Good News is Bad News + Financial Market Update + 10.11.22

Last Friday, the Bureau of Labor Statistics published its monthly payrolls report, showing the economy added 263,000 new jobs during September. The figure marked a decline from the prior month’s 315,000 and came in below expectations, with economists surveyed by MarketWatch expecting 275,000. Despite falling month-over-month and missing expectations, the report was actually considered to be quite strong. Going back to 1939, the average number of jobs added each month has been a much lower 122,000. Additionally, the unemployment rate declined to 3.5%, matching the lowest level since 1969.

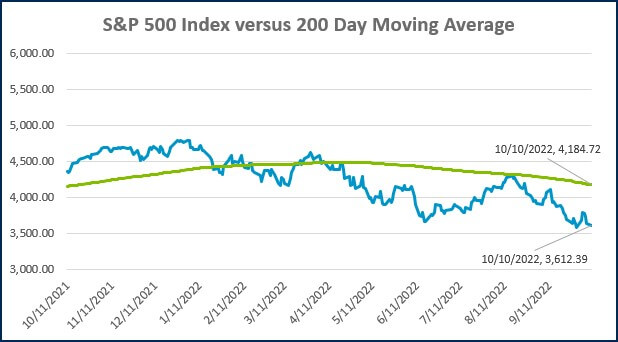

Under normal circumstances, strong economic data would be considered a positive for the stock market, but that was certainly not the case last week. The S&P 500 fell -2.8% on Friday following the report. So why did objectively ‘good’ news result in a clearly ‘bad’ outcome for stocks? The answer has much to do with the relationship between the labor market and inflation.

The Federal Reserve has the dual mandate of supporting both maximum employment and stable prices. Price stability is easily defined and is represented by the rate of inflation. Maximum employment is more difficult. It would be understandable to think of maximum employment as an environment where everyone that wanted a job had one, but that is technically not the case.

There is a relationship between employment and wage growth that is described by an economic model known as the Phillips Curve. At a high level, the model demonstrates that:

- Low levels of unemployment are associated with higher inflation, and

- High levels of unemployment are associated with lower inflation

Based on this relationship, if everyone that wanted a job had one, there would likely be extremely low unemployment accompanied by price instability in the form of high inflation. In light of this, the Federal Reserve instead defines maximum employment as the highest level of employment the economy can sustain without generating unwanted inflation.

A major challenge for policymakers is that the maximum level of employment cannot be directly measured, and it changes over time. With inflation at multi-decade highs and unemployment at multi-decade lows, you would be hard-pressed to make the argument that the labor market was not beyond the maximum level.

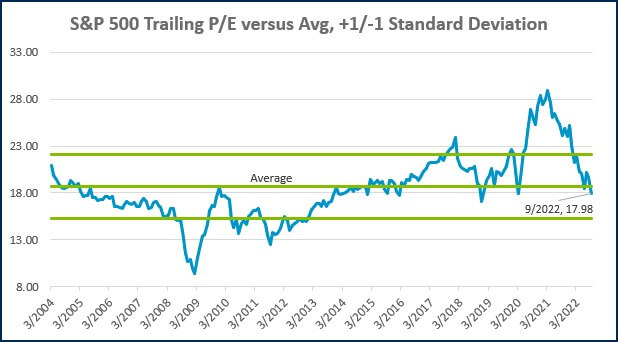

This brings us back to the market’s reaction to the strong payrolls report. The Fed has been rapidly tightening monetary policy to cool the rate of inflation. As of this writing, the fed fund futures market is pricing an additional 1.25% worth of hikes between the next two Fed meetings (on 11/2 and 12/14). Higher interest rates can negatively impact the stock market in two primary ways:

- The expected return on a relatively low-risk government bond begins to look more attractive as interest rates rise. To entice investors to take on stock market risk, the expected return on stocks must commensurately increase.

- Higher interest rates are a headwind to economic activity, which can lower the earnings prospects for businesses.

Any evidence that suggests the Fed will have to do more than the market is currently expecting could be met with a further decline in asset prices. Conversely, evidence that inflationary pressures are abating could be met with a rally. Said another way, good news is bad news for the time being, at least as it relates to labor market data.

WEEK IN REVIEW

- Aside from the payrolls report last week, a couple of other indicators flashed hints of a cooling labor market. Initial jobless claims (a proxy for layoffs) increased by 29k, the largest weekly increase since June. Additionally, job openings declined by 1.1 million to a still (very elevated) 10.1 million.

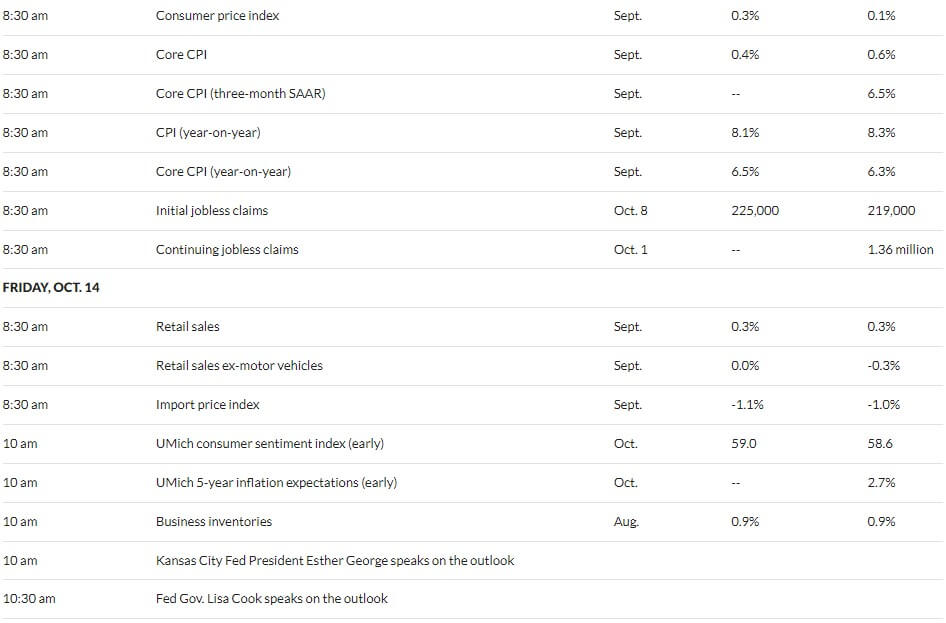

- The most important economic data to watch for this week will be the Consumer Price Index (CPI), to be published Thursday morning. Economists surveyed by MarketWatch expect headline inflation to fall 0.2% YoY to 8.1%. Core inflation, which strips out the volatile food and energy components, is expected to increase by 0.2% to 6.5%. The market could experience a substantial move if the data differs widely from expectations.

- Earnings season is poised to hit full steam this week as some of the nation’s largest banks are set to report results. According to FactSet, analysts are expecting earnings growth for the S&P 500 of 2.4%. The estimates have been downgraded from the beginning of the quarter when analysts were excepting earnings growth of 9.9% for Q3.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Unemployment Rate Falls to 3.5% in September, Payrolls Rise By 263,000 as Job Market Stays Strong (CNBC)

- Job Openings Plunged by More than 1.1 Million in August (CNBC)

- Why the Federal Reserve Won’t Be So Quick To Ease Up On Its Fight Against Inflation (CNBC)

Investing

- Expectations (Morgan Housel)

- The Last Time the Fed Created a Recession (Ben Carlson)

- Y’all Should Stop Making Emotional Bets(Barry Ritholtz)

Other

- The Repairs That Will Help Sell Your House In a Cooling Market (WSJ)

- BAM! NASA Says DART Really Clocked That Asteroid (Wired)

- 5 Key insights into ‘Quit: The Power Of Knowing When to Walk Away’ (Annie Duke)

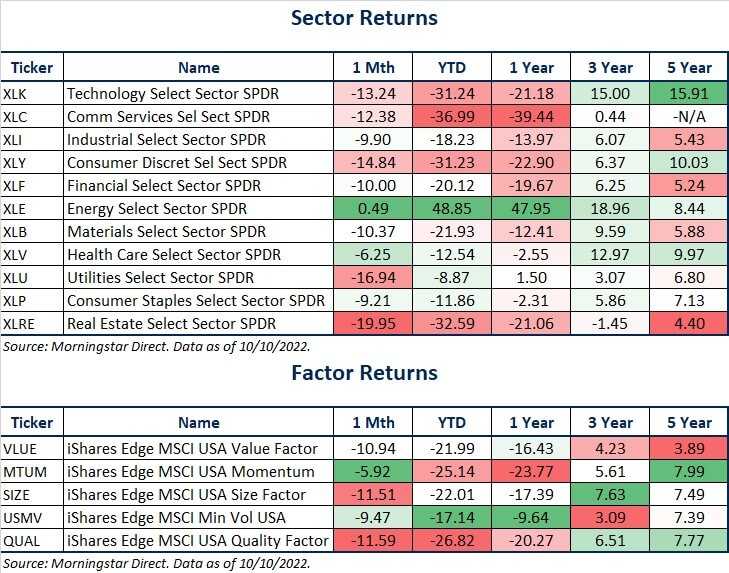

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

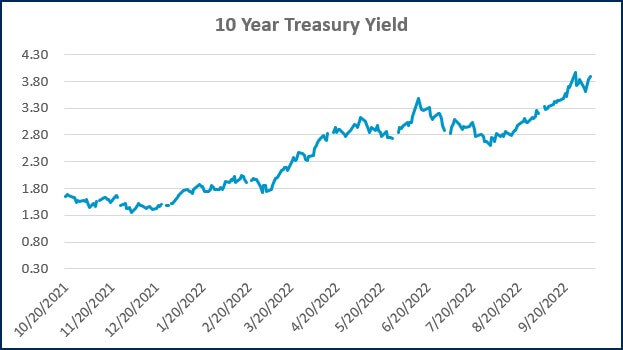

Source: Treasury.gov

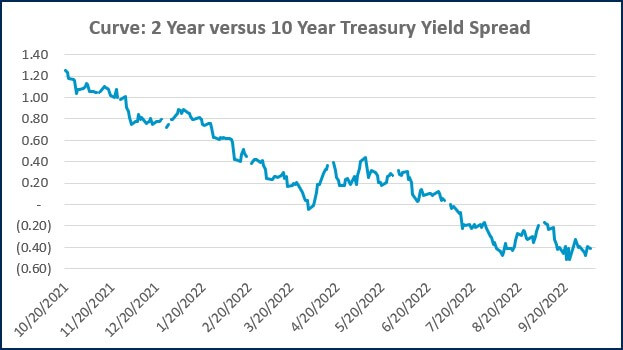

Source: Treasury.gov

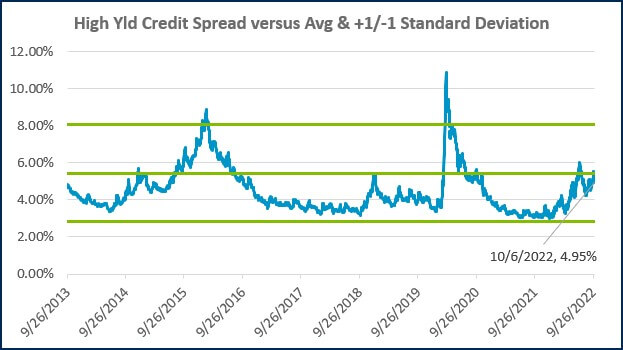

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

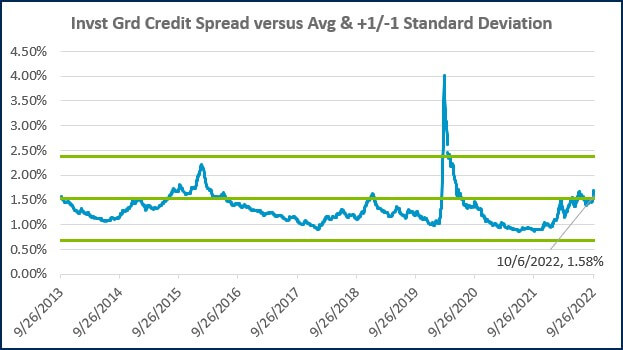

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)