Will I Outlive My Assets?

Running out of money is often cited as the biggest fear of retirees. Most investment and financial advice has traditionally been focused on the accumulation phase (growing assets before retirement). But, with the elimination of traditional pension plans and increased life expectancies, retirees are now finding that the distribution phase (spending down assets in retirement) is far more complex and requires a skill-set that they may not possess. This blog will provide a couple brief pointers on how to review your financial situation and investment allocation so that you don’t spend your retirement worrying about outliving your assets.

How much can I spend each year in retirement?

The best way to answer this is to perform a comprehensive retirement cash flow analysis. By modeling out detailed projections, you can analyze how your income and expenses will affect your retirement nest egg over time. This will include a review of your balance sheet, sources of annual income, tax features and how much you plan on spending each year. It is important to work with an experienced advisor who uses a high-quality planning software that can model out different scenarios so that you can see how modifying various assumptions can impact your financial picture.

Keep the following points in mind to ensure an accurate review of your financial situation:

- Understand the timing and length of your retirement (estimate of retirement date and how long you will live) – longevity is one of the biggest stresses on retirement funds

- Prepare an estimated budget of your annual expenses (don’t just wing this, if this is way off it can materially impact the analysis)

- Quantify your sources of income (Social Security, rental income, farm income, pension, part-time employment, required minimum distribution (RMD) income, etc.)

- Get a good estimate of what your healthcare and potential long-term care expenses will be[i]

- Have a conservative assumption for taxes and inflation

- Set a realistic growth rate for your investments based on your overall asset allocation (more on this to come below)

The cash flow analysis will help you find out if a level of annual spend is sustainable based on your balance sheet and the underlying assumptions (the key is to be realistic but conservative). It's important to update this analysis periodically as you progress through retirement to account for any changes in your situation and to confirm your plan remains on track.

How do I determine my investment allocation in retirement?

As mentioned above, it’s important to use a reasonable investment growth rate when modeling out your retirement cash flow. What's “reasonable” depends in part on what your investment allocation will be in retirement (i.e., your ratio of stocks vs. bonds/cash). But, how do you go about determining what that allocation should be? While there are lots of personal factors to consider and several different methodologies to use to answer that question, the approach we like to use is what I will call the “3 bucket model.”

Three Bucket Allocation Model

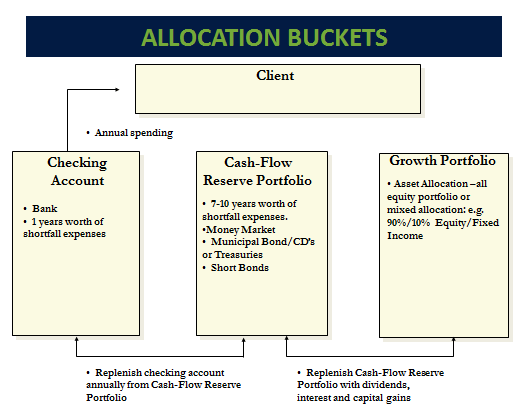

In the bucket approach, you start out by estimating what your annual retirement “shortfall” will be (meaning by how much do your annual retirement expenses exceed your annual retirement net income). You then try to fill Bucket 1 with one year of this shortfall in a money market account. Next, you try to fill Bucket 2 with 7-10 years (or more) of this shortfall amount in a diversified fixed income (bond) portfolio. Lastly, fill Bucket 3 with the remainder of the portfolio in a diversified stock/bond mix. How aggressively Bucket 3 is allocated depends on how large the overall portfolio is and what the primary goal of the investor is (i.e., either protecting the corpus to provide a bigger spending cushion for the investor or growing the pot in an attempt to leave a larger amount for heirs or charity).

What this 3 bucket approach accomplishes is theoretically not having any funds you plan on needing in the next 7-10 years in the stock market. It also helps to avoid having to sell stocks at an inopportune time. If the stock market pulls back (as it inevitably will at various points during your retirement), you can pull any funds needed for living expenses from Bucket 1 or Bucket 2 and allow your stocks in Bucket 3 time to recover.

If you are in retirement and can’t fill a 7-10 year bucket with conservative bonds, you may either need to be more aggressive with your investments then is ideal or you may need to reduce your annual spend. An illustrative example of this 3 bucket approach is set forth below.

As you approach and enter retirement, managing your finances becomes much more complex. Determining how much you can safely spend each year and how to allocate your investments are just a couple of the many critical financial decisions you will face in retirement. Make sure you work with your financial advisor to put together a plan that meets your needs. If you don’t feel that your current advisor is providing adequate guidance in these areas, find one that will. Feel free to contact us for more information on this topic or to schedule a meeting to discuss your situation further.

[1] See https://www.lutz.us/planning-health-care-costs-retirement/ and https://pressroom.vanguard.com/nonindexed/Research-Planning-for-healthcare-costs-in-retirement_061918.pdf for more information on how to estimate healthcare and long-term care costs in retirement.

- Achiever, Learner, Competition, Arranger, Focus

Joe Hefflinger, JD, CFP®, CAP®

Joe Hefflinger, Investment Advisor & Principal, began his career in 2005. With a background in corporate law, mergers and acquisitions, and tax planning, he brings a unique perspective to financial advising, reinforcing his ability to guide clients through complex financial decisions.

Specializing in investment advisory services and financial planning, Joe works closely with high-net-worth families and business owners in transition. He focuses on estate planning, insurance planning, and charitable giving, helping clients structure their wealth to achieve their long-term objectives. His background in law allows him to navigate the intricate details of succession planning, ensuring clients have a clear path for both their business and personal financial future.

At Lutz, Joe serves beyond expectations by providing proactive, personalized financial guidance. He takes the time to understand each client’s unique needs, delivering tailored strategies that build confidence and security. His focused approach has helped make Lutz Financial a trusted resource for individuals and business owners alike.

Joe lives in Omaha, NE, with his wife, Kim, and their daughters, Lily and Jolie. Outside of the office he can be found in basketball gyms across the Midwest, cheering on his daughters’ teams.

Recent News & Insights

Is sales-based apportionment helping or hurting your bottom line?

Employee Stock Ownership Plan (ESOP) Benefits & Best Practices

The 60/40 Portfolio is Alive and Well

International Momentum Continues

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)