Do Active Funds Beat the Market? + Financial Market Update + 2.8.22

Active investment management has strong appeal for many investors. Sure, you could strive to match the market’s return, but where is the fun in that? Settling for ‘average’ may feel un-American to many. You would think it would be easy for an investment professional to do better than a broad market index. Everyone knows that Apple and Amazon are amazing, while stodgy old companies like Berkshire Hathaway and Intel are out of touch and far past their prime. Just own the great companies and ignore the laggards, and you’re done.

The problem, of course, is that it is far from being that simple. It does not require any innate talent to observe which companies are ‘good’ and which ones ‘suck’ (please excuse the finance jargon). Most participants can and do make this determination. The challenge comes from knowing the appropriate prices to pay for the good and bad companies.

Benjamin Graham famously said, “In the short run, the market is a voting machine. In the long run, it’s a weighing machine.” Like a popularity contest, investors tend to chase after the ‘good’ companies, sometimes bidding the prices up too high. Even the best company on the planet can turn into a mediocre or even poor investment if the investor paid too much to acquire it. Conversely, less than stellar businesses can be ignored, causing their price to decline. A middling business can turn out to be a fantastic investment if the entry price paid was low enough. The challenge to investing then is not just knowing the good companies from the bad, but also the high prices from the low. As it turns out, this is extremely difficult, and very few can consistently do it better than the market.

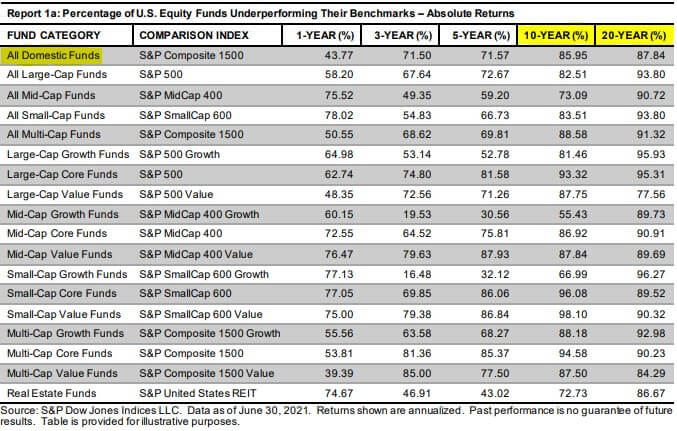

S&P Dow Jones provides us with some data to back up this assertion. The table below from their semi-annual SPIVA Scorecard illustrates the performance of U.S. equity funds. Specifically, it shows the percentage of funds across a variety of categories and time horizons that have underperformed relevant benchmarks.

The table provides damning evidence against active stock picking. Most funds across the categories underperform the benchmarks over the short term. Stretching the analysis out to longer periods and funds overwhelmingly fail to keep pace. As the top row indicates, 85% or more of domestic funds underperform a broad market benchmark on a 10-to-20-year basis.

There are a variety of reasons active stock pickers tend to deliver poor results. First, the stock market is pretty efficient. Stock prices reflect the collective knowledge of all participants. That doesn’t mean prices are always correct, but it does represent the best guess of fair value at any given point in time. To consistently outperform the market, you must consistently have an estimate of fair value that is more accurate than the collective wisdom of all other investors. Second, active managers tend to charge higher fees. This raises the hurdle that must be cleared to deliver superior results.

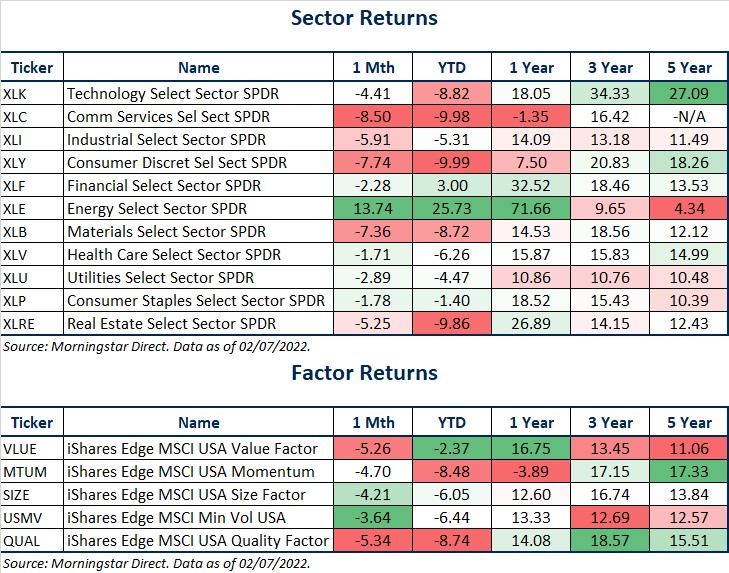

None of this is to say that investment professionals cannot be leveraged to help people reach their financial goals. Designing an appropriate asset allocation, the mix between riskier equity and more stable fixed-income investments is a critical role that can deliver immense value. The behavioral component is also vital. A financial advisor can help keep emotions at bay, allowing clients to stay the course while other investors become overly optimistic or pessimistic. Lastly, while market efficiency generally renders active stock-picking useless, there are ways to use the information held in market prices to enhance returns. Decades of empirical research have identified certain stock characteristics that are readily observable in current prices and deliver a return premium. These include low price (value), low market capitalization (size), and high earnings (profitability). Tilting a diversified portfolio toward these characteristics is a way to improve returns without the high cost and guesswork associated with active stock picking.

WEEK IN REVIEW

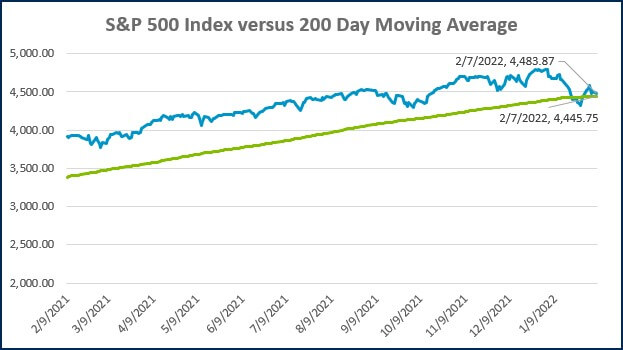

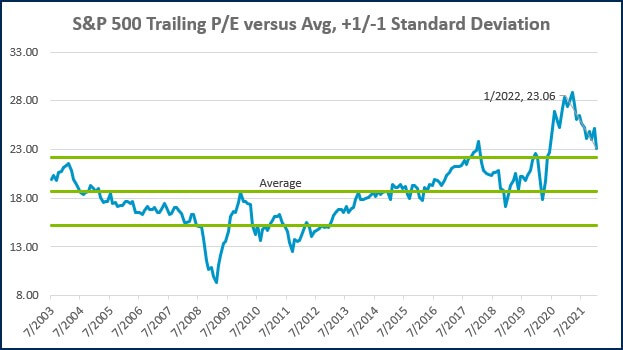

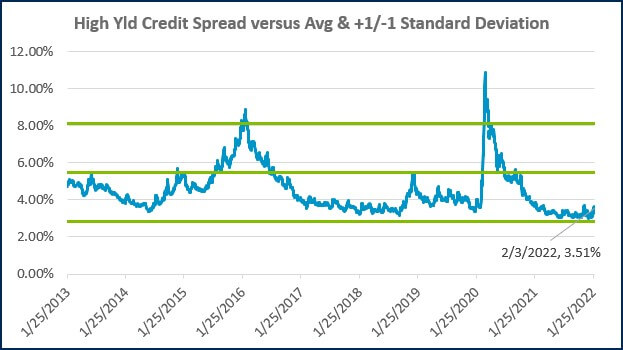

- According to FactSet, 56% of S&P 500 companies have reported Q4 earnings thus far. 76% of these firms have reported earnings above expectations, which is right around the 5-year average for the portion of companies beating estimates. The degree to which they are beating estimates is slightly below the 5-year average, however. Entering the new year, analyst estimates for Q4 earnings was 21.3%. The updated growth estimate using actual results for companies that have reported and estimates for those that have yet to report is 29.2% YoY. A continuation of strong earnings growth would go a long way to getting the U.S. stock market back to a fair valuation without the need for additional market volatility.

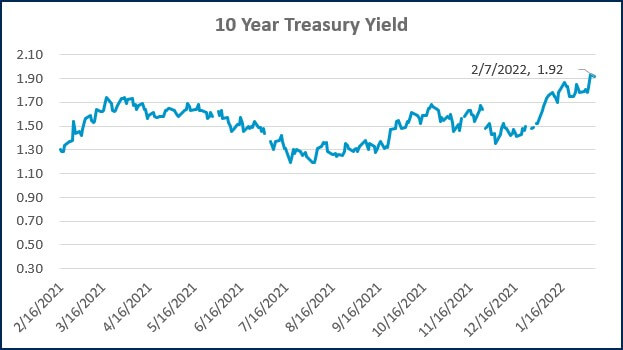

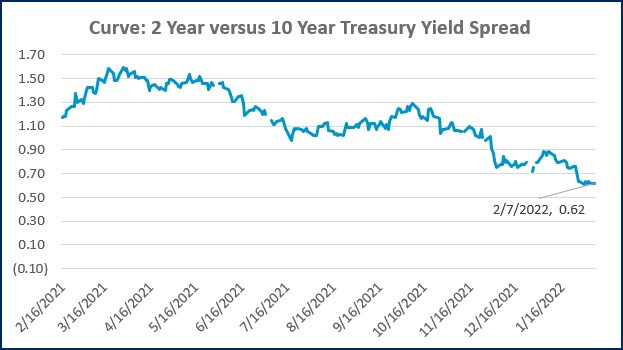

- Data published last week showed that nonfarm payrolls increased by 467,000 in January, handily exceeding analyst estimates of 125,000. Additionally, job gains from November and December were revised higher by 709,000. The data was not quite as strong as the headline figures suggest, however, as much of the job gains were related to a change in the seasonal adjustment methodology. The bond market sold off on Friday following the print, partially because of the pace of wage gains, which increased by 5.7% from a year ago. Economic theory generally suggests that rapid wage gains is the transmission mechanism that converts a strong labor market into rising inflation.

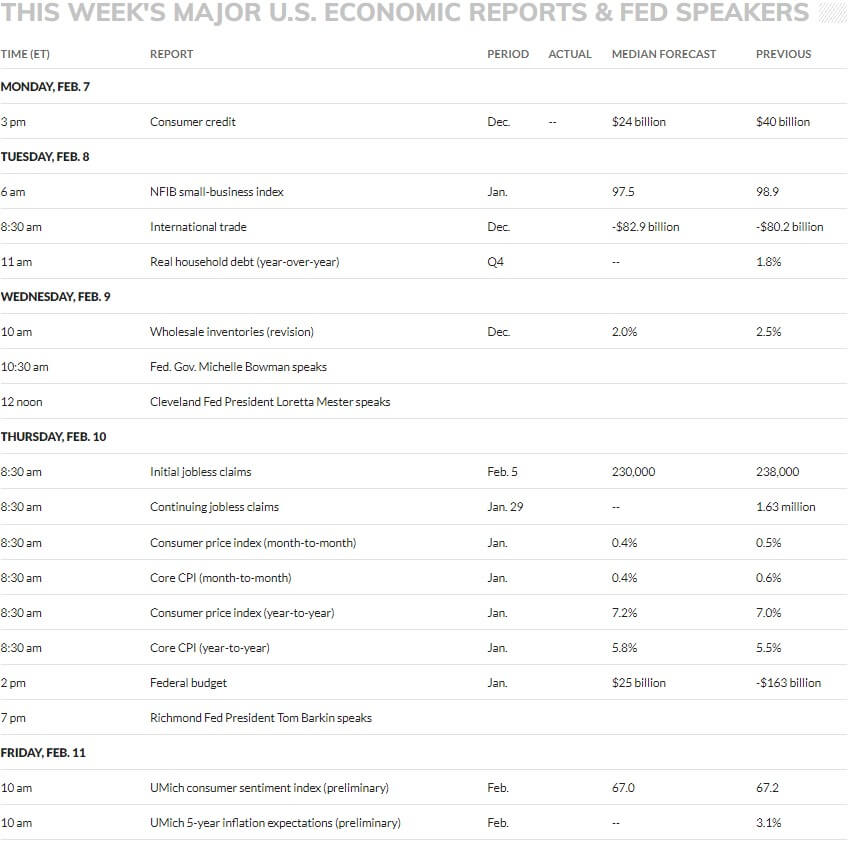

- Headlining the coming week of economic data is the CPI print on Thursday. According to MarketWatch, economists are expecting the headline figure to increase further to 7.2% YoY. Continued strength in labor market data and rising inflation has pushed the market to price in between 5 and 6 rate hikes for 2022.

ECONOMIC CALENDAR

HOT READS

Markets

- Payrolls Show Surprisingly Powerful Gain of 467,000 in January Despite Omicron Surge (CNBC)

- Fast-Rising Wages Could Cause The Fed To Raise Interest Rates Even Higher This Year (CNBC)

- Green Startups Stumble, Accelerating Selloff of Risky Stocks (WSJ)

Investing

- You Can Get Crypto Right and Still Play It Wrong (Jason Zweig)

- Most things that look like superpowers are just a bunch of ordinary skills mixed together (Morgan Housel)

- 8 Of The Biggest Investing Myths (Ben Carlson)

Other

- Inside Beijing’s Closed Loob at the Winter Olympics (SI)

- Astronomers Find First Ever Rogue Black Hole Adrift in the Milky Way (SA)

- What Great Managers Do (HBR)

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

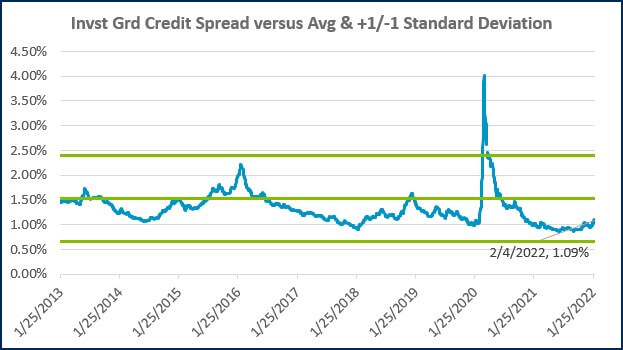

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Implementing Power BI Analytics for Modern Agricultural Operations

Mileage Reimbursements Aren't Always Non-Taxable: Why Accountable Plans Matter

Budgeting Tips for Business Owners & High Earners

Why Consultants & Temporary Talent Make Sense in Today's Market

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)