Clarke Beller and Ryan Cook

A new project manager at your construction company is consistently seeing margins deteriorate at the end of their construction projects. The key question when confronting this situation is to determine if project management and accounting know and understand their costs. Knowing your costs can improve the bidding process and help you determine problem projects and employees.

Direct Costs

Construction costs that are specifically allocable to construction contracts are typically referred to as direct costs. Common direct costs are often made up of materials, direct labor, and subcontractor costs. There is little ambiguity with these costs, and they are typically easy to apply or assign to a specific construction contract.

Indirect Costs

In contrast, construction costs that are not specifically allocable to construction contracts are typically referred to as indirect costs. The three most common types of indirect costs include:

- Overhead – Job site costs, home office costs, and general conditions

- Project Managers, Superintendents, and other Support Staff

- Office Trailers, Equipment, and Supplies

- Insurance, Office Salaries, and other Miscellaneous Costs

- Equipment – Owned equipment and small tools

- Depreciation

- Repairs and Maintenance

- Taxes and Insurance

- Labor Burden

- FICA Taxes

- Workers Compensation

- Federal and State Unemployment

- Vacation and Other Fringe Benefits

Common Methods to Allocate Indirect Costs

Below are a few examples of popular methods used to allocate indirect costs.

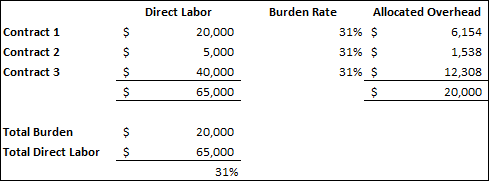

Allocate indirect costs based on direct labor:

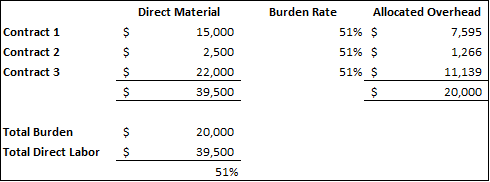

Allocate indirect costs based on material costs:

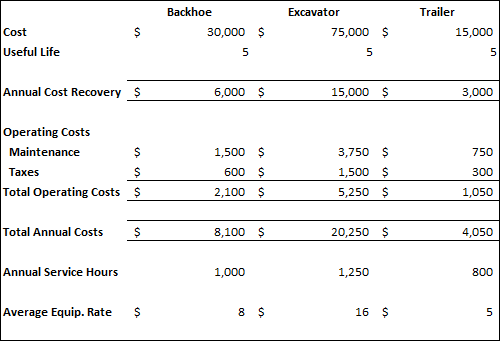

Allocate indirect equipment costs based on equipment hours:

Common Pitfalls While Allocating Indirect Costs

However, when allocating indirect costs, be aware of the common mistakes people often make. A few of these common pitfalls include:

- Not considering indirect costs in your bidding process.

- Not allocating indirect costs on a timely basis (i.e., annually instead of monthly).

Maintaining timely records and being sure to include all costs during the entire project will help you avoid any potential errors.

Keeping track of your construction project costs can be tricky and time-consuming. Being able to understand the difference between the two different types of costs will not only help you improve your margins but will give you a better estimate of your project spend. By leveraging your accounting system—and partnering with a team like Lutz—you can streamline and even automate parts of this process, saving valuable time and reducing manual errors. If you have any questions or would like more information on this topic, please contact us today.

- Analytical, Significance, Individualization, Responsibility, Context

Clarke Beller

Clarke Beller, Audit Shareholder, began his career in 2010. With a background in financial analysis, he has developed a strong foundation in financial reporting and business operations. Clarke serves as the construction niche lead, demonstrating his expertise and leadership in this sector.

Specializing in audit and consulting services for privately held companies, Clarke focuses primarily on the construction industry. He oversees audits, reviews, and compilations while offering business consulting on a monthly, quarterly, and annual basis. Clarke values Lutz's customer-first approach, which allows him to apply his analytical skills and industry knowledge to help clients succeed.

At Lutz, Clarke embodies the firm's "say it straight" philosophy, offering honest and candid insights to clients. His ability to dissect complex financial data and present clear, actionable recommendations ensures clients receive transparent, reliable guidance.

Clarke lives in Omaha, NE, with his wife Kayla and their two sons, Brock and Brant. Outside the office, he spends time golfing, boating, and following football.

.jpg?width=306&height=456&name=Large%20Headshot%20Crop%20%2B%20Web%20Crop%20(1).jpg)

- Command, Woo, Competition, Self-Assurance, Ideation

Ryan Cook

Recent News & Insights

Lutz Named Gold Winner in Quantum Workplace's 2025 Employee Voice Award

Update: Tax Highlights of “The One, Big, Beautiful Bill”

From Seed to Scale: Tax & Operational Strategies for AgTech Startups

Case Study: A Smarter 401(k) Strategy for a Busy Doctor's Office

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)