Should Investors Be Concerned About the Debt Ceiling? + Market Update

Story of the Week

Should Investors Be Concerned About The Debt Ceiling?

Treasury Secretary Janet Yellen generated some headlines after the close on Monday, sparking renewed focus on the U.S. debt debate. Her announcement suggested the U.S. risks a default, potentially as early as June 1st, without an increase to the Federal debt ceiling. The initial guidance from several months ago anticipated the government would likely hit the limit sometime between June and September. According to the Congressional Budget Office (CBO), smaller-than-expected tax receipts in April accelerated that timeline.

There remains considerable uncertainty as to exactly when the final deadline is for Congress to modify the debt ceiling. Technically, the Treasury hit the $31.4 trillion limit on January 19th, 2023(1). Since then, the Treasury has been using “extraordinary measures” to satisfy its financial obligations. Unfortunately, this is only a temporary solution, and as time ticks on, the focus on the debt ceiling is likely to intensify considerably. How much should investors pay attention to this unfolding drama?

Before we get there, let’s get some historical context. The Federal debt was originally created in the 1790s under the direction of Alexander Hamilton, the nation’s first Treasury Secretary. He successfully implemented a plan for the Federal government to assume the considerable debt incurred at the state level to fund the Revolutionary War. Among other things, this act resulted in the creation of the modern U.S. bond market and established how the Federal government would handle its day-to-date financing and budget activities.

Between the First and Second World Wars, the process underwent a change. Up to this point, Congress would largely approve new bond issuances that were tied individually to new projects. As the size of the government increased, this process became unwieldy. To ease this burden, the Treasury was given more flexibility in its power to structure and service the debt, subject to a limit on the aggregate amount(2).

Since World War II, Congress has approved 102 separate debt limit modifications to accommodate the growing Federal debt level. It has done so 20 times since the year 2000 alone. Clearly, this type of political fight is not a rarity. In most circumstances, the debt ceiling has been successfully lifted with limited attention paid by the general public. Periodically, however, political brinksmanship has turned the process into a volatile spectacle.

The most dramatic episode in recent history came in 2011. Although the impasse was eventually resolved, the debate was intense. The country came close enough to the brink that Standard and Poor’s cut the nation’s credit rating to AA+ from the highest possible AAA rating. Other notable debt ceiling debates have occurred recently, including those in 2013 and late 2018 into early 2019. These events included government shutdowns that lasted 16 and 35 days, respectively.

The exact consequences of the U.S. defaulting on its debt are not known with certainty because it has never happened before. Still, it’s probably safe to assume there would be widespread fallout. Some potential ramifications include:

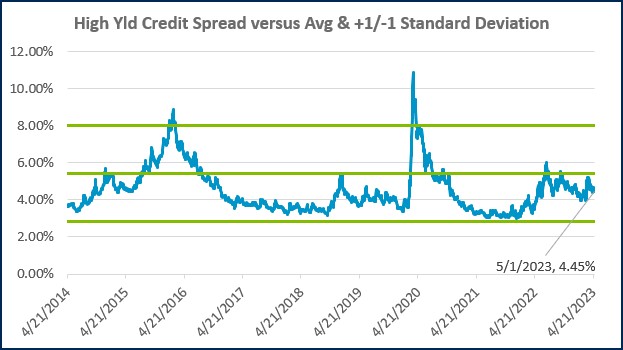

- Financial market instability

- Higher government borrowing costs

- Government shutdowns

- Economic slowdown

Regardless of how smooth (or not) this process has been in the past, historical precedent suggests Congress will reach a deal in time. The consequences of failing to do so are too high. While some politicians may seek to use this as an opportunity to move policy in one direction or another, the simple act of avoiding a default enjoys bipartisan support. Additionally, the public views the issue as a serious matter, and the threat of political backlash can serve as an additional motivating factor. Ultimately, this is a scene that has played out 100 times before, and cooler heads will hopefully prevail once again.

A challenge every investor must confront is how to respond to the prospect of a low-probability event that carries dire consequences. While some of these rare events do materialize from time to time, it is impossible to know in advance which ones will. An investor resolved to avoid these situations entirely may find their assets permanently buried in their mattress. Unfortunately, this strategy is unlikely to make any headway in achieving one’s long-term financial goals.

Faced with such uncertainty, being diversified, having a plan, and maintaining a long-term focus offers the most reliable path forward. This approach best balances the potential reward of staying invested in the market while minimizing the fallout when these unlikely outcomes arise.

- Federal Debt and the Statutory Limit, February 2023 – (Congressional Budget Office)

- The Debt Limit – (Congressional Research Service)

Week in Review

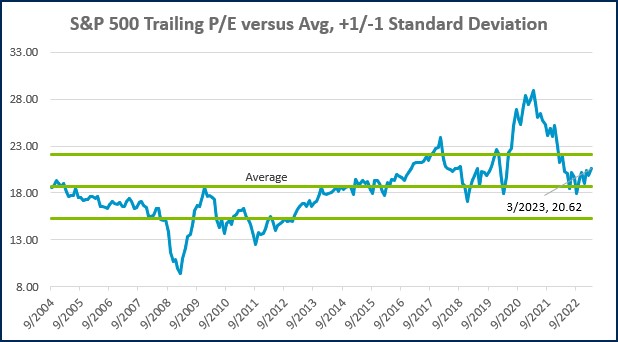

- According to FactSet, 53% of the S&P 500 has reported Q1 results as of last Friday’s close. The earnings growth rate, blended between companies that have already reported with the estimates for those that have yet to report, is at -3.7% year-over-year. Expectations for the earnings growth rate at the onset of earnings season was -6.7% year-over-year. A few of the big tech companies, particularly Amazon, have contributed to a modestly improved aggregate earnings picture.

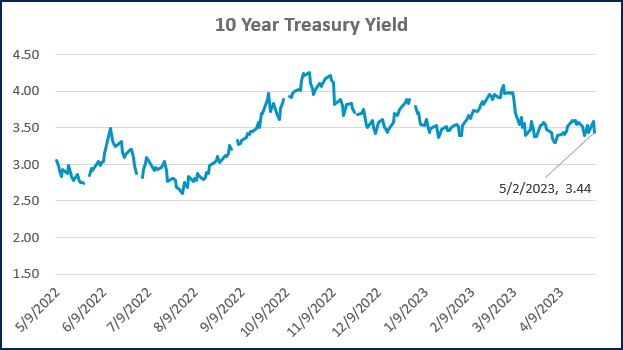

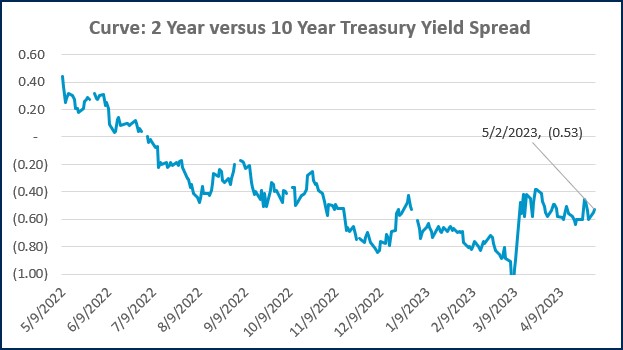

- The Federal Reserve will conclude its two-day monetary policy meeting today. The market is currently pricing in a 0.25% hike, which would move the target fed funds rate to a range of 5.00% to 5.25%. The market will watch Fed Chair Jerome Powell’s comments during the press conference closely for clues on the future direction of policy. Both the market and the Fed’s own projections suggest a pause on further rate moves is possible after this meeting.

- Big data releases due this week include the ISM Services figure later this morning, Jobless claims on Thursday, and the payrolls report on Friday.

Hot Reads

Markets

- Fed Set to Raise Interest Rates to 16-Year High and Debate a Pause (WSJ)

- Key Inflation Gauge For the Fed Rose 0.3% in March as Expected (CNBC)

- Job Openings Fell More Than Expected in March to Lowest Level in Nearly Two Years (CNBC)

Investing

- Getting the Sharp End of the Investing Stick (Jason Zweig)

- The Fastest Way to Get Rich is to Go Slow (Morgan Housel)

- How Interest Rates and Inflation Impact Stock Valuations (Ben Carlson)

Other

- Everything an NFL Scout Does During the Draft Process to Find Super Stars (YouTube)

- Where Did Mars’s Moons Come From (Scientific American)

- The Modern World is Aging Your Brain (Wired)

Markets at a Glance

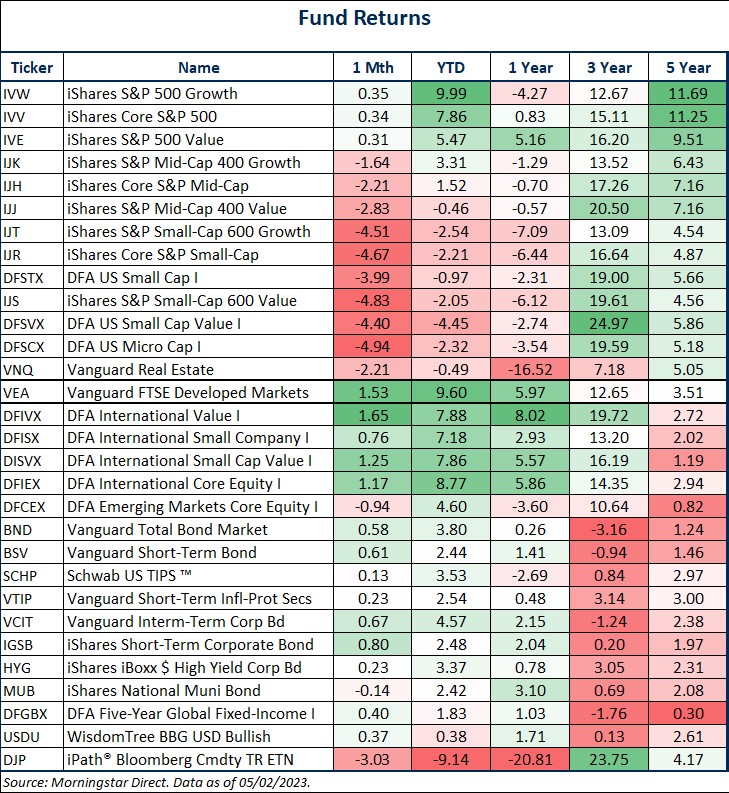

Source: Morningstar Direct.

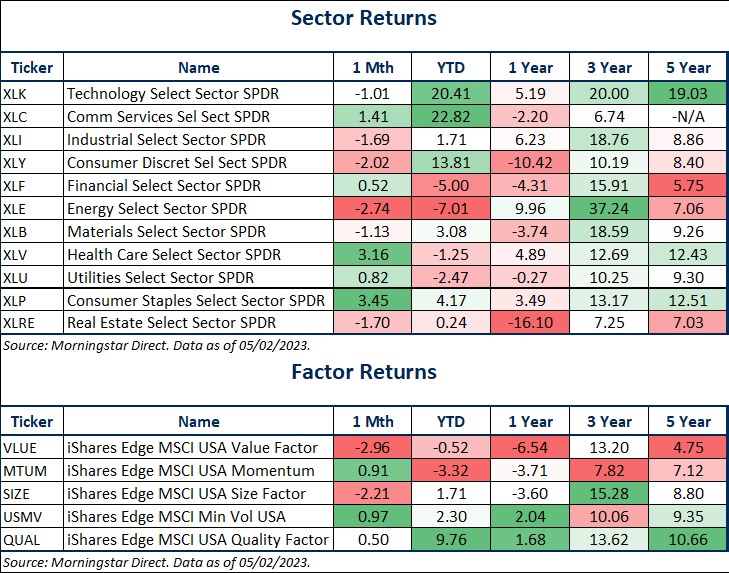

Source: Morningstar Direct.

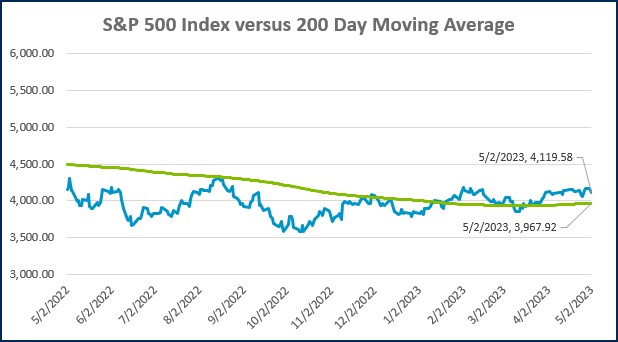

Source: Treasury.gov

Source: Treasury.gov

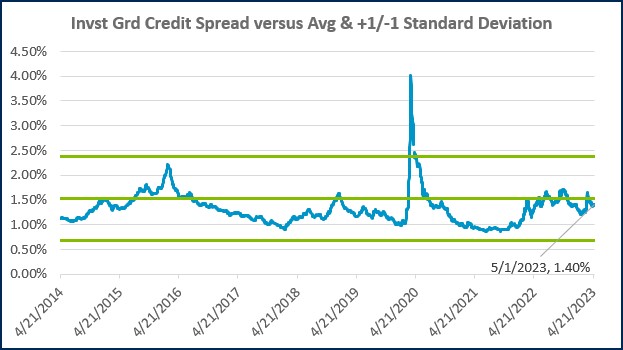

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

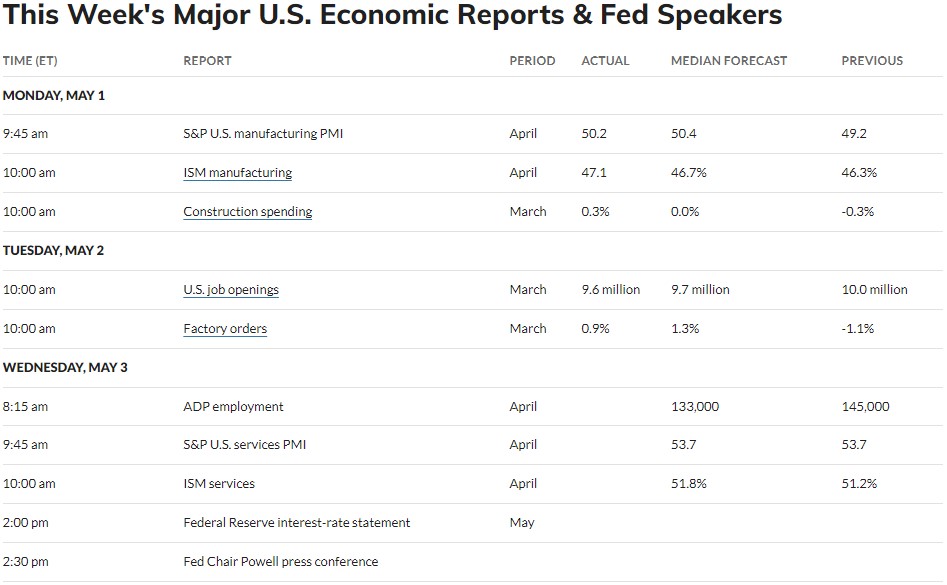

Economic Calendar

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)