Investing During Geopolitical Uncertainty + Financial Market Update + 3.1.22

The Russian invasion of Ukraine has gripped the markets over the last week. While volatility was already elevated, in part due to the rapid pace of inflation and the impending shift in monetary policy, geopolitics appear to be firmly in the driver’s seat now. The developments in recent days have heightened fears that the current crisis could spiral out of control and lead to a broader military conflict. This has also led many investors to pounder whether it is still prudent to remain invested in the stock market.

We have no special insight into the situation that would allow us to anticipate how this will all play out. There is no way that anyone could. Still, there is no shortage of individuals ready to go on CNBC and confidently predict what is about to happen and how to position your portfolio for it. I wonder how many of these people have already been proven wrong. Who would have guessed that in the three days following the actual invasion, the S&P 500 (a proxy for US stocks) would have risen by 3.5%? Not only are events in the future impossible to predict, so are the market’s reactions to them.

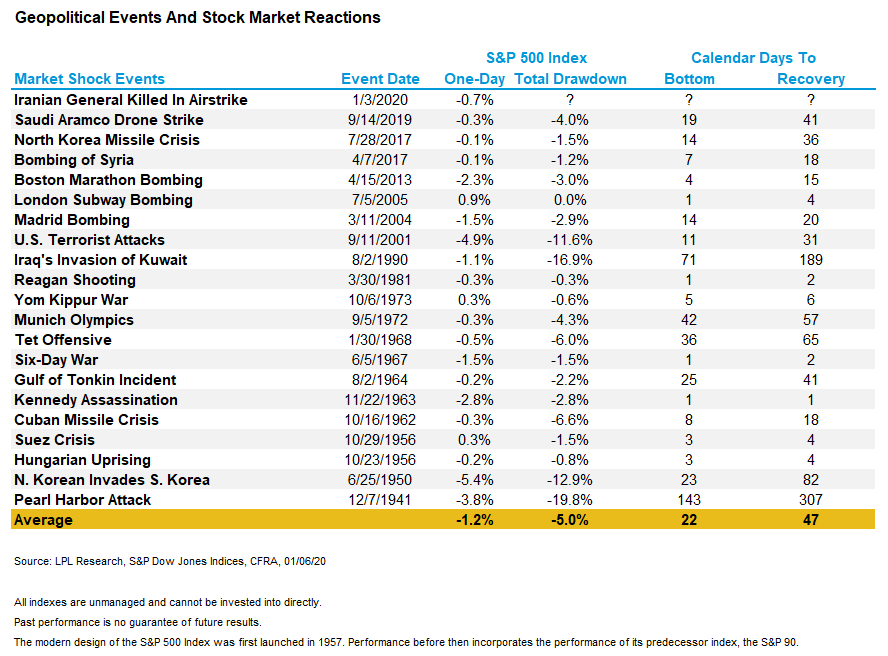

One thing that we do know is that war and geopolitical upheaval have been prevalent throughout history. The table below from LPL Research highlights key events since World War II and how the market has reacted to them.

There are a few important takeaways from this table:

- Geopolitical events are common throughout history

- The market generally reacts negatively to them

- The negative impact on asset prices tends to be short-lived

It has been known for months that Russia was mobilizing forces on the Ukrainian border. In recent weeks the S&P 500 has declined as much as 11.9%. How much of that pullback was attributed to the prospects of an invasion versus other market developments? It is impossible to know, though it would not be unreasonable to believe at least some portion of the geopolitical risk was incorporated into asset prices in advance of Russian boots hitting the ground in Ukraine.

It is possible that by selling out of risky assets, an investor can avoid some future volatility. It is also likely that some of the eventual rebound will also be missed. The market does not provide a notice when the coast is clear, and a recovery can occur rapidly, even though substantial uncertainty may persist. This is not to say the crisis, and the market’s reaction to it, couldn’t intensify from here. A major shift in an investor’s asset allocation based out of fear that things will continue to get worse can be very damaging if they don’t. That is particularly true with the market already down close to 10% from its recent high.

The benefit of investing in a diversified portfolio is that you don’t have to predict how the future is going to unfold. The market is resilient, and businesses are skilled at adapting to the environment. Investors have experienced many scary and volatile periods in the past, we are living through one now, and there will be more to come. The best strategy an investor can take is to stick to their plan and ride out the volatility. As the famous quote goes, “history is just one damned thing after another.”

WEEK IN REVIEW

- According to FactSet, 95% of S&P 500 companies have reported earnings for the 4th quarter. 76% of these companies have reported earnings above estimates, while 78% of companies have reported revenue above estimates. The blended growth rate, combining the results for companies that have reported with the estimates from companies that have yet to report, was 30.7% year-over-year. That compares to a forecast growth rate for the 4th quarter of 21.2% as of year-end 2021.

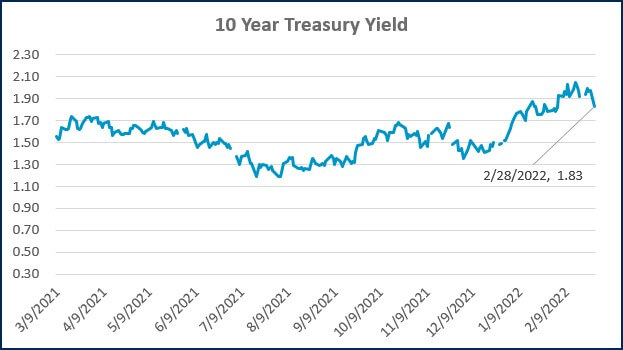

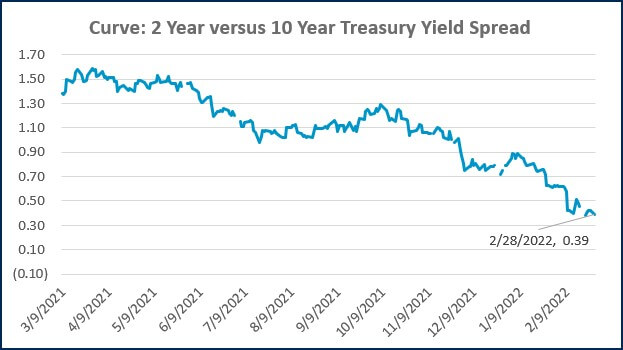

- The pace of rate hikes being priced in by the bond market has slowed in recent weeks. This is likely at least partially attributable to the intensifying geopolitical risk. The market is now pricing in a 0.25% hike in March (down from 0.50%) and just five total 0.25% hikes in 2022 (down from seven).

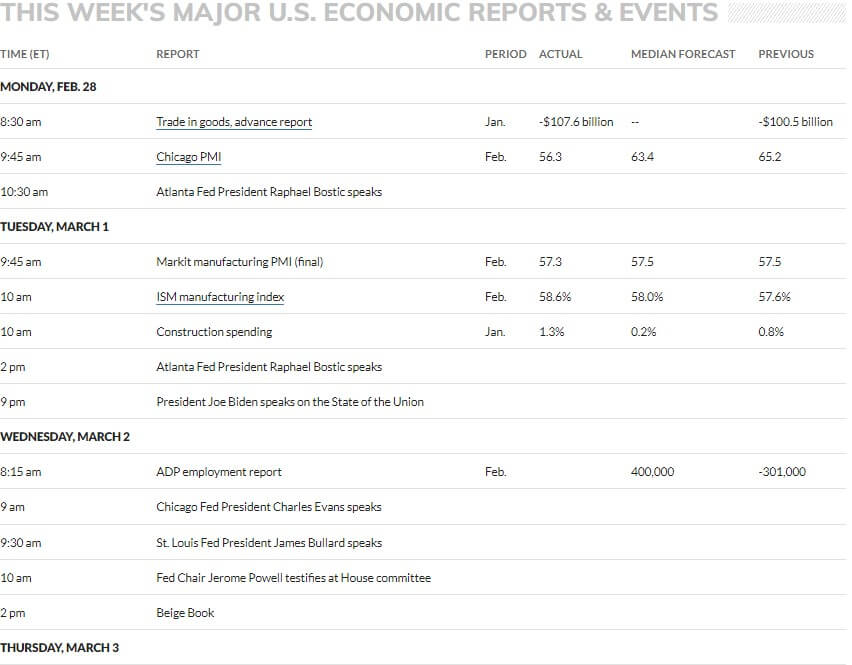

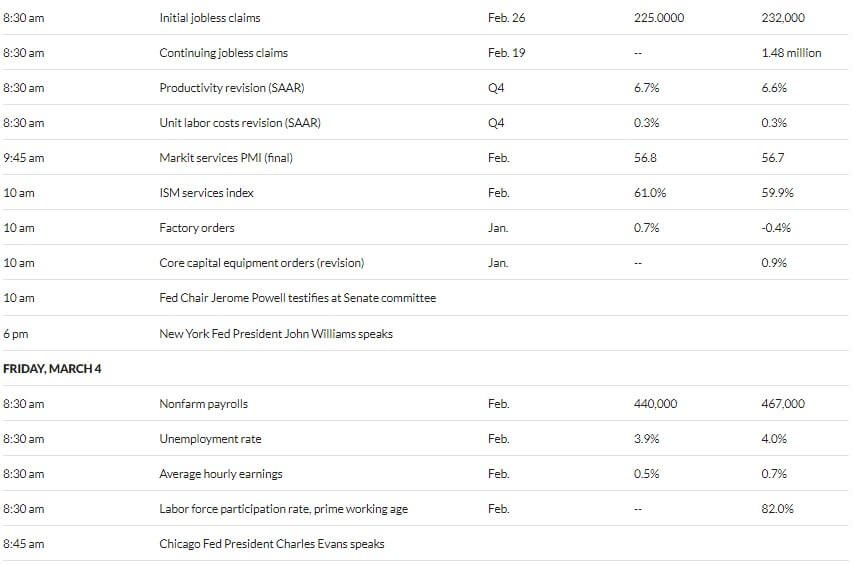

- This will be a big week for economic data. Look for an update on Manufacturing activity from the ISM today, initial jobless claims and an update on the Services activity from the ISM on Thursday, and the jobs report on Friday. Additionally, Fed Chair Jerome Powell will testify before Congress Wednesday and Thursday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Fed’s Favorite Inflation Guage Up 5.2% For Biggest Annual Gain Since 1983 (CNBC)

- Western Sanctions Bite Russian Economy, But Pose Unpredictable Risks (WSJ)

- Why Does the U.S. Buy Russian Oil? (WSJ)

Investing

- How To Invest Calmly in a Chaotic World (Jason Zweig)

- It’s Hard to Know How You Will Handle High Stress Until You Experience It First Hand (Morgan Housel)

- When Was The Last Time The Market Was Fairly Valued (Nick Maggiulli)

Other

- The Metaverse Is Coming: We May Already Be In It (Scientific American)

- Ukraine’s Volunteer ‘IT Army’ Is Hacking in Uncharted Territory (Wired)

- Antarctica Is the Ultimate Family Vacation for Bonding, Adventure and Bragging Rights (WSJ)

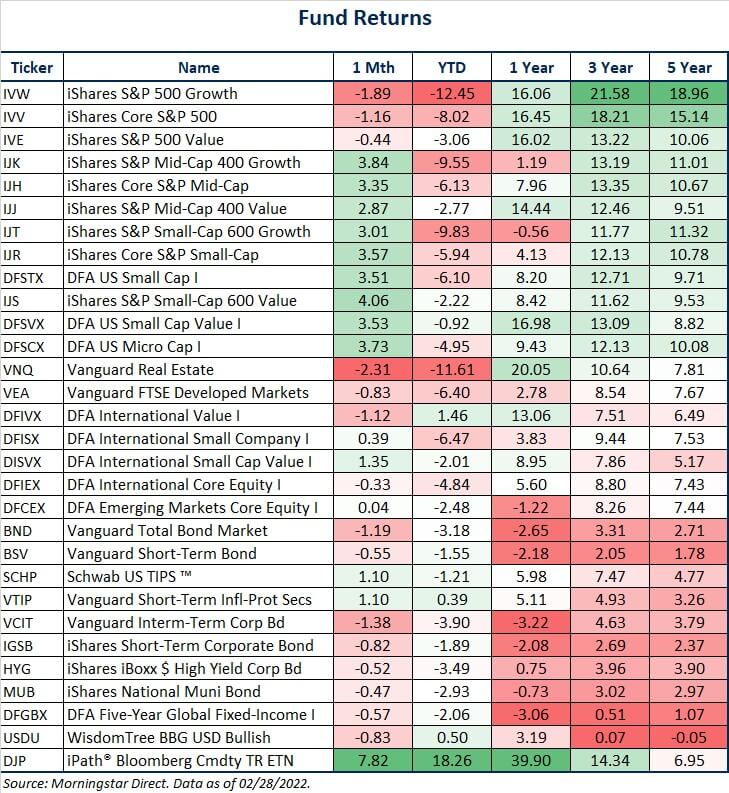

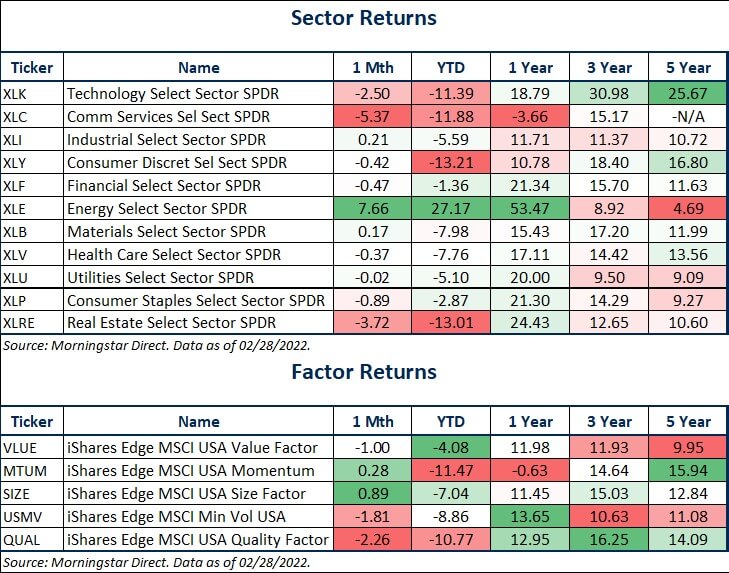

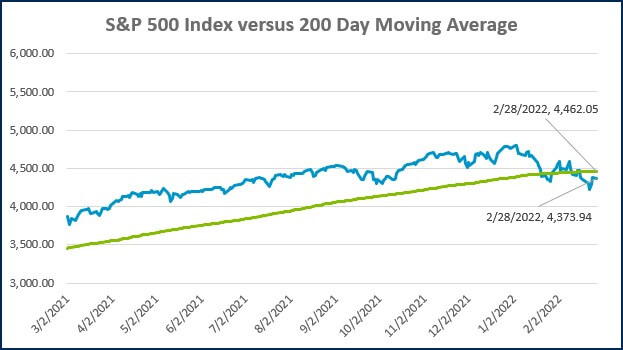

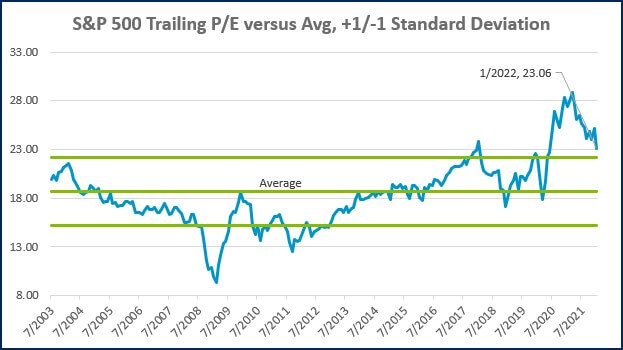

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

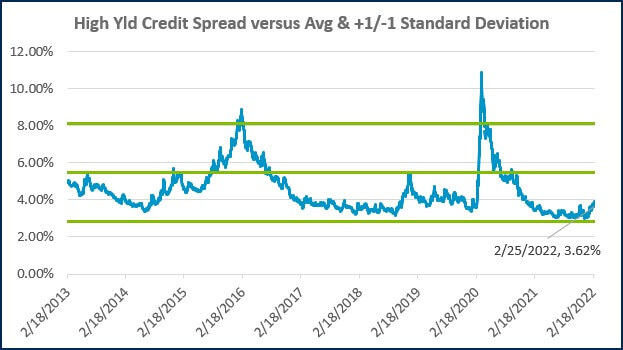

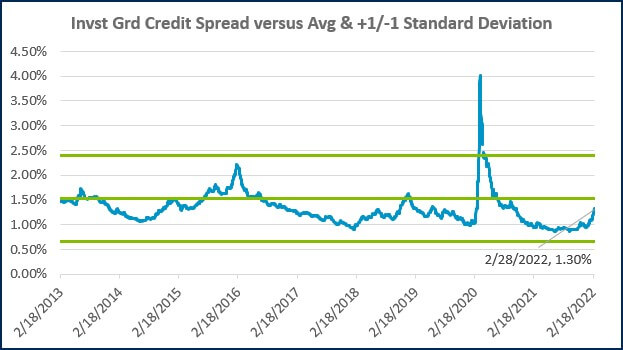

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)