Who Is Winning The Active vs. Passive Debate? + Market Update + 9.20.22

For decades there has been a contentious debate around the use of active versus passive investment options. Historically, active managers, which I will define as those that pick individual stocks and bonds with the goal of beating the market, dominated the fund industry. For many years now, however, there has been a tidal wave of money flowing into passive investment options, and for good reason.

Twice a year, S&P Global publishes the S&P Index Versus Active (SPIVA) scorecard. This semi-annual study tracks the performance of active managers relative to an appropriate passive benchmark. If active managers were able to deliver on their promise of outperforming the market, you would be able to observe that success within the SPIVA scorecard. Unfortunately for investors in those funds, that is not the case.

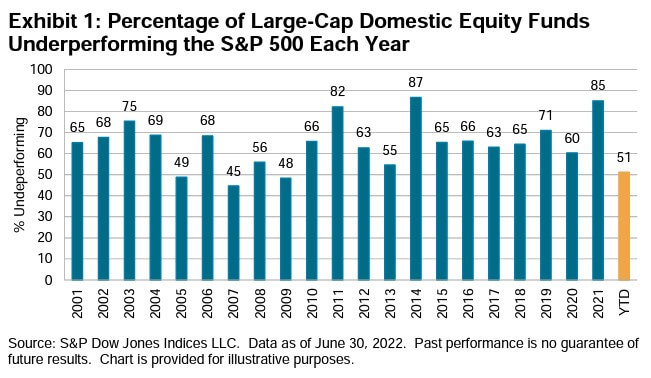

The table below illustrates the percentage of funds within the large-cap domestic equity category that have underperformed the benchmark each year since 2001. As you can see, despite a little more than half of the funds underperforming, the first six months of 2022 were actually a relatively successful period. In fact, it was the lowest degree of underperformance going all the way back to 2009. A majority of active funds outperformed in only three of the twenty-one years contained in the chart above. Even in those years (2005, 2007, & 2009), barely more than half of the managers outperformed.

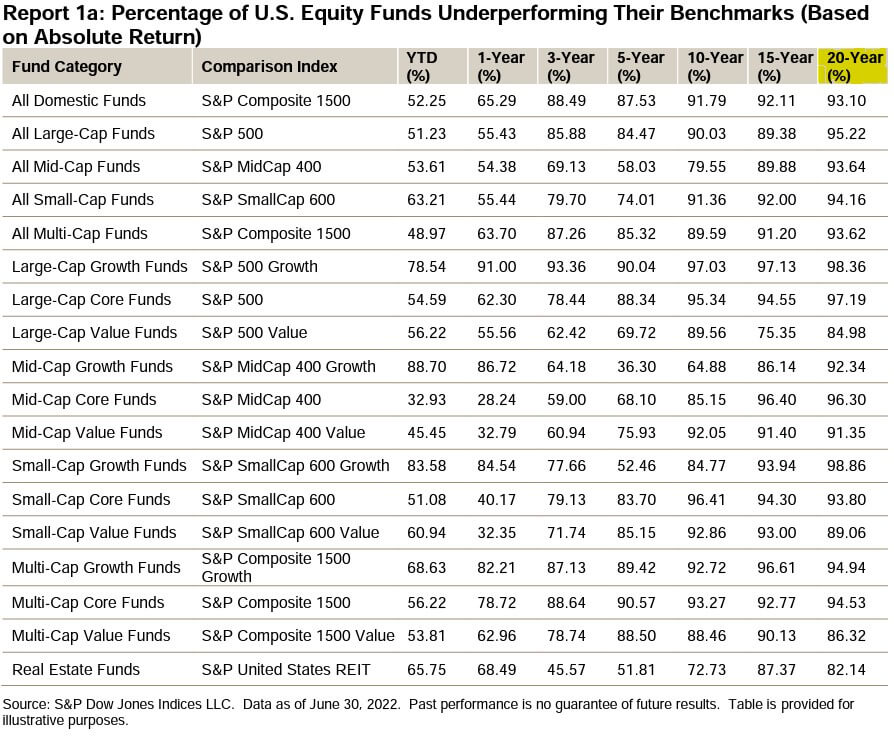

As bad as active funds have looked in any given year, they look absolutely abysmal when you string the years together. The table below illustrates a variety of fund categories and the percentage of funds that have underperformed across a variety of timeframes. Generally speaking, performance evaluation is best achieved using the longest possible timeframe. Based on our data below, that would be the 20-year figure on the far right of the table. As you can see, the vast majority of active funds underperform the market over time.

The best performing category above was Real Estate, which still saw 82% of funds underperform. Shockingly, or perhaps not, fourteen of the eighteen fund categories saw 90% or more of the funds underperform over the last 20 years!

There are a variety of reasons active stock pickers tend to deliver poor results. First, the stock market is pretty efficient. Stock prices reflect the collective knowledge of all participants. That doesn’t mean prices are always correct, but it does represent the best guess of fair value at any given point in time. To consistently outperform the market, you must consistently have an estimate of fair value that is more accurate than the collective wisdom of all other investors. Second, active managers tend to charge higher fees. This raises the hurdle that must be cleared to deliver superior results.

None of this is to say that investment professionals cannot be leveraged to help people reach their financial goals. Designing an appropriate asset allocation, the mix between riskier equity and more stable fixed-income investments, is a critical role that can deliver immense value. The behavioral component is also vital. A financial advisor can help keep emotions at bay, allowing clients to stay the course while other investors become overly optimistic or pessimistic.

Lastly, while market efficiency generally renders active stock-picking useless, there are ways to use the information held in market prices to enhance returns. Decades of empirical research have identified certain stock characteristics that are readily observable in current prices and deliver a return premium over time. These include low price (value), low market capitalization (size), and high earnings (profitability). Tilting a diversified portfolio toward these characteristics is a way to improve returns without the high cost and guesswork associated with active stock picking.

WEEK IN REVIEW

- All eyes will be on the Federal Reserve on Wednesday at 1 PM CT when they announce their interest rate decision following the conclusion of their two-day FOMC meeting. The market is currently pricing in a 0.75% hike as the most likely scenario, with a small probability of a full 1.00% hike.

- In addition to the rate decision, the Fed will publish an updated Summary of Economic Projections (SEP). The SEP is published once a quarter and contains forecasts of major economic variables as well as the path for the fed funds rate over the next couple of years. The market will pay close attention to the SEP and the post-meeting press conference with Fed Chair Jerome Powell for clues as to how high-interest rates are heading and how long they will stay there.

- Other economic data to be published this week includes jobless claims (a proxy for layoffs), the index of Leading Economic Indicators, and an early estimate of economic activity from the services and manufacturing sectors.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Retail Sales Growth Sluggish in August as Consumers Fight to Keep Up With Inflation (CNBC)

- Inflation Isn’t Just About Fuel Costs Anymore, As Price Increases Broaden Across the Economy (CNBC)

- Jerome Powell’s Inflation Whisperer: Paul Volker (WSJ)

Investing

- Where You Can Find Stock-Market Bargains (Jason Zweig)

- How Much Do Interest Rates Matter to the Stock Market (Ben Carlson)

- It’s Supposed to Be Hard (Morgan Housel)

Other

- Why Do All These 20-Somethings Have Closed Captions Turned On? (WSJ)

- Peloton’s New Rowing Machine is Here. Get Ready to Pay Up (Wired)

- The AI Unbundling (Stratechery)

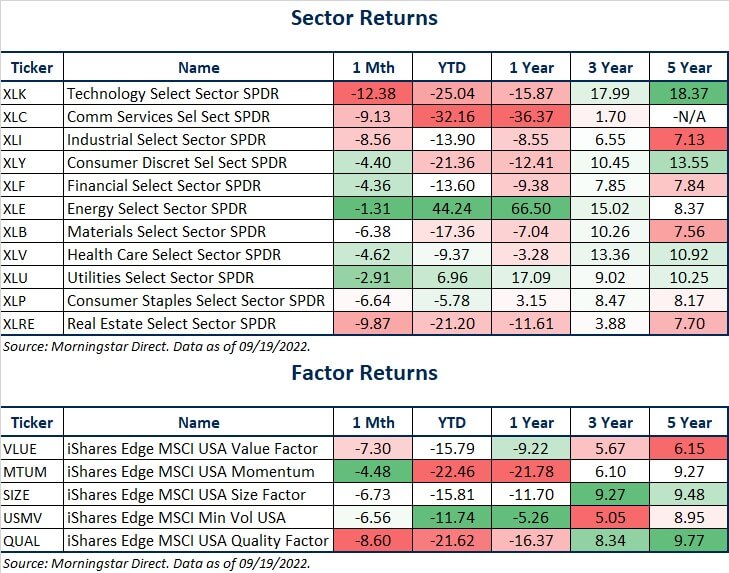

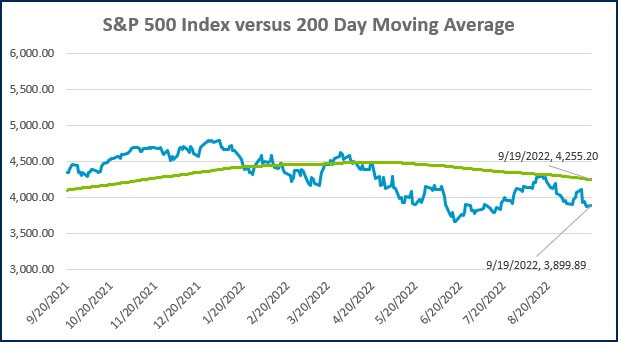

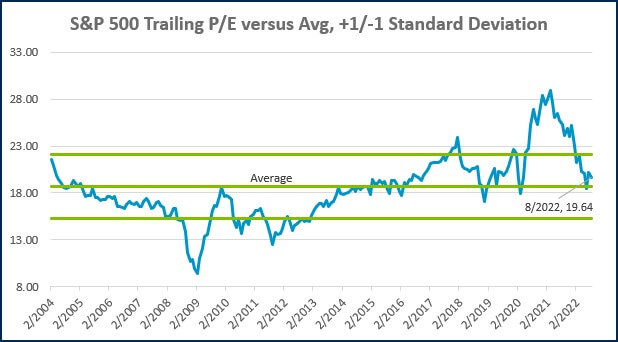

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

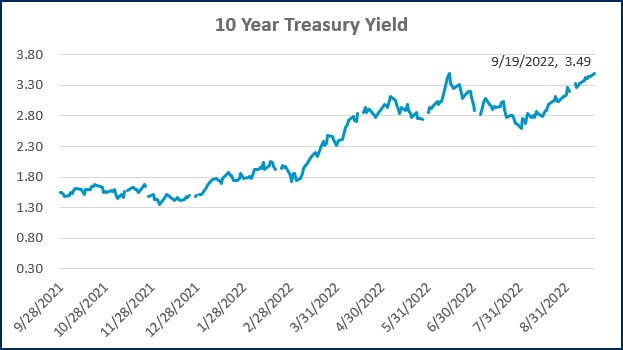

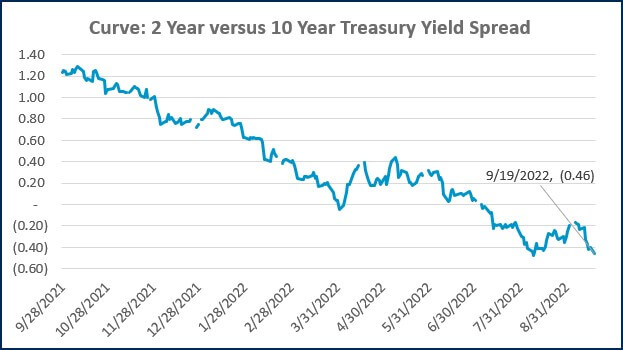

Source: Treasury.gov

Source: Treasury.gov

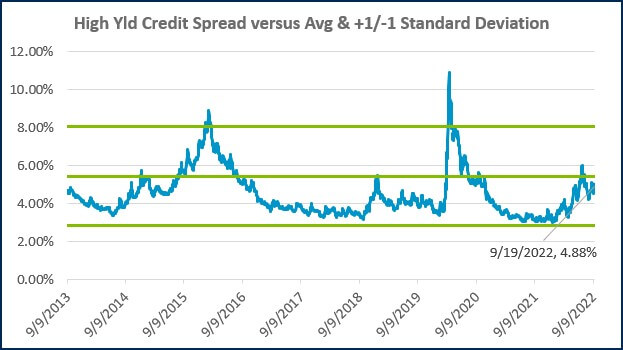

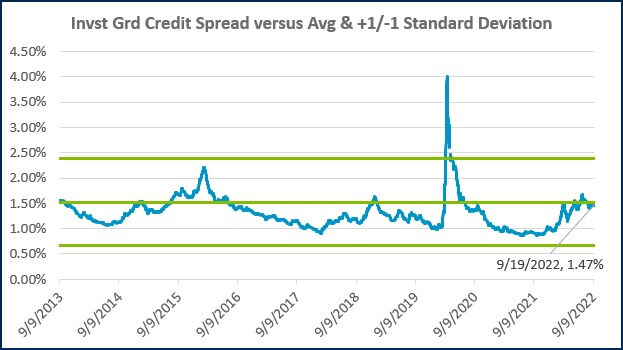

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)