What If You Knew Tomorrow's News Today? + Financial Market Update + 9.27.22

STORY OF THE WEEK

WHAT IF YOU KNEW TOMORROW’S NEWS TODAY?

Go back one year ago to September 2021. At that time, the two-year Treasury note sat at a whopping 0.30% yield. Had I told anyone that a year later the two-year Treasury would be trading a full four percentage points higher at 4.3%, most market “experts” would have laughed you out of the room. Sure, we were looking at some inflation coming out of Covid, but the perception at that time was that it was likely to be contained.

What if you had your interest rate “crystal ball” and knew that higher than expected inflation and the 4.3% two-year was coming? Knowing the future, you now had a reason and ability to do something with your funds. Cash wouldn’t be a great option, as inflation would erode your purchasing power. Stocks would be hit, too, if the unexpected happened. Bonds are not a good investment in the face of higher rates as prices get hit lower. Real estate is not a great choice as prices would fall as financing becomes more costly.

You would then think to yourself, what about gold? Gold is always a good hedge for inflation and a historically perfect asset to buy under this scenario. You sell your portfolio and buy the SPDR Gold ETF inside your brokerage account (GLD) in September 2021. You rest easy as you know what’s coming.

Pretend you take a nap for a year and wake up to check the markets on 9/26/2022. You first check the 2-year Treasury and see that it moved the full 4% higher, the stock market has fallen into a bear market, and your Zillow Zestimate™ on your house has also fallen. You log in to your brokerage account excited to see how much money you made on your gold ETF. Shockingly, you see that your Gold ETF has fallen more than 6% over that same year! How can that be the result? It seemed like the perfect trade because you knew what was going to happen.

“I should have bought oil,” you tell yourself. Looking at the price of oil a year earlier, you find it is almost in the exact same spot from a year earlier. How can this be? You would struggle to make sense of it all.

Again, you had the “interest rate crystal ball.” You knew what was going to happen, and you still couldn’t profit from it. So, how can we as investors expect to predict the next 12 months?

The point is, and always is, that we can’t predict what is going to happen. Hindsight seems so obvious, but the reality is that the future is always uncertain. Talking heads and those trying to predict the markets are generally wrong. Predictions tell us more about the person making them than it does about the future.

Timing the market, shifting positioning based on charts or technical analysis, using leverage, and shorting the markets are all forms of trying to predict the future. Sure it may work once in a while, but it is not a long-term strategy that can be successful.

Having a strategy, a diversified portfolio, and a plan are the best allies you can have in markets like this because it stops you from making irrational decisions. Very few investments in the past year have worked for any investors (sans a few commodities), as it’s been a year fraught with volatility everywhere. Even if you knew this was coming, it would have been hard to profit from it.

WEEK IN REVIEW

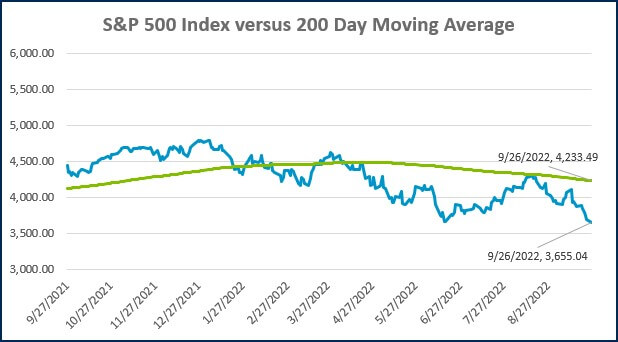

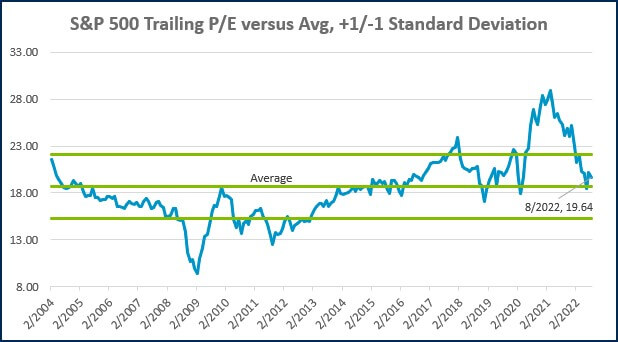

- As expected, the Federal Reserve announced the third consecutive interest rate hike of 0.75%. The move brought the target range for the benchmark Federal Funds rate to 3.00-3.25%. A forecast for the expected path of the fed funds rate published in Fed’s Summary of Economic Projections (SEP) showed an additional 1.25% of hikes before the end of the year. According to fed fund futures, the market is pricing in a similar scale of moves by year-end.

- Economic data published on Tuesday provided an update on the housing market, as well as business investment. Both the Case-Shiller and FHFA home price index’s demonstrated a small month-over-month decline in home prices. Home price appreciation decelerated but remained positive on a year-over-year basis. Elsewhere, shipments of non-defense capital goods (excluding aircraft) increased by a healthy 0.3% in August. This figure is a key component of the business investment component of the GDP calculation.

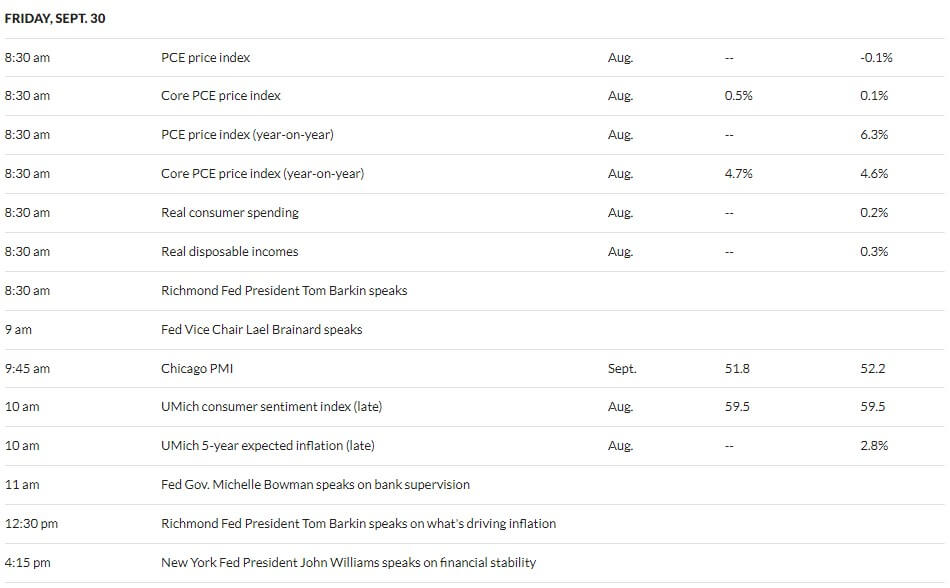

- Additional data to be published this week includes initial jobless claims (a proxy for layoffs), the next revision of Q2 GDP, personal consumption expenditures (PCE – the Fed’s preferred inflation gauge), consumer sentiment, and inflation expectations.

LFS BLOG

- Is Value Investing Dead?

- Why Investors Should Own International Stocks

- 3 Things All Investors Should Know

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Home Prices Cooled in July at the Fastest Rate in the History of S&P Case-Shiller Index (CNBC)

- Consumer Moods Improved in September as Gasoline Prices Fell (WSJ)

- Lumber Prices Fall Back to Around Their Pre-Covid Levels (WSJ)

Investing

- Josh Brown: ‘I don’t care what the NBER says… if people don’t get fired, then its not a recession’ (MarketWatch)

- Retail Investors Have Been This Bearish Only 5 Other Times in History (Sentiment Trader)

- Bear in Mind (Josh Brown)

Other

- NASA’s DART Spacecraft Successfully Smacks a Space Rock – Now What? (Scientific American)

- Super/Natural Uses New Tech to Reveal Nature as Never Seen Before (Wired)

- Apple AirPods Pro Review (2nd-gen): Big Improvements, All on the inside (Engadget)

MARKETS AT A GLANCE

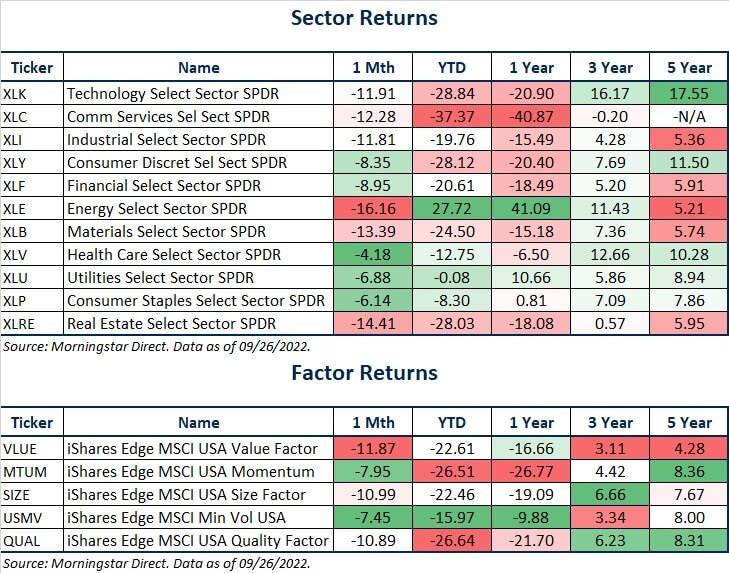

Source: Morningstar Direct.

Source: Morningstar Direct.

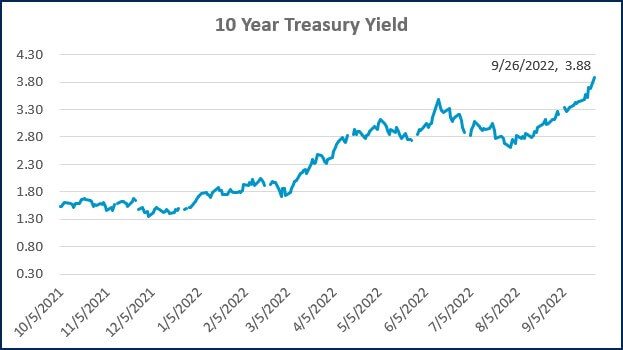

Source: Treasury.gov

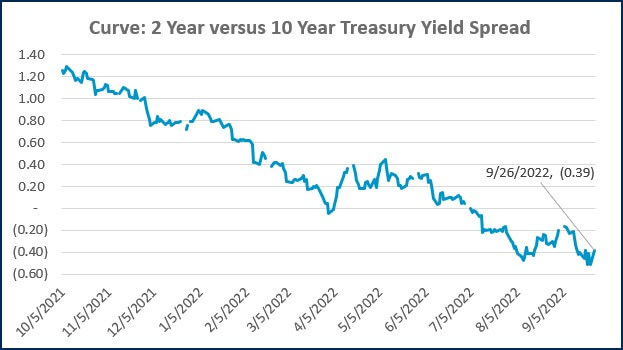

Source: Treasury.gov

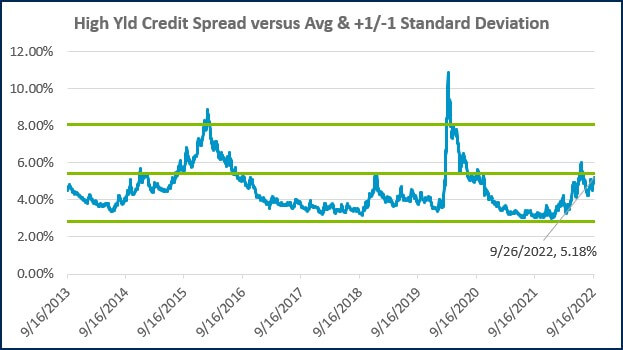

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

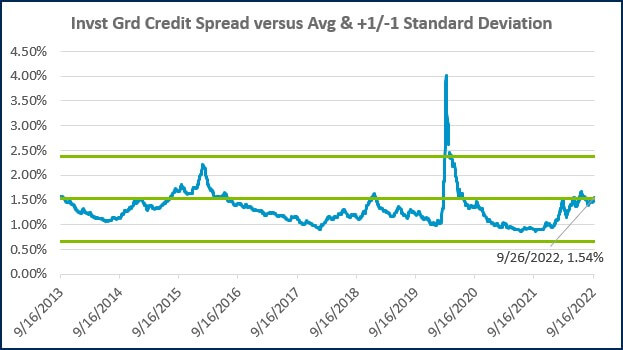

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)