What the Positive CPI Report Means for Investors + Financial market Update + 11.15.22

STORY OF THE WEEK

WHAT THE POSITIVE CPI REPORT MEANS FOR INVESTORS

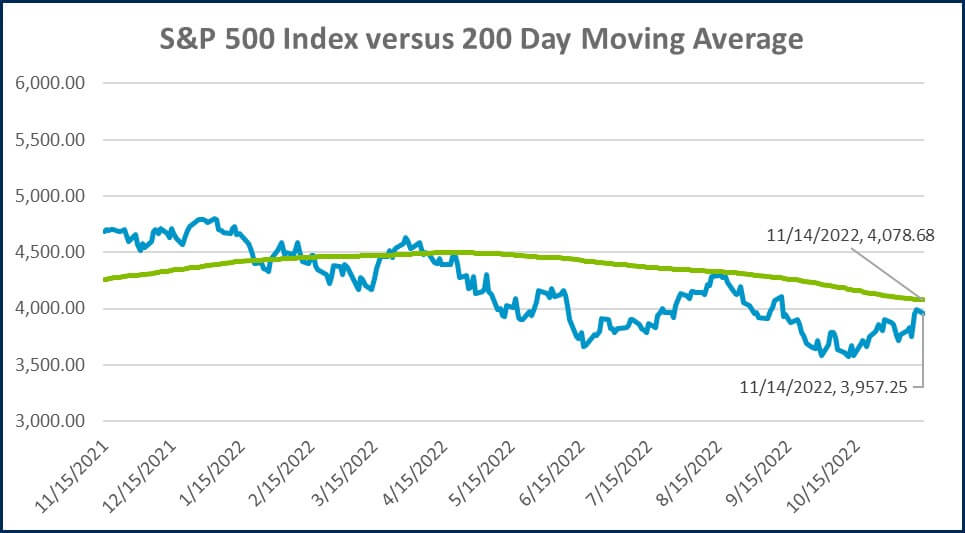

Last week the Bureau of Labor Statistics (BLS) published an update on inflation. The Consumer Price Index (CPI) data surprised the market, with the rate of price increases in October coming in lower than expected. The market responded in dramatic fashion, with the S&P 500 recording its highest single-day gain (+5.54%) since April 2020.

Much of the market’s reaction to the cooler than expected inflation print relates to its potential impact on the path of monetary policy. At the press conference following the most recent Federal Reserve (Fed) policy meeting, Chairman Jerome Powell framed the evolution of their fight against inflation as three questions:

- How fast to raise rates?

- How high to raise them?

- How long to leave them there?

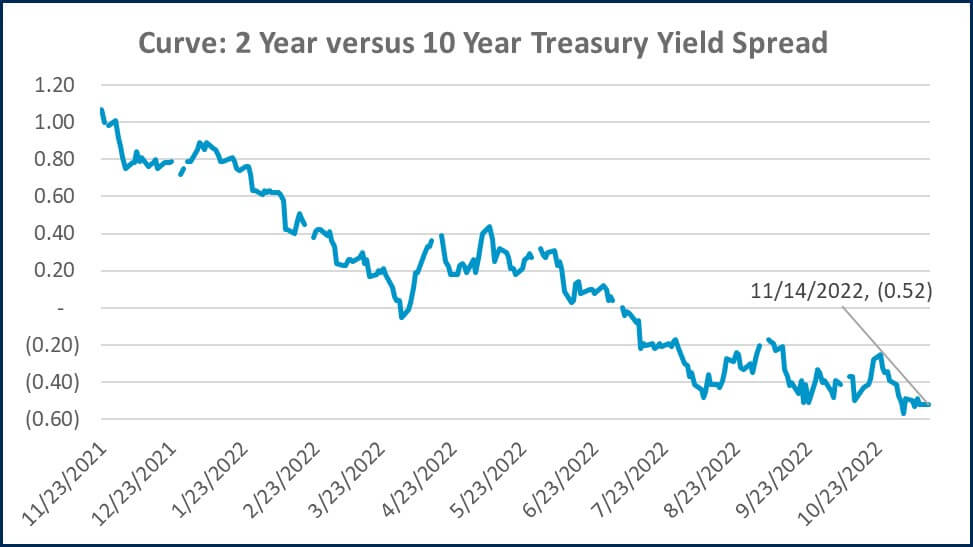

At this stage of the game, the answer to the first question has been well established. The Fed has lifted the benchmark federal funds rate at the fastest pace going back to the early 1980s, increasing it by 3.75% since March. How high the Fed will ultimately raise rates is arguably much more important moving forward.

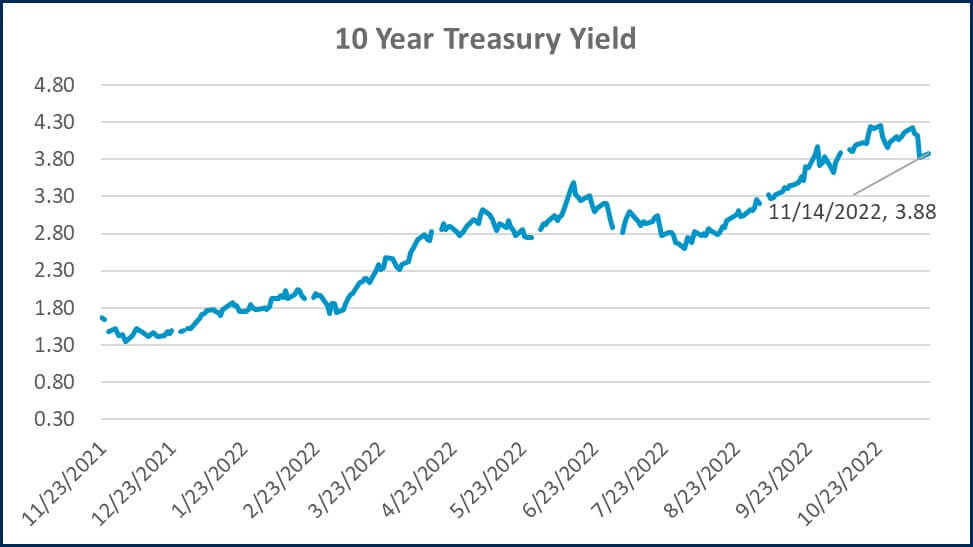

The cooler than expected inflation data has potentially (but not certainly) provided some evidence that inflation has peaked and is rolling over. The implication here is that the Fed may not have to raise interest rates as high as previously thought, which means less breaking power applied to the economy. The prospect of this sent bond yields tumbling and stock pricing skyrocketing last week.

The peak level for fed funds during a given cycle is often referred to as the ‘terminal rate.’ The question of how high to raise interest rates can then be translated to: what will the terminal rate be? There are a couple of ways to see an estimate for the expected terminal rate:

Ironically, the market-based measure has been more accurate in recent cycles, even though the Fed officials making those forecasts are the people with direct control over the rate! During the prior few tightening cycles, the Fed consistently overestimated how high they would be able to raise rates. During the current cycle, they have consistently underestimated it. Each of the three SEPs published thus far in 2022 came with sizable upward revisions to the Fed’s forecasted path of the fed funds rate.

Following the CPI print last week, the market-based measure of the terminal rate declined, although it remains above the last Fed Forecast. The Fed will publish its next SEP following the next meeting, which concludes on December 14th. The market will be watching closely for changes to their forecast.

Despite the market’s joyous reaction to the CPI report, investors would do well not to get carried away with this news. While the report was undoubtedly a positive development, economic data is notoriously noisy, and one data point does not equal a trend. The July CPI report was similarly low on a month-over-month basis, only to be followed by multiple months of elevated readings.

Additionally, The Fed’s message at the last press conference was that despite the expected slowdown in the pace of rate hikes, it was premature to think about pausing rate increases altogether. The Fed has continued to deliver that message this week, saying they have a ‘ways to go’ before rate hikes are done.

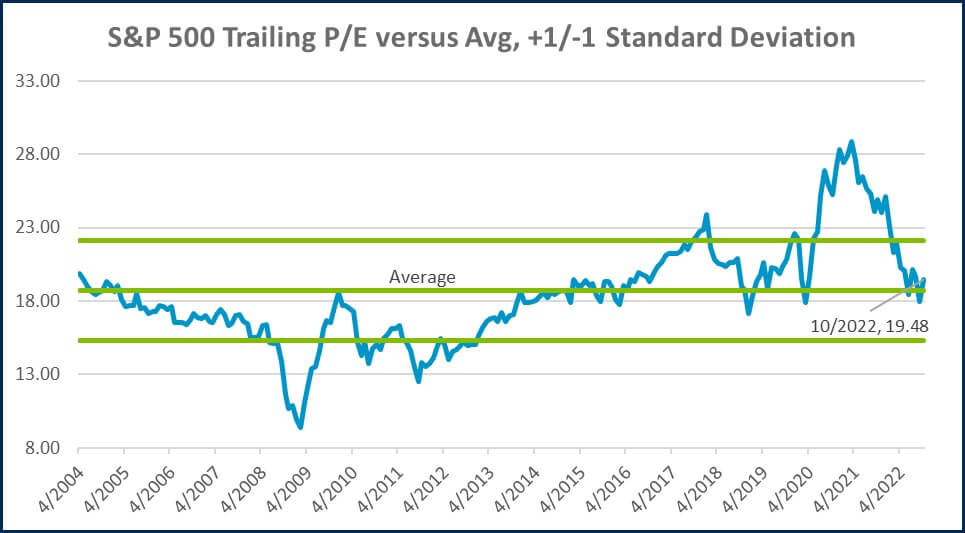

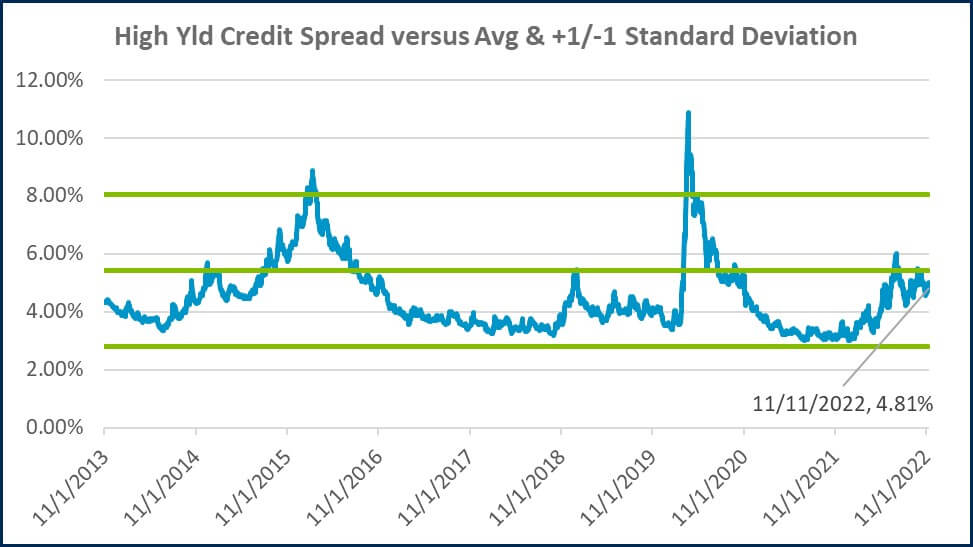

Finally, the prospect that the Fed’s policy path puts the economy into a recession remains a very real possibility. That kind of slowdown in economic activity would likely put pressure on stock earnings, which would, in turn, put pressure on stock prices. While stock valuations have come down dramatically from the 2021 highs, they still aren’t necessarily cheap for the S&P 500. It’s unclear exactly how much bad news is being priced in. Ultimately, the path forward remains highly uncertain, and the markets will likely remain volatile. The best course of action for investors is to stay diversified and not allow market sentiment (positive or negative) to derail your long-term plan.

WEEK IN REVIEW

- The top story from last week was the Consumer Price Index (CPI) data published before the market opened on Thursday. The report, published by the Bureau of Labor Statistics (BLS), showed that inflation increased in October at a slower rate than anticipated. The headline figure increased 0.4% MoM vs. expectations of a 0.6% increase (7.7% YoY vs. expected 7.9%). Core CPI, which excludes the volatile food and energy categories, increased by 0.3% MoM vs. expectations of a 0.5% increase (6.3% YoY vs. expected 6.5%). Used cars and trucks, apparel, and medical care services all declined during October and contributed to the cooler than expected figures.

- Market prices jumped following the inflation report. The S&P 500 gained 5.5% on the day, while the yield on the 10-Year Treasury declined 0.3%. The fed fund futures market is now pricing in an 80% chance that the Fed will only hike 0.5% at the next FOMC meeting (12/14). A few Federal Reserve officials have made public comments in the last couple of days urging the market not to overreact to the positive news, suggesting the Fed has more to do to ensure inflation is under control.

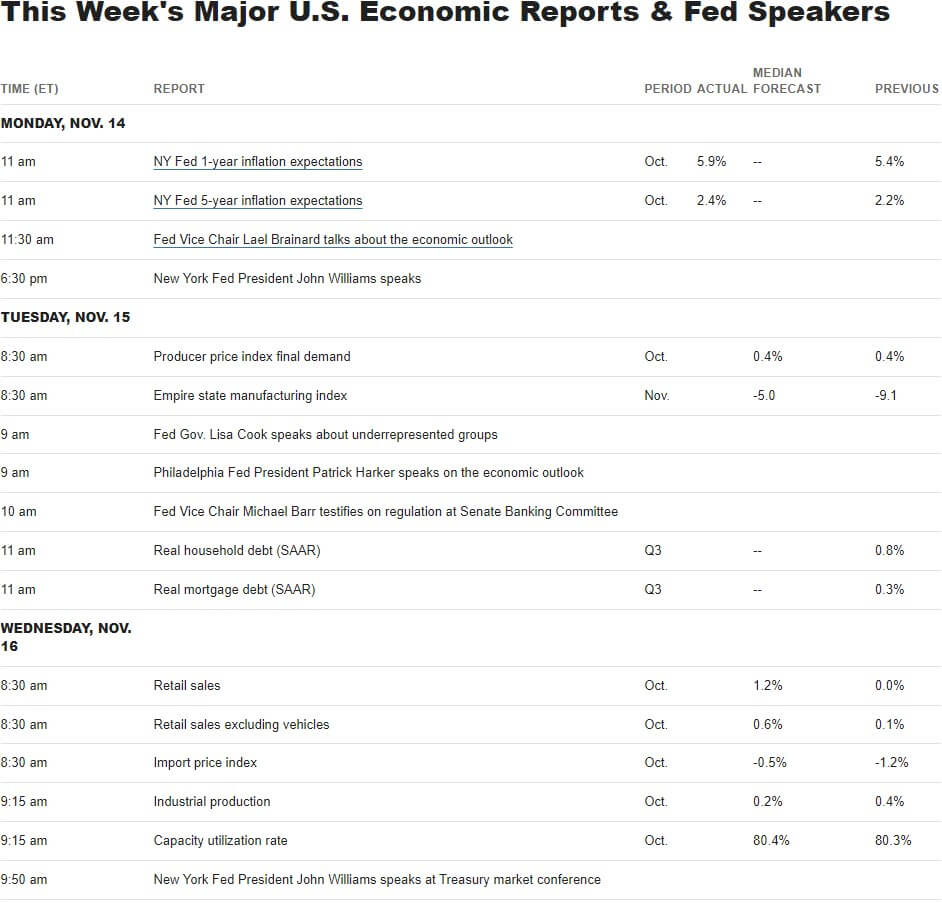

- Economic data to be published this week includes retail sales and industrial production on Wednesday, jobless claims (a proxy for layoffs) on Thursday, and existing home sales and the Index of Leading Economic Indicators on Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Consumer Prices Rose 0.4% in October, Less than Expected, as Inflation Eases (CNBC)

- Fed Official Warns Inflation Fight Has ‘Ways to Go’ (WSJ)

- Move Over, Inflation: Here Comes the Earnings Crunch (WSJ)

Investing

- Important and Hard To Teach (Morgan Housel)

- The Optimal Spreadsheet Answer Is not Always The Best Solution for People (Adam Grossman)

- A comparison of Sam Bankman-Fried’s FTX vs a massive Fraud That Unraveled During the Great Depression (Ben Carlson)

Other

- Your Next Car Might Not Drive If You’ve Been Drinking (Axios)

- World Cup Predictions and Knockout Brackets (Sports Illustrated)

- What we learned After Testing a Chevy C8 Corvette Over 40,000 Miles (YouTube)

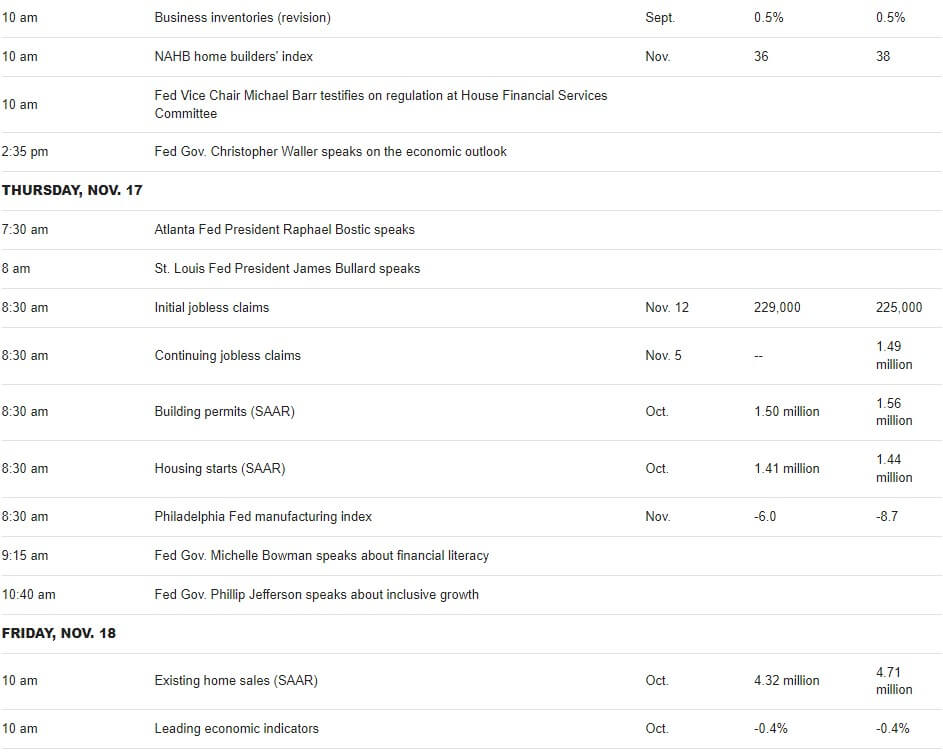

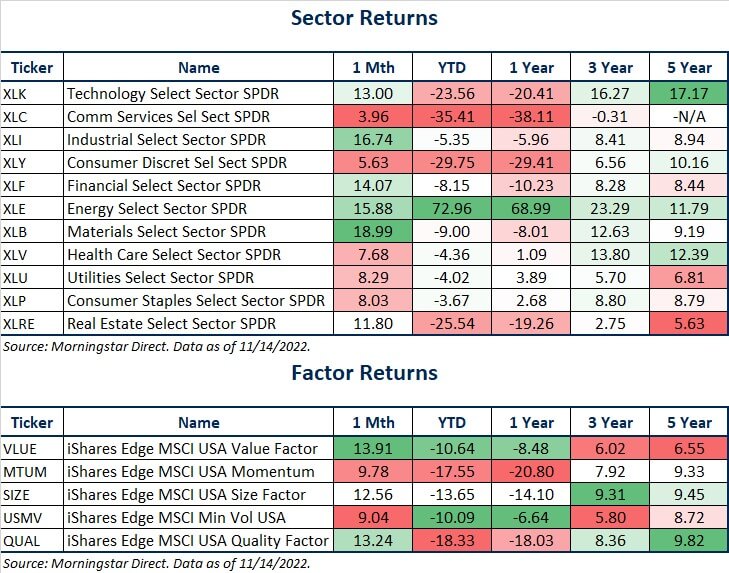

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

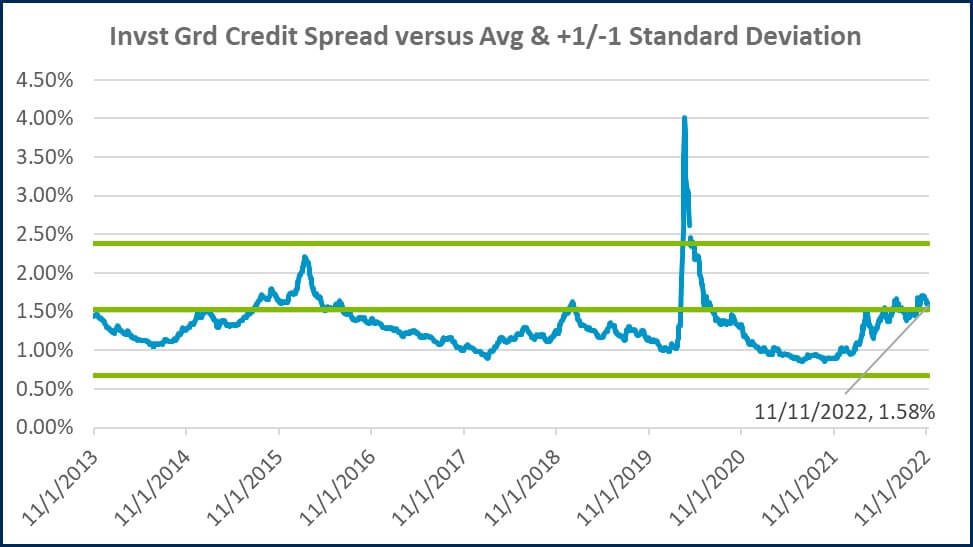

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)