Further Developments in the Banking Industry + Market Update 3.21.2023

The market’s attention remains focused squarely on the health of the banking system. In our previous Market Update, we highlighted factors that contributed to the collapse of three U.S. banks, as well as the attempts by regulators to contain the fallout. Since that time, the market has remained volatile. Below we examine a few new developments from the last week and discuss some of the most closely watched storylines moving forward.

Market Volatility Has Persisted

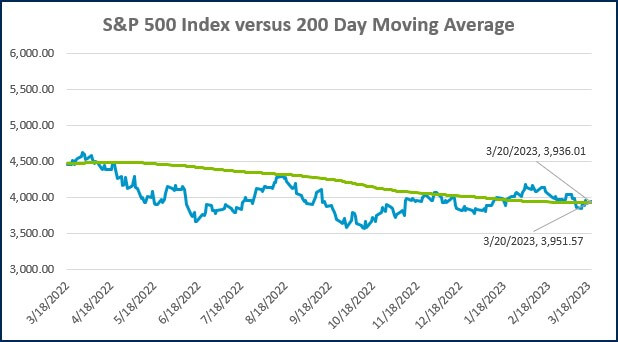

Despite the efforts of regulators to reassure the public that the banking system remained stable, sharp market volatility has continued. The Invesco KBW Bank ETF (Ticker: KBWB), a popular fund that tracks domestic banks, fell an additional -12.3% last week, closing Friday -27.9% lower in March. The S&P 500, more broadly, rose 1.3% last week but remains down -1.2% month-to-date as of Friday’s close.

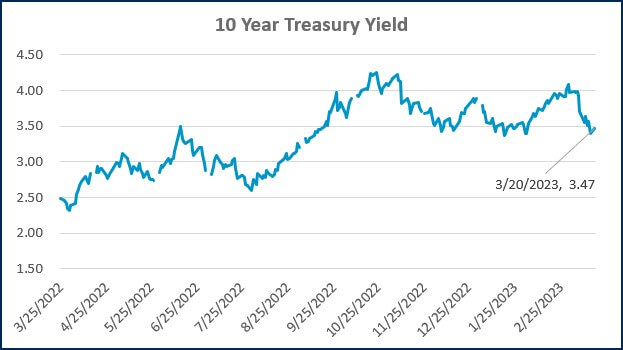

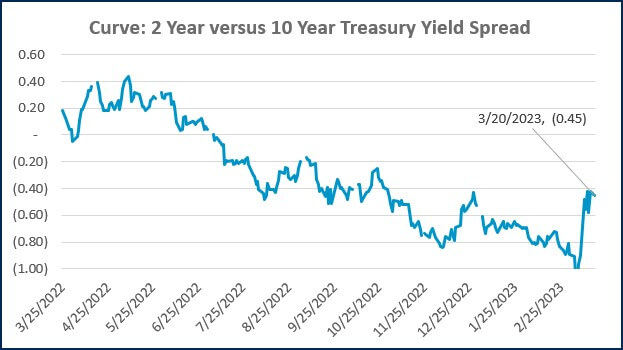

Volatility has also been elevated in the bond market. Treasury yields, including those on relatively safe short-term bonds, have swung wildly in recent days. The Two-Year Treasury saw its rate decline from 5.05% on March 8th to as low as 3.81% on March 17th. It has since returned to 4.20% as of this writing on Tuesday morning. The MOVE Index, which is a measure of bond volatility similar to the equity market’s VIX Index, has moved to multi-year highs, even surpassing the elevated levels that occurred during the peak of the Covid selloff.

Additional Banks on the Brink

A few additional firms, including Credit Suisse and First Republic Bank, remained under especially intense pressure through last Friday. Credit Suisse is unique relative to the banks that have failed recently. Founded over 165 years ago, it is a massive global investment bank based out of Zurich, Switzerland. Credit Suisse had weathered the Financial Crisis in 2008 well relative to other major banks that required bailouts, including its main Swiss rival, UBS. However, Credit Suisse grew weaker in the ensuing years as poor risk management repeatedly saddled the bank with large losses and legal woes.

On Wednesday, Credit Suisse’s largest shareholder, the Saudi National Bank, announced on Bloomberg TV that it could not add to its investment due to regulatory rules. This led to the stock dropping 24% in a single day. Shortly after, the Swiss National Bank (SNB) offered Credit Suisse a lifeline in the form of a $54 billion loan. That, however, was not enough to calm its investors or its customers, who were withdrawing $10 billion a day, according to the Wall Street Journal. Fearing the bank was racing toward insolvency, the SNB orchestrated a sale to UBS, which was able to acquire Credit Suisse for a steeply discounted price and a sizable government backstop for potential losses stemming from the deal.

First Republic, whose stock finished last week down -81.3% in March, appears to be the most vulnerable remaining bank. Relative to Credit Suisse, it is a very small player, primarily catering to high-net-worth individuals in the United States. It has come under substantial pressure because a large portion of its deposits exceed the FDIC’s limit on insurable deposits, similar to the problem that plagued Silicon Valley Bank.

First Republic has experienced a massive exodus of these deposits, which have left for the perceived safety of larger banks. In an effort to restore confidence, Treasury Secretary Janet Yellen and JP Morgan CEO Jaime Dimon were able to coordinate a group of eleven major banks to deposit approximately $30 billion at First Republic. Additionally, the bank has hired JP Morgan to advise on its path forward, which may include an additional capital infusion or sale of the business. Investors will be watching the developments at First Republic closely, as well as looking for signs that other banks are coming under increased pressure.

Potential Policy Shifts

Investors are on the lookout for potential changes to both regulatory and monetary policy in the aftermath of the recent banking turmoil. When Silicon Valley Bank and Signature Bank failed, the FDIC announced that it would insure all deposits, including those that were above the $250,000 cap. This move has likely been interpreted as an implicit guarantee on all deposits of other banks as well. It would not make much sense for the government to provide a backstop in this situation, but not step in if the crisis appeared to worsen. There have been growing calls for the FDIC to make this implicit guarantee an explicit one, at least for a set period. There has been precedent for this. During the Financial Crisis in 2008, the FDIC offered increased coverage as a way of restoring confidence among depositors.

Additionally, in 2018 there was a move to reduce the regulatory burden on smaller banks from the Dodd-Frank Act, which was the major bank regulation passed in the aftermath of the Financial Crisis. It is unclear whether the reduction in regulations had an impact on the bank failures, but this will likely be reviewed with a potential for regulatory changes moving forward.

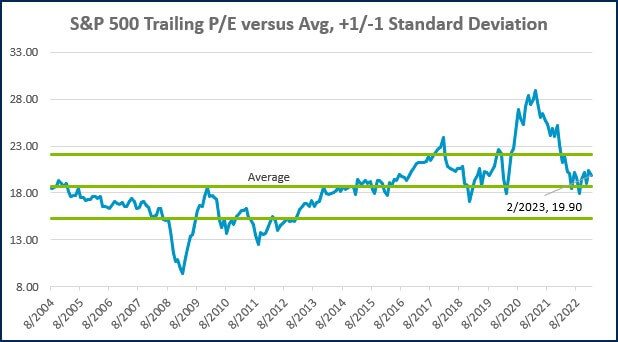

Monetary policy is another area that may be impacted. Economic activity appeared to pick up at the start of 2023, most notably within the labor market. As a result, during his semi-annual testimony to Congress on March 7th and 8th, Federal Reserve Chairman Jerome Powell indicated that a reacceleration of the pace of interest rate hikes was on the table. At that time, the market was pricing in a 0.50% hike as the most likely scenario following the next monetary policy meeting, which concludes Wednesday, 3/22. Now the market is only pricing in a 0.25% hike, with many suggesting the Fed should pause its hikes altogether in the interest of ensuring stability in the financial markets.

Perhaps as important as the rate decision itself is the forward guidance provided on future policy. Investors will pay close attention to two other items following the rate decision.

1. The post-meeting press conference with Fed Chairmen Jerome Powell, where he will articulate the committee’s thought process and expectations moving forward.

2. The updated ‘Summary of Economic Projections’ (SEP). The SEP includes the individual committee member’s median estimate for a variety of major economic data points, including the federal funds rate, over the next couple of years.

Looking Forward

The broader market, and banking stocks in particular, have risen to start the week. This could be a sign that the fallout is successfully being contained, or it could simply be a brief pause within the storm. The onset of the banking turmoil was swift and largely unforeseen. Where things go from here could be equally unexpected. When uncertainty in the market is this elevated, patience and humility are often rewarded traits.

WEEK IN REVIEW

- This week will be headlined by the conclusion of the Federal Reserve’s monetary policy meeting on Wednesday. The market is currently pricing in an increase to the fed funds rate of 0.25% is the most likely outcome. Such a move would push the target range to 4.75-5.00%.

- Following the meeting, the Fed will publish the ‘Summary of Economic Projections’ (SEP). This document is published once a quarter and includes the so-called Dot Plot, which illustrates the expected path of the Federal Funds rate over the next few years. Given the banking turmoil, the market has been pricing in cuts to the fed funds rate as early as June. Investors will pay close attention to how the market’s pricing compares with the newly published expectations of Fed officials.

- Aside from the Fed decision, it is a fairly quiet week for economic data releases. Data published on Tuesday showed existing home sales increased month-over-month for the first time in twelve months and represented the largest monthly increase since July 2020. Other economic data this week includes jobless claims on Thursday, durable goods orders, and an initial reading on services and manufacturing sector activity due Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

MARKETS

- The Fed is Likely to Hike Rates by a Quarter Point But It Must Also Reassure It Can Contain a Banking Crisis (CNBC)

- Homes Sales Spike 14.5% in February as the Median Price Drops for the First Time in Over a Decade (CNBC)

- Everyone’s Talking About Credit Suisse’s Risky Bonds. Here’s What They Are and Why They Matter (CNBC)

INVESTING

- What Gets Lost When You Rescue Markets (Jason Zweig)

- Volatility is Nothing New (Ben Carlson)

- How Much Money Buys Happiness (Barry Ritholtz)

OTHER

- ‘Top Gun: Maverick’ gets a reality check from actual graduates – 60 Minutes (YouTube)

- TaylorMade Launches Survey Seeking Everyday Golfer’s Input on Golf Ball Rollback Proposal (Golf Digest)

- The Death of the Local Sports Anchor (Sports Illustrated)

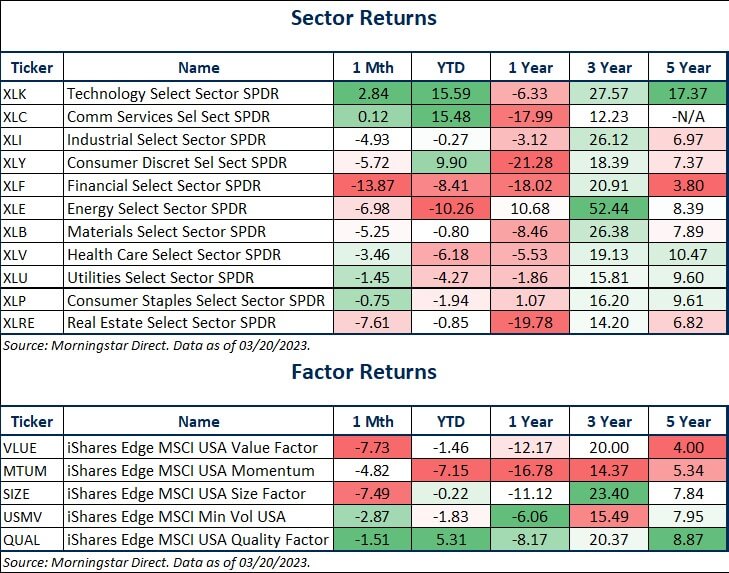

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)