Turmoil in the Banking Industry + Financial Market Update + 3.14.2023

Over the past few days, the news flow has been dominated by the turmoil taking place in the banking industry. Within the span of a week, a handful of banks have collapsed, including the second and third-largest bank failures by assets in U.S. history. Banking stocks have been in freefall since last week on concerns that widespread fear could continue to spread throughout the system. This prompted regulators over the weekend to announce measures aimed at eliminating the potential for any additional fallout. Below we will shed some light on what is happening within the banking industry and what that means for investors.

What Factors Led to the Banking Failures

Silvergate was the first to fall after announcing it would voluntarily wind down its operations on Wednesday, March 8th. Silicon Valley Bank was placed into receivership by the Federal Deposit Insurance Corp Friday, March 10th. Signature Bank then followed after being seized by New York State regulators on Sunday, March 12th.

While there is a litany of reasons a bank could fail, these three had a unique set of circumstances that many other regional banks don’t share. At a high level, all three banks went down because of some combination of the following reasons:

1. Heavily concentrated client bases

All three banks had a relatively heavy concentration in areas of the market that saw rampant and extreme speculation in 2021. Silvergate and Signature bet heavily on the crypto industry. That bet soured in 2022 as cryptocurrencies plummeted in value. Silvergate was long expected to fail following the collapse of one of its prominent clients, the crypto exchange: FTX. While Silicon Valley Bank (SVB) did not share the same exposure to crypto, it was very concentrated in technology startups.

2. Large unrealized losses in their bond portfolios

During the craziness of 2021, money flooded into speculative areas, including crypto firms and other tech startups, much of which ended up as deposits at the banks. SVB, for example, took short-term deposits and invested them in long-term bonds. Doing so created a substantial asset/liability mismatch.

The purchase of these bonds occurred before the Federal Reserve began lifting interest rates to combat inflation. After the Fed began hiking rates, the value of the bonds held at SVB fell far below where they were purchased. Typically, this is not an issue, as bonds with an unrealized loss due to interest rate shifts still get paid in full at maturity. As long as the bank is not forced to sell the bonds it intends to hold to maturity, it wouldn’t have to realize any losses.

3. Insufficient liquidity when depositors ran for the exits

This became a big problem for SVB for several reasons. First, the river of easy money flowing into the startup companies dried up as monetary policy was tightened. As a result, deposits at SVB were declining as the startup firms burned through the cash to fund their operations. The failure of Silvergate exacerbated the issue, sparking fear among its customers and sharply accelerating the exodus of deposits. In order to meet its client’s redemption requests, SVB was forced to sell its entire portfolio of bonds it had originally intended to hold to maturity at a sizable loss. The announcement led to venture capital firms urging their portfolio companies to pull their money out of the bank. The ultimate death blow for each entity amounted to a classic run on the bank where panicked customers demanded their cash all at once.

How Has the Government Responded to the Banking Turmoil

Over the weekend, U.S. regulators announced a series of measures aimed at containing the fallout from the bank failures. The moves were designed to prevent the further flight of deposits and increase bank liquidity.

The FDIC announced that all depositors at both Signature Bank and SVB would be made whole. The FDIC typically only insures deposits up to a cap of $250,000. The Wall Street Journal reported that around 97% of deposits held at SVB were above that threshold, which likely contributed to the speed at which deposits were yanked from the bank. With this implicit guarantee that the FDIC could step in and guarantee uninsured deposits at other banks, they potentially averted additional bank runs at the start of this week.

In addition to the move made by the FDIC, the Federal Reserve announced a new program dubbed the “Bank Term Funding Program.” The program will provide a loan to banks for up to one year using U.S. Treasury and Agency Mortgage-Backed Securities (MBS) as collateral. Importantly, the banks will be able to obtain funding based on the ‘par’ value of the bonds, as opposed to the market value. This will allow banks to obtain funding based on the maturity value of the bonds and avoid the haircut associated with selling the bonds at a loss. Had this program been in place last week, SVB would have likely survived.

What This All Means for Investors

It’s unclear if the failure of Signature Bank on Sunday will be the last major event in this tumultuous episode. Banking stocks continued to get hammered on Monday, particularly the smaller players. Thus far, however, it appears the actions taken by regulators may be sufficient to contain the fallout and prevent continued panic from spreading further through the banking system. On Tuesday morning, banking stocks experienced a substantial rally.

The banks that failed last week were relatively small compared to the financial institutions that stumbled in 2008. They also contained client bases that were concentrated in industries that have been among the hardest hit over the last year. Larger banks with more diverse client bases are better equipped to handle the pressures faced by the now-defunct firms. Banks are also in a much stronger position than they were entering the Financial Crisis in 2008. Tougher regulations mean banks, particularly the largest institutions, are much better capitalized.

Investors that are concerned about the safety of their cash should ensure their deposits are insured. FDIC insurance covers up to $250,000, per depositor, per insured bank, for each account ownership category (think individual vs. joint account). Investors with cash balances that exceed the insurance caps have a few additional options. Short-term Treasury bills, or government money market funds that invest in similar assets, are generally considered risk-free and often have yields that are higher than traditional bank accounts.

WEEK IN REVIEW

- The Bureau of Labor Statistics published the February Consumer Price Index (CPI), which is an important reading on inflation. Headline inflation increased 6.0% YoY, in line with expectations. Core CPI, which excludes the volatile food and energy categories, increased slightly more than expected MoM. Core CPI was up 5.5% YoY.

- The shelter component of CPI, which comprises about 1/3 of the overall calculation, continued to be a key driver of the elevated rate of inflation, increasing by 8.1% over the last year. Given the way the Shelter component is calculated, many believe it is erroneously making inflation look too high. The so-called ‘super core’ inflation, which strips out food, energy, and shelter, increased by 3.7% YoY.

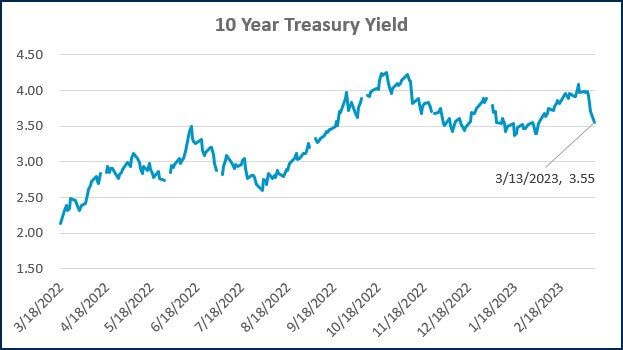

- Turmoil in the banking sector led some to believe that the Fed would opt to take a pause rather than continue to hike rates following its monetary policy meeting next week. Following the CPI report, fed fund futures were still pricing in a 70% chance of a 0.25% hike next Wednesday. The market will pay extra attention to the Dot Plot, which the Fed will publish at the conclusion of its meeting. The Dot Plot illustrates the individual committee member’s expected path of interest rates over the next few years.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

MARKETS

- Inflation Gauge Increased 0.4% in February, As Expected and Up 6% From a Year Ago (CNBC)

- Something Broke, But the Fed is Still Expected to Go Through With Rate Hikes (CNBC)

- (Video) The Fed’s 2% Inflation Target, Explained (WSJ)

INVESTING

- Yale Invests This Way, Should You? (Jason Zweig)

- Psychological Paths of Least Resistance (Morgan Housel)

- Bank Runs, Now & Then (Ben Carlson)

OTHER

- Where Is a Large Predator Most Likely to Attack You? (Scientific American)

- When Exercising Through Pain Helps Make It Better (Slate)

- Amateurs vs. Island Green at TPC Sawgrass before THE PLAYERS (PGA Tour)

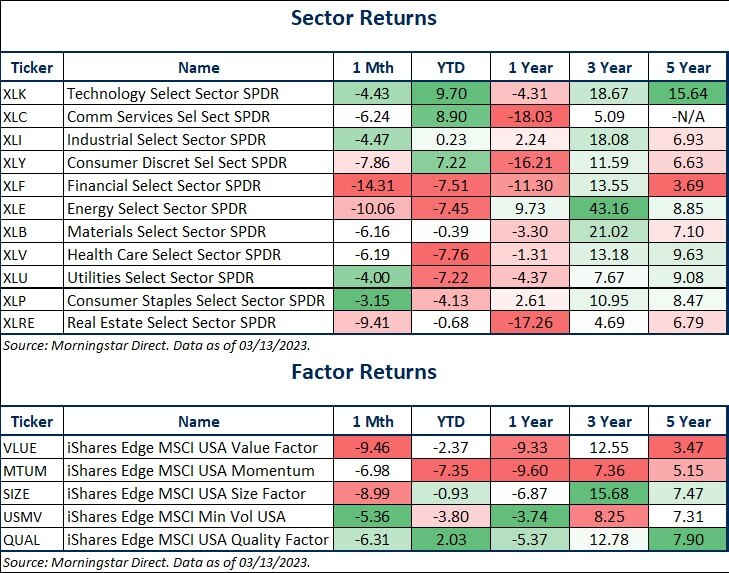

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

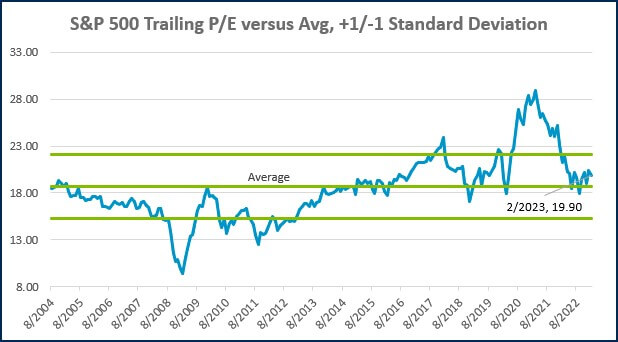

Source: Treasury.gov

Source: Treasury.gov

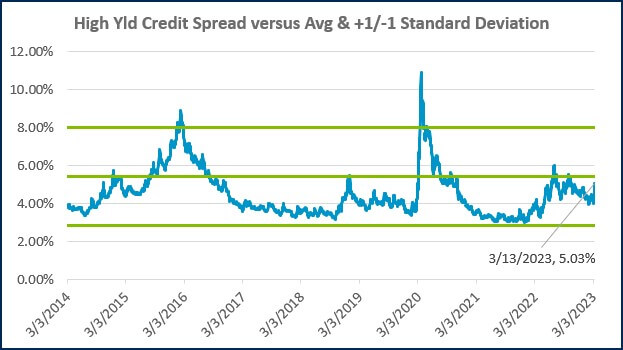

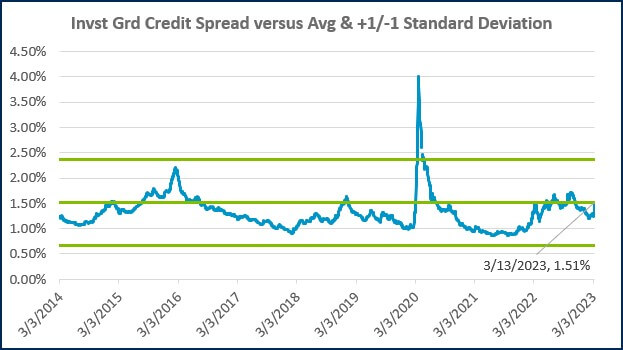

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

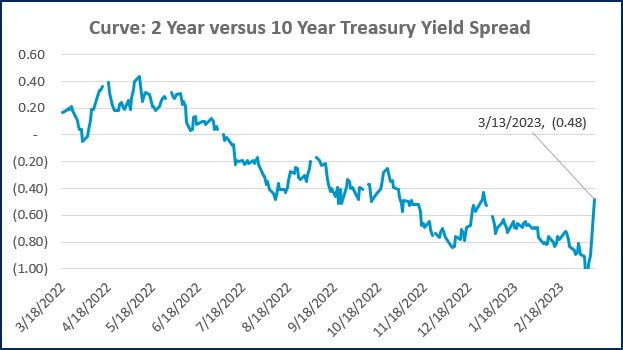

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)