The American Rescue Act, passed on March 10, 2021, includes $28.6 billion in direct aid for the restaurant industry to be distributed by the US Small Business Association (SBA). Eligible businesses can receive a tax-free federal grant equal to its Pandemic Related Revenue Loss. These grants do not need to be repaid.

1. Who is eligible?

Any restaurant or similar business[1] who owned or operated 20 or fewer establishments (together with any affiliates[2]) as of March 13, 2020. Publicly-traded companies are ineligible, as are any applicants with a pending application for a Shuttered Venue Operators Grant (Section 324 of the Economic Aid Act).

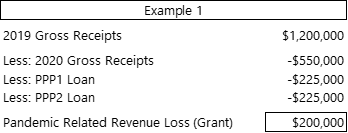

2. How is the Pandemic Related Revenue Loss (grant) amount determined?

The amount of grant to be received by the restaurant is calculated by subtracting its 2020 gross receipts from its 2019 gross receipts, less any Paycheck Protection Program (PPP) first and second draw loan amounts. The grant is capped at $10 million per business and limited to $5 million per physical location.

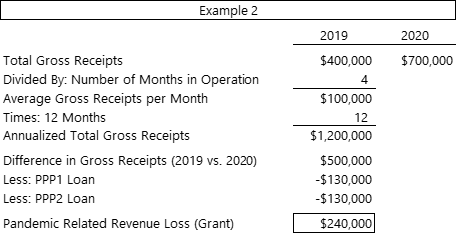

If the restaurant was not in business for the entirety of 2019, the difference in 2019 and 2020 gross receipts is calculated based on the average monthly gross receipts during 2019 times 12, less any PPP loan amounts:

There are additional pandemic-related revenue loss calculations for instances in which the restaurant was not in business until 2020.

3. What expenses can a business spend the Restaurant Revitalization Funds on?

Funds can be spent on payroll, principal, or interest on any mortgage obligation (not including prepayments), rent, utilities, maintenance including construction to accommodate outdoor seating, supplies including protective equipment and cleaning materials, food and beverage expenses, covered supplier costs, operational expenses, paid sick leave, and any other expenses that the SBA determines to be essential to maintaining operations.

4. How long does the business have to spend the funds?

A business can use the funds during the covered period, defined for the RRF as the period between February 15, 2020, through December 31, 2021. The SBA has the ability to extend this date range for up to two years. If all grant funds are not spent by the business, or the business permanently closes before the end of the covered period, the business must return any unused funds to the Treasury.

5. What is the tax treatment for the business receiving the RRF grants?

The grants will not be taxable income, and the business will keep the federal tax deductions for the relevant expenses used with grant monies.

6. How will the grant funds be distributed?

For the first 21-days of grant distribution, the SBA shall prioritize awarding eligible entities with small business concerns owned and controlled by women, veterans, or socially and economically disadvantaged small business concerns. After this period, funds will be disbursed on a first-come, first-serve basis.

7. What are the next steps?

As of the date of this posting, we do not know when the SBA will begin disbursing funds or how the rollout of fund disbursements will work. The US Chamber of Commerce recommends restaurant owners that want to apply for RRF grants immediately register with the government using the System of Award Management (SAM). To register for the SAM, restaurant owners need to do the following:

- Register for a free Data Universal Numbering System (D-U-N-S Number) at: https://www.dnb.com/duns-number/get-a-duns.html

- Register for a free System for Award Management (SAM Number) at: https://sam.gov/SAM/

We understand that interested parties will need to be registered on the SAM system prior to receiving the RRF grant. The other thing interested restaurant owners can do at this point is to begin preparing the relevant paperwork demonstrating the gross receipts in 2020 and 2019 and PPP1 and PPP2 loan amounts (if received). Please contact us or your Lutz Representative with questions.

[1] Includes any restaurant, food stand, food truck, food cart, caterer, saloon, inn, tavern, bar, lounge, brewpub, tasting room, taproom, licensed facility, or premise of a beverage alcohol producer where the public may taste, sample, or purchase products, or other similar place of business in which the public or patrons assemble for the primary purpose of being served food or drink.

[2] Affiliation measured by greater than or equal to 50% of equity or right to profit distributions or contractual authority to control the relevant businesses.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)