Is Today's New Asset Yesterday's Liability? + Market Update + 8.22.23

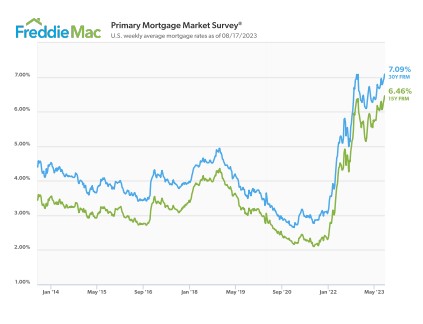

Last week, 30-year mortgage rates rose to their highest levels in more than ten years to 7.09% as measured by the Freddie Mac Primary Mortgage Market Survey®. As you see in the chart below, rates were barely 3% beginning in 2022, so the move has been aggressive and quick at the same time.

A move that aggressive in rates makes home affordability much more difficult. Moving a 30-year mortgage rate from 3% to 7% results in a payment that is 50% higher. What defies logic is that if payments on home loans have moved up 50% since the beginning of 2022, why haven’t home prices collapsed to compensate for the higher payments?

Quite the opposite has happened to home prices. According to statistics on the realtor site Redfin.com, the median sales price for a single-family home in the United States has moved higher by 1.8% year-over-year (ending 8/17/2023) to $440,492.

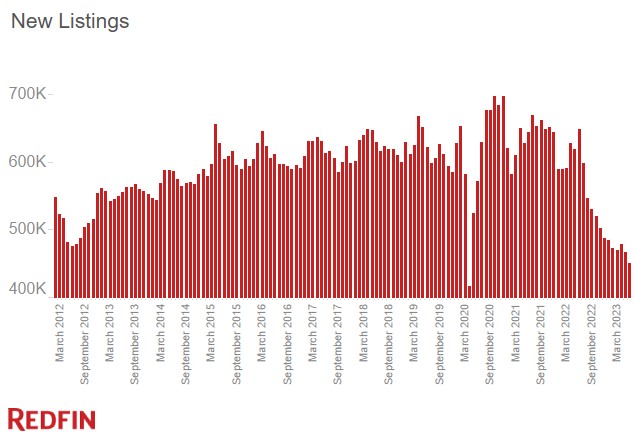

So, why are home prices stubbornly moving higher? It can be argued that it is a supply issue. Right now, according to Redfin, there are less than two months of housing supply on the market. Overall, new for-sale listings have plummeted to nearly the lowest point in years, as you see in the Redfin graph below.

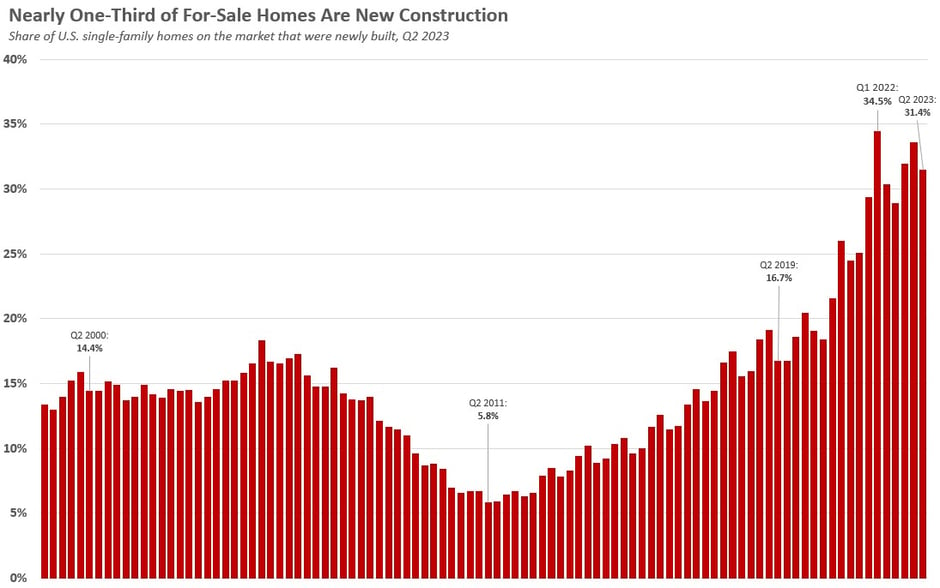

One would assume that with the lack of inventory and new listings, new-construction inventory would be down. Surprisingly, relative to the homes for sale, Redfin notes that new home construction accounts for nearly one-third of homes for sale. As you can see in the following graph, new-construction listings are a significantly higher portion of the overall single-family homes for sale since the late 90s.

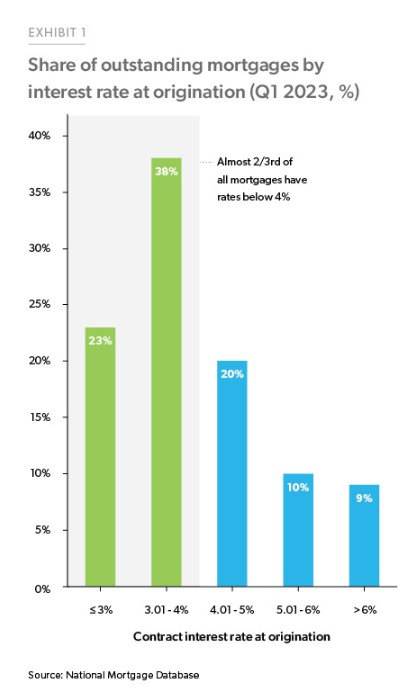

So, if new construction is higher as a proportion of homes for sale these days, it’s safe to say existing home listings must be at a paltry pace. Why is that? The old mortgage that the homeowner had refinanced or used to purchase the home is significantly lower than market rates today. Thus, the long-term “liability” becomes a beneficial “asset” to the homeowner by keeping the current house more affordable.

In fact, according to the National Mortgage Database, more than 60% of homeowners carry an interest rate on the mortgage lower than 4%. More than 90% of homeowners carry a mortgage rate lower than 6%. There is little incentive, other than life events, for them to sell their home with mortgage payments 20-50% lower than they would if they refinanced today.

How long rates persist at these levels is currently unknown. However, we can assume that as long as rates persist at these levels, you can expect home listings to be lower, absent a major recession that forces moves and defaults. Will new home construction fill the void?

Week in Review

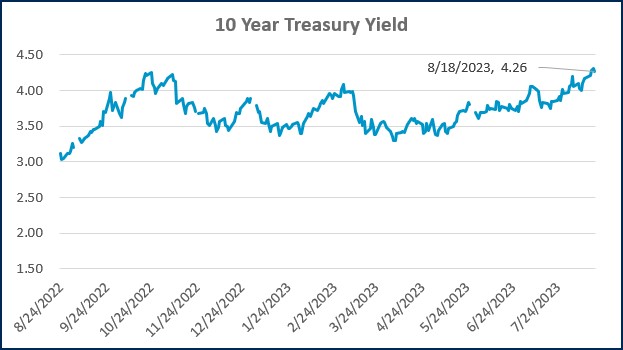

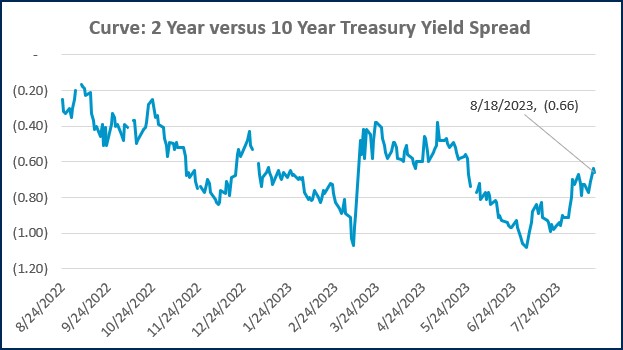

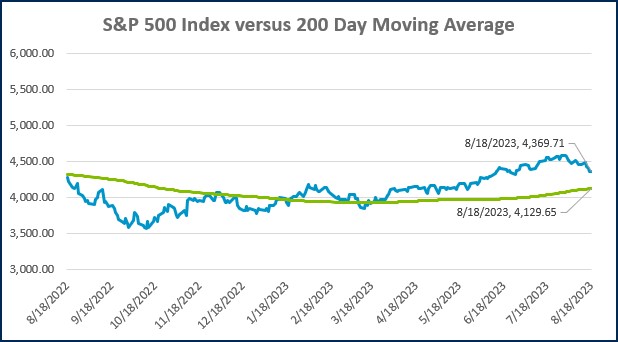

- The yield on the 10-year Treasury reached 4.35% yesterday (8/21), the highest level since 2007. While the 10-year yield has risen from 3.79% to 4.35% (as of 8/21) Year to Date, the yield curve continues to be inverted as short-term yields remain higher than long-term yields.

- Housing starts in July rose by 3.9% month-over-month to a seasonally adjusted annualized rate of 1.452 million, beating the market expectations of 1.448 million. This was 5.9% above the July 2022 rate of 1.371 million. On the contrary, data published today on existing home sales highlighted a 2.2% month-over-month decline to a seasonally adjusted annual rate of 4.07 million, coming in below market expectations for a decline to 4.15 million. Other data to be published this week includes US Services and Manufacturing PMI on Wednesday and Initial Jobless Claims on Thursday.

- The market will be tuning into the Jackson Hole Economic Policy Symposium on Thursday and Friday as dozens of central bankers, policymakers, academics, and economists from around the world meet to discuss new developments affecting the global economy. All eyes will be on Federal Reserve Chair Jerome Powell, who is set to speak on Friday morning at 9:05 AM CT. The market will be watching closely for any further clues on the future path of the Federal Funds rate.

Hot Reads

Markets

- Why The Era Of Historically Low Interest Rates Could Be Over (WSJ)

- Mortgage Rates Hit 7.09% Highest in More Than 20 Years (WSJ)

Investing

- Why Aren’t Investors Selling Stocks to Buy Bonds? (Ben Carlson)

- If I Gave You Tomorrow’s News, You Still Couldn’t Profit (Michael Batnick)

- The Greatest Investment Quotes (Of Dollars and Data)

Other

- Who’s In, Who’s Out at the 2023 Tour Championship: All 30 Qualifiers and Where They Start at East Lake (Golf Digest)

- Top Gun Maverick – The Scene That Gives You Chills (YouTube)

Markets at a Glance

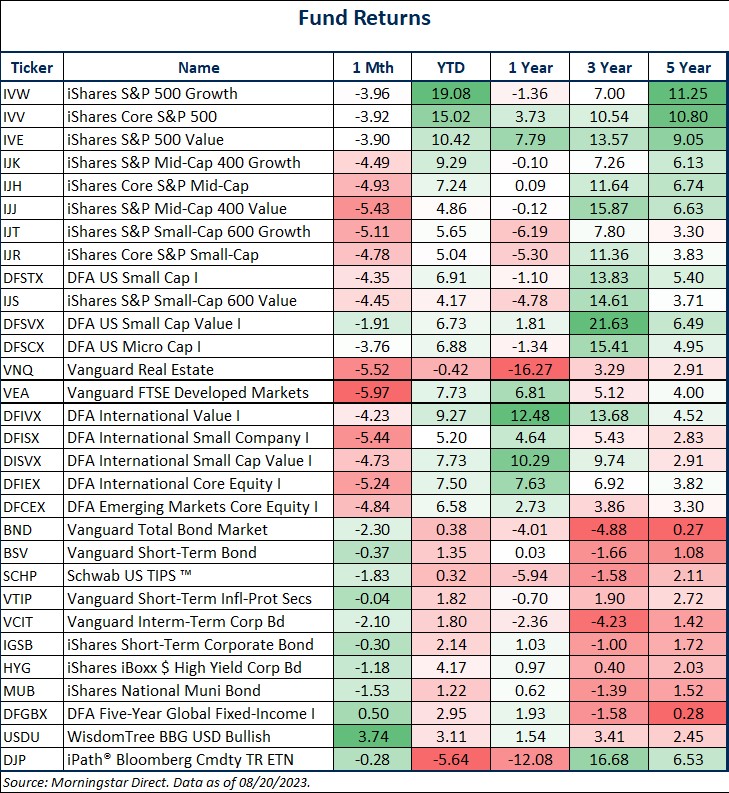

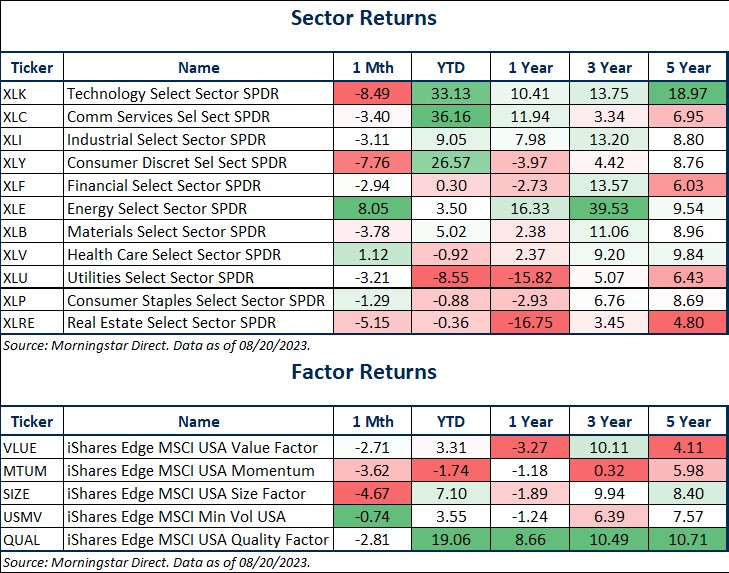

Source: Morningstar Direct.

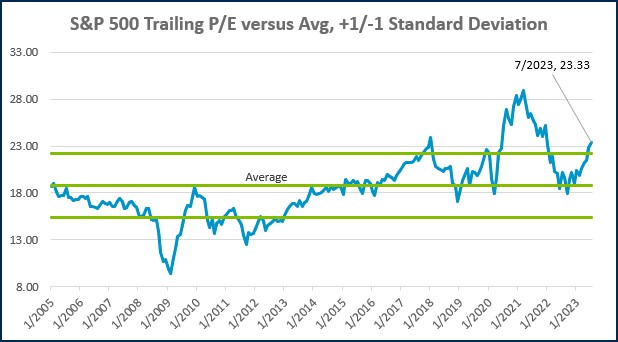

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

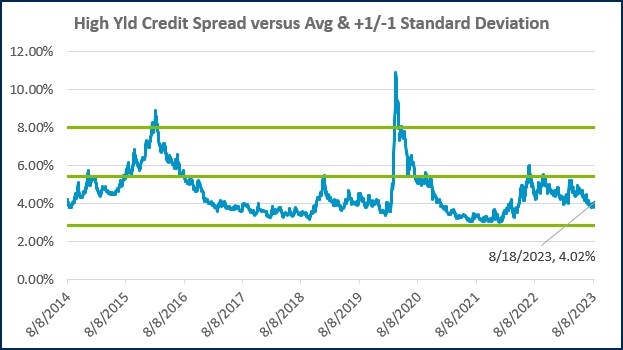

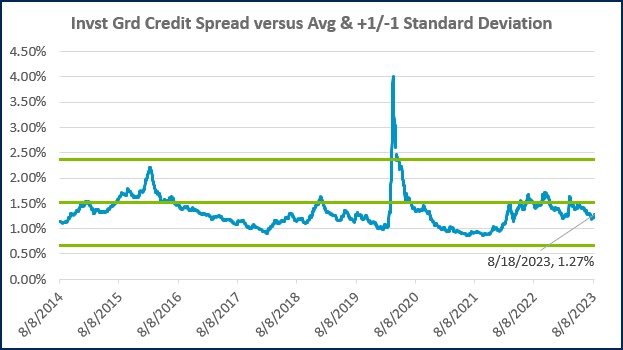

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Economic Calendar

Source: MarketWatch

- Analytical, Strategic, Consistency, Includer, Input

Justin Vossen, CFP®

Justin Vossen, Investment Advisor and Principal, began his career in 1997. With extensive experience in finance, banking, and investment management, he brings comprehensive expertise to his role advising high-net-worth clients and foundations. As a member of the Lutz Financial Board his leadership extends beyond client relationships to shaping the firm's direction.

Leveraging his background in bond trading and portfolio management, Justin focuses on providing comprehensive investment and planning services. He develops tailored financial strategies across wealth management, retirement planning, and estate planning. Justin values creating solutions that give clients peace of mind about their financial situations.

At Lutz, Justin establishes unshakeable trust through his analytical mindset and strategic approach to investment management. He takes time to understand what truly matters to each client—whether it's retiring early or successfully transferring a business—and then builds comprehensive financial strategies to help them get there.

Justin lives in Omaha, NE. Outside the office, he can be found spending time with his wife, Nicole, and their children, Max and Kate.

Recent News & Insights

Implementing Power BI Analytics for Modern Agricultural Operations

Mileage Reimbursements Aren't Always Non-Taxable: Why Accountable Plans Matter

Budgeting Tips for Business Owners & High Earners

Why Consultants & Temporary Talent Make Sense in Today's Market

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)