From Higher Earnings to Lower Valuations + Financial Market Update + 10.26.21

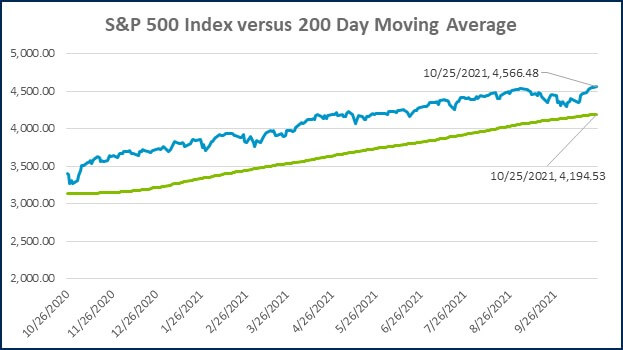

Through three quarters, the stock market is on pace to have an excellent year. The S&P 500, which represents large US stocks, has returned 14.7% before dividends through the end of September. With such a strong streak of performance, many investors are concerned that the stocks could be widely overpriced. While stretched valuations should indeed temper return expectations moving forward, a large selloff is not the only way for stock prices to move back in line with their fundamentals.

For context, US stocks have historically returned about 10.4% per annum, including dividends(1). The market is clearly well ahead of that pace, in addition to strong returns achieved in 2019 (31.5%) and 2020 (18.4%). This year alone, the S&P 500 has closed at a record high level on fifty-four occasions. With this backdrop, it’s no surprise that there are concerns that the market has moved too far too fast.

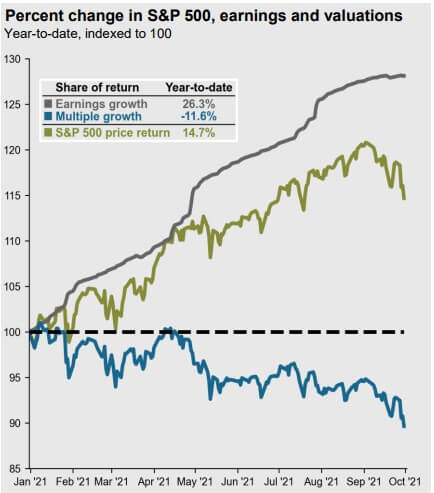

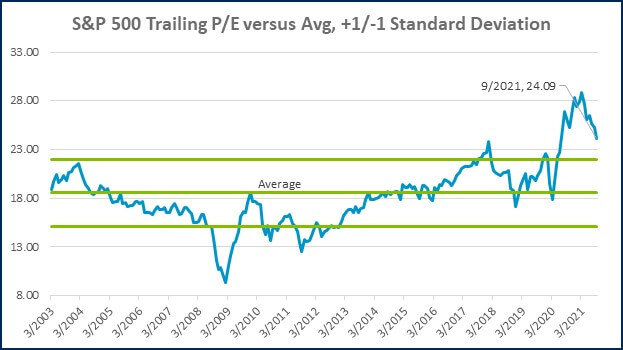

Valuation measures like the Price-to-Earnings (P/E) Ratio ballooned last year as markets priced in the economic recovery well in advance. That degree of appreciation without the business results to support it would clearly be unsustainable. In recent quarters, however, businesses have begun to deliver on the optimism that has pushed their share prices higher. Evidence of this can be found in the chart below from JP Morgan Asset Management.

Source: FactSet, Compustat, Standard & Poor’s, J.P. Morgan Asset Management. Historical EPS levels are based on annual operating earnings per share. Earnings estimates are based on estimates from Standard & Poor’s and FactSet Market Aggregates. Past performance is not indicative of future returns. Guide to the Markets – U.S. Data are as of September 30, 2021.

The chart illustrates the growth in corporate earnings, the percentage change in the forward P/E ratio, and the return on the S&P 500 before dividends. As you can see, earnings have increased at a faster pace than stock prices (26.3% vs. 14.7%). As a result, the ‘multiple growth’ (percentage change in the P/E ratio) was negative. This outcome may seem counterintuitive to some, so I will repeat it another way. Despite the S&P 500 achieving 50+ record-highs and delivering a return that is well above historical norms, the stock market has actually gotten cheaper in 2021!

Stocks are typically more vulnerable to a pullback when valuations are high, and despite declining in recent quarters, they remain above historical norms today. In this sort of environment, the market can move toward a fair valuation in one of two ways (or a combination thereof):

- Prices fall to a level that is justified by the fundamentals

- Fundamentals improve to a level that justifies the prices

The first option occurs regularly and is a normal and healthy feature of investing in the stock market. We saw some volatility in September, and it would not be surprising to see more as the Federal Reserve begins to normalize monetary policy. The second option also occurs regularly and is generally preferable. After a strong showing in the first half of the year, companies have begun to report results for the third quarter and have largely outperformed expectations. Continued strength in corporate profits provides an avenue for the market to deliver gains while moving towards more sustainable valuation levels.

1. Source: Morningstar Direct. Based on the Ibbotson and Associates US Large Cap Stock TR USD Index from Jan 1927 through September 2021.

WEEK IN REVIEW

- According to Factset, 23% of S&P 500 companies have reported earnings for the 3rd quarter as of last Friday, with 84% of those firms beating expectations. Earnings growth for the S&P 500 was estimated to be 27.5% YoY as of the end of the quarter. The growth rate of companies that have reported, blended with the estimates of companies that have yet to report, has increased to 32.7%.

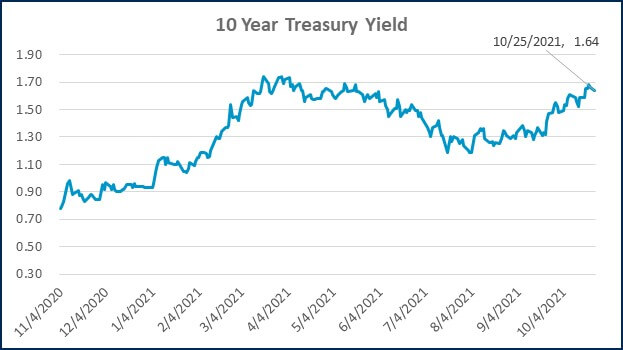

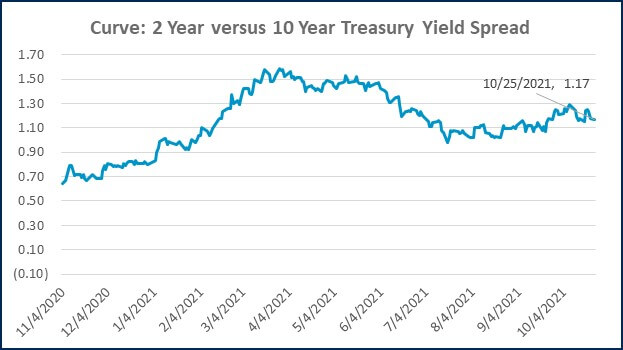

- The yield on the 10-year Treasury has increased from 0.93% to 1.64% in 2021 through Monday’s close. The uptick in yields has put upward pressure on mortgage rates during the year. According to Freddie Mac, the national average 30-year fixed-rate mortgage has increased by 0.42% to 3.09% as of 10/21/21.

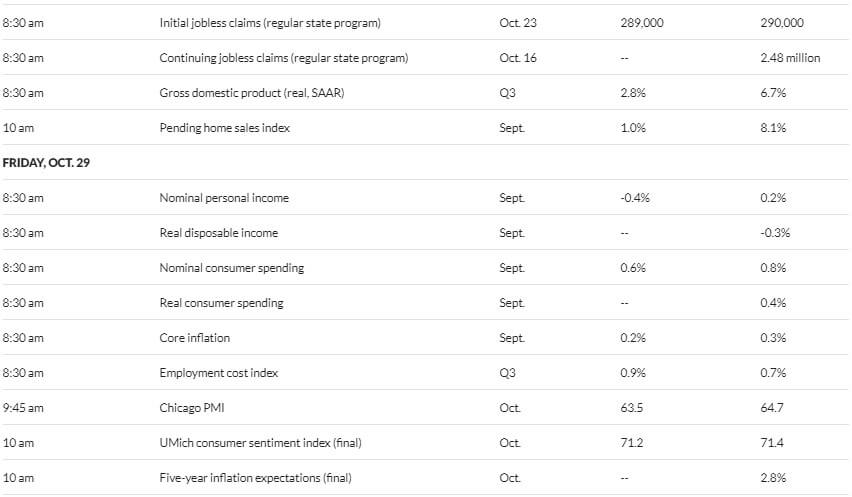

- This week will be busy with economic data releases. Look for durable goods orders on Wednesday, initial jobless claims and the first estimate of Q3 GDP on Thursday, and personal consumption expenditures and inflation expectations on Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Home Prices in August Hinted at Possible Cooling in the Market, S&P Case-Shiller Says (CNBC)

- U.S. Consumer Confidence Rebounds in October After Three Straight Declines (CNBC)

- Fed Prepares to Taper Stimulus Amid More Doubts on Inflation (WSJ)

Investing

- Bitcoin ETF’s Success Could Come at Fundholders’ Expense (WSJ)

- It Sounds Crazy (Morgan Housel)

- Inflation vs. Stock Market Returns (Ben Carlson)

Other

- What the Giant James Webb Telescope Will See That Hubble Can’t (Mashable)

- For the First Time, Drones Autonomously Attacked Humans. This is a Turning Point (Popular Mechanics)

- The Top New Features in Apple’s iOS 15 (Wired)

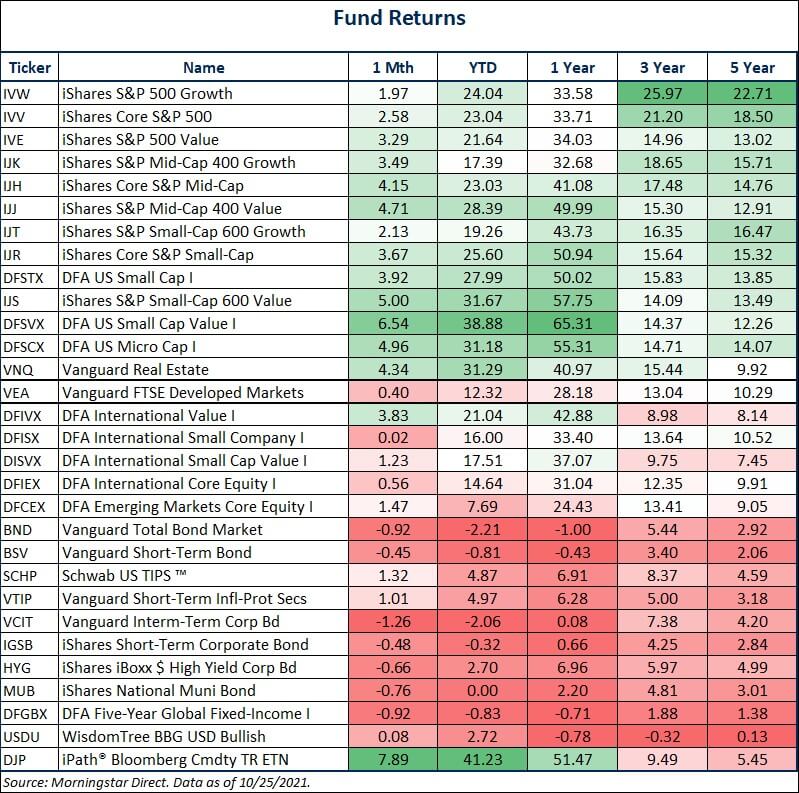

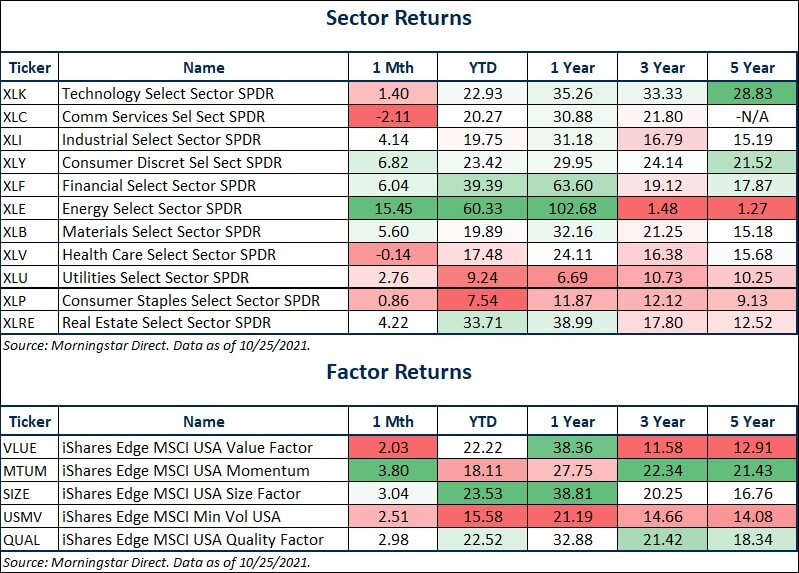

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

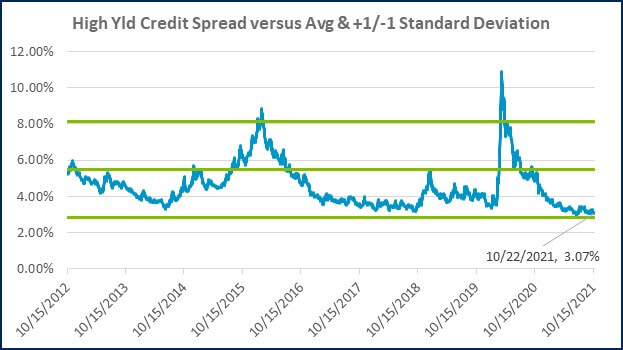

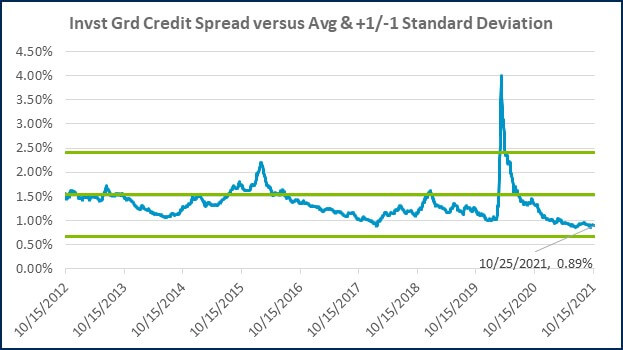

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Update: Tax Highlights of “The One, Big, Beautiful Bill”

From Seed to Scale: Tax & Operational Strategies for AgTech Startups

Case Study: A Smarter 401(k) Strategy for a Busy Doctor's Office

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)