Investor Do’s & Don’ts During a Bear Market

We are a little over halfway through 2022, and to this point, both the stock and bond markets have been under a good amount of pressure. As of this writing, the S&P 500 is down about 22% YTD, and the Nasdaq Composite is down about 30%, both in bear market territory. At the same time, the Barclays US Aggregate Bond Index is down about 12% YTD. Inflation, rising interest rates, fear of a recession, the war in Ukraine and the Covid lockdown in China (amongst others) have all been cited as drivers of the recent market volatility. Given all of this uncertainty, what is an investor to do? Let’s start first with what not to do.

What Not to Do

Don’t Panic

First, it’s important to remember that bear markets (drops of 20% or more from a recent peak) are a fairly common occurrence that any long-term investor is going to have to deal with. In the past 80 years, both the S&P 500 and the Dow Jones have experienced a 20% or more decline on average once every six years. This means that for someone about to enter a potentially 30-plus year retirement, they may have to successfully navigate five or more bear markets.

This is why it’s so important to have a sound financial plan in place based on your goals and objectives. Any good financial plan will account for the fact that bear markets can and will happen along the way. When they do occur, review your plan and, more importantly, stick to it. If you don’t already have a plan in place, there is no time like the present.

Don’t Try to Predict the Bottom or Otherwise Time the Market

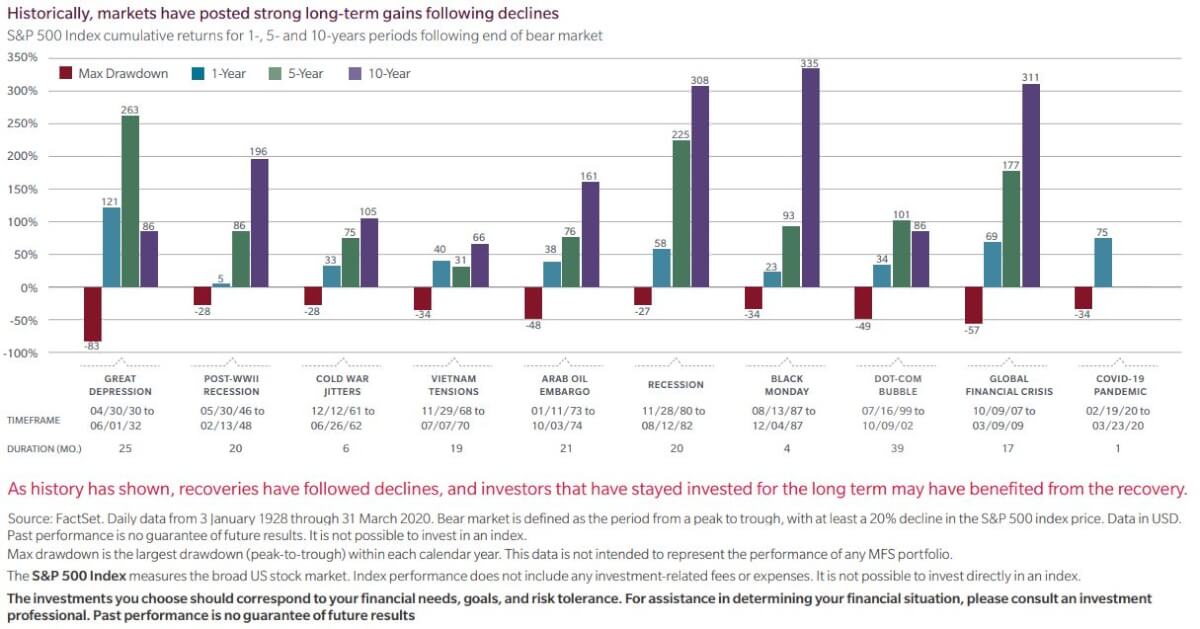

Where will the markets go from here? I certainly don’t have a crystal ball, and you should be very skeptical of anyone who tells you they do. All bear markets are different. If you just retired and plan on spending the next 30 years trying to predict the peaks and valleys of the market (and shifting your portfolio based on those predictions), you will be very lucky to be right half the time. And if you end up being really wrong at the wrong time, you may not be in a position to financially recover. Note the chart below put together by MFS, which highlights the risk of market timing during a bear market.

Investing is like attending a hockey game. If you get up to get a beer, you may miss one of the few goals that are scored. Similarly, with investing, if you are constantly moving in and out of the market, there is a good chance you will end up missing out on a substantial bounce back at some point (which can materially alter your long-term investment performance). With both hockey and investing, you need to stay in your seat to reap the rewards.

Don’t Watch CNBC all Day

The financial media knows that the average person tends to consume more financial information when markets are down as opposed to when they are up. When things turn south, the media plays on people’s fear, and the headlines get negative very quickly. It’s a competition for eyeballs and clicks, and the more worry they can stoke, the more people will pay attention.

Further, the more people pay attention the more likely they will want to do…something. There are things to consider doing as an investor during these times (more on that to come), but often the best thing to do is…nothing.

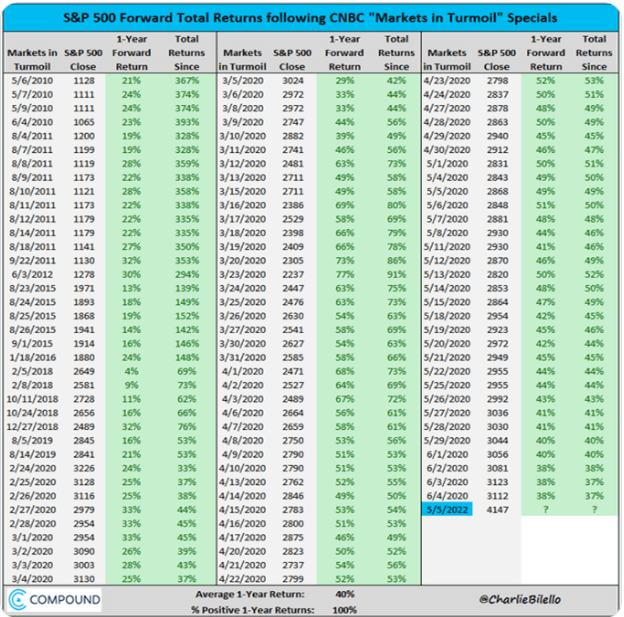

Case in point. CNBC is one of the primary sources of financial information on TV. They are well-versed in trying to draw a wider audience during down times when they frequently will run a series of specials in prime time titled “Markets in Turmoil.” Investors who have watched these specials over the years and decided to try to time things by getting out of the market until the “dust settles” probably wished they had not, as evidenced by the chart below from Charlie Bilello.

This is not to say that the markets will for sure be higher a year from now. As mentioned, all bear markets are different. The point is that paying more attention to the markets during times like these is just as likely to lead to bad investment behavior as opposed to good.

What You Should Do

Stick to Your Financial Plan (or Put One in Place)

I touched on this earlier, but it really is the most important thing you can do as an investor, so it bears repeating: put a financial plan in place and stick to it in good markets and bad. Your plan should include a review of your entire financial situation and then a detailed asset allocation target for each of your investment accounts based on your specific planning goals and objectives.

Once you set a target allocation (stock to bond mix), you shouldn’t be altering it based on short-term market movement. Rather, what should bring about an adjustment to your target allocations is a change in your goals and objectives. If nothing has changed on your end in terms of your investment time horizon, potential cash needs from the portfolio, job or family situation, etc., then you shouldn’t be making big moves in your target stock to bond mix in response to a bear market.

Rebalance Your Investments

Once you have set target allocations for each of your investment accounts, you should be monitoring them to determine if any of your accounts have moved out of tolerance due to market movement. It is very likely during a bear market that your equity holdings have gone down in value. If this downward pressure has moved your stock to bond mix outside of your desired level, it may be time to consider rebalancing that account back to target.

For example, say you have an IRA with a target of 60% stock and 40% bonds. Due to the recent market pullback, say that account is now 55% stock and 45% bonds. This could warrant making trades to sell some of your bonds and buy more stock to get back to your desired 60-40 mix.

This process is known as rebalancing, and there are multiple ways to go about doing it. Some people will rebalance on a calendar basis (e.g., once every year or semi-annually) at pre-determined time periods. We tend to favor rebalancing on a tolerance basis, meaning set a pre-determined % amount by which you don’t want your target allocation to move past. Once that threshold is passed, you consider rebalancing back to target.

The point is to have a set process in place and stick to it. This helps you to remove emotion and make trades in your portfolio based on a disciplined approach that was put in place when you created your financial plan. Obviously, other factors need to be taken into consideration as well. If it’s a taxable account, the potential tax impact of any trades needs to be factored into any trading decisions.

Sell Undesired Holdings w/ Existing Gains

Say you bought a holding a while back and no longer feel it’s an appropriate part of your investment portfolio moving forward. But you’re hesitant to sell it based on an existing capital gain that you’d trigger upon sale. Well, often times a bear market presents an opportunity to unwind positions like these with a reduced tax impact. That may then allow you to reinvest these proceeds in a holding that you feel better about owning on a go-forward basis.

Tax-Loss Harvesting

Another potential opportunity created by a bear market is the ability to “harvest” some capital losses that can help lower your tax bill now or in the future. Here’s how it works. You identify a holding that has decreased in value, sell it, and then immediately replace it with a holding that is not “substantially identical.” The idea is to generate the loss to help your tax position while at the same time remaining invested in a similar holding so that when the market eventually bounces back, you can still participate in the upside.

The losses you harvest can offset any capital gains you may have this year or can be rolled into the future to offset capital gains you have in future years. The capital losses can also offset up to $3,000 in ordinary income each year as well until the losses are used up. The ability to harvest losses during a bear market is one way to make the best of an otherwise bad situation. Banking some losses can give you more flexibility in the future when determining when and how to trigger capital gains once the markets recover.

There are some caveats here. You need to be mindful of the “wash sale” rule, which prohibits you from using the loss if you purchase a “substantially identical” holding within 30 days before or after selling the loser. There is no clear guidance on what level of distinction between the holdings is needed to pass muster. Presumably, selling one S&P 500 index fund and buying another from a different fund company would not work.

You also need to check on your state’s rules on capital losses, as not every state allows you to roll forward losses indefinitely (the vast majority of states do allow it, but a few don’t). In addition, you need to factor in the rest of your financial and tax situation/bracket to determine if harvesting is appropriate for you in a given year. It’s always best to consult with your financial adviser and CPA as needed when evaluating this type of strategy.

Roth Conversions

Finally, Roth conversions are another strategy to consider in a bear market. If you have pre-tax assets (say in an IRA), you are allowed to convert those funds over to a Roth IRA regardless of how high your income is in a given year. You do have to pay tax on any amount you convert at ordinary income rates.

The reason this may be more effective in a down market is that you can potentially convert assets at a lower value and thus pay a lower amount of tax. Then hopefully, you can enjoy the eventual bounce back with assets that are now in your Roth IRA (which is free of tax). As with any tax strategy, again, it’s important to consult with your financial and tax advisers on the particulars of your situation.

Bottom Line

Bear markets are a fact of life for every long-term investor. Enduring them successfully is as much about knowing what not to do as it is about the planning and investment strategies you should be considering. Having a financial plan in place and sticking to it are the keys to wealth accumulation and preservation over the long run. If you have any questions, please contact us.

- Achiever, Learner, Competition, Arranger, Focus

Joe Hefflinger, JD, CFP®, CAP®

Joe Hefflinger, Investment Advisor & Principal, began his career in 2005. With a background in corporate law, mergers and acquisitions, and tax planning, he brings a unique perspective to financial advising, reinforcing his ability to guide clients through complex financial decisions.

Specializing in investment advisory services and financial planning, Joe works closely with high-net-worth families and business owners in transition. He focuses on estate planning, insurance planning, and charitable giving, helping clients structure their wealth to achieve their long-term objectives. His background in law allows him to navigate the intricate details of succession planning, ensuring clients have a clear path for both their business and personal financial future.

At Lutz, Joe serves beyond expectations by providing proactive, personalized financial guidance. He takes the time to understand each client’s unique needs, delivering tailored strategies that build confidence and security. His focused approach has helped make Lutz Financial a trusted resource for individuals and business owners alike.

Joe lives in Omaha, NE, with his wife, Kim, and their daughters, Lily and Jolie. Outside of the office he can be found in basketball gyms across the Midwest, cheering on his daughters’ teams.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)