The Fed Policy Shift and What it Means for You + Market Update + 3.22.22

Last Wednesday, the Federal Reserve increased its benchmark federal funds rate, a move that was widely expected by the market. The 0.25% change reflects the first increase in interest rates since 2018 and comes at a time when the pace of inflation is substantially higher than the Fed’s 2% target. Here is an overview of the Federal Reserve’s recent policy shift and what it could mean for investors.

The Federal Reserve sets monetary policy through its Federal Open Market Committee (FOMC), which meets every six weeks. Upon the conclusion of its most recent meeting last Wednesday, the Fed announced that it was lifting its benchmark federal funds rate to a range between 0.25% and 0.50%. This marks a shift from the ultra-accommodative stance the Fed took to support the economy during the pandemic. Additionally, the Fed announced its intention to begin shrinking its balance sheet by unwinding asset purchases at a steady pace beginning at the next meeting.

The Fed does not like to surprise the market. Catching it off guard with an unexpected policy move can introduce painful volatility and disruption. Instead, it uses a tool commonly referred to as ‘forward guidance.’ This effectively equates to telegraphing expected moves, which allows prices to adjust in advance in a relatively orderly fashion. At the prior FOMC meeting in January, Fed officials essentially told the market it would begin tightening policy at the March meeting. It did this to satisfy its dual mandate of:

- Price stability – defined as 2% inflation on average.

- Maximum employment – Note this does not mean 0.0% unemployment. Maximum employment refers to the level of employment the economy can sustain without generating unwanted inflation. Maximum employment is not directly measurable and is loosely determined by considering a wide variety of measures, including the unemployment rate.

A major challenge the Fed must confront in achieving its dual mandate is that actions taken to support one generally move the other in an undesirable direction. This occurs because boosting the labor market has historically led to higher inflation while fighting inflation generally crimps the labor market.

The labor market’s recovery from the Financial Crisis in 2008 was painfully slow for years. By late 2019 and early 2020, however, the unemployment rate had reached the lowest level since the 1960s. Despite that considerable strength, core inflation never sustainably reached the Fed’s 2.0% target. This led many economists to question the historical relationship between inflation and employment. Some even criticized the Fed for raising interest rates too early. Fast forward to the start of the pandemic, and the level of unemployment was staggering. Whereas the unemployment rate peaked at 10.0% following the Financial Crisis, it hit 14.7% during the pandemic lockdowns. Almost 50% higher than it was during the worst recession since the Great Depression!

This time around, the Fed prioritized its full employment mandate. It switched its approach for price stability to ‘average inflation targeting,’ which effectively meant they were comfortable allowing inflation to briefly run hot so long as it averaged 2.0% over time. This would give it more leeway in supporting the labor market.

The current bout of accelerating inflation was initially believed to have been caused by transitory factors, including the supply-chain bottlenecks that emerged following the reopening of the economy from pandemic lockdowns. The rate of inflation and the improvement in the labor market seem to have each progressed faster than the Fed likely expected. As a result, the Fed has accelerated its anticipated pace of policy tightening.

Every 12 weeks (roughly quarterly), the Fed produces a document called the Summary of Economic Projections (SEP). Among other things, it illustrates the median estimate of where the benchmark federal funds rate will be over the course of the next few years. When the SEP was published last September, the Fed was projecting just one 0.25% hike in 2022. By December, it was projecting three 0.25% hikes. The SEP published last week showed a forecast of seven 0.25% hikes!

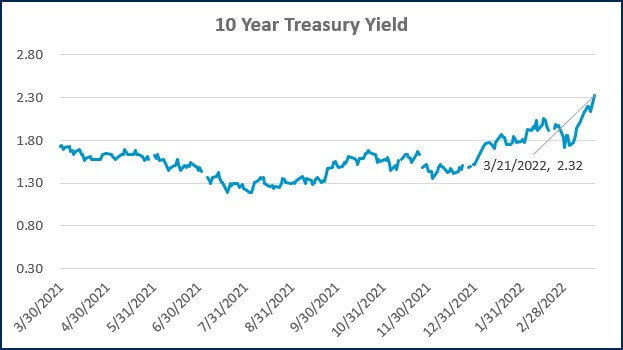

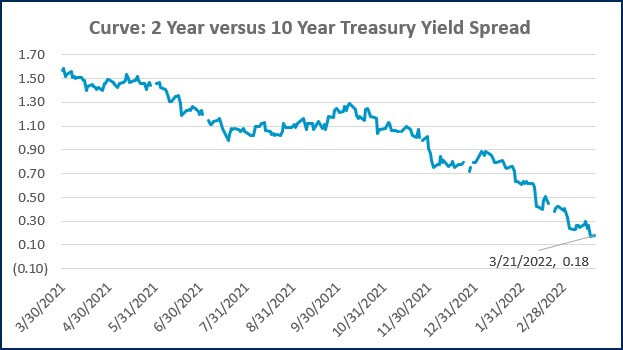

Based on data from the CME group, the bond market likely believes the Fed is doing too little too late. Prices for fed fund futures currently reflect a scenario where the Fed must hike even more than it is currently projecting. As of this morning, the market is pricing in nine hikes in 2022, which would leave the benchmark rate at 2.25% to 2.50%. For context, the tightening cycle that occurred following the Financial Crisis lasted three years, peaking at that same level.

There are a variety of ways investors may feel the reverberations of the Fed’s policy shift, some of which may occur with a substantial time lag. These include:

- Rising mortgage rates. According to Freddie Mac, the 30 Year Fixed Rate Mortgage Average in the US increased from 3.11% at the end of 2021 to 4.16% as of 3/17/2022.

- Increased borrowing rates on other items, including business and personal loans, credit cards, and vehicle leases.

- Higher savings rates! A positive for savers, though cash investments will likely lose value after inflation for the foreseeable future.

- Pressure on bond investments. This can be painful upfront, but the ability to reinvest principal and interest at higher rates leads to higher expected returns in the long-term.

- Declining inflation and a potential slowdown in economic activity.

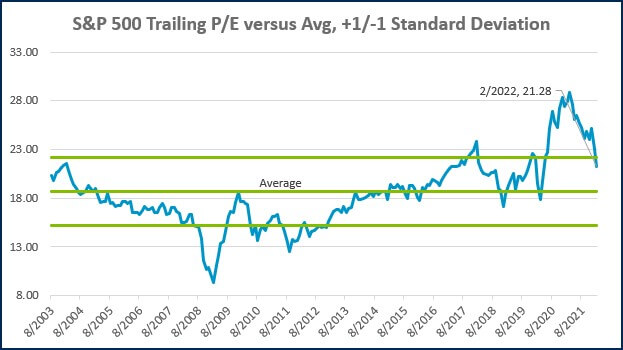

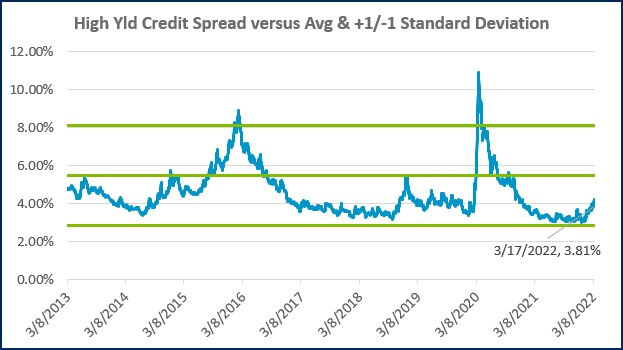

- Potential pressure on the stock market, particularly high-growth technology companies. Low interest rates have supported high stock valuations in recent years. Strong earnings growth, however, has been moving the market rapidly towards fair valuation.

Ultimately, the Federal Reserve is trying to engineer what is commonly referred to as a soft landing. This equates to getting inflation under control without pushing the economy into a recession. It is unclear whether they will be successful in this endeavor. Either way, getting inflation under control and moving bond yields toward historically normal levels would each be positive for investors long-term. Most economists believe the economy has enough momentum to avoid a recession in the near term. Of course, it’s impossible to know what the future has in store. Being appropriately diversified puts investors in the best position to participate if things continue to go well and mitigate some downside risk if they don’t.

WEEK IN REVIEW

- The top story moving markets over the last week relates to the Fed’s decision to raise rates for the first time since 2018. Based on their Summary of Economic Projections, the Fed is projecting seven hikes in 2022 (up from 3 last December). According to CME data, fed fund futures are pricing in 9 total hikes for the year, including a 0.50% hike at the next meeting in May. If the Fed were to raise rates by a larger than 0.25% increment, it would be the first time it has done so since the 2004-06 hiking cycle.

- Retail sales data published last week showed consumer activity remains strong. While the 0.3% MoM figure slightly missed economist expectations of 0.4%, retail sales are 17.6% from a year ago. Additionally, there were some upward revisions to prior period figures.

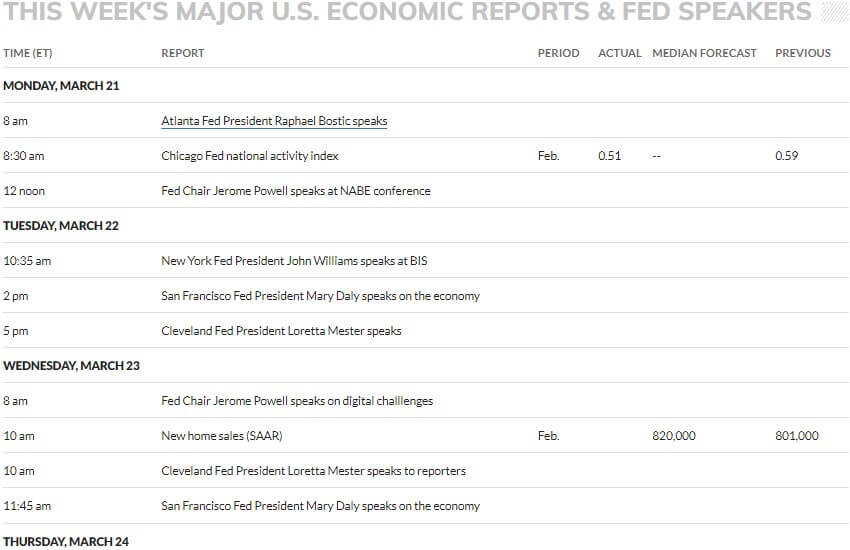

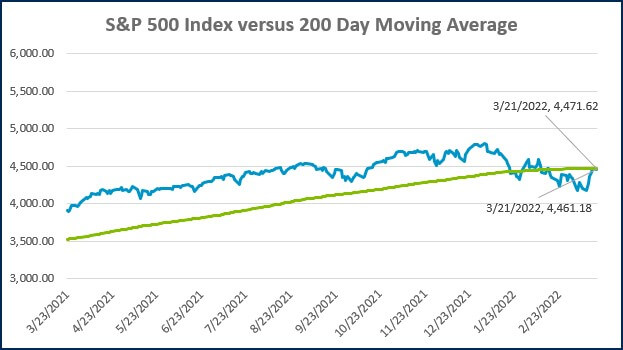

- There will be a large number of Fed officials speaking to the media throughout the week as they continue to try and frame recent and expected policy moves. On the economic data front, look for jobless claims, durable goods orders, and an early look at services and manufacturing sector activity on Thursday. On Friday, we will get consumer sentiment, 5-year inflation expectations, and pending home sales.

HOT READS

Markets

- Powell Says ‘Inflation is Much Too High’ and the Fed Will Take ‘Necessary Steps’ To Address (CNBC)

- Why the Federal Reserve Raises Interest Rates to Combat Inflation (CNBC)

- Mortgage Rates Are Surging Faster Than Expected, Prompting Economists to Lower Their Home Sales Forecasts (CNBC)

Investing

- Low Expectations (Morgan Housel)

- So Much Losing (Humble Dollar)

- What Happens When You Buy Stocks in a Bear Market (Ben Carlson)

Other

- Can We Untie Real Estate and Employment (Barry Ritholtz)

- Where is Russia’s Cyberwar? Researchers Decipher Its Strategy (Scientific American)

- 5G Drains Your iPhone’s Battery. Here’s What You Can Do About It (WSJ)

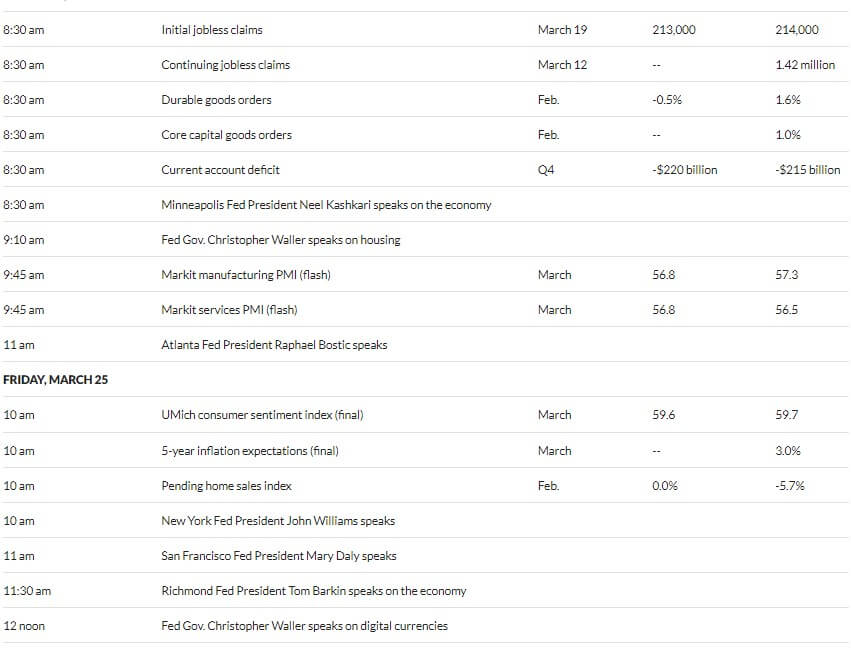

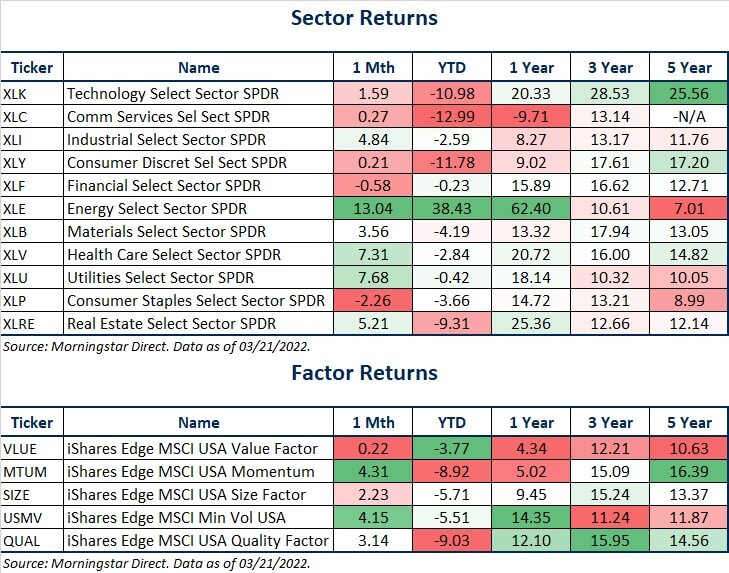

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

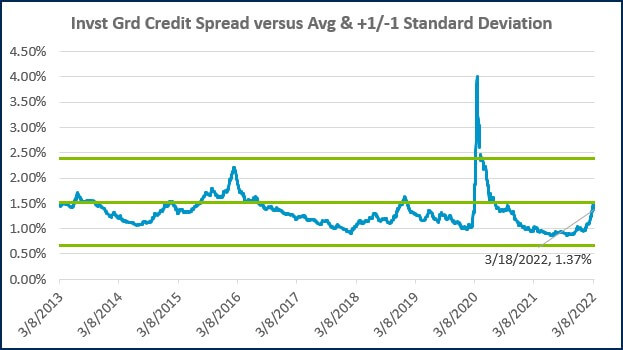

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

ECONOMIC CALENDAR

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Lutz Named Gold Winner in Quantum Workplace's 2025 Employee Voice Award

Update: Tax Highlights of “The One, Big, Beautiful Bill”

From Seed to Scale: Tax & Operational Strategies for AgTech Startups

Case Study: A Smarter 401(k) Strategy for a Busy Doctor's Office

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)