The Retirement Savings Glass Is Only Half Full for Women

According to recent data from the National Council on Aging and the Women’s Institute for a Secure Retirement, nearly half of women ages 25 and older lack access to a tax-advantaged, employer-sponsored retirement plan.

Digging Deeper Into the Data

The top reported financial concerns among women, alongside insufficient retirement savings, include housing costs, Social Security and Medicare cuts. But unfortunately, lack of access to retirement plan benefits doesn’t paint a complete picture of the problem. Because even among those women who are eligible for workplace retirement plans, average account balances lag behind those of men by a startling 50%, according to Bank of America’s Financial Life Benefits Impact Report. This disparity can create a chain of negative financial consequences for both female workers and organizations.

Impacts on Women and Employers

The impacts of the shortfall in women’s retirement savings on the overall gender wealth gap are far-reaching, exacerbating their longer-term financial insecurity. Due to their longer average lifespan, women often require larger nest eggs for retirement than men. Therefore, a lack of adequate savings can often translate to a lower quality of life in retirement for women and can also delay their exit from the workforce due to economic necessity, which can then pass on additional costs to employers.

A Multi-Pronged Strategy

Beyond closing the gender pay gap, employers can help women better prepare for a more secure retirement in a number of

ways:

- Implement auto-enrollment and auto-escalation features to help increase contribution rates among all those who may be contributing insufficiently, including women.

- Encourage saving by offering matching contributions — or increase the match offered.

- Provide financial wellness programming to educate women about the retirement savings gap and steps they can take to close it, including catch-up contributions for all eligible workers.

- Furnish additional education around the areas of concern for women mentioned above.

- Offer family leave to allow for continuing retirement plan contributions during periods of family care (only 24% of private-sector U.S. employers offer this benefit, according to the Department of Labor).

- Institute flexible work arrangements and allow part-time worker inclusion to help women stay in the workforce and continue contributing.

A Win-Win Solution

Implementing measures to address the gender gap in retirement savings can lead to many tangible benefits for organizations, including an increase in productivity and staff retention rates, maintaining a competitive edge in talent acquisition, and more effective and cost-efficient succession planning. In these and many other ways, helping women win at retirement can also yield significant dividends for the businesses that employ them.

Sources:

https://www.plansponsor.com/nearly-half-of-women-lack-workplace-retirement-plan-access-survey-shows/

https://newsroom.bankofamerica.com/content/newsroom/press-releases/2023/06/bofa-data-finds-men-s-average-401-k--account-balance-exceeds-wom.html

https://www.dol.gov/sites/dolgov/files/WB/paid-leave/PaidLeavefactsheet.pdf

Empowering Gen Z: Setting Your Youngest Participants Up for Success

Understandably, companies typically devote considerable attention to assisting participants nearing retirement. But the outsized value of early contributions to retirement readiness means employers should also focus on getting their youngest workers enrolled — and contributing — to their workplace retirement plan as soon as possible.

So, what do we actually know about Gen Zers’ attitudes toward retirement planning and their understanding of employer assistance in this area?

What the Research Says

What Retirement Plan Features Do Employees Really Want? A survey conducted by the Society of Actuaries and Deloitte Consulting found that 18- to 24-year-olds were five times more likely than others to be unaware of their employer-sponsored retirement benefits. Additionally, 40% indicated friends and family were among their top three resources for financial advice.

Concerningly, nearly one-quarter of this age segment also listed social media and influencers among their top sources of advice, in contrast to just 7% of the overall population. Unsurprisingly, this group also indicated a lower likelihood of tapping financial advisors for assistance. Taken together, the findings suggest that younger workers may be relatively uninformed about the retirement benefits available to them and are more likely to turn to nonprofessionals for financial advice.

How Plan Sponsors Can Help

Implementing auto-enrollment and auto-escalation features can help get more younger workers into plans, but you’ll want to take additional steps to keep them participating and contributing sufficiently. Organizations should, therefore, also boost their outreach efforts to this cohort to increase awareness of their employer-sponsored retirement benefits — as well as the advantages of getting an early start. And tailoring the approach and messaging to the preferences of this demographic can make their efforts even more effective.

This can be accomplished by leveraging online resources and video content channels to increase the utilization of advisory and financial wellness resources. Short-form videos (in the style of TikTok, YouTube Shorts, and Instagram Reels) may be particularly effective for this audience, especially when the messaging comes from their peers. Please be aware that modern-thinking advisers who wish to leverage these means of communication need to implement technologies and processes that comply with SEC tracking and record-keeping requirements.

Financial wellness topics of particular interest to this age group would likely include managing student loan debt, establishing good credit, saving for milestones like getting married, and budgeting for major purchases such as a new car or a first home.

The Good News

One bright spot in research from the Transamerica Center for Retirement Studies suggests that each generation is starting to save a little earlier (Gen Z at 19, millennials at 25, Gen X at 30, baby boomers at 35). And this may mean that your youngest employees could just need a little encouragement — and education — to set them on the right path. By helping address this generation’s unique financial wellness needs, employers can encourage early participation in retirement savings and get them on track toward a more secure future.

Sources:

https://www.soa.org/4963c4/globalassets/assets/files/resources/research-report/2023/ret-plan-features-emp-want.pdf

https://www.businessinsider.com/personal-finance/typical-age-generation-started-saving-for-retirement-2021-8?op=1

How Resuming Student Loan Payments Affects Sponsors

Starting August 29, student loan payments will be back on after a 3-year pause. What does this mean for plan sponsors? As employees prepare to, once

again, deal with the financial burden of student loans, sponsors have an opportunity to help lessen the load and ensure retirement contributions don’t fall to the wayside.

One way employers can do this is by implementing an optional change laid out by the Secure Act 2.0. This provision allows employees to continue receiving retirement matching benefits from employers while forgoing retirement contributions to focus on repaying student loans. These payments would be treated as retirement contributions, meaning employers would match them based on the plan design features already in place. This provision wouldn’t cause any unnecessary extra work for sponsors. Employers can rely on an employee’s self-certification to ensure the loan payments are being made and can continue matching contributions based on the same vesting schedule. For most student debt holders, this provision could save years of lost retirement savings.

Not only does the implementation of this program benefit employees’ finances, but it can also be cost-effective for employers. First, the contributions being made under this provision are contributions that would have otherwise been made if the employee was still contributing to the 401(k). Therefore, this student loan aid approach is more cost-efficient than most other approaches. If the employer were to add a new student loan benefit program, it would result in additional costs for the employer. For example, student loan repayment dollars given directly to employees are still treated as taxable income, whereas 401(k) contributions are not taxable. Tax advantages like this are generally hard to come by within typical student loan repayment benefits.

Towards the end of August, employees will be scrambling to find ways to balance student loan payments with their current savings contributions. The adoption of this benefit would support employee participation in retirement plans, despite overwhelming student debt, and would serve as a competitive advantage when it comes to recruiting and attaining employees.

Sources:

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/irs-allows-401k-match-for-student-loan-payments.aspx

https://money.usnews.com/money/retirement/401ks/articles/how-to-get-a-401k-match-for-your-student-loan-payment

https://smartasset.com/financial-advisor/the-secure-2-0-act-student-loan-matching

Participant Corner: Are You Over Age 50?

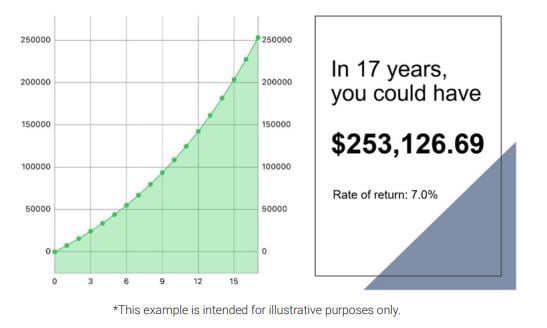

Consider making a catch-up contribution to your retirement! If you contribute $7,500 each year from age 50 to age 67 (17 years), you can make a big impact on your future.

When am I eligible to make a catch-up contribution?

If you turn age 50 anytime in the calendar year, you are eligible to contribute an additional $7,500 to your plan as a catch-up contribution. This is in addition to the $22,500 annual limit.

Is the catch-up contribution pre-tax or Roth?

Yes, either type of savings is available for your catch-up contribution. Depending on your income, the Secure Act 2.0 may require a change for your situation to Roth (more information to follow).

What does this all mean?

If you wish to save an additional $7,500 per year, you can accumulate over $250,000 in the next 17 years! As the limits to save increase, you may be able to save even more each year. Please access your retirement plan provider’s website or consult with your financial professional

IMPORTANT DISCLOSURE INFORMATION

Recent News & Insights

Lutz Gives Back + 12 Days of Lutzmas 2025

Tis the Season... For Market Forecasts

Tired of Complex Books? 8 Ways to Simplify Your Accounting

HR Solutions That Elevate the Employee Experience

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)