The Fed Announcement Explained + Financial Market Update + 9.28.21

Last week was headlined by the Federal Reserve announcement that followed the September meeting. There were several developments that came from the official post-meeting statement and press conference that have been in the news. Today we’ll break down and provide some background on a few of the larger storylines.

Rates Left Unchanged

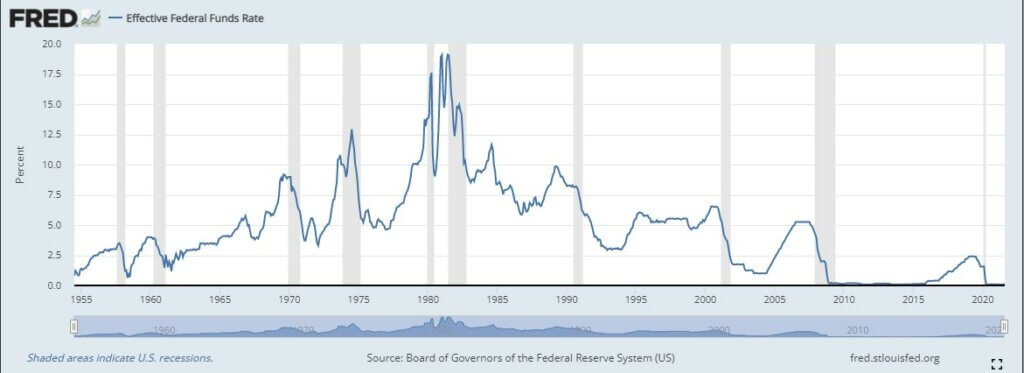

As expected, the committee left its benchmark federal funds rate (FFR) unchanged. The FFR is the primary tool used by the Federal Reserve for setting monetary policy, representing the rate at which commercial banks can borrow or lend their excess reserves to each other on an overnight basis. As a part of the Federal Reserve’s accommodative monetary policy response to the COVID-19 pandemic, the FFR has been set to a range of 0.00% – 0.25% since March of 2020. The chart below provides some historical context to this benchmark rate. A few things to notice:

- The nearly 20% rate level in the 1980s as the Federal Reserve battled high inflation

- The prolonged period of near 0% interest rates following the Financial Crisis of 2007-08

- The gradual trend higher beginning in 2015, before ultimately falling back to the zero-bound during the pandemic

Something that tends to confuse people is how the financial media discusses interest rate moves daily, despite the Fed leaving rates unchanged near zero for the last 18 months. There are a couple of nuances to understand with this. First, short-term interest rates, in general, are heavily influenced by the FFR but fluctuate due to changes to supply and demand in the marketplace. Additionally, they are often higher than the FFR to reflect a premium to compensate the lender for additional liquidity and credit risks. Long-term interest rates are also impacted, although less directly. Long-term rates can be thought of as short-term rates plus an additional premium to compensate the lender for the longer term, lower liquidity, the potential difference in credit quality, and risk of inflation.

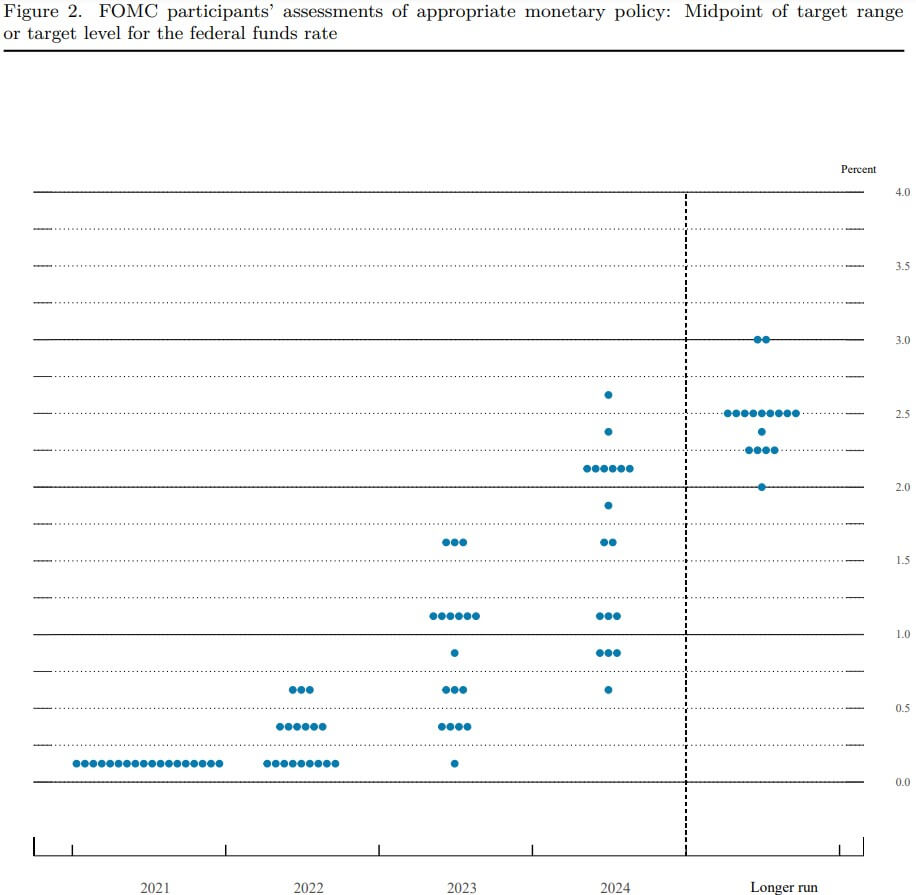

The Dot Plot

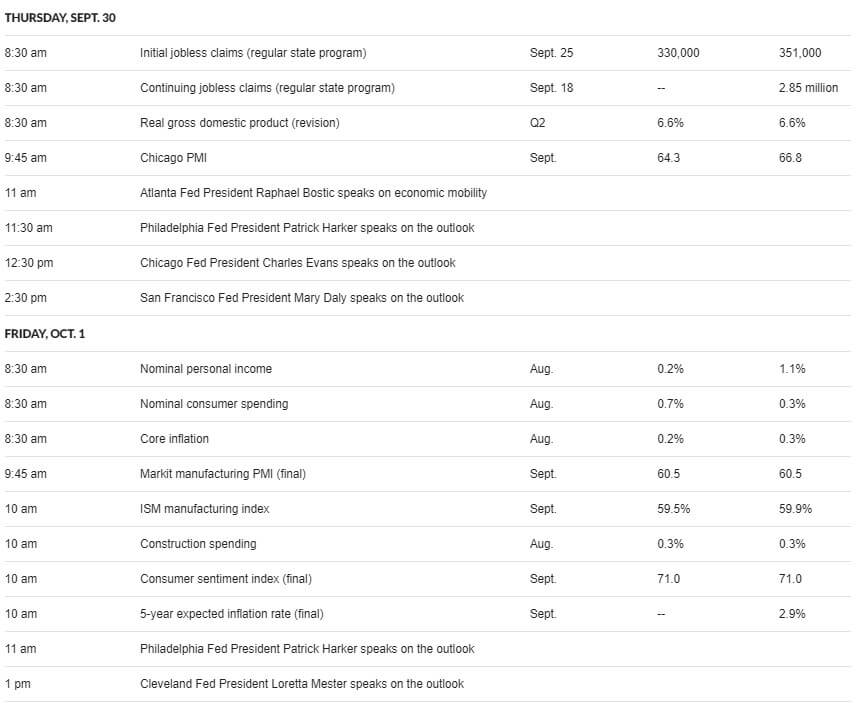

Once a quarter, the Federal Reserve publishes its Summary of Economic Projections (SEP), which reflects the median forecast of the committee members for a variety of economic variables. The table below summarizes the current estimates vs. the previous ones published in June. The revisions were generally unfavorable for the current year (2021):

- Real GDP was lowered

- The unemployment rate was increased

- Inflation was increased

Summary of Economic Projections. Source: Federal Reserve, released 9/22/2021. 1) For each period, the median is the middle projection when the projections are arranged from lowest to highest. When the number of projections is even, the median is the average of the two middle projections. 4) Longer-run projections for Core PCE inflation are not collected.

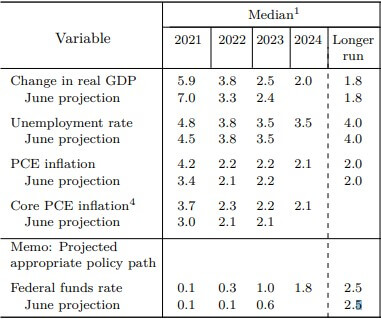

Although the GDP growth rate was revised lower for this year, it was increased for both 2022 and 2023. The projected path of the federal funds rate was also revised, with the median estimate now calling for the first hike to come in 2022 as opposed to the previously estimated 2023. The expectation that rate hikes may come sooner was likely related to the sharp increase in the inflation estimate. Though the inflation estimate returns toward the Fed’s 2.0% target by 2022, it seems the high inflation readings of the past few months have proved more persistent than what the Fed originally expected. The projected path of the FFR is better illustrated in the ‘Dot Plot’ below.

Source: Federal Reserve, released 9/22/2021

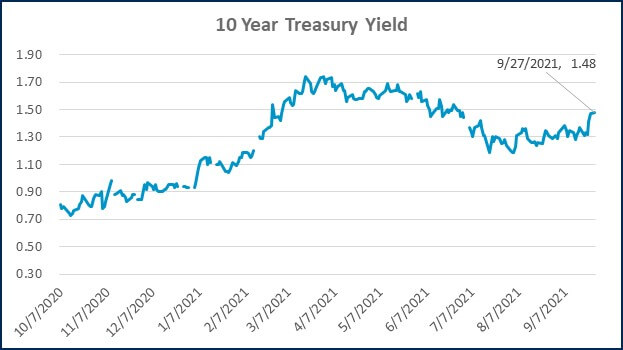

Note that while the market tends to fixate on the Dot Plot, Fed Chair Jerome Powell frequently cautions against putting too much weight on the estimates. He contends the figures represent individual forecasts, some of which are made by non-voting members of the committee and do not reflect an actual plan by the committee. I would expect these warnings from Powell are largely ignored by the market. The expectation that rate hikes may be coming sooner could be the catalyst for the roughly 0.20% increase to the 10-year Treasury yield that has occurred over the last week.

Fed Taper Coming Soon

In March 2020, the Federal Reserve launched a quantitative easing (QE) program to provide additional stimulus above and beyond lowering the FFR to 0.00% – 0.25%. This program consisted of the Fed purchasing $80 billion of Treasury bonds and $40 billion of mortgage-backed bonds each month. The goal of the program was to put additional downward pressure on longer-term interest rates by introducing additional demand for bonds of longer maturities through their purchases. Similar programs were used following the Financial Crisis of 2007-08.

When the Federal Reserve went to unwind the previous QE program in the Spring of 2013, the market was caught off guard. As a result, long-term interest rates shot dramatically higher over the remainder of the year, and the episode of volatility was dubbed the ‘taper tantrum.’ This time around, the Fed took extra efforts to ensure it was providing enough forward guidance to allow the market to price in changes to the program in a more orderly fashion.

For the entirety of 2021, the Fed has suggested that it will continue its pace of purchases until “substantial further progress has been made toward the Committee’s maximum employment and price stability goals.” In the post-meeting statement released last week, the Fed added language stating, ‘moderation in the pace of asset purchases may soon be warranted.’ Shortly after the release of the official statement, Chairman Powell gave his customary post-meeting press conference, saying, “the purpose of that language is to put notice out that that could come as soon as the next meeting.”

The general expectation is that the Fed will begin steadily reducing the amount of bonds it purchases each month until the program is eliminated by the middle of next year. The Fed has suggested that they would not begin to increase rates until bond purchases were completely halted and that the bar for raising interest rates is much higher than it is for tapering. Still, given the dot plot, it may not be unreasonable to expect rate increases as early as the second half of next year.

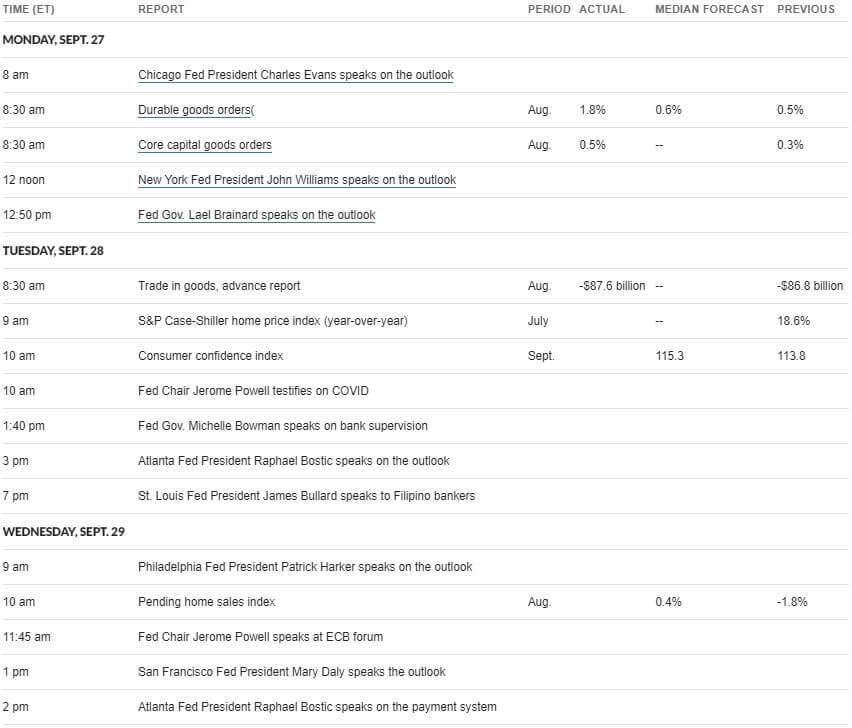

WEEK IN REVIEW

- The main event last week was the conclusion of the Fed meeting. The FOMC voted to leave its benchmark fed funds rate unchanged, they signaled the beginning of tapering soon, and the dot plot revealed that two additional committee members penciled in at least one rate hike in 2022, which bumped the median estimate up to one hike for the year from none.

- Data published on Monday showed that new orders for durable goods rose a healthy 1.8% in August, which was higher than expectations. Business investment used in the calculation for GDP comes from the shipments of non-defense capital goods excluding aircraft figure, which grew 0.7% in August. Business investment is on pace to be a nice tailwind for GDP in Q3 and is currently growing at an annualized 8.6% rate vs. the previous quarter.

- Other notable economic data to be published this week includes jobless claims and the next revision of Q2 GDP on Thursday. On Friday, we will see realized inflation, expected inflation, manufacturing activity, and consumer sentiment. Typically the jobs report is published on the first Friday of every month. Since this month’s 1st Friday is on 10/1, the publication has been pushed back to the following week to provide time to compile the report.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- US Core Capital Goods Orders, Shipments Rise Strongly in August (CNBC)

- Congress Must Raise Debt Limit By Oct 18, Treasury Secretary Yellen Warns in New Letter as Default Looms (CNBC)

- Fed Chair Powell to Warn Congress that Inflation Pressures Could Last Longer than Expected (CNBC)

Investing

- Benjamin Graham vs. Jesse Livermore (Ben Carlson)

- History’s Seductive Beliefs (Morgan Housel)

- Costly Arguments (Adam Grossman)

Other

- Much of What You’re Going to Do or Say Today is Not Essential (Farnam Street)

- Justin Tucker and the Data Behind the NFL’s Record 66-Yard Field Goal (WSJ)

- Everything Amazon Announced – Including a Cute Security Robot (Wired)

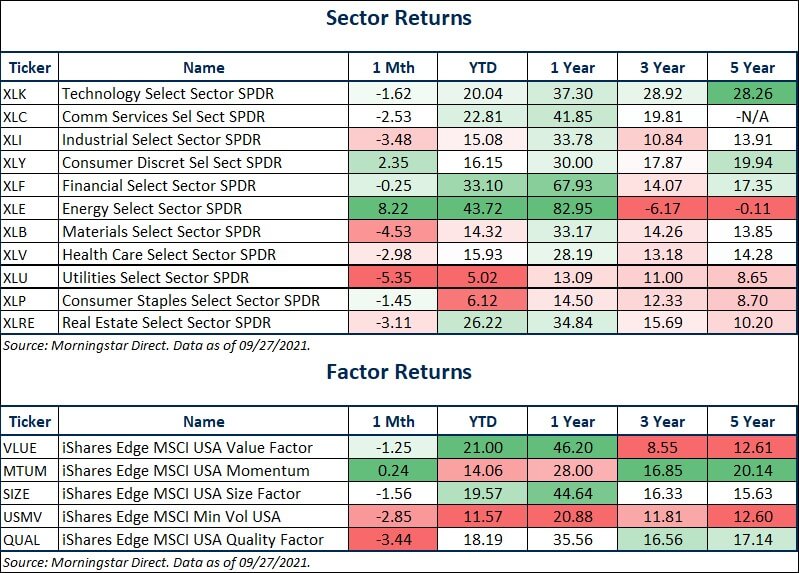

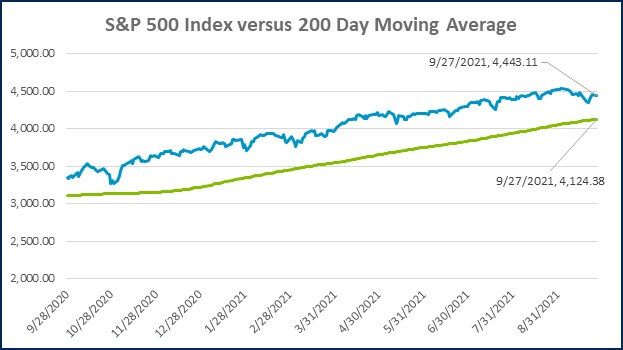

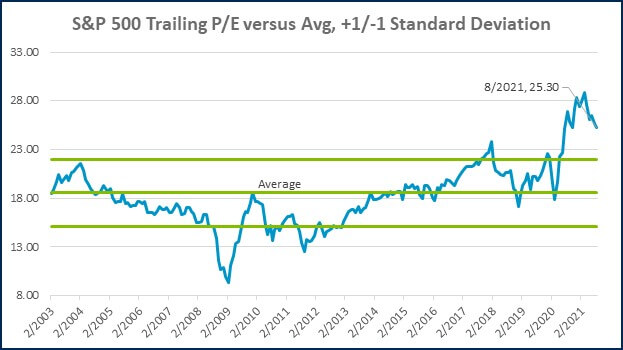

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

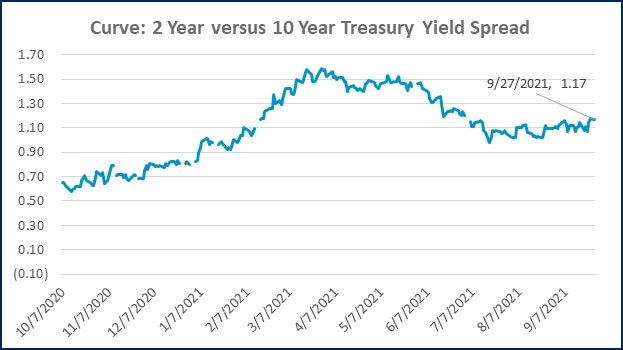

Source: Treasury.gov

Source: Treasury.gov

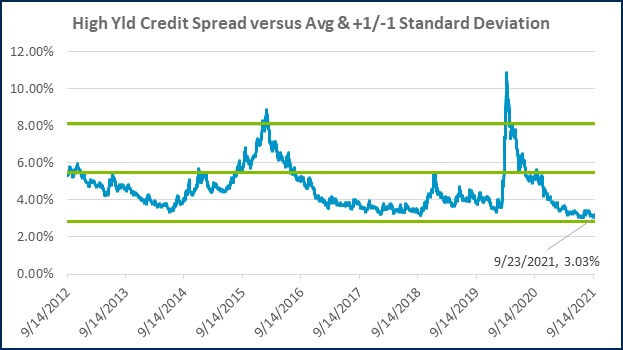

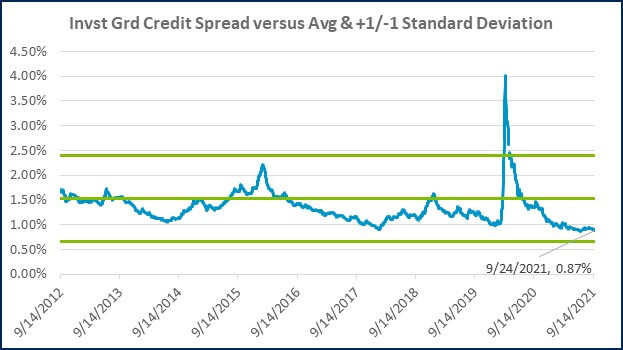

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)