Inflation Surprises to the Upside + Financial Market Update + 9.13.22

Inflation has been dominating the headlines since accelerating last Spring. It’s a major factor in the Federal Reserve’s shift toward tightening monetary policy, the overall increase in interest rates, and the ongoing selloff in the stock market. This morning the Bureau of Labor Statistics (BLS) published the Consumer Price Index (CPI) for August. The data came in higher than expected and is once again making its impact felt across markets.

Details of the Report

The previous month’s CPI report surprised to the downside, as a sharp drop in energy prices kept inflation flat in July. Economists polled by MarketWatch were calling for a continuation of that trend, with the median forecast for August at -0.1%. Data published this morning was slightly higher, coming in at +0.1% (8.3% YoY). Despite a 0.8% monthly increase in the price of food, a sharp drop in energy prices once again held inflation relatively low. Digging deeper into the report, however, revealed some less positive news.

Core CPI, which excludes the volatile food and energy segments, accelerated during August, increasing to +0.6% (6.3% YoY). Housing rents, both for actual tenants as well as the rental value of owner-occupied homes, increased 0.7%. This category makes up a third of the overall CPI measure and will likely keep upward pressure applied to inflation, as rents have a long way to go to catch up to the surge in home prices in recent years.

Implications

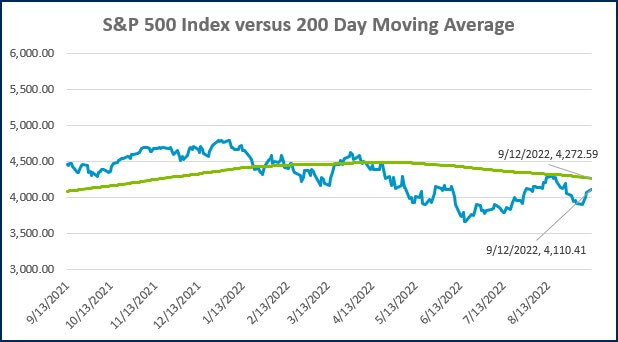

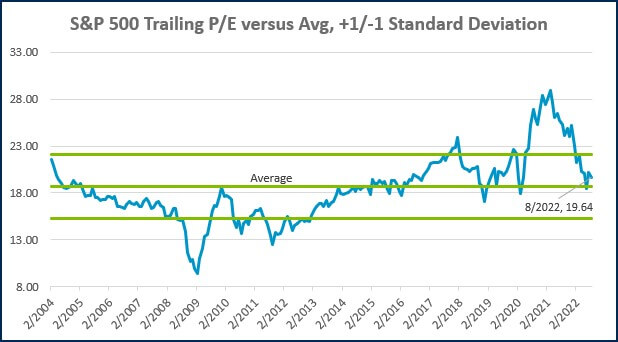

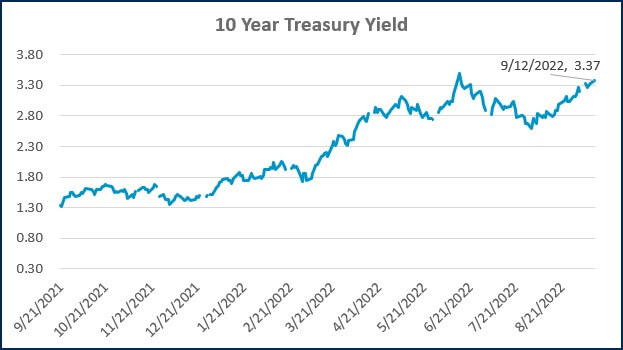

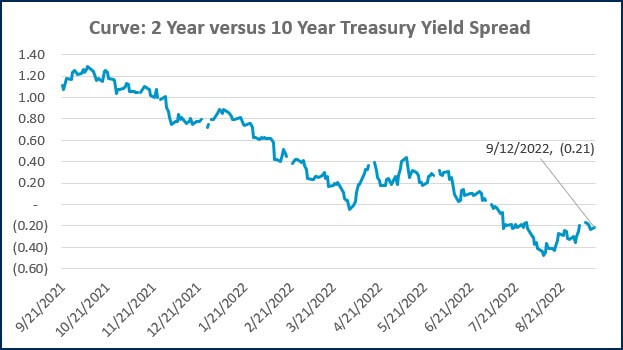

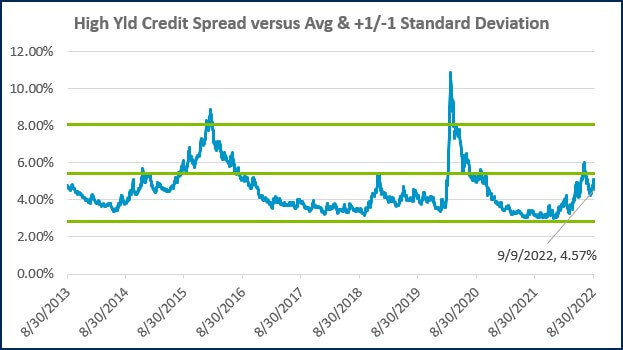

Overall, core inflation tends to be more persistent than the headline figure. An acceleration there is seen as a big negative, which was clearly reflected in the market’s reaction to the data. The S&P 500 fell -4.2% Tuesday, the largest single-day decline since 2020. Meanwhile, the 10-Year Treasury yield rose above 3.40% (bond prices fall as yields rise).

July’s low figure had provided some increased hope that not only did inflation peak in June, but it was poised to move back towards normal. If that were the case, an argument could have been made that the Federal Reserve was further along in its fight against inflation than originally thought. The result would be an increased chance of successfully orchestrating a ‘soft-landing,’ which is a popular term for lowering inflation without pushing the economy into a recession.

The Federal Reserve meets for its next monetary policy meeting next week and will announce its rate decision Wednesday afternoon. The fed fund futures market has been pricing in a third consecutive 0.75% hike as the most likely scenario, with the rate surpassing 4.0% by the end of the year. For its part, the Fed will publish an updated Summary of Economic Projections (SEP), which will include the median estimate for the path of the fed funds rate over the next couple of years. The market will be watching the post-meeting press conference as well as the SEP for clues on how it sees the fight against inflation progressing.

It does appear that inflation has already peaked on a year-over-year basis, and pockets of recent economic data have continued to show strength, particularly within the labor market. Ultimately, while the prospect of a soft-landing, or even a mild recession, is still very much on the table, further signs that inflation is cooling would go a long way to ease the market’s nerves.

WEEK IN REVIEW

- Today the Bureau of Labor Statistics published their widely anticipated Consumer Price Index (CPI), a popular measure of inflation. The report surprised to the upside, particularly core CPI, which strips out the volatile food and energy components. This was the last major economic datapoint to be released ahead of next week’s monetary policy meeting. The fed fund futures market is currently pricing in a 0.75% hike as the most likely scenario.

- Recent data published by the BLS continued to show strength in the labor market. According to the recent jobs report, a robust 315,000 jobs were added to the economy during August. While the unemployment rate increased 0.2% to 3.7%, it appears to have been the result of the labor force participation rate increasing, which is generally viewed as a positive.

- Other economic data to be published this week includes jobless claims (a proxy for layoffs), retail sales, industrial production and the University of Michigan surveys on consumer sentiment and inflation expectations.

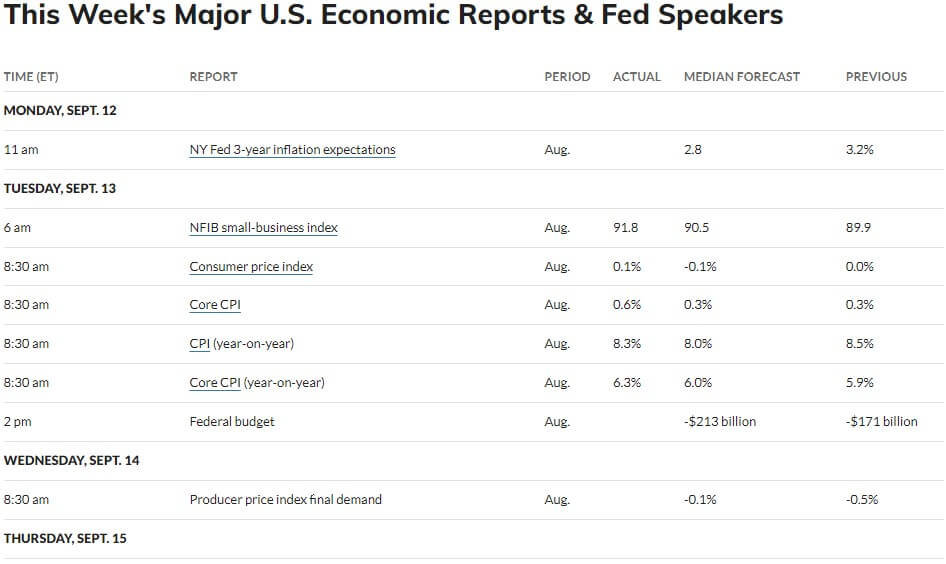

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Inflation Rose 0.1% in August Even With Sharp Drop in Gas Prices (CNBC)

- Payrolls Rose 315,000 in August as Companies Keep Hiring (CNBC)

- Inflation Report Keeps Fed on Aggressive Rate-Rise Path (WSJ)

Investing

- The Illusion of Knowledge (Howard Marks)

- The Stock Market’s Real Inflation Fighters Might Surprise You (Jason Zweig)

- Were actually very good at predicting the future – except for the surprises, which tend to be all that matter (Morgan Housel)

Other

- An ACL Tear That Heals Itself? (WSJ)

- Joe Buck and Troy Aikman Are Here to Save Monday Night Football (SI)

- Apple’s Killing the Password. Here’s Everything You Need to Know (Wired)

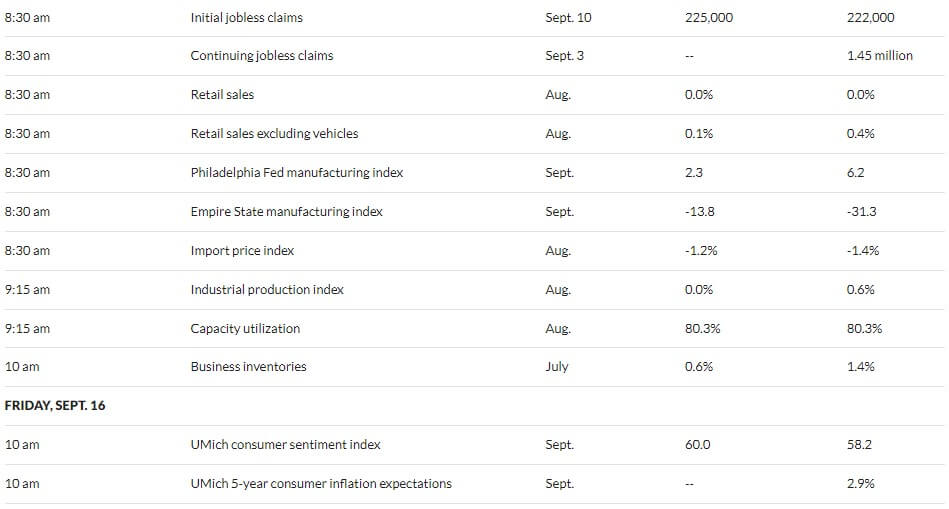

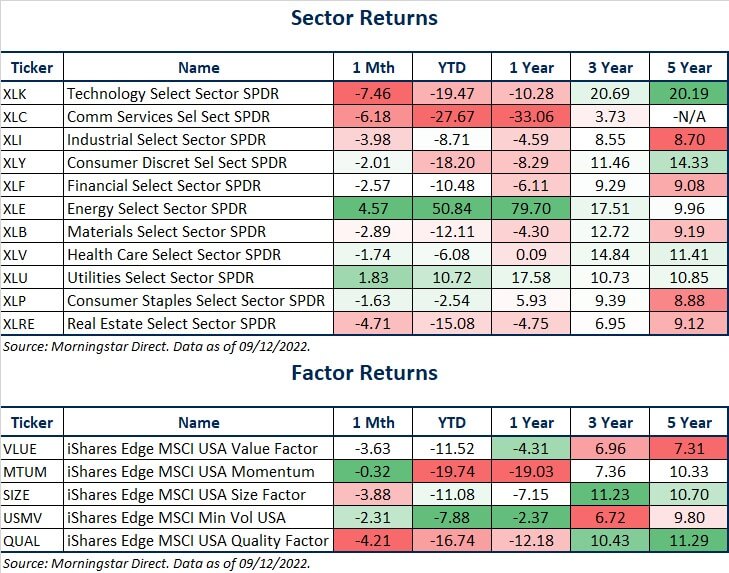

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

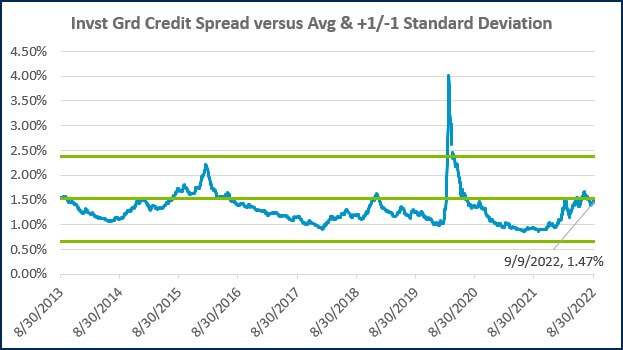

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)