The Decision Investors Must Get Right + Market Update + 2.28.2023

One of the most important decisions investors face when constructing a portfolio is how much to allocate across the various asset classes. The desired mixture, referred to as the asset allocation, is what drives the risk and return characteristics of the portfolio. The decision is so important, in fact, studies have shown that the asset allocation explains about 90% of a given portfolio’s return variation over time(1). The other 10% is determined by market timing and security selection, which can collectively be referred to as ‘active management.’

An appropriate asset allocation allows an investor to balance the tradeoff between risk and reward. Stocks generally carry a high expected return but come with a relatively unpredictable payoff in the near term. Bonds and cash, on the other hand, have a more predictable near-term payoff, but the expected return is typically lower. By combing these asset classes together, investors can satisfy several objectives:

- Grow the balance of the portfolio

- Reduce portfolio volatility

- Hold relatively safe assets that can be tapped if funds are needed during a market downturn

The consequence of not selecting the appropriate asset allocation can be severe. If a portfolio is set too conservatively, it may fail to meet the investor’s desired long-term spending needs or goals. This could mean not being able to afford that vacation home, delaying retirement, or even outliving one’s assets. If set too aggressively, the investor may not be able to stomach a period of heightened volatility, or they may be forced to sell equity assets at a steep loss if a large cash need arises at an inopportune time.

Once the appropriate mixture of asset classes has been determined, there are two broad approaches to implementing an asset allocation. These include:

- Tactical Asset Allocation (TAA)

- Strategic Asset Allocation (SAA)

At a high level, Tactical Asset Allocation begins with a market-cap-weighted benchmark as the baseline for the portfolio. From there, the manager will make intentional deviations from that benchmark in anticipation of short-term changes in market direction. Think of this as active management at the asset class level, where the manager attempts to add value through market timing.

Strategic Asset Allocation also begins with a market-cap-weighted benchmark as the baseline for the portfolio. The manager can choose to deviate from the benchmark, or they can seek to match it exactly. The key difference with SAA is that once the allocation is established, the manager does not make frequent changes to the portfolio in an attempt to outsmart the market. It is important to highlight that as an investor’s risk and return profile changes throughout their investing career, the SAA is updated to ensure that it continues to align with the investor’s objectives.

The Strategic approach to asset allocation has a few key advantages over the Tactical approach:

- The frequent changes made in tactical portfolios can result in higher trading costs, lowering the return.

- The high volume of trading can also result in a large tax bill at the end of the year, lowering the after-tax return.

- Funds that specialize in tactical asset allocation are typically more expensive than those that employ strategic asset allocation.

- Adding value through tactical asset allocation requires an investor or fund manager to consistently predict the future better than the market. There is a substantial pool of evidence that suggests this is not possible.

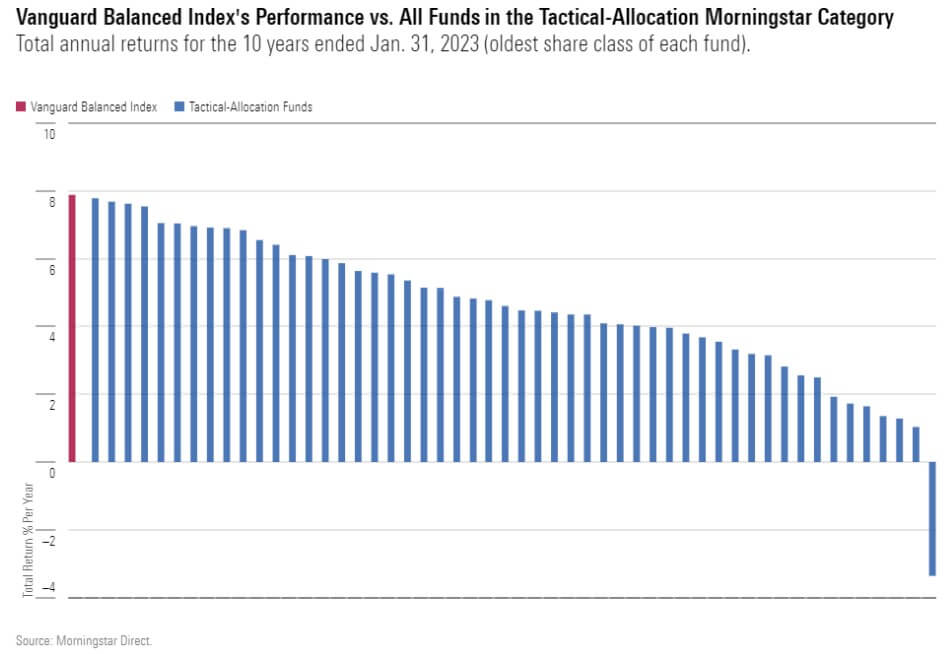

Morningstar, a leading provider of investment fund data, recently published some research related to mutual funds that focus on tactical asset allocation. The author had this to say:

In an ideal world, we’d ratchet our asset exposures up and down in anticipating market gyrations, bagging gains and sidestepping losses. The world doesn’t work that way, though, as the dismal record of tactical allocation mutual funds well attests: Not a single tactical fund beat a simple 60% U.S. stocks/40% U.S. bonds portfolio over the trailing 10 years ended Jan. 31, 2023.

As the author of the Morningstar report highlighted, not one tactical fund was able to compete with the purely passive Vanguard option. These Tactical funds are managed by professionals. They have large investment teams, expensive tools, and sophisticated processes. If none of them were capable of success over a long period of time, what hope do individual investors have?

Getting the asset allocation correct is a critical hurdle on the way to long-term investing success. Unfortunately, a suitable allocation is unique to every individual investor. It depends heavily on the investor’s personal balance sheet, cash flows, financial goals, and attitude toward risk. While there is no one size fits all solution, investors looking for help can engage an investment advisor that specializes in comprehensive financial planning. A well-designed financial plan can help prospective investors find that balance between risk and reward. Implementing the asset allocation is a little more one-size fits all. When choosing between the Strategical and Tactical approaches, recent evidence clearly favors SAA.

1. Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower.1986. “Determinants of Portfolio Performance.” FinancialAnalysts Journal, vol. 42, no. 4 (July/August):39–48.

WEEK IN REVIEW

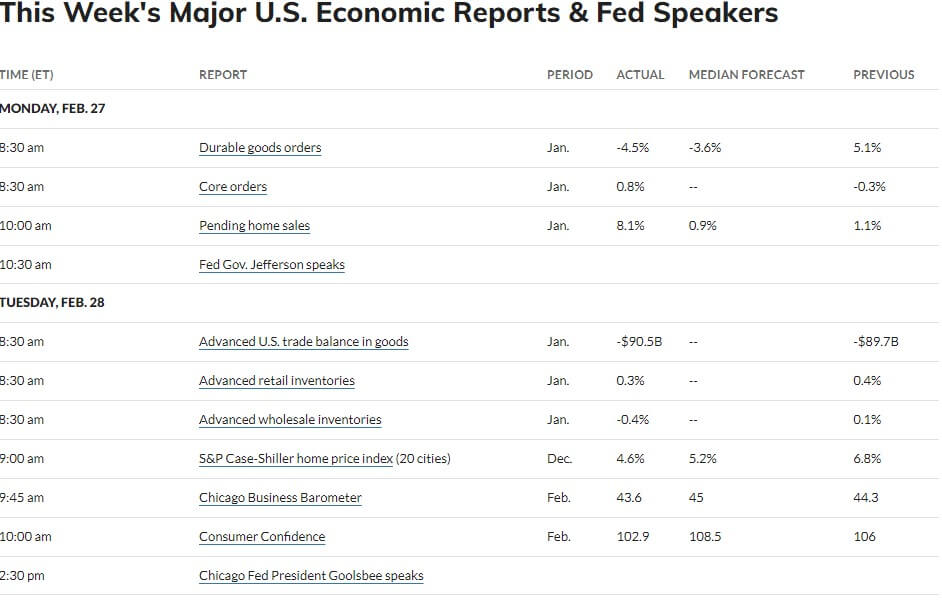

- A report published on Monday showed durable goods orders fell more than expected in January (-4.5%). Much of that decline was caused by the volatile transportation sector, which includes orders for commercial airlines. Shipments for ‘core’ non-defense capital goods, excluding aircraft, a key input for business investment in the GDP report, increased by 1.1% after declining for two consecutive months.

- According to FactSet, 94% of S&P 500 companies have reported earnings as of last Friday. The forecasted growth rate blended with actual results from companies that have already reported is now -4.8% year-over-year. The expected earnings growth rate as of 12/31/2022 was -3.2%, which implies earnings season has been worse than expected thus far. Earnings growth is what ultimately fuels appreciation in the stock market. Companies will need to return to positive earnings growth to justify continued market gains.

- Major economic data releases due this week include an update on manufacturing and service sector activity from the Institute of Supply Management (ISM). The Labor Department typically publishes its payrolls report on the first Friday of the month. However, it will be delayed till next Friday, given how early in the month the first Friday comes this time around.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

MARKETS

- Key Fed Inflation Measure Rose 0.6% in January, More Than Expected (CNBC)

- Mortgage Demand From Homebuyers Drops to a 28 Year Low (CNBC)

- Long-Robust U.S. Labor Market Shows Signs of Cooling (WSJ)

INVESTING

- How It All Works (Morgan Housel)

- Will High Risk-Free Rates Derail the Stock Market (Ben Carlson)

- Welcome to the 5% World, Where Yield Chases You (WSJ)

OTHER

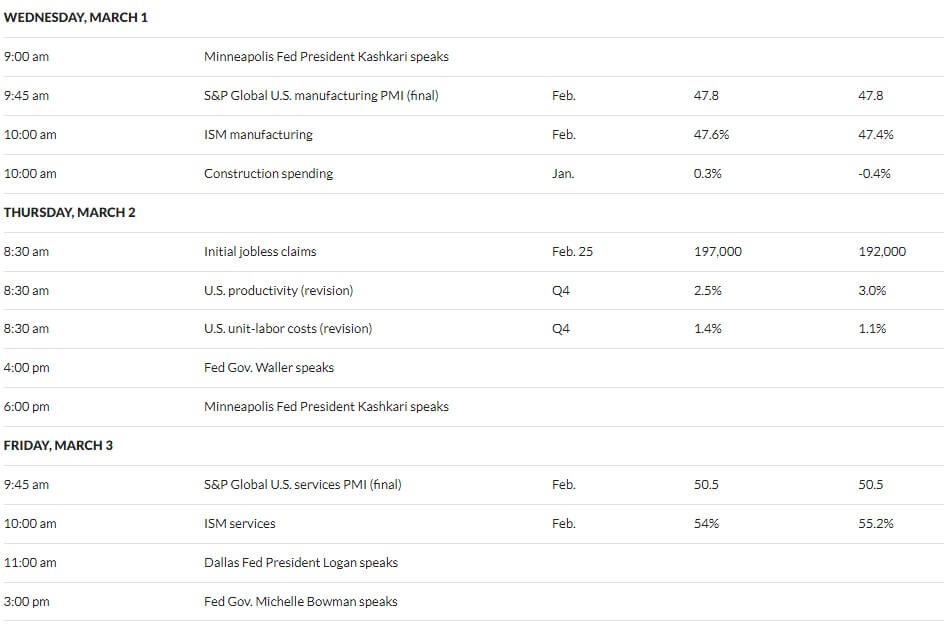

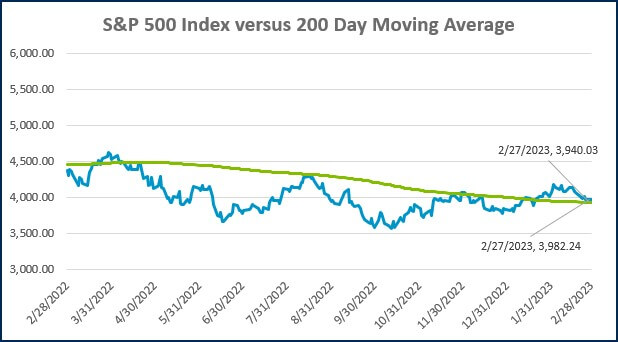

MARKETS AT A GLANCE

Source: Morningstar Direct.

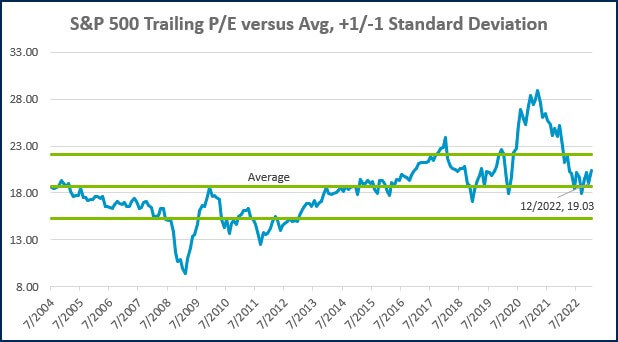

Source: Morningstar Direct.

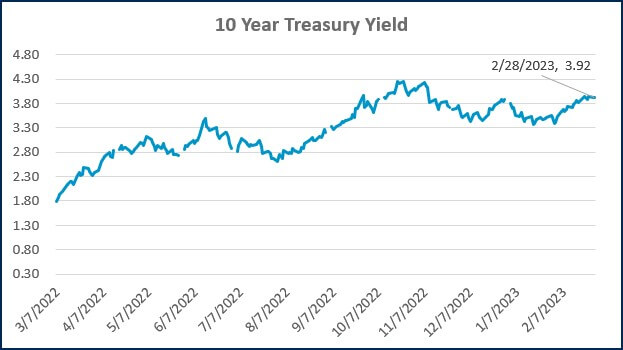

Source: Treasury.gov

Source: Treasury.gov

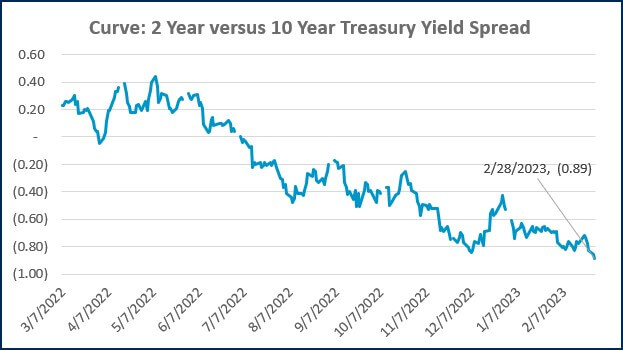

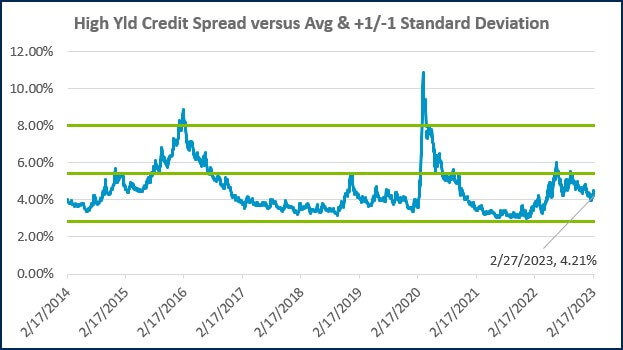

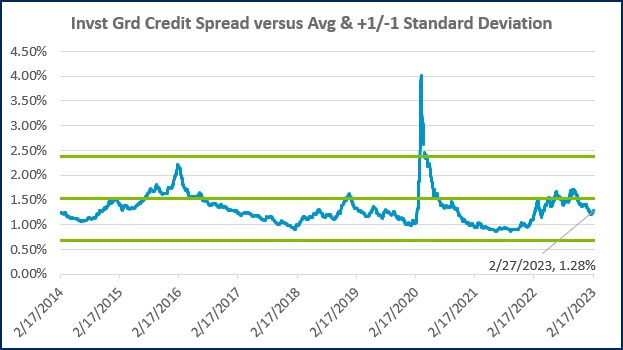

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)