The Wealth Creating Power of the Stock Market + Financial Market Update + 1.31.23

STORY OF THE WEEK

THE WEALTH CREATING POWER OF THE STOCK MARKET

Recent volatility in both the stock and bond markets has some investors searching for a safer alternative. After delivering a positive return last year, cash appears to fit that bill. For most of the period since the Financial Crisis in 2008, short-term interest rates have been near zero. As the Federal Reserve continues its fight against inflation, the yield on cash has finally become meaningful again. Despite cash’s strong relative performance in 2022, however, history cautions against abandoning a well-diversified portfolio when times are tough.

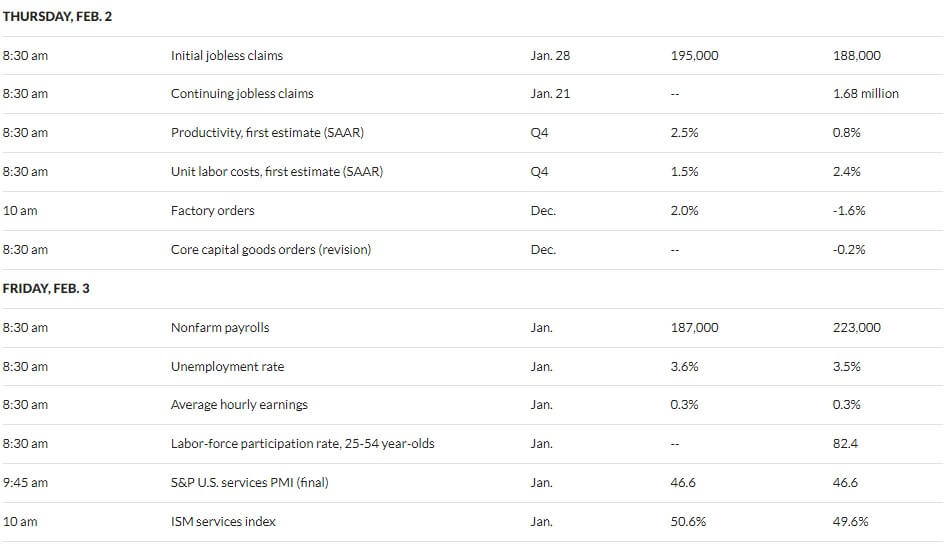

Last year was relatively unique in that stocks and bonds were negative in the same year. In the ninety-seven calendar years since 1926, that has only happened two other times (1931 & 1969). The recent struggles for these asset classes do not mean that cash deserves a more prominent role in portfolios. Cash is an excellent tool for managing liquidity needs. It is important for investors to have sufficient cash on hand to handle known and unknown expenditures in the near term. As a wealth creation tool, however, cash leaves a lot to be desired. The table below shines some light on why this is the case.

Average 1-Year Asset Class Returns Since 1926

Source: Morningstar Direct. Data from January 1926 to December 2022. Stocks are represented by the IA SBBI Large Cap US Stock Index, bonds by the IA SBBI Intermediate-Term Government Bond Index, and cash by the IA SBBI 1-Month Treasury Bill Index. All Returns are Annualized.

In virtually every year since 1926, the return on cash has been positive. 1938 was the only negative year when it declined by -0.02%. Based on this data, it’s reasonable to assume that when a spending need arises, the principal value of cash will be there, intact. Since the same cannot necessarily be said for stocks and bonds, cash dominates other asset classes in satisfying short-term needs.

For individuals that do not have sufficient cash on hand to fully fund their retirement, philanthropic goals and desire to leave some wealth to their children, a long-term investment plan is required. In this arena, cash has historically fallen woefully short. To understand why this is the case, one must understand the link between risk and return.

While it’s great that cash sidesteps volatility, it also sidesteps much of the reward associated with investing. If the more volatile stock and bond asset classes delivered the same return as cash, no rational investor would purchase them. To induce people to endure the higher level of volatility, these asset classes must appear to offer a higher level of return. Of course, that does not mean the returns will always be higher. Still, history tells us that over long periods of time, investors in these more volatile asset classes have earned a premium for taking on that additional risk.

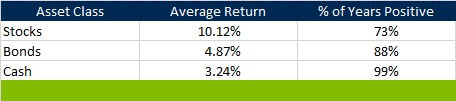

The chart below demonstrates the powerful wealth-creating ability of the stock market. It depicts the growth of $100 invested in each of the three asset classes since 1926. While an investment in cash and bonds grew to an impressive $2,205 and $10,111, respectively, the equity return was off the charts.

Source: Morningstar Direct. Data from January 1926 to December 2022. Stocks are represented by the IA SBBI Large Cap US Stock Index, bonds by the IA SBBI Intermediate-Term Government Bond Index, and cash by the IA SBBI 1-Month Treasury Bill Index.

Although the long-term annualized return on stocks (10.12%) was just 3x higher than cash (3.24%), that difference compounded for a long period resulted in an ending value of wealth that was over 500x larger. The difference in ending values was so dramatic the bond and cash lines sort of just bleed together, despite bonds delivering an ending wealth nearly 5x that of cash.

In a perfect world, investors would be able to rotate between stocks and cash in a manner that would allow them to reap the long-term growth potential of stocks while avoiding the pain and discomfort that stem from periodic bouts of volatility. Sadly, no such ability exists. Those that attempt this generally sell stocks once the volatility has already begun (and stocks are lower) and buy back into the market once the dust has settled (and stocks are higher). As common sense might tell you, selling low and buying high is not a recipe for investing success.

Investors would instead be better served by holding sufficient cash for short-term needs and investing the remaining assets in a diversified portfolio of stocks and bonds. This strategy allows investors to avoid becoming forced sellers when volatility arises. Instead, there is sufficient cash to cover spending needs, while the riskier asset classes are given time for compounding to work its magic.

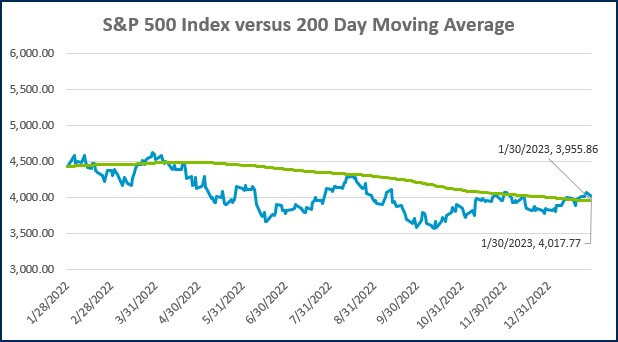

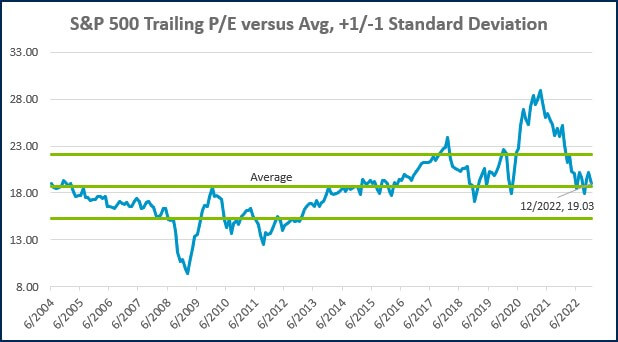

WEEK IN REVIEW

- According to FactSet, 29% of S&P 500 companies have reported earnings as of last Friday. The forecasted growth rate blended with actual results from companies that have already reported is now -5.0% year-over-year. The expected earnings growth rate as of 12/31/2022 was -3.2%, which implies earnings season has been worse than expected thus far. Earnings growth is what ultimately fuels appreciation in the stock market. Although returns have been strong in January, companies will need to return to positive earnings growth to justify continued market gains.

- Data published Tuesday showed the Employment Cost Index (ECI) rose less than expected during the 4th quarter. The ECI is watched closely by the Federal Reserve because they are trying to avoid the wage/price spiral of the 1970s. A deceleration in the ECI is consistent with other measures of inflation that have been cooling. This data is unlikely to alter the expected 0.25% interest rate increase when at the Federal Reserve meeting Wednesday (Feb 1st).

- This is a very big week for economic data. Look for the post FOMC meeting announcement Wednesday at 1 PM CT. The rate decision will be followed by a press conference with Fed Chair Jerome Powell about half an hour later on Yahoo Finance. Other big data releases this week include the ISM Manufacturing and Services Indices, job openings/quits, initial jobless claims, and the jobs report.

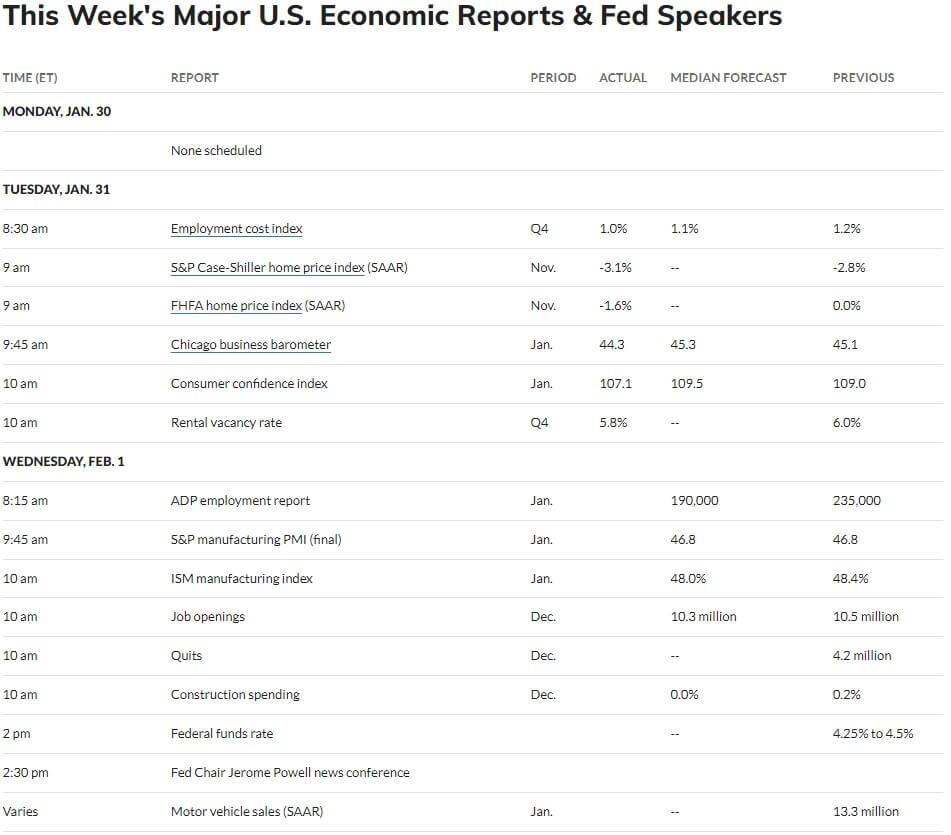

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- How Quickly Rate Increases Slow the Economy Could Shape 2023 Fed Policy (WSJ)

- Important Wage Inflation Measure for the Fed Rose Less Than Expected in Q4 (CNBC)

- Euro Zone Economy Posts Surprise Expansion in the Fourth Quarter, Curbing Recession Fears (CNBC)

Investing

- The Art and Science of Spending Money (Morgan Housel)

- 5 Lessons From an Awful Year For Financial Markets (Ben Carlson)

- Seth Klarman: The Forgotten Lessons of 2008 (Farnam Street)

Other

- The Quarterback Battle That Unlocked Patrick Mahomes (ESPN)

- Ranking Every Super Bowl From Worst to Best (YouTube)

- Cyprus: A Hiding Spot For Russian Money (60 Minutes)

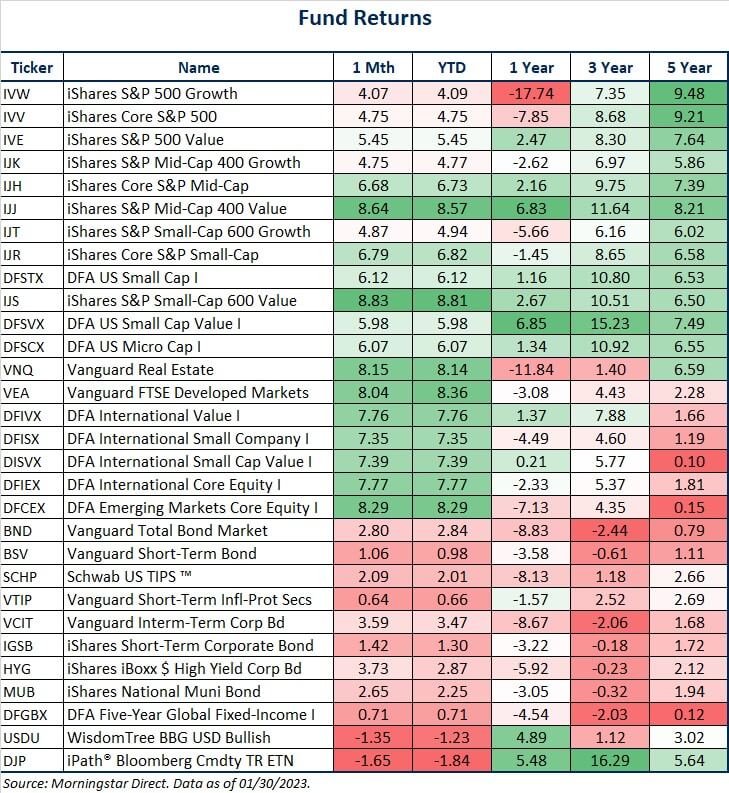

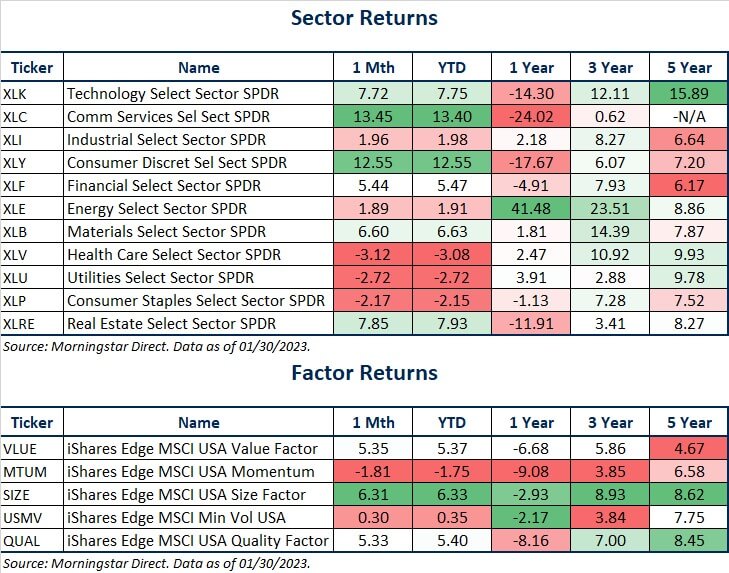

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

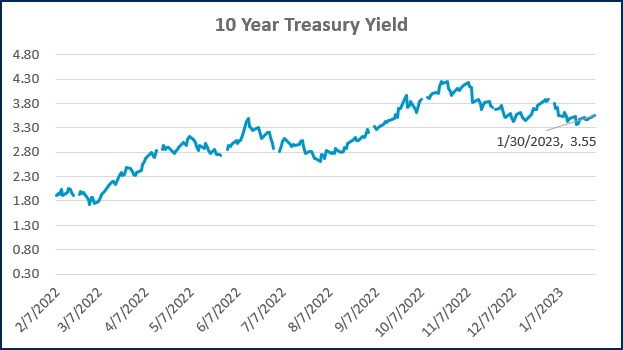

Source: Treasury.gov

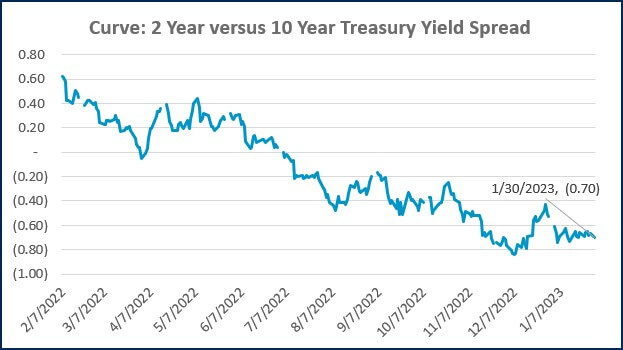

Source: Treasury.gov

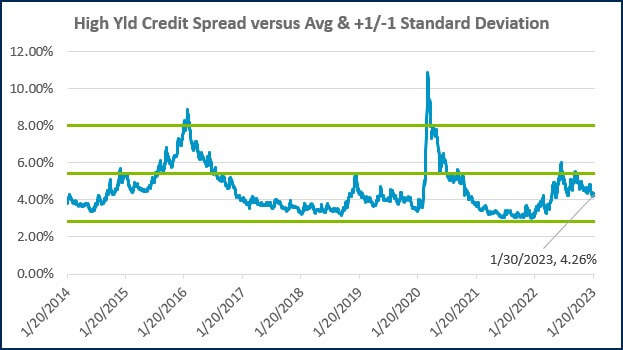

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

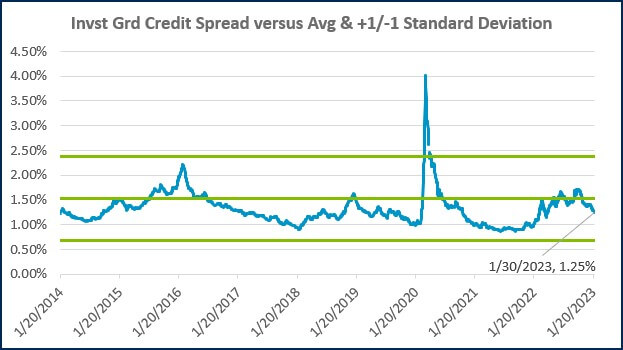

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)