Is the Fed finally poised to cut again? + 9.10.25

%20(1)-Jun-24-2025-07-32-43-4857-PM.jpg)

Last fall, the Federal Reserve lowered interest rates from multi-decade highs. After holding steady through 2025, policymakers appear ready to move again at the September 17 meeting. Here is what to watch and what it means for investors.

Background

The Federal Reserve has a dual mandate: support maximum employment and maintain stable prices. These objectives can sometimes conflict. Actions that stimulate the labor market can be inflationary, while tempering price pressures can cool hiring.

If you watch Federal Reserve Chair Jerome Powell, you will almost certainly hear him refer to the “balance of risks.” The phrase highlights how the Fed approaches policy. When both sides of the mandate are in a good place, the Fed aims to hold rates at a level it views as neither stimulative nor restrictive. If risks start to tilt toward inflation or the labor market, it will adjust interest rates to restore balance.

How We Got Here

Since 2022, inflation risk has dominated, and the Fed has kept policy restrictive. As inflation eased last year, the Fed began to cut, lowering its benchmark rate by a cumulative 1.0% across three meetings starting in September 2024. Entering 2025, it paused as inflation progress stalled and the labor market stayed resilient. As the year progressed, added uncertainty from tariffs, immigration and deportations, and government job cuts kept the Fed in wait-and-see mode.

Recent data show the labor market is slowing. This appears to have tipped the balance of risks toward emphasizing employment when setting policy. Powell used his August remarks at the Jackson Hole Economic Symposium to signal that a policy recalibration may be on the way.

What to Expect

With jobs softening even further since Jackson Hole and only two mid-month inflation reports left, the base case for September 17 is a rate cut, barring a major upside inflation surprise.

The more important question may actually be the pace of cuts moving forward. To gauge the path, watch:

1. The Summary of Economic Projections, especially the “dot plot” of policymakers’ rate projections, and

2. Powell’s post-meeting remarks on what would make them pause or accelerate the easing path.

What This Means for Investors

Falling policy rates create reinvestment risk for investors sitting in cash, as cash yields tend to quickly follow the Fed lower. Bonds are different, as they lock rates in for a longer period. If yields decline, prices can rise, which adds to total return. That is why high-quality bonds historically diversify stock risk better than cash over full market cycles.

Trying to “time the jump” from cash to bonds around an announcement is hard. Markets are forward-looking, and prices often move on expectations before the actual event. We have already seen large yield moves ahead of the meeting, with 2-Year Treasury yields falling from nearly 4.0% at the end of July to at the time of this writing(1). Year-to-date, bonds have handily outperformed cash (6.4% vs 3.0%)(2), and it’s about to get even harder for cash to keep up.

Rather than trying to time the market, a better approach is to maintain exposure to bonds over time. It is the most reliable way to ensure you own them when you need them.

Bottom Line

The Fed appears ready to lean a bit more toward the employment side of the mandate as the data continue to soften. For portfolios, the practical takeaway is simple. As cash yields fade, the steady role of high-quality bonds becomes more valuable.

(1) Mid-day 9/9/2025

(2) Based on Total Returns from 1/1/2025 – 9/9/2025. Bond market is represented by the Bloomberg US Aggregate Bond Index, while cash is based on the Bloomberg US Treasury Bill 1-3 month Index.

Week in Review

- The latest ISM (Institute for Supply Management) service-sector PMI, a key indicator of economic activity in the services industry, increased from 50.1 in July to 52.0 in August. This marked the third month in a row that the PMI surpassed 50, signaling continued expansion in the services sector, which accounts for more than two-thirds of the US Economy.

- The July Job Openings and Labor Turnover Survey (JOLTS), released on September 3, 2025, showed a decline of 180,000 job openings from the previous month, bringing the total to 7.18 million. This marks the lowest number of job openings since last fall and the second-lowest level recorded since 2020.

- According to FactSet, 100% of the S&P 500 reported Q4 results as of August 28. The earnings growth rate for the quarter ended at 11.7% year-over-year, which marks the third straight quarter of double-digit earnings growth for the index. The Communication Services sector was the biggest contributor to earnings growth for the quarter, with a staggering 46% year-over-year growth. Going forward, analysts are expecting slower growth for Q3 2025 of 7.5%.

Hot Reads

Markets

- The Fed Waits Out the Tariff Economy (WSJ)

- Fed Holds Key Rate Steady, Still Sees Two More Cuts This Year (CNBC)

- Retail Sales Fell 0.9% in May, Worse Than Expected, as Consumers Pull Back (CNBC)

Investing

- Expected Returns in the Stock Market (Ben Carlson)

- Very Bad Advice (Morgan Housel)

- Avoiding Investor FOMO (Adam Grossman)

Other

- Why Omaha is Home of the Men’s College World Series – ESPN Originals (YouTube)

- Our Latest Artificial Intelligence Reports – 60 Minutes (YouTube)

- 3 Simple Wedge Strategies Pros Use From Inside 100 Yards – Golf Digest (YouTube)

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

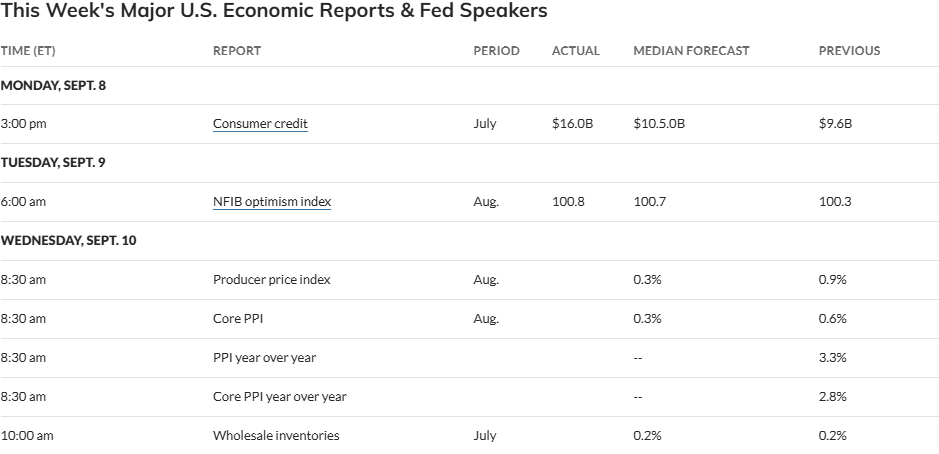

Economic Calendar

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

FASB Guidance for Nonprofits: Key Reminders & What’s Ahead in 2025

Is now the time to own gold?

Lutz adds 18 Staff Accountants

Lutz Named a 2025 POWER Awards Recipient

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)