Is Your Retirement Plan "Catchy?"

By offering — and encouraging — catch-up contributions, plan sponsors can demonstrate a heightened commitment to employee retirement readiness. Over a five-year period ending in 2020, nearly 15% of participants utilized catch-up contributions when they were offered, according to a report by Vanguard. And those who did were more likely to be higher earners with larger portfolio balances.

Employers can help close the retirement savings gap by deploying several smart strategies aimed at increasing catch-up contributions. Here are a few ideas to consider implementing at your organization.

Match-up the catch-up. Instead of simply allowing participants to make catch-up contributions, employers can consider offering or ensuring a company match on those contributions to further incentivize older workers.

Would they rather Roth? With SECURE 2.0 signed into law, employers can consider offering their participants the ability to make matching contributions (including those on the catch-up) in the form of a Roth contribution.

Make a day of it. Create a “Catch-up Contribution Day” (or week) dedicated to educating participants about the important benefits of catch-up contributions for their retirement readiness. Provide additional support to workers aged 50 and over, such as special group sessions or one-on-one meetings with plan advisors.

Burst ahead. SECURE 2.0 also allows for a short-term catch-up “burst” from ages 60 to 63, where participants can elevate their catch-up contributions from an indexed $5,000 ($7,500 for 2023 plan year) to an indexed $10,000. This can help workers nearing retirement who may have fallen behind on their savings goals make up lost ground more quickly.

Bring home the benefits. Develop online resources and educational materials geared toward various levels of financial literacy around the benefit of catch-up contributions. Include easy-to-digest video content and infographics — and provide timely reminders to participants aged 50 and over.

Take a multichannel approach. Use all communication channels at your disposal as a plan sponsor, including employee newsletters, email, the company intranet, social media, and in-person events. Spread the word in as many ways as you can about the advantages of making catch-up contributions.

Provide the right tool for the job. Give participants access to online retirement planning tools to help them evaluate whether catch-up contributions could help them achieve their savings goals and to adjust their savings targets accordingly.

A Catch-As-Catch-Can Strategy

The retirement readiness end game has high stakes for workers. That’s why it’s so important to take a multi-pronged approach to reach as many of your participants as possible and encourage them to make catch-up contributions as necessary to stay on track for retirement. SECURE 2.0 provides sponsors with an even wider array of options to assist workers who’ve fallen behind in their retirement preparedness — and help catch-up contributions catch on among those they might benefit the most.

Leveraging ChatGPT in Retirement Plan Management: Opportunities, Concerns, and Best Practices

The advent of generative artificial intelligence (AI) technology, such as ChatGPT, promises to transform the way businesses operate across sectors. Yet as quickly as novel applications and abilities surface, so does more evidence of the limitations and shortcomings of large language models. Plan sponsors can harness the immense power and utility of generative AI to provide better support to plan participants, but they must do so only after putting prudent processes and safeguards in place.

Identify Appropriate Applications

ChatGPT could be used to help streamline the retirement plan onboarding process by giving employees detailed instructions on how to enroll. Sponsors could use it to help provide information about plan options, as well as answers to employees’ frequently asked questions regarding their retirement plan benefits. The technology could also help craft customized messaging around more routine tasks such as:

- Informing participants of investment menu changes.

- Providing instructions for updating beneficiary designations.

- Giving eligible participants timely information regarding catch-up contributions.

- Helping workers access their account statements and other plan information.

- Reminding employees of contribution limits and important deadlines.

However, at present, it is advised that such technology be limited in use to non-legally required communications. Because ChatGPT is only as effective as the directives it receives, it is possible it may not generate a complete document meeting legal requirements. Thus, at present, it is advisable to avoid using this technology for legally required disclosures, notices, or legal documents.

Transparency, Security, and Oversight

While the opportunities for gains in efficiency are significant, it’s critical to address potential concerns when implementing nascent generative AI systems into your plan.

Training

Employers must establish clear guidelines about which employees can access ChatGPT — and for what purposes. Appropriate training regarding the limitations of the technology should be given to those authorized to use the platform. Workers should be instructed how to handle complex or sensitive issues that require human intervention.

Data Integrity & Security

At all times, participants’ personal and financial information must be protected by strict adherence to privacy standards. Establish clear protocols for sensitive data handling and retention. Implement and document oversight processes to protect information from unauthorized access, disclosure or misuse.

Compliance

Designated individuals should review and approve all generative AI outputs for compliance with regulatory and internal requirements before they’re communicated. Their review should include ensuring that all information provided to participants is accurate and consistent with plan provisions. Audit generative machine learning systems regularly to identify potential issues or vulnerabilities and take any necessary corrective action.

Transparency

Employers should be transparent with workers regarding the use of ChatGPT with respect to their retirement benefit. This includes how their personal information is being used — and protected.

A Prudent Path Forward

Plan sponsors should regularly review and evaluate generative AI integrations to flag any potential issues and identify ways to optimize their use of the technology while ensuring they remain compliant with all pertinent industry regulations and standards. With guardrails in place and adherence to prudent processes, appropriate use of AI-powered generative tools in retirement plan management presents an opportunity for sponsors to increase efficiency and enhance outcomes for plan participants.

Dear Prudence: What is Prudence Anyway?

When it comes to monitoring and selecting investments, the responsibility lies with the ERISA fiduciary for managing your company’s 401(k) plan, and this means the fiduciary is subject to ERISA’s prudent man rule (sometimes referred to as the “prudent expert rule”). What exactly is a prudent expert?

With respect to investments, the fiduciary is responsible for selecting and monitoring the investment alternatives that are available under the plan. Acting on behalf of the plan in this way means that someone is exercising the care, skill, prudence, and diligence that a prudent person familiar with such matters would exercise in similar circumstances. This expert is giving “appropriate consideration” to all the facts and circumstances that they know, or should know, are relevant to either the investment itself or to the course of action the investment requires.

This prudent expert is also selecting investment options as laid out in ERISA section 404(a). Furthermore, a prudent expert should maintain and follow a written investment policy statement (IPS). Although ERISA doesn’t require a written IPS, it is considered best practice to maintain one and follow it because it will be requested by the DOL in any audit situation, and it provides evidence that a prudent process has been adopted by fiduciaries.

A person or entity can be considered a prudent expert if they possess enough expertise to accept full personal responsibility for managing long-term investments. This is a sizable liability, and if you’re not completely confident in your ability to take on that responsibility, then you can (and ERISA says you should) engage a trusted advisor to assist with this responsibility and act solely in the best interest of the plan participants.

A qualified advisor will accept, in writing, the fiduciary responsibility for their recommendations as a 3(21) fiduciary investment advisor or for their actions as a 3(38) fiduciary investment manager. The nuance here is that a 3(21) fiduciary is making recommendations to the employer or to the Plan Committee, who will then consider and make the final say and therefore retain fiduciary responsibility. But in a 3(38) engagement, the fiduciary investment manager has transferred discretion to select and monitor (via prudent process with the IPS, etc.) investments for the plan and then reports back to the employer or committee the actions they took and why it was prudent to do so.

The 3(38) scenario is where the language above is so important that it bears repeating: Acting on behalf of a plan means the entity monitoring and selecting investments exercises everything a prudent person familiar with such matters would exercise. A third-party 3(38) fiduciary is often hired when there is no in-house “prudent expert” available to assume the full financial responsibility of selecting and monitoring investments, and the plan sponsor wishes to outsource the responsibility.

We hope this clarifies ERISA’s prudent man rule. If you have questions about which lanes 3(21) or 3(38) fiduciaries follow—or about any other ERISA nuance—reach out, and we will be happy to walk through it with you.

Participant Corner: The Advantage of Saving Early

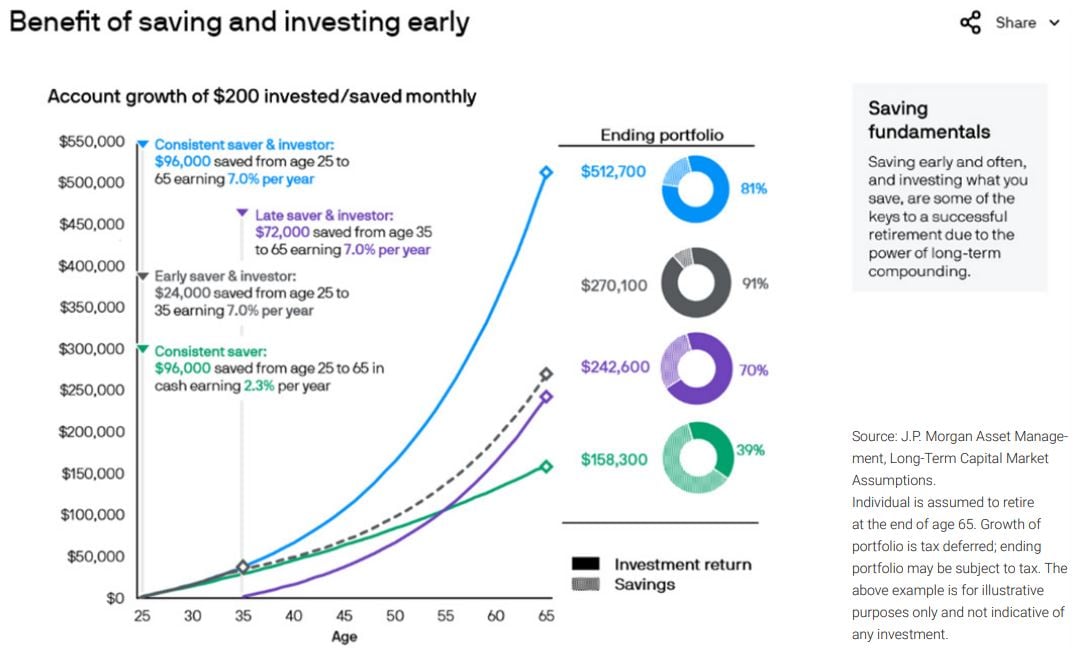

The early bird really could get the worm! In the chart below, you will find no secret tips or tricks to investing that cite prior market events: just plain old math.

The amount of your total nest egg is exponentially influenced by the duration of time it has to compound. In other words, the earlier you start saving, the better, by leaps and bounds. Of the four scenarios, please focus on the two profiles in the middle.

The “early saver & investor” invests ($200/month) for only 10 years, while the “late saver & investor” saves ($200/month) for 30 years. Both portfolios earn the same amount in this example (7%), but the early saver has a higher amount at retirement by nearly $30,000!

Of course, we all want to be the “consistent saver & investor,” and there is much to be said about the importance of staying invested for the long term. However, as some have been told when beginning their working career, it’s not about “timing the market” but much more about “time in the market.”

Chances are that you are already on a path of saving for your retirement or playing a little catch-up. That does not preclude you from stressing the importance of saving to all your younger colleagues, family, and friends! The math shows that individuals could be significantly better off starting as early as possible.

IMPORTANT DISCLOSURE INFORMATION

Recent News & Insights

Understanding Farm Income Averaging

Job Counteroffers: What You Gain & What You Risk

Maximizing Your Nebraska R&D Credit

What do buyers look for when purchasing a roofing business?

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)