The Three-Year Anniversary of the Pandemic Selloff + Financial Market Update + 2.21.23

Three years ago this week, stocks reached their peak level before collapsing in the face of the global pandemic and the corresponding economic shutdowns. Over the course of just twenty-three trading days during the first quarter of 2020, the S&P 500 shed about 34% of its value. The episode marked the steepest loss since the Financial Crisis in 2008, with a pace of decline unparalleled in recent times.

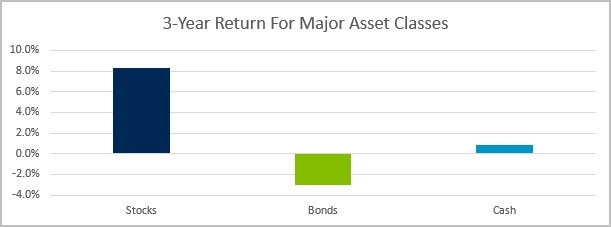

The pandemic has not been the only major event over the last three years to roil the financial markets. Investors have also had to contend with the first war on European soil since World War II, the highest inflation rate in decades, and an aggressive Federal Reserve rapidly normalizing monetary policy, to name a few. Had an investor known in advance that all of these events were going to transpire, they might have rationally been hesitant to invest. Despite all these headwinds, however, the stock market has delivered a reasonable return over this period.

Source: Morningstar Direct. Stocks were represented by the S&P 500 TR USD Index, Bonds by the Bloomberg US Aggregate Bond TR USD Index, and Cash by the Bloomberg Treasury Bill 1-3 Month TR USD Index. Returns are annualized using daily data between 2/19/2020 and 2/17/2023.

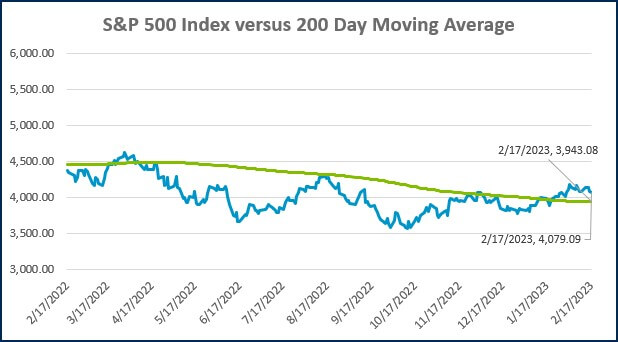

The recent market selloff, which has eased somewhat after falling as much as 25%, remains about 15% off prior highs. Given the degree of volatility that we have endured since the beginning of 2022, it may be surprising to see how well stocks have held up over the last three years.

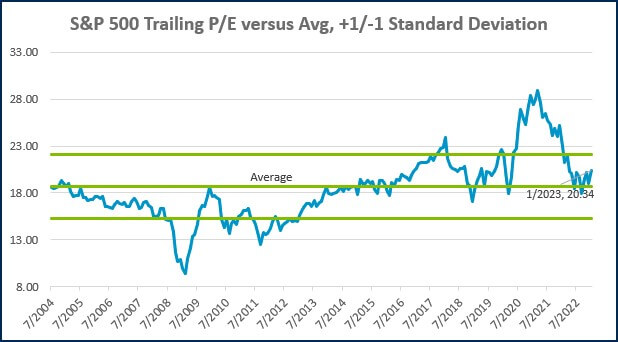

Stock prices adjust daily to reflect all available information as well as expectations about the future. As real-time data and the market outlook deteriorates, stock prices decline. We experienced this last year as investors expected the Federal Reserve’s policy shift to slow the economy and potentially push it into a recession.

The repricing of stocks based on expectations occurs for a very important reason. In order to induce investors to take risk with their money, stocks must be priced so that their expected return exceeds that of a riskless asset like cash. As a result, the expected return for the stock market is always positive, regardless of how gloomy the future appears. At any given moment, the aggregate expectation of all investors is baked into the price. Of course, the future may turn out worse than expected, which could cause further declines. Similarly, the future could be better than expected, which could lead to a rapid recovery. It is certainly possible that the strong market performance thus far in 2023 has come from a brightening investor outlook.

The key takeaway here is that being a prudent investor does not require you to take action when the outlook deteriorates. The market adjusts stock prices to the changing environment faster and more accurately than any individual could hope to do alone. Since stocks are priced to a point that their future expected return is positive, investors can still hope to generate a reasonable return going forward, even when stocks are down and the future appears dour. Earning an 8%+ on stocks despite the substantial volatility of the last three years offers a great example of this. Those able to remain in their seats were rewarded for doing so.

WEEK IN REVIEW

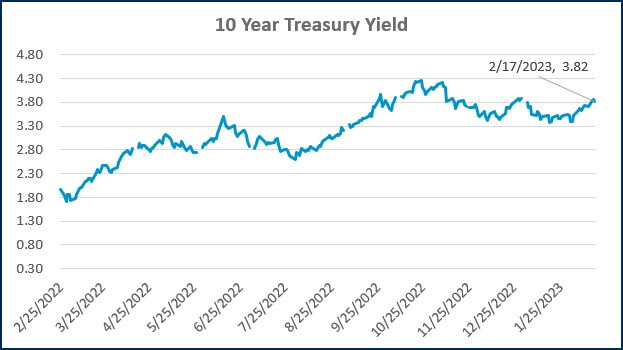

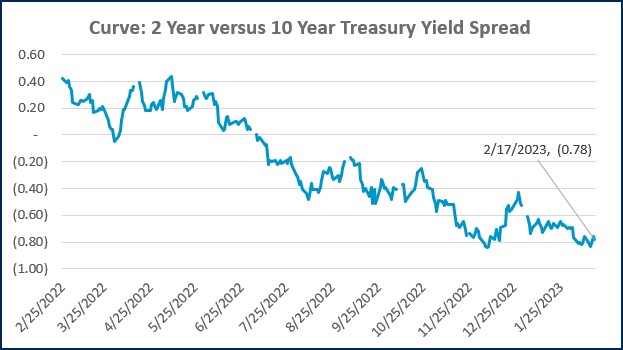

- A host of economic data reports from January have revealed an uptick in economic activity to start the year. Non-farm payrolls, service sector activity, retail sales and the Consumer Price Index (CPI), just to name a few, have all come in well above expectations. Some of this uptick may be attributable to seasonal adjustments. Still, hotter than expected economic activity has led the market to price in the potential for two additional 0.25% rate hikes in 2023 relative to what was expected at the end of last year.

- According to FactSet, 82% of S&P 500 companies have reported earnings as of last Friday. The forecasted growth rate blended with actual results from companies that have already reported is now -4.7% year-over-year. The expected earnings growth rate as of 12/31/2022 was -3.2%, which implies earnings season has been worse than expected thus far. Earnings growth is what ultimately fuels appreciation in the stock market. Although returns have been strong in 2023 thus far, companies will need to return to positive earnings growth to justify continued market gains.

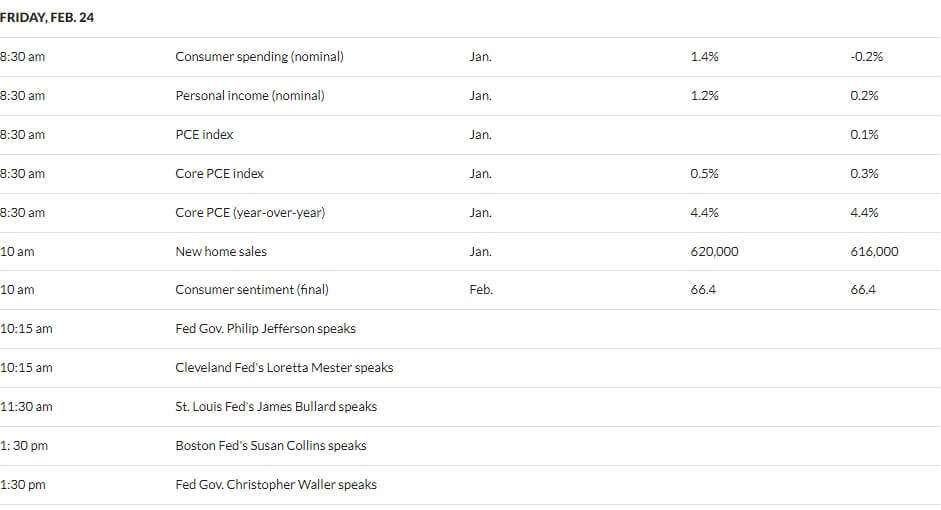

- Economic data scheduled to be published this week include the minutes for the February 1st FOMC meeting due Wednesday, jobless claims and the first Q4 GDP revision on Thursday, and the Personal Consumption Expenditures (PCE), personal income and consumer spending on Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Retail Sales Jump 3% in January, Smashing Expectations Despite Inflation Increase (CNBC)

- Inflation Rose 0.5% in January, more than expected and up 6.4% from a year ago (CNBC)

- US Households Lifting Economy After Being Stung by Inflation last Year (WSJ)

Investing

- Risk and Regret (Morgan Housel)

- Stock Buybacks Aren’t Bad, They Aren’t Good Either (Jason Zweig)

- Buy and Hold is Dead, Long Live Buy and Hold (Ben Carlson)

Other

- How Google Ran Out of Ideas (The Atlantic)

- Pickleball May Not Translate Well to TV (NY Mag)

- Golf Course Living Is Paradise – Except for the 651 Balls Pelting Your House and Yard (WSJ)

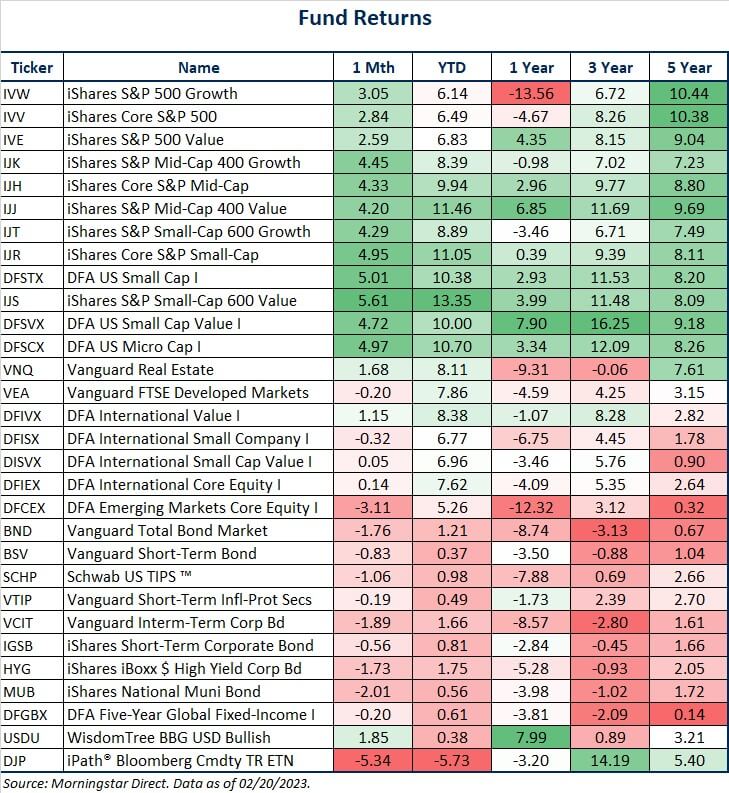

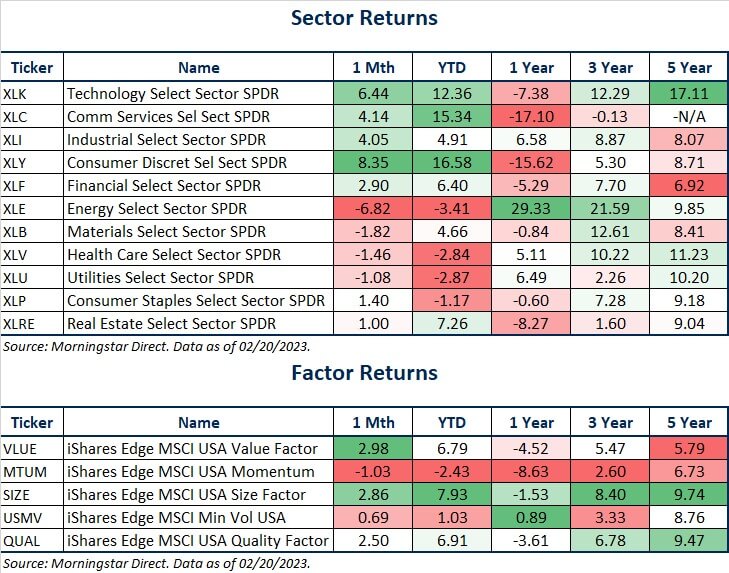

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

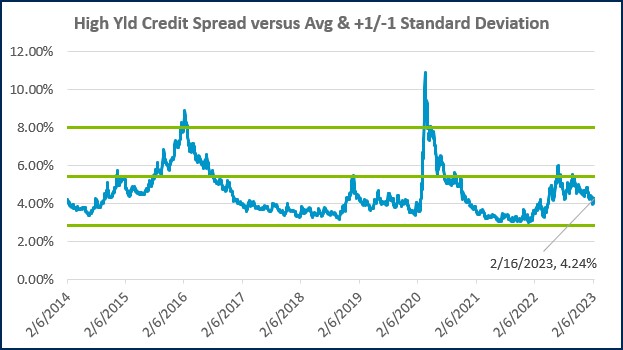

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

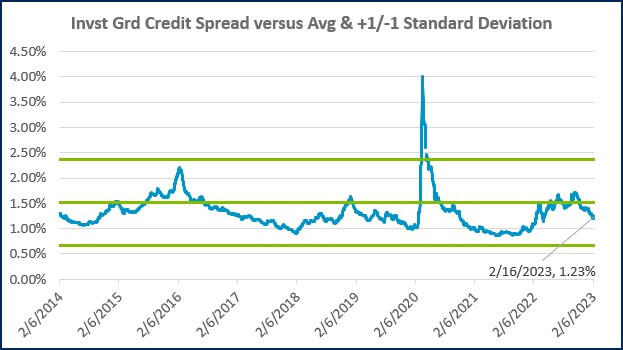

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)