Billing for Time: How QuickBooks Does It

- Enter service hours one block at a time.

- Enter service hours directly on a timesheet.

- Transfer employee hours worked to payroll.

- Mark time-based activities as billable.

- Make billable hours available when you’re creating invoices.

Creating Individual Time Entries

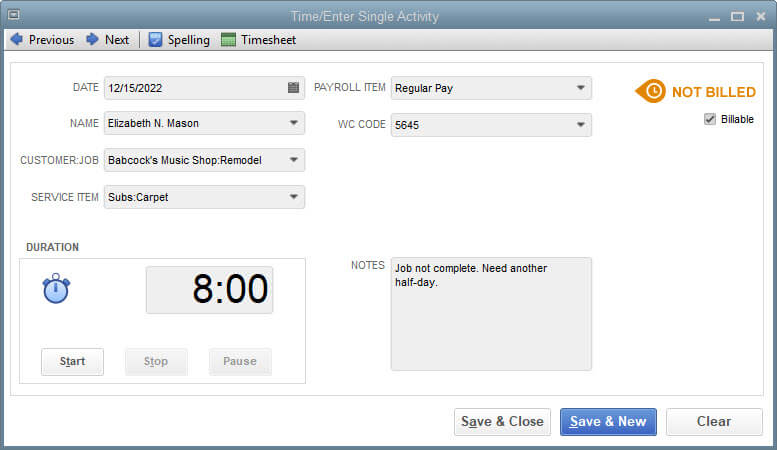

The mechanics of recording blocks of billable time are fairly simple. Click the Enter Time icon on QuickBooks’ home page, then click Time/Enter Single Activity. In the window that opens, you’ll either select from lists of existing data or click <Add New> to complete these fields:- The DATE the service was provided.

- The NAME of the employee who provided the service.

- The CUSTOMER:JOB.

- The SERVICE ITEM.

- The job’s DURATION (either by using the timer or entering it manually).

- The PAYROLL ITEM and WC CODE (Workers’ Compensation).

Weekly Timesheets

If you have multiple time entries to record, you can enter them on a timesheet by clicking Enter Time on QuickBooks’ home page and selecting Use Weekly Timesheet. This graphical table contains columns for all the fields available in the Single Activity window. In fact, if you’ve already created a service record for a specific employee, that information will appear in the timesheet when you select the employee’s name and the applicable work week. Further, you’ll be able to view anything you enter on the timesheet as an individual record by clicking Edit Single Activity in the timesheet’s toolbar.Transferring Time to Invoices

QuickBooks makes it easy to bill customers for services you or your employees have provided. Once you’ve recorded a time entry and marked it as Billable, it will be available the next time you create an invoice for that customer. As soon as you open an invoice form and select the CUSTOMER:JOB, a small window will open labeled Billable Time/Costs. A message will be generated notifying you there are outstanding billable time items and/or costs for that customer or job. You select to have these items either automatically transferred to the invoice or excluded.Simple, But Not

QuickBooks’ time-tracking features are easy enough to use, but you’re dealing with two critical elements of your accounting system which include payroll and customer billing. Both have to be exactly right. If you’re planning to transfer time entries to both, our Outsourced Accounting team can assist you. We can even manage all your payroll tasks if you’d like, as well as other elements of your company’s accounting. Contact us, and we’ll see how we can best meet your needs.

- Learner, Input, Strategic, Intellection, Competition

Lauren Harris

Lauren Harris, Client Advisory Services Manager, began her career in 2016. She has developed comprehensive knowledge in business operations and consulting, building on her early experience as a finance and tax intern, while taking on leadership roles in training and development.

Leveraging her background, Lauren provides outsourced accounting to clients across family office, construction, and service industries. She provides payroll compliance, accounting procedures assessments, and software implementation support. Lauren values building long-term partnerships with clients and serving as a trusted advisor for their businesses. Her analytical mindset and strategic thinking enable her to offer tailored solutions for each client's unique needs.

Lauren lives in Lincoln, NE, with her husband Casey and their two dogs, Lucy and Rosco. Outside the office, she is an avid Husker Volleyball fan and can be found reading, golfing, and playing volleyball.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)