Bed Bath & Bankruptcy + Financial Market Update + 4.25.23

The iconic retail chain Bed Bath & Beyond (ticker: BBBY) announced a bankruptcy filing over the weekend. Just five years ago, the company was valued at $2.5 billion. Now, after facing years of pressure from the rise of e-commerce, the brick-and-mortar store’s shares are effectively worthless.

Founded as Bed ‘n Bath in 1971, the company started with just two stores. Their strategy was to offer name brands at a discount. According to a write-up in the Wall Street Journal(1), “Money was tight, and what little of it they had went to merchandise, not to advertising or trying to make stores look pretty. To hide the industrial fixtures, they piled towels, linens, and bedding to the ceiling, giving rise to the clutter that became a hallmark of the chain, which started in the New York City suburbs.” By the 1980s, the company expanded its merchandise offering and changed its name to Bed Bath & Beyond.

The full history of the firm is beyond the scope of this post, but fans of the store might enjoy the WSJ write-up linked below.

In the grand scheme of the U.S. stock market, BBBY was insignificant. Its market value peaked in 2013 at around $17 billion. By 2017, deteriorating operational results led to its removal from the S&P 500. In recent years, however, the company periodically garnered outsized attention.

In 2021, it was one of the key stocks involved in the meme-stock frenzy that captivated retail investors. During this crazy episode in market history, a mass of retail investors on social media platforms such as Reddit and Twitter banded together to drive up the stock prices of certain companies, most notably GameStop, AMC Entertainment, and Bed Bath & Beyond.

The investors shared memes and encouraged others to buy and hold the stocks, regardless of their fundamental value. This led to a rapid increase in the prices of these stocks, which attracted more retail investors, putting further upward pressure on prices in what became an explosive upward spiral.

In a matter of months, the phenomenon went from the obscure Reddit forum to the most discussed day-to-day topic in the mainstream financial media. Ultimately, the movement likely ended poorly for most retail investors that piled in late in the game. After reaching peak popularity in early June of 2021, shares of these companies have been in absolute freefall. As the chart below illustrates, while the S&P 500 has been essentially flat over this period, the meme stocks have shed most of their value.

Source: Koyfin. Chart illustrates the cumulative total return between 6/2/2021 to 4/24/2023.

Interestingly, while the fervor around meme stocks had largely faded away, retail investor interest in Bed Bath & Beyond never disappeared completely. In a desperate attempt to avoid bankruptcy, BBBY had been flooding the market with newly issued shares to raise capital. According to a recent article from the Wall Street Journal(2), the shares outstanding for the company increased from 117 million in January of this year to 428 million by the end of March. With existing shares facing extreme dilution, the price fell below $0.50/share by the start of April. According to the article, individual investors were the primary buyers of these new shares.

Why would anyone purchase stock in a company so obviously racing toward bankruptcy? Rumors circulating on Reddit suggested that Billionaire Ryan Cohen was poised to acquire the company. This would have presumably resulted in a generous payout for those stepping in to purchase the newly issued shares.

For many individuals, the promise of hitting it big with the meme stocks was too much to resist. Unfortunately, pursuing outsized gains in a short period of time is a speculative endeavor fraught with risk. The announced bankruptcy of Bed Bath & Beyond marks a new chapter in this cautionary tale. Proper diversification and a disciplined ability to ignore the noise tend to win out over greed.

- Bed Bath & Beyond Used to Be Great. These Two Are Why (WSJ)

- Bed Bath & Beyond’s Stock-Sale Deluge Lures Retail Investors (WSJ)

Week in Review

- According to FactSet, 18% of the S&P 500 has reported Q1 results as of last Friday’s close. The earnings growth rate, blended between companies that have already reported with the estimates for those that have yet to report, is at -6.2% year-over-year. Expectations for the earnings growth rate at the onset of earnings season was -6.7% year-over-year.

- This morning we got an update on the housing market. According to the Case-Shiller National Home Price Index, prices rose for the first time in 8 months in February (+0.2%). On a year-over-year basis, homes appreciated at the slowest pace in 11 years, increasing by just 2.0%.

- Data to be published later this week includes durable goods orders on Wednesday, Q1 GDP and jobless claims on Thursday, and the Personal Consumption Index ( the Fed’s preferred gauge of inflation) on Friday.

Hot Reads

Markets

- U.S. Home Prices Rise for First Time in 8 Months, Case-Shiller Says (MarketWatch)

- Stanford and MIT Study: A.A. Boosted Worker Productivity by 14% - Those Who Use It ‘Will Replace Those Who Don’t’ (CNBC)

- Sliding Diesel Prices Signal Warning for U.S. Economy (WSJ)

Investing

- One Big Web: A Few Ways the World Works (Morgan Housel)

- Picking a Stock for the Year 2048 (Jason Zweig)

- Will We Ever See Affordable Housing Prices Again? (Ben Carlson)

Other

- Japanese Ispace Moon Landing Attempt Falls Short at ‘Very End,’ CEO Says (CNBC)

- This Private Moon Lander is Kicking Off a Commercial Lunar Race (Wired)

- Where Aaron Rodgers Ranks Among AFC QBs After Trade to the Jests (SI)

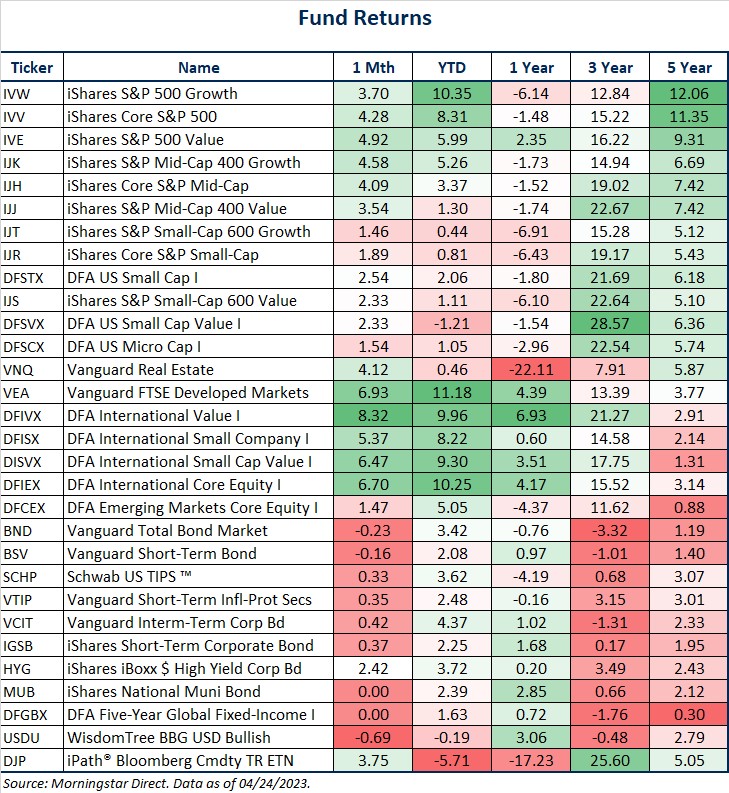

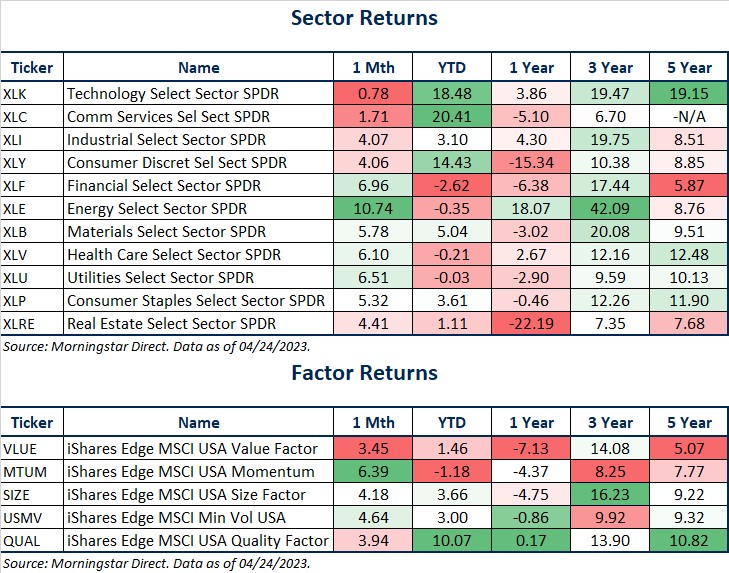

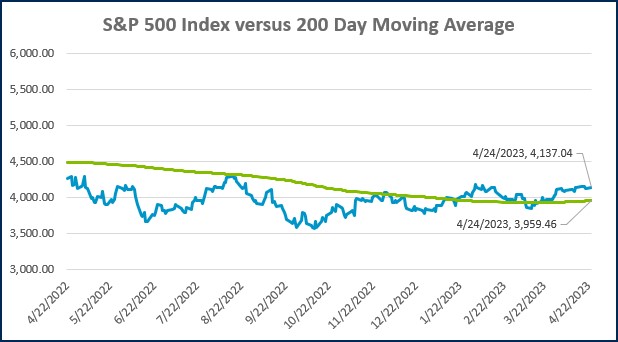

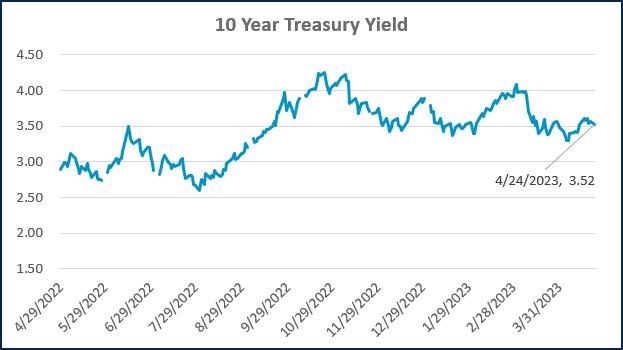

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

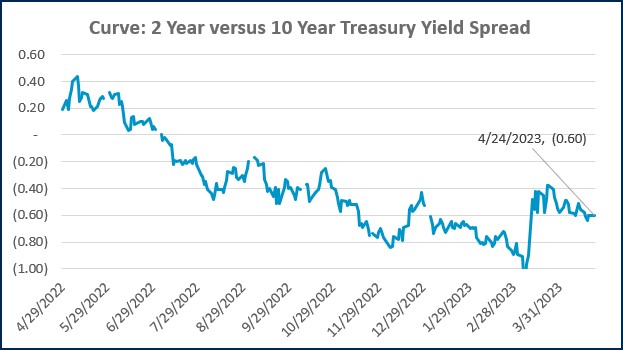

Source: Treasury.gov

Source: Treasury.gov

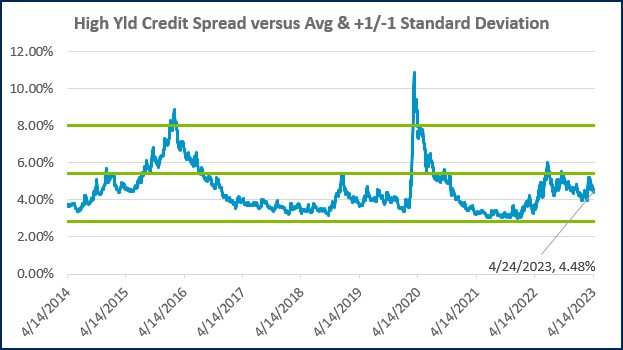

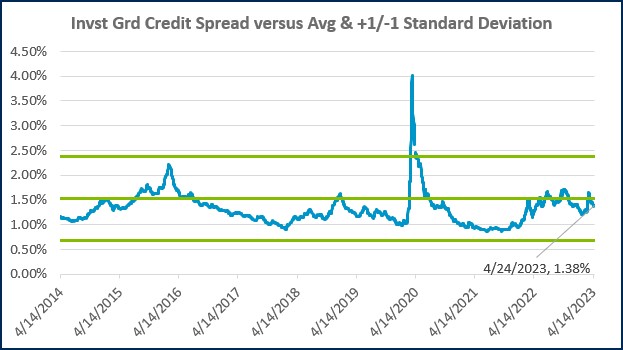

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Economic Calendar

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)