DOL UPDATES GUIDANCE ON AUDITOR INDEPENDENCE FOR RETIREMENT PLAN ENGAGEMENTS

In September, the U.S. Department of Labor (DOL) released an Interpretive Bulletin that updates guidance on audits of benefit plans under the Employee Retirement Income Security Act. The updated guidelines are intended to help determine when a qualified public accountant is independent for the purpose of auditing and rendering an opinion on the Form 5500. With the new guidance, DOL removes what it describes as certain “outdated and unnecessarily restrictive provisions” and reorganizes other provisions for clarity.

While offering clarification for auditors, the bulletin also aims to inform plan sponsors seeking to engage external accounting resources and ensure adequate access to knowledgeable practitioners. “Our goal in updating the Interpretive Bulletin is to make sure the Department of Labor’s interpretations in this area continue to foster proper auditor independence while also removing outdated and unnecessary barriers to plans accessing highly qualified auditors and audit firms,” said Acting Assistant Secretary of Labor for Employee Benefits Security Ali Khawar in a statement.

Among changes in the new bulletin is an update on what constitutes a “disqualifying financial interest” for new audit engagements. According to the guidelines, an accountant, or accounting firm, is not prohibited from taking on a new engagement solely due to a related party holding the plan sponsor’s publicly traded securities during the financial statement period. However, DOL specifies that “the accountant, accounting firm, partners, shareholder employees, and professional employees of the accountant’s accounting firm, and their immediate family,” must dispose of any such holdings before the period during which the engagement occurs. It defines that period as beginning when the accountant either signs an agreement to perform the engagement or commences the audit process (whichever comes first) and “ending with the formal notification, either by the member or client, of the termination of the professional relationship or the issuance of the audit report for which the accountant was engaged, whichever is later.”

The bulletin also provides clarification on what constitutes an “office” for determining who is considered a “member” of an accounting firm and when someone would be regarded as “located in an office” of a firm that performs a substantial portion of the engagement. The department explains that it views an office as a “reasonably distinct subgroup within a firm” that serves the same group of clients or performs work on “the same categories of matters.” It places more weight on substantive matters, such as an individual’s expected interactions with personnel and their reporting channels, rather than physical location.

In addition to its revised guidance, the new bulletin also restates some of its original promulgations on auditor independence from 1975. The guidance reminds plan administrators, for example, of the requirement to retain an “independent qualified public accountant” to conduct an annual review. The accountant, it states, must render an opinion on whether the financial statements conform with generally accepted accounting principles and whether required schedules within the plan’s annual report fairly present the information contained therein.

The full updated bulletin is available on the U.S. Federal Register website.

Sources:

https://www.dol.gov/newsroom/releases/ebsa/ebsa20220902

https://www.plansponsor.com/ebsa-issues-new-audit-independence-guidance/

DOES YOUR RETIREMENT PLAN STAND OUT FROM THE CROWD?

With more than two-thirds of American workers having access to a retirement plan, employees and job seekers have come to expect one as part of their benefits package. That means it’s more important than ever to make sure your offering differentiates your organization from the competition. Whether you’re looking to deepen your bench by attracting top talent or retain the valued employees you have, evaluate if your retirement benefit is enough to move the needle.

Workers Want Financial Wellness

Access to a retirement plan can be desirable but also overwhelming. A retirement plan is many workers’ first investing experience, and it can be intimidating if they fear making a mistake with their hard-earned pay or “locking up” funds for many years. When employees sit on the sidelines, they aren’t getting all they can out of their retirement plan. Providing the necessary guidance to better understand their plan can give employees the confidence they need to take full advantage of this valuable benefit. A 2022 Schwab survey shows that 23% of respondents desire a financial wellness program, and 20% want access to a financial advisor. Companies like Apple know that offering flexible options to learn about product features and providing one-on-one support helps consumers get the most out of their purchases and promotes customer satisfaction and loyalty. Empower your employees with a robust financial wellness offering with plentiful options for participants to access the information and support they need on demand.

Investment Choices May Bolster Enthusiasm

As worker turnover rates remain stubbornly high during the “great resignation,” your retirement plan can help reduce churn. Offering an array of professionally vetted investment choices may boost participation and enthusiasm. If you do include self-managed options, just be sure to talk to your advisor about providing appropriate education and guardrails so workers can make prudent decisions, especially when it comes to novel or alternative asset classes such as cryptocurrency, which may not be considered prudent in the current regulatory environment.

Features That Can Provide a Boost

Consider adding bonus features to set your plan apart when appropriate, such as profit sharing, for example. Or consider allowing participants to use contributions to pay down student debt or build an emergency fund. Also, don’t overlook the ability of more generous “standard” features — such as immediate eligibility, faster vesting, a larger match, and low fees — to give your plan an edge.

A retirement plan offering requires a significant investment of time, money and other organizational resources. It also carries with it a certain degree of risk. Make sure yours is getting the street cred it deserves and paying out the dividends you want as a plan sponsor.

Sources:

https://www.blog.personalcapital.com/blog/retirement-planning/average-401k-balance-age

https://www.planadviser.com/role-401k-todays-tight-labor-market

DOCUMENTING FIDUCIARY PLAN MANAGEMENT RESPONSIBILITIES

ERISA states that every plan document must identify a “Named Fiduciary” to be the individual or entity serving as the primary fiduciary responsible for all plan management activities (e.g., President, Plan Administrator, The Company (BOD), or another individual or entity).

The Named Fiduciary can delegate nearly all plan management responsibilities to “co-fiduciaries”; however, they must retain the responsibility to regularly monitor the prudent management of these co-fiduciaries (e.g., individuals who comprise a plan steering committee or others who impact plan decision making).

Having a Committee Charter is very beneficial when delegating any fiduciary responsibilities to co-fiduciaries.

A Committee Charter documents the delegation of the specified plan management responsibilities, as well as plan practices and procedures, to plan co-fiduciaries. A board resolution adopting the committee is also helpful (if there is no BOD or other controlling entity, an adoption resolution is not necessary). Your financial professional can assist with a sample Committee Charter and related documents that can be easily edited to suit your needs.

Co-fiduciary Acceptance, and Resignation signatures, although not specifically required by ERISA, are quite important. The fiduciary acceptance (by signature) specifies the specific responsibility delegations. Resignation signatures are important, and they can remove the fiduciary from further post-resignation liability. ERISA holds that if a co-fiduciary (e.g., Committee member) leaves the Committee but does not leave the company, they remain liable for the actions of the remaining co-fiduciaries (committee members) unless they sign a resignation statement (also available via your financial professional). Finally, resigning fiduciaries need to follow plan procedures and make certain that another fiduciary is carrying out any responsibilities left behind that are required for prudent plan management. It is critical that a plan has appropriate fiduciaries in place so that it can continue operations and participants have a way to interact with the plan.

See the following link for the DOL’s stated positions on these and other fiduciary responsibilities:

PARTICIPANT CORNER: ARE YOU THANKFUL FOR YOUR HEALTH?

With small lifestyle changes and healthy choices (especially with all the shared yummy foods), you may reduce your annual healthcare costs and increase your income. These lifestyle changes can be as simple as limiting your salt intake or taking your prescribed medication regularly.

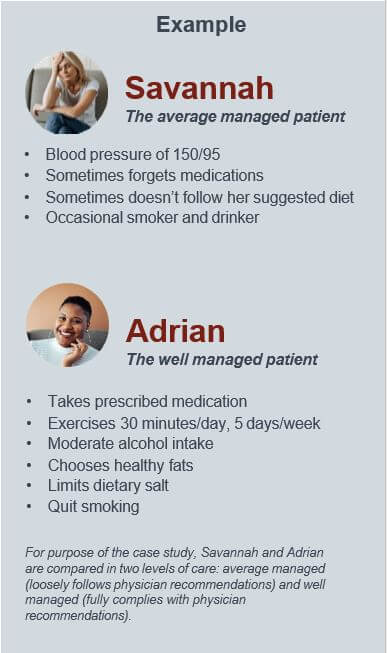

By adopting healthy habits, you can mitigate future healthcare costs. Data from HealthyCapital reveals that by simply making a few minor changes to daily routines and reducing the risk factors leading to chronic disease, individuals could potentially add years to their lives and save thousands of dollars in lifetime medical expenses. (See example below)

Savannah and Adrian are both 45 years old, and both sought medical treatment for high blood pressure. Savannah doesn’t follow the lifestyle changes her doctor suggested, whereas Adrian diligently follows her doctor’s recommendations. With Adrian’s small changes, she saves more than $1,000 in out-of-pocket healthcare costs. Additionally, Adrian’s combined pre-retirement and in-retirement savings will be $89,456 more than Savannah, as shown in the table below.

Annual Out-of-Pocket Healthcare Costs:

| Savannah | Adrian |

Adrian’s Savings in Health Expenditures |

|

| Age 45 | $2,477 | $1,286 | $1,192 |

| Age 64 | $13,936 | $7,343 | $6,592 |

| Total Pre-Retirement | $138,288 | $72,591 | $65,697 |

| Total In Retirement | $51,790 | $28,031 | $23,759 |

| Grand Total | $190,078 | $100,622 | $89,456 |

IMPORTANT DISCLOSURE INFORMATION

Recent News & Insights

In-House vs. Outsourced Controller: What makes sense for my business?

Estate Planning Guide

Understanding Farm Income Averaging

Job Counteroffers: What You Gain & What You Risk

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)