Bitcoin Back in the Spotlight + Financial Market Update + 12.29.20

Over the last few months, Bitcoin has recaptured the imagination of investors. While risk assets, in general, have had a strong quarter, Bitcoin has been on another level entirely. Since the start of October, the price of the popular cryptocurrency has increased 154%. In the last two weeks alone, the price has increased by nearly $10,000, rocketing to a new all-time high. The previous peak, achieved in December of 2017, came courtesy of a similarly explosive rally. In the twelve months that followed, Bitcoin experienced a devastating selloff that reduced its value by 83%(1).

The recent rally has been propelled by several factors. There has been increased institutional backing for Bitcoin. Prominent Hedge Fund managers, including Stanley Druckenmiller and Paul Tudor Jones, have publicly indicated they have made purchases. A few corporations, including software company MicroStrategy and insurance giant MassMutual, have also made headlines after announcing they purchased Bitcoin into their corporate treasuries. Finally, fintech companies have made it considerably easier to purchase Bitcoin. Popular services, including those operated by PayPal, Square, and Robinhood, allow individuals to make a purchase with a few quick taps of their smartphone.

Another factor that has likely supported the rise in Bitcoin has been inflation. Global central banks have aggressively eased monetary policy in response to the pandemic induced economic slowdown. This has generated fears that a sharp rise in inflation will degrade the purchasing power of the US Dollar and other major currencies. The code that underpins Bitcoin, meanwhile, caps its total supply at 21 million. This feature is a cornerstone of the belief that Bitcoin offers a strong hedge against inflation, but more on that later.

Unsurprisingly, the soaring value of cryptocurrencies has once again piqued the interest of many individual investors. In order to assess whether Bitcoin is suitable as an investment, it would be informative to compare it to other traditional investments. In a paper published just days before the 2017 Bitcoin peak, Dimensional Fund Advisors (DFA) went through such an exercise(2). The excerpt below summarizes the comparison:

When a company issues stock, it offers investors a residual claim on its future profits. When a company issues a bond, it offers investors a promised stream of future cash flows, including the repayment of principal when the bond matures. The price of a stock or bond reflects the return investors demand to exchange their cash today for an uncertain but greater amount of expected cash in the future. One important role these securities play in a portfolio is to provide positive expected returns by allowing investors to share in the future profits earned by corporations globally. By investing in stocks and bonds today, you expect to grow your wealth and enable greater consumption tomorrow.

Holding cash does not provide an expected stream of future cash flow. One US dollar in your wallet today does not entitle you to more dollars in the future. The same logic applies to holding other fiat currencies — and holding Bitcoins in a digital wallet.

The fact that stocks and bonds generally produce a positive cash flow is the critical differentiator. Similar to gold, Beanie Babies, and tulips, Bitcoin does not generate any cash flow. The entire investment thesis for Bitcoin revolves around the belief (hope) that someone will be willing to pay you more than your initial purchase price on some date in the future. Unfortunately, an investment strategy based on hope is merely speculation. This simple but powerful reason for avoiding cryptocurrencies will likely not be heeded by everyone. The allure of a potential rapid increase in wealth can elicit emotions that are difficult to suppress.

If you are determined to purchase Bitcoin, there are a few additional things you should consider:

- Determine an appropriate position size. A widely accepted practice for doing this is to hold assets in proportion to their total market value. This idea is the basis for popular market cap indices, including the S&P 500. The total market value of Bitcoin is about $493 billion(3), compared to the global stock market value of $95 trillion(4) and the global bond market value of $106 trillion(4). This would suggest an appropriate position size for Bitcoin of no more than 0.25% of an investor’s portfolio.

- The idea that bitcoin has a finite supply is a common thesis for its use as a hedge against inflation. This logic fails to consider that Bitcoin is just one among thousands of different cryptocurrencies, the supply of which is essentially limitless. Additionally, the US has not experienced high inflation since the creation of Bitcoin, so the jury is still out. Also, there are some studies that question whether Bitcoin will prove an effective hedge(5).

- There is risk associated with Bitcoin storage. Some estimates suggest that as much as 4 million Bitcoin have been permanently lost due to broken computers, lost private keys, or otherwise inaccessible wallets(6).

- There is risk of regulation. While no one entity controls Bitcoin or the underlying blockchain, the government has power over many of the gatekeepers that are helping to make it mainstream. This includes the exchanges and other apps like PayPal, Robinhood, and Cash App.

- Transacting in Bitcoin can be accompanied by high fees, wide spreads, and potential tax consequences. In 2014, the IRS issued IRS Notice 2014-21, which established “virtual currencies” as property for Federal income tax purposes. Among other things, this means that sellers of Bitcoin must recognize a capital gain or loss on the sale.

After spending a few years in relative obscurity (an 83% loss of value will do that to you), Bitcoin’s blistering rally has it once again dominating the headlines. Our view is that there is no basis for an expected return because Bitcoin does not produce any cashflows. The ability to make money rests solely on the hope that another buyer will come along and be willing to pay a higher price in the future. While this is certainly possible, this represents a gamble rather than an investment.

1.. Source: Koyfin. Bitcoin price and return data represented by BTCUSD.

2. “To Bit or Not to Bit: What Should Investors Make of Bitcoin Mania?” Dimensional Fund Advisors, 14 Dec. 2017, https://www.mydimensional.com/to-bit-or-not-to-bit

3. Source: Coinmarketcap.com

4. Source: SIFMA Capital Markets Factbook 2020

5. Erb, Claude B., Bitcoin is Exactly Like Gold Except When it Isn’t (December 14, 2020). Available at SSRN: https://ssrn.com/abstract=

6. Source: Chainalysis

WEEK IN REVIEW

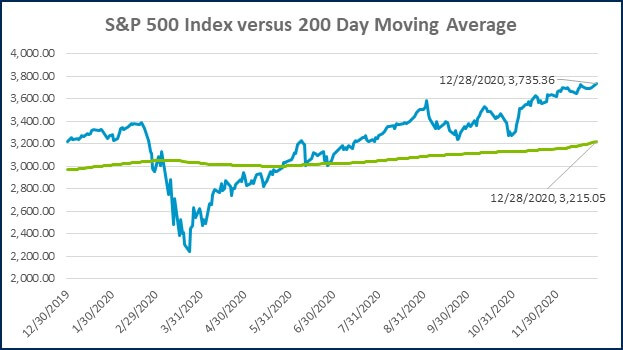

- It has been an excellent quarter for the equity markets, with major US stock indices at or near record highs as of the close on Monday. There are only three more trading days left in 2020 including today, although the market is down slightly as of this writing.

- President Trump signed the Pandemic Relief Bill on Sunday, which will provide $900 billion of aid and fund the government through September. The House subsequently passed a bill that would increase the stimulus checks for individuals from $600 to $2,000 on Monday. On Tuesday an attempt in the Senate to call a vote on an increase to the stimulus amount was blocked.

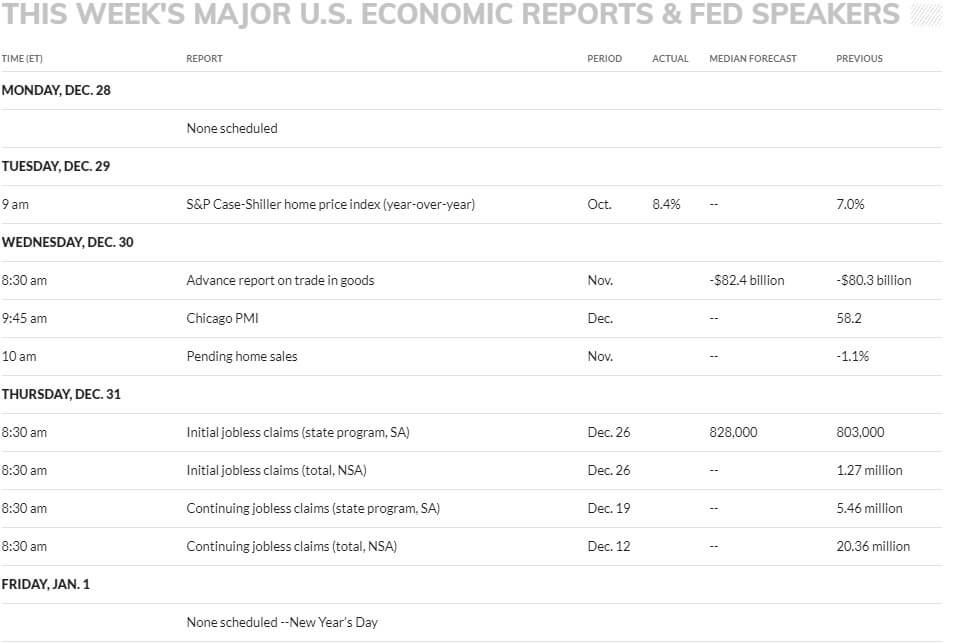

- The final week of the year is light in terms of economic data releases. This morning the S&P Case-Shiller Home Price Index showed the fastest rate of home price appreciation in six years. Tomorrow we will get an update on pending home sales. On Thursday, look for an update on jobless claims. The market will be closed on Friday for New Year’s Day, and there will be no economic data published that day.

HOT READS

Markets

- U.S. Home Prices Rise at Fastest Pace in More than 6 Years (CNBC)

- How the 2020 QE Boom Might Trip Up Central Bankers (WSJ)

- Pandemic Reshapes U.S. Employment, Speeding Changes Across Industries (WSJ)

Investing

- Last Man Standing (Morgan Housel)

- A Short History of Chasing The Best Performing Funds (Ben Carlson)

- Do Individual Investors Trade on Investment-Related Internet Postings? (Alpha Architect)

Other

- The Best Books I read in 2020 (Ben Carlson)

- You Got a New iPhone 12 For The Holidays – Here Are The First Things You Should Do (CNBC)

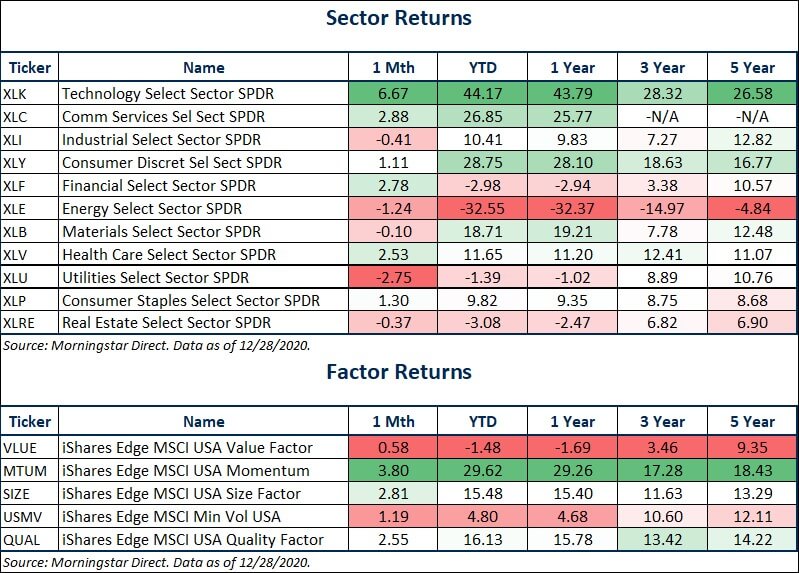

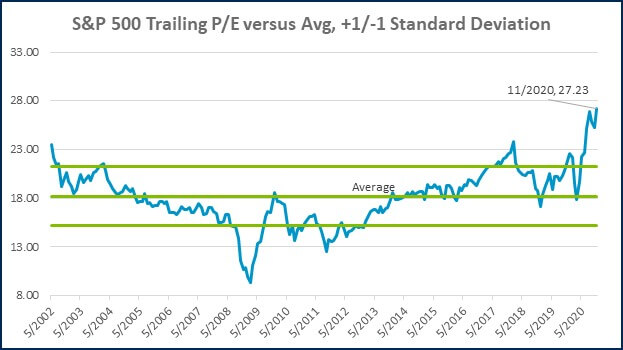

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

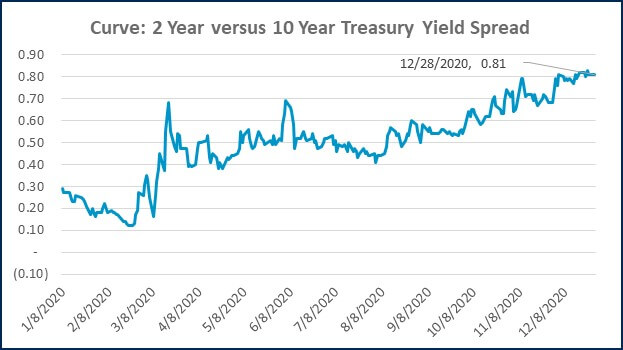

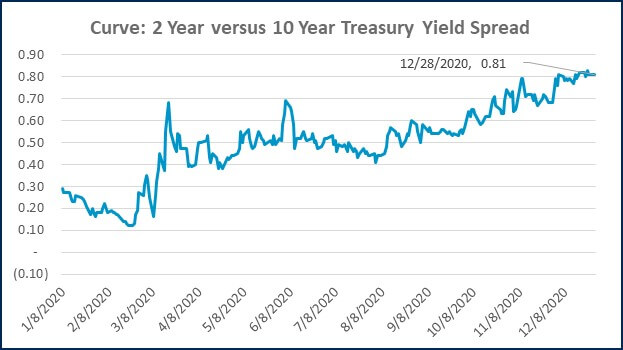

Source: Treasury.gov

Source: Treasury.gov

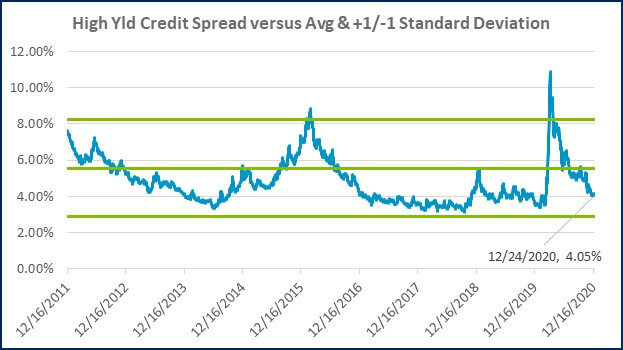

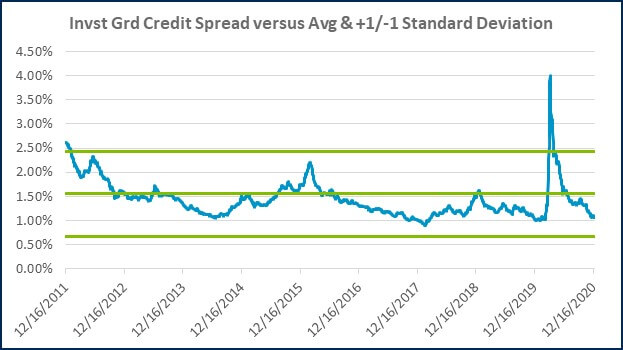

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

ECONOMIC CALENDAR

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)