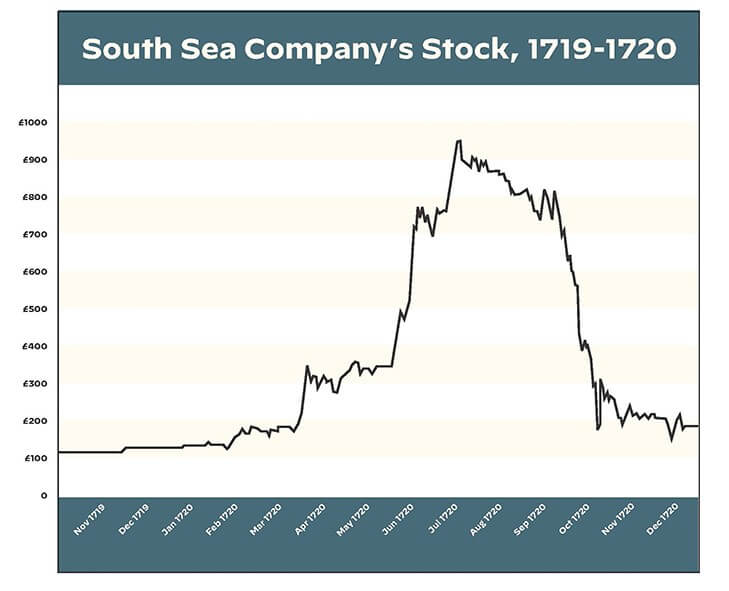

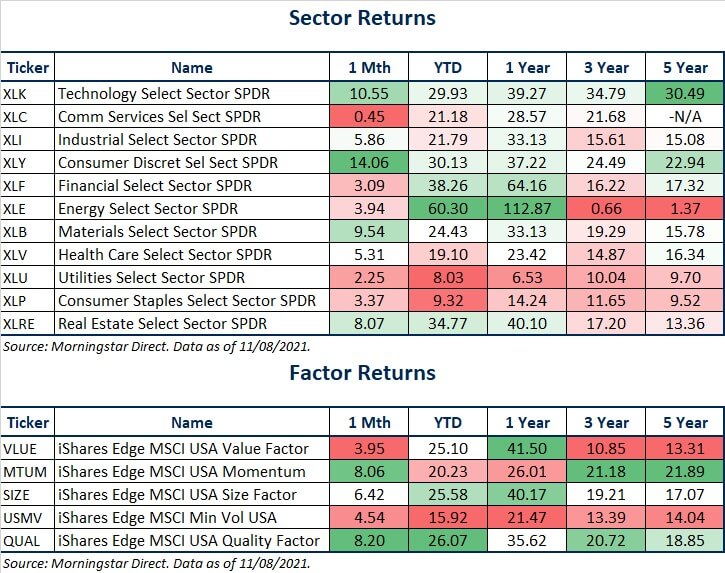

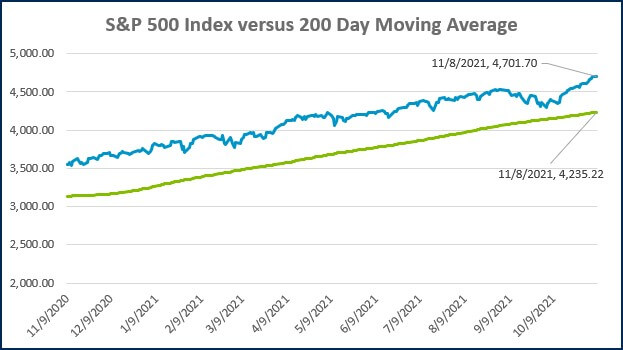

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

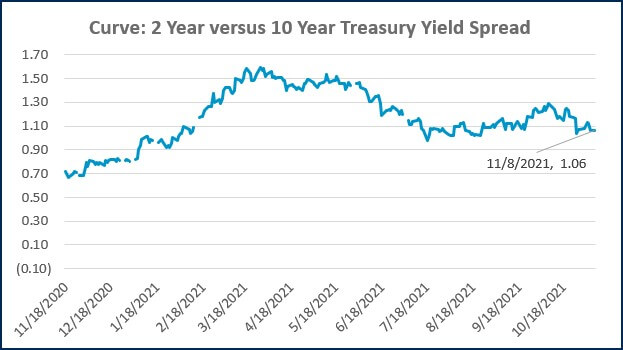

Source: Treasury.gov

Source: Treasury.gov

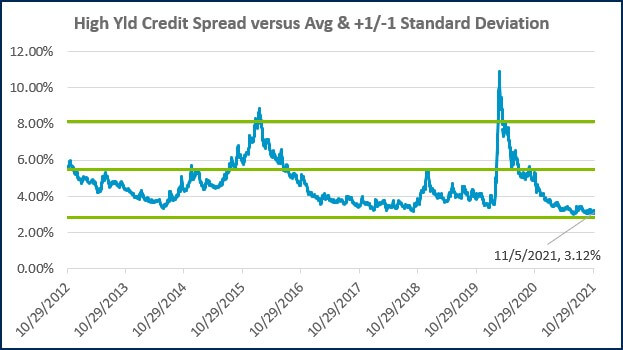

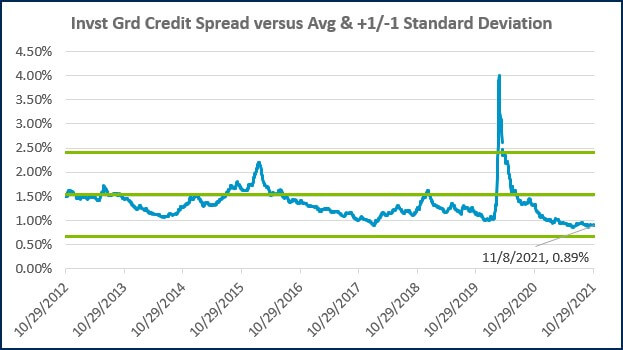

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Implementing Power BI Analytics for Modern Agricultural Operations

Mileage Reimbursements Aren't Always Non-Taxable: Why Accountable Plans Matter

Budgeting Tips for Business Owners & High Earners

Why Consultants & Temporary Talent Make Sense in Today's Market

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)