What Market Efficiency Means for Investors + Financial Market Update + 12.20.22

In the early 1970s, Professor Eugene Fama of the University of Chicago popularized an idea that forever changed the world of finance. It was the notion that stock prices at any time fully reflect all available information. The ‘Efficient Market Hypothesis,’ as the concept is now often referred to, can be credited with the creation of index funds and eventually led to Professor Fama winning the Nobel Prize in Economics. What makes the markets so efficient? And what does it mean for investors?

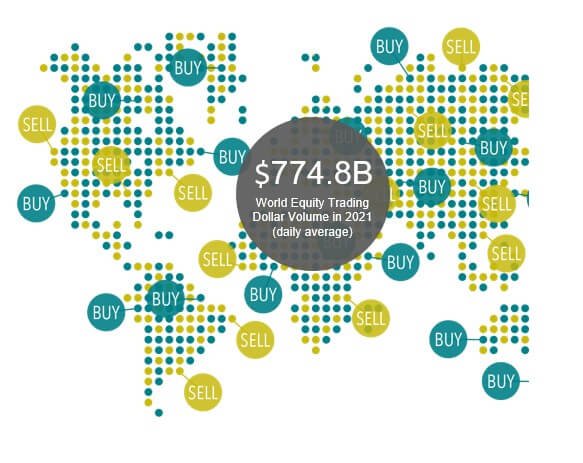

The stock market can be thought of as a massive information processing machine. Every day, millions of investors execute billions of dollars in trades based on their own unique motives, data, and analysis. These trades move prices to an equilibrium that incorporates all available information.

Source: Dimensional Fund Advisors

The efficiency of the stock market has significant implications for investors. Depending on the strategy deployed, the market’s efficiency can either be a powerful tool or a fierce competitor. If an investor attempts to outperform through stock picking, they are choosing to square up and compete directly against the market. With this approach, investing is a zero-sum game. For every winner, there must be a loser. It is not sufficient to be good and smart. To outperform over time, an investor must be consistently better and smarter than the collective wisdom of all other market participants. There is substantial evidence that demonstrates that most people cannot do this (more on this later).

Competing Against The Market

Source: Dimensional Fund Advisors

An alternative approach puts the power of the markets to work on the investor’s behalf. Over time, capitalism has demonstrated a substantial ability to generate wealth, and broad and diversified ownership through the stock market has allowed investors to participate in that wealth-creating power. Market efficiency does not mean that stock prices are always correct. The price simply represents the best collective guess of all investors. Since that collective assessment of value is so tough to improve upon, market prices are generally reasonable and provide investors with a great roadmap for allocating their money across stocks. While trying to outguess the market is a zero-sum game, a rising tide can lift the boats of all broadly diversified investors.

Harnessing the Markets Power

Source: Dimensional Fund Advisors

It is important to note that market efficiency does not require all stocks to have the same expected return. In fact, it has historically been the norm for certain types of stocks to possess higher expected returns than others. There is a large body of research that explains these differences and supports the notion that broadly diversified investors can use the information from market prices to tilt a portfolio to the areas of the market that carry those higher expected returns. We will cover these ideas in another post as they are outside the scope of what we are discussing here.

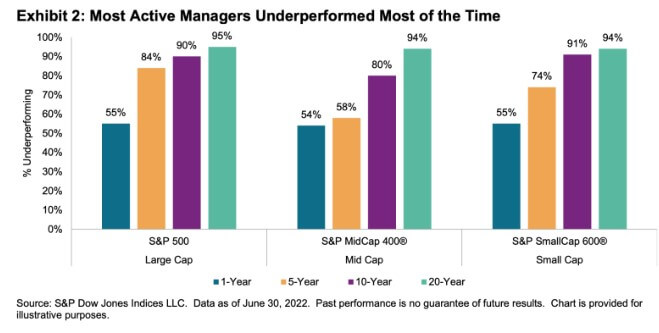

Although the concept of efficient markets has been around since the early 1970s, there remains a large number of investors that still play the stock-picking game. Fortunately for us, there is some rich data on how these active investors have performed historically.

The chart below illustrates the performance of active mutual fund managers across three major fund categories. Within each category, it shows the percentage of managers that have underperformed a relevant market index over the last one, five, ten, and twenty-year periods.

As you can see, over the last year, a little over half of these managers have underperformed the market across each category. To put this performance into context, I like to use the analogy of going to the casino.

If you went and sat down at a roulette table, there is a chance you would get lucky and win some money. The game of roulette, however, is designed to put the odds in the casino’s favor. The longer you stay and continue to play the game, the longer those odds can work against you. This same phenomenon is evident in the data above. As you extend the time horizon to five or ten years, the percentage of underperformers increases. By the time you reach the twenty-year mark, 94 to 95% of all active managers across those major fund categories underperform the market.

The track record for active stock pickers is poor. Over long periods of time, I imagine it’s far worse than most people would guess. Whether it’s in the casino or the stock market, when you play a game where the odds are stacked against you… the longer you play, the more likely you are to lose. Ultimately, the implication is clear: it’s better for investors to harvest the power of efficient markets than it is to compete against it.

WEEK IN REVIEW

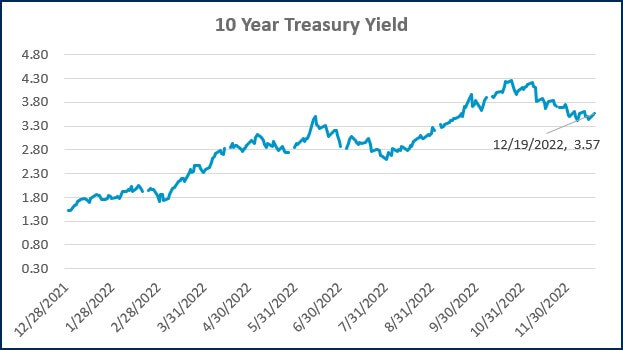

- Last week the Federal Reserve lifted the benchmark federal funds rate by 0.50% (as expected), increasing short-term interest rates to the highest level since 2007. Additionally, the Fed published its updated Summary of Economic projections. Included in those projections is the forecasted path for the fed funds rate over the next several years. The Fed is currently projecting the rate to peak at 5.00 to 5.25% in 2023. The market is currently pricing in a similar peak level next year.

- Data from the Bureau of Labor Statistics published last week showed inflation cooled more than expected. The Consumer Price Index (CPI) fell in November to 7.1% YoY from 7.7%. Core CPI, which removes the volatile food and energy components, fell to 6.0% from 6.3%. Despite the positive news, inflation remains well above the Fed’s 2.0% target, suggesting more rate hikes are likely.

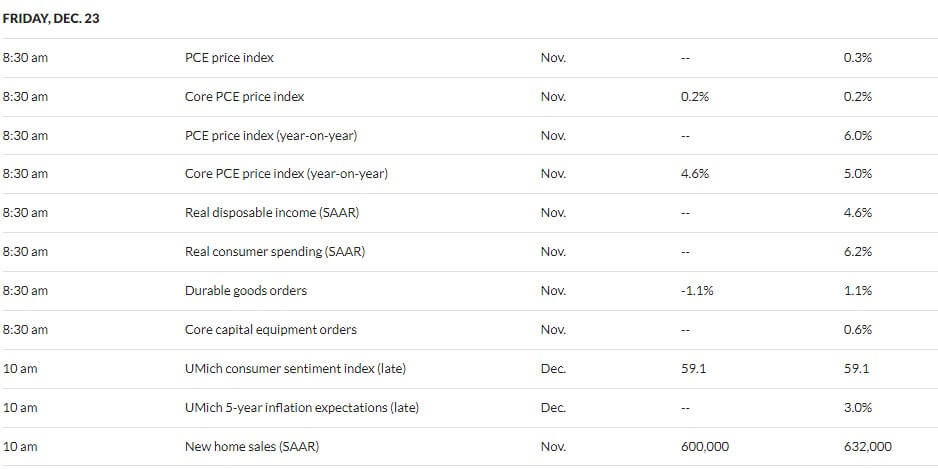

- Data to be published later this week includes an update on consumer confidence on Wednesday, jobless claims, the index of leading economic indicators, and the final revision to Q3 GDP on Thursday, followed by Personal Consumption Expenditures (PCE), durable goods, inflation expectations, and new home sales on Friday.

HOT READS

Markets

- Bank of Japan Shocks Global Markets With Bond Yields (CNBC)

- How Long Should Powell Keep Raising Interest Rates? Fed Officials Are Divided (WSJ)

- Retail Sales Fell 0.6% in November as Consumers Feel the Pressure From Inflation (CNBC)

Investing

- Don’t Try To Get Rich Twice (Ben Carlson)

- Mirror, Mirror on the Wall, Who Knew That Stocks Would Fall? (Jason Zweig)

- Sea Change (Howard Marks)

Other

- Why Heart Attacks Rise During The Holiday Season (WSJ)

- New Human Metabolism Research Upends Conventional Wisdom About How We Burn Calories (Scientific American)

- Winging It: Inside Amazon’s Quest to Seize the Skies (Wired)

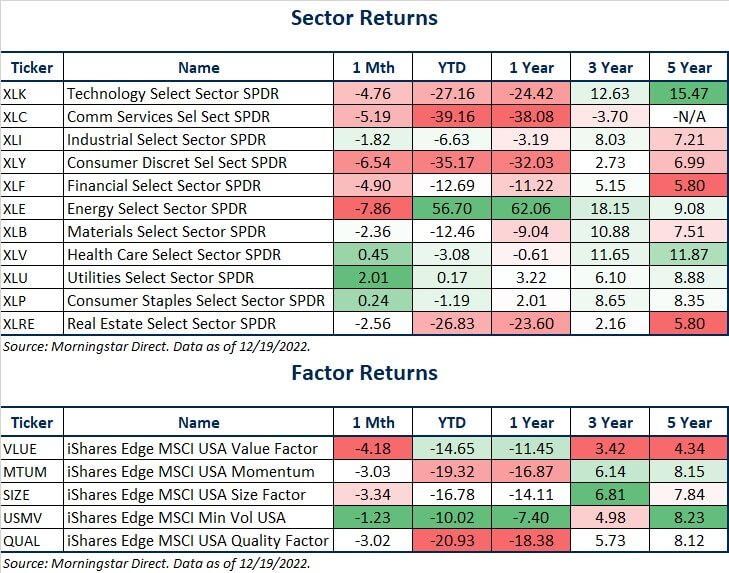

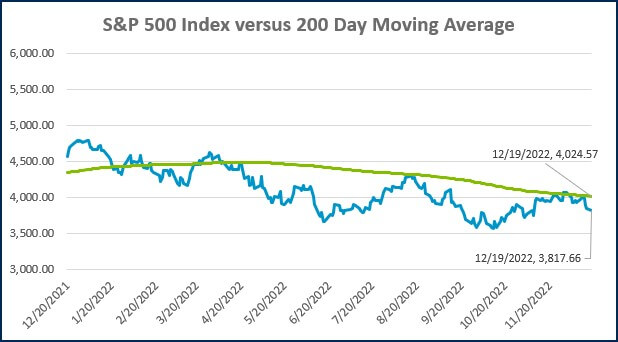

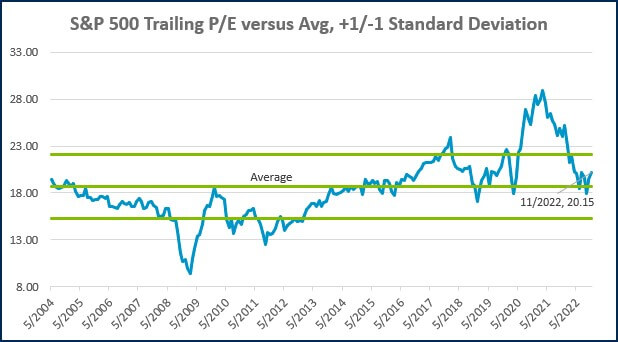

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

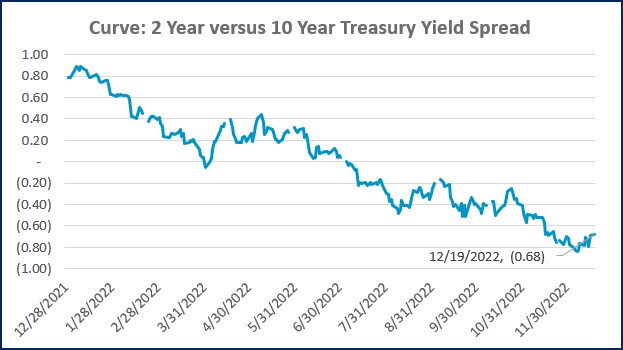

Source: Treasury.gov

Source: Treasury.gov

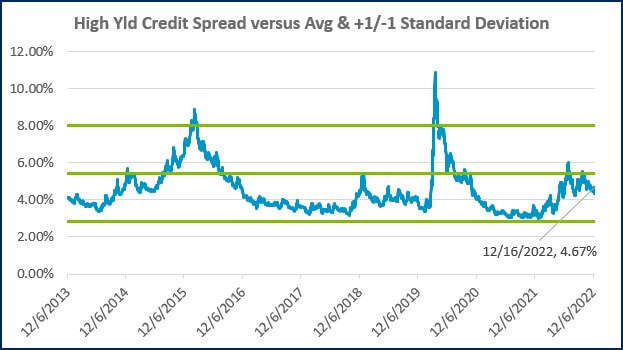

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

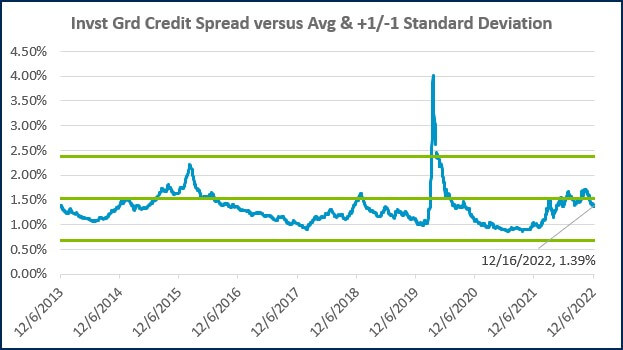

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

ECONOMIC CALENDAR

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)