The Fed's Pivot Sparks a Market Rally + Market Update + 12.19.23

The financial markets began a furious rally last week, ignited by the conclusion of the Federal Reserve’s monetary policy meeting. After witnessing the dramatic impact on asset prices, one might assume the Fed took some sort of concrete action. Instead, they voted to keep rates unchanged for the third consecutive time. So, what exactly did the Fed do to get the markets so excited? And what should investors expect moving forward?

The Fed Meeting

The decision to leave the policy rate unchanged was widely expected. Markets were instead focused on how the Fed anticipated its inflation fight would progress in the coming year. This information would come from a series of forecasts that the Fed publishes once a quarter, known as the SEP (Summary of Economic Projections).

Compared to the prior publication of the SEP in September, the projections published last week implied a view among Fed officials that:

- Economic growth will continue in 2024, albeit at a slightly lower pace than previously expected (1.4%).

- Unemployment would remain low at 4.1%.

- Inflation would decline faster than previously expected.

- There would be no further hikes in 2023. The prior SEP projected the fed funds rate to be 0.25% higher than it is today by year-end.

- The Fed funds rate would fall by 0.75% next year, consistent with three 0.25% rate cuts during 2024.

The Policy Pivot

For two years, Fed Chairmen Jerome Powell was unwavering in his message that the Fed was committed to restoring price stability, even if that meant causing a jump in unemployment and pushing the economy into a recession. Just two weeks prior, at a speaking engagement in Atlanta, Powell continued to reinforce this notion, suggesting it was too soon to speculate about when lower rates might be appropriate.

However, the outlook illustrated by the SEP suggested the Fed may finally be ready to pivot away from its policy-tightening bias. That view was reinforced when Powell began his post-meeting press conference. During the Q&A session, Powell was asked how the Fed will ensure they are not behind the curve on loosening policy. Powell responded by saying, “We know that’s a risk and were very focused on not making that mistake.” He went on to note that they had “come into a better balance between the risk of overdoing it (with tight policy) and the risk of underdoing it.”

The notion of the ‘balance of risks’ is an important one for the Fed. They have a dual mandate of maintaining price stability and maximum employment. A challenging aspect of monetary policy is that action taken to pursue one mandate often hurts the pursuit of the other. Cooling an overheating economy generally increases unemployment and risks a recession. Conversely, stimulating the labor market can spark upward price pressures.

For two years, the Fed has been saying an imbalance in risks has forced them to focus on price stability, labor market be damned. Now, with these risks more balanced, the strength of the labor market and the economy is re-entering the calculus. This may increase the likelihood of a so-called ‘soft landing,’ where the Fed can restore price stability without causing a jump in unemployment that pushes the economy into a recession.

Looking Forward

There are generally two reasons for the Fed to cut rates:

- The economy is under pressure, and the Fed wants to stimulate activity.

- Interest rates are higher than what is required to achieve price stability.

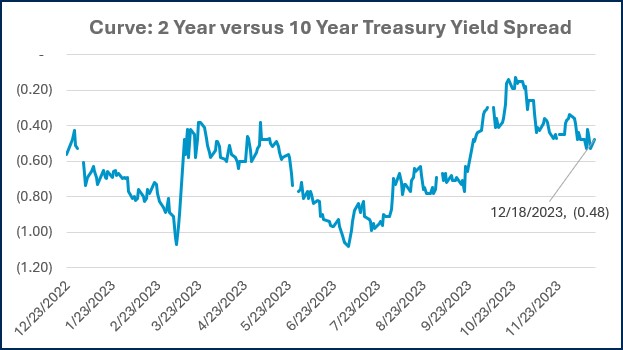

Since late 2021, when the Fed initially signaled it was going to tighten monetary policy, the market has been debating which reason would eventually lead to rate cuts. Entering 2023, most economists were forecasting a recession by year-end. This would suggest the need to stimulate the economy would be the likely catalyst. Indeed, most of the interest rate cutting cycles in recent decades have occurred for this reason.

In a vacuum, lower interest rates are good for asset prices. It’s generally bad for asset prices, however, if interest rates are being cut because a recession is on the horizon. It’s no surprise, then, that there has been some confusion among individual investors about the intensely positive market reaction to the potential rate cuts next year.

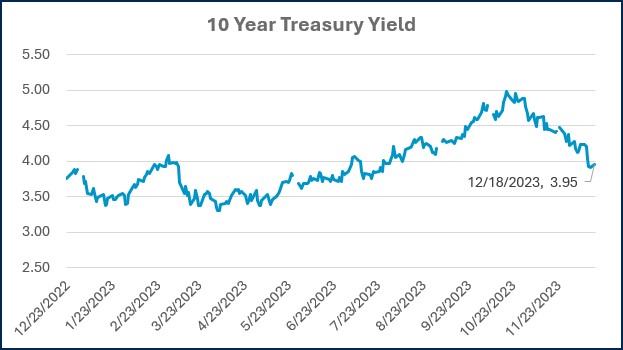

If you consider the second reason for cutting rates, the market’s reaction makes much more sense. If the Fed is confident that the rate of inflation will continue to decline, they will need to cut rates or risk monetary policy tightening on its own. This would occur because the economy responds to the inflation-adjusted level of interest rates (known as ‘real’ rates). If inflation declines and the policy rate remains unchanged, then the inflation-adjusted policy rate has actually increased. To maintain a consistent policy stance next year in the face of declining inflation, the Fed will need to cut rates.

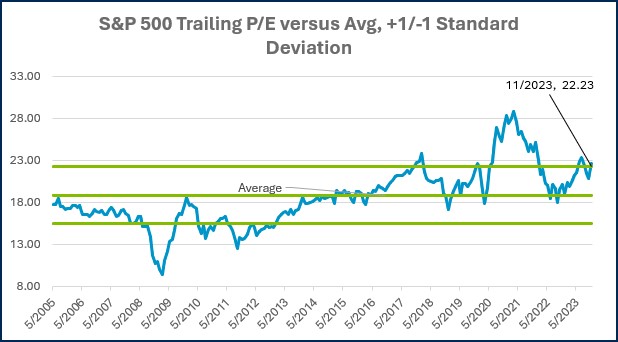

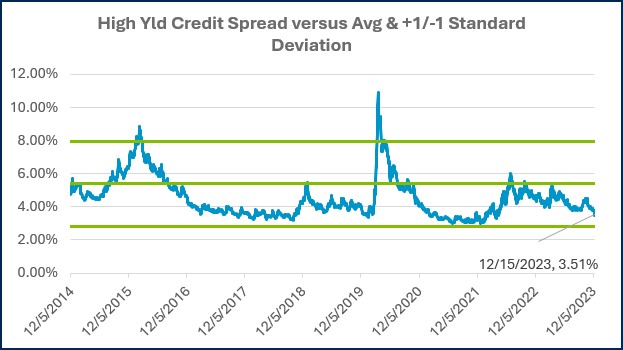

While option two above is better for the markets than option one, it would be wise for investors to temper their excitement. For starters, there has already been a significant repricing in the markets. Valuations appear stretched across certain asset classes, particularly large-cap U.S. stocks. With the recent surge, there is some risk that the market has gotten ahead of itself.

There is also the risk that the future does not align with the Fed’s projections. It is still possible that we will see a reacceleration in inflation, which occurred several times during the 1970s. On the flip side, the economy could slow much more than expected. You don’t have to look back very far to see economists completely miss the mark on a year-ahead forecast. The consensus view entering 2023 was for a recession to hit by year-end. As the past few years have shown, narratives can shift on a dime as the market digests incoming data. Investors would be wise not to be carried away by the unpredictable swings in market sentiment.

Week in Review

- The Federal Reserve concluded its final monetary policy meeting of 2023 last Wednesday (12/13), voting to leave its benchmark interest rate unchanged at a 22-year high. The real news came from the updated Summary of Economic Projections (SEP) and post-meeting press conference, which collectively suggested a pivot towards a more accommodating policy in the future.

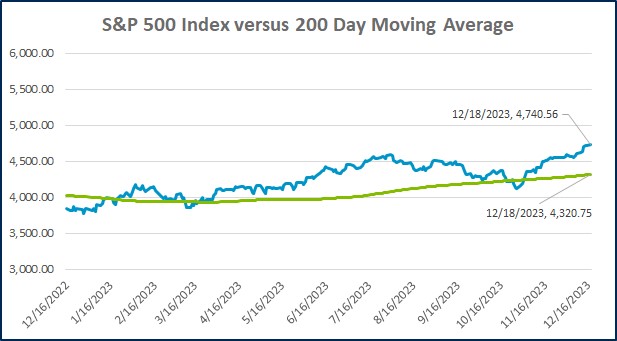

- The markets reacted positively to the news. The S&P 500 closed 1.4% higher, while the 10-year Treasury yield dropped to the lowest level since August (4.0%).

- The U.S. retail sales data for November was released last Thursday and showed that sales at U.S. retailers rose .3% in November versus the estimate of a -.1% decline. The positive sales number was a welcomed surprise as U.S. retail sales had declined in October for the first time in seven months.

Hot Reads

Markets

- Fed Lowers Inflation Forecast for 2024, Seeing Core PCE Falling to 2.4% (CNBC)

- It’s The Magnificent Seven’s Market. The Other Stocks Are Just Living In It (WSJ)

- Fed Official Says Central Bank Isn’t ‘Really Talking About Rate Cuts’ (WSJ)

Investing

- Stayin the Course Is Harder Than It Sounds (Ben Carlson)

- Long-Term News (Morgan Housel)

- Doing the Thing vs. Selling the Thing (Nick Maggiulli)

Other

- Why Iceland’s Latest Volcanic Eruption Looks So Different – WSJ (YouTube)

- 5 Lessons From the Iron (ArtofManliness)

- Forget the Oven, This Is How I Make Prime Rib Now – Chef Billy Parisi (YouTube)

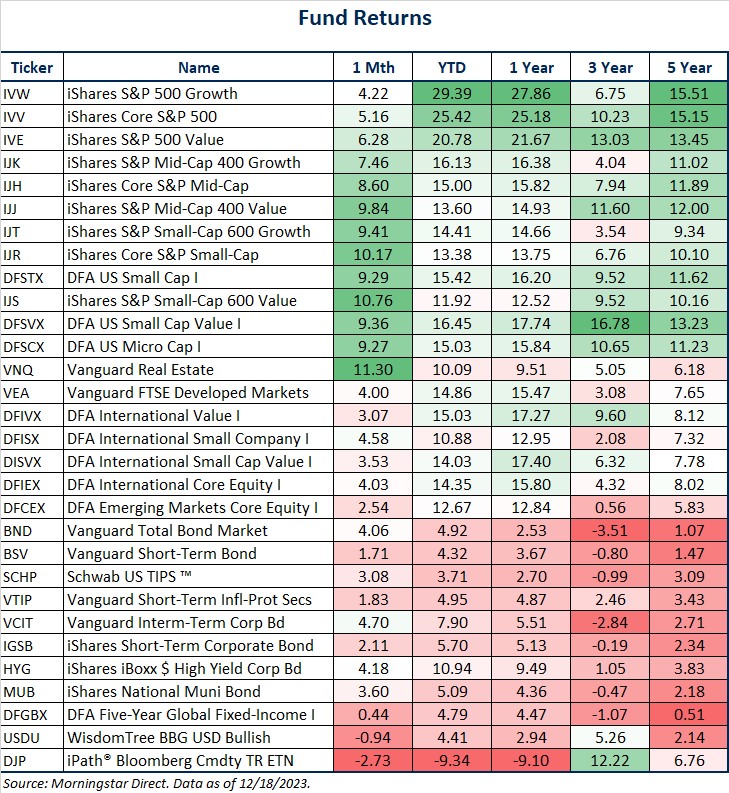

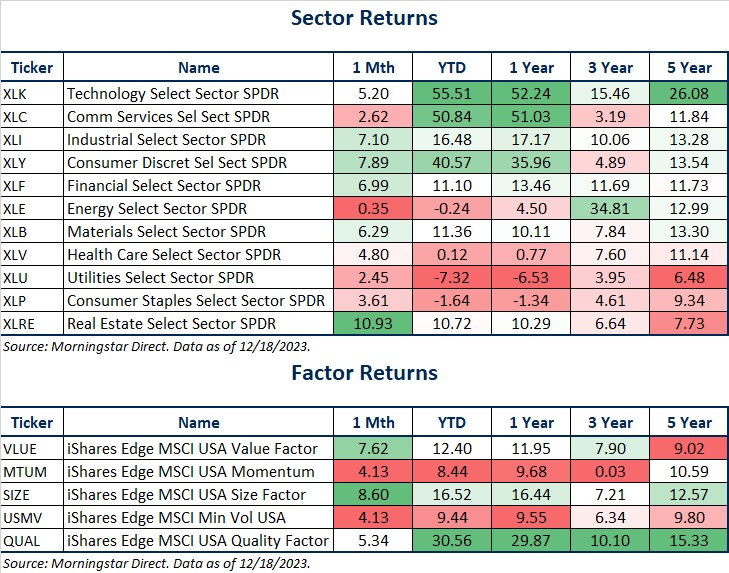

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

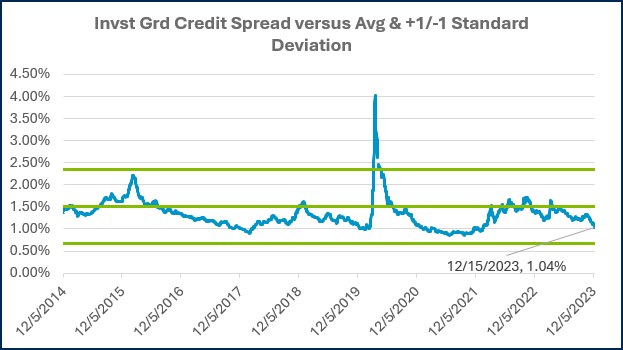

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

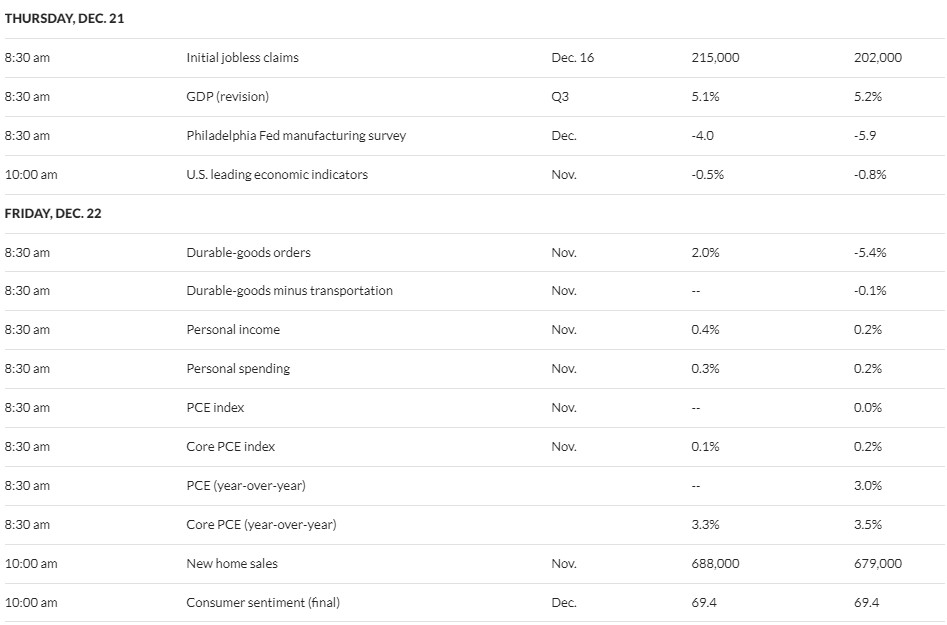

Economic Calendar

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)