Putting the Cryptocurrency Selloff Into Perspective + Market Update + 6.21.22

With the markets experiencing significant volatility these days, it seems as if no asset class has been spared, except many commodities. Some of these asset deteriorations have knock-on effects for other assets as they are inputs or parts of a whole. For example, the fall of bond prices (thus increases in yields) has caused an increase in mortgage rates, which in turn causes homebuilder stocks to fall and puts a damper on future home prices.

We have been asked a lot about what knock-on effect the cryptocurrency free-fall could have on the general economy and other markets. Could destabilization in that market cause other markets to de-stabilize?

It’s somewhat hard to disseminate the inner-plumbing of the crypto market as it relates to the normal economy. However, it is safe to say that a fall in crypto could cause a negative wealth effect on those who hold it. But how many people actually own crypto? The Pew Research Center conducted a survey in September of 2021 and found that 16% of U.S. adults surveyed had either invested in, traded, or used a cryptocurrency. Stunningly, 43% of men ages 18 to 29 say they have invested in, traded, or used a cryptocurrency. For comparison, Gallup found that 58% of Americans report they own stocks in the U.S. in 2022. That number rises to 89% of U.S. households owning stock who make $100,000 or more.

The total population as tracked by the U.S. Census Bureau counted 331.4 million people in 2020, with adults over 18 totaling 258.3 million in 2020. So, 16% of 258.3 million means that roughly 41 million people have invested in, traded, or used a cryptocurrency. So, what kind of wealth effect would result from more than 70% of the value being wiped over the course of the last year?

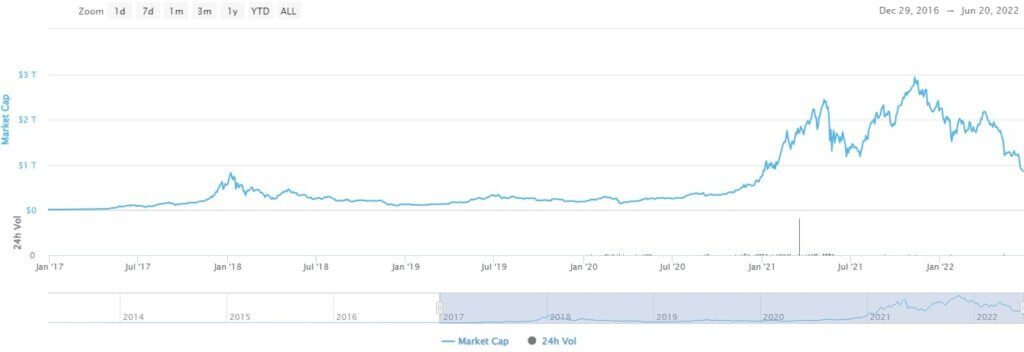

To do that, we probably need to examine the size of the crypto market. Coinmarketcap.com estimates the total cryptocurrency market cap. I would say that the term “market cap” is a misnomer, as traditional market cap is price multiplied by shares outstanding. The crypto market cap is basically the price of crypto multiplied by the number of coins in circulation. The number of coins in circulation is a bit dubious as well as many of these are marginal assets and potential frauds. It’s estimated that there are more than 18,000 different cryptocurrencies in circulation.

Total Cryptocurrency Market Cap

Source: Coinmarketcap.com

That said, you can see the total value of crypto was estimated at close to $3 trillion towards the end of 2021. Today, as of June 20, 2022, that value is closer to $1 trillion. So an estimated $2 trillion of value has, in a sense, evaporated in the last few months. While many of these losses were paper losses (and gains), there can be no doubt it has had a negative wealth effect for those who still hold it.

To compare, the U.S. public stock market had a market capitalization of more than $52 trillion as of 12/31/2021, and the world stock markets had a market cap of $124 trillion, according to SIFMA estimates.

Probably a better comparison is that of the world’s second most valuable company. At its peak market cap, Apple was worth almost $3 trillion at the end of 2021. It’s now worth roughly $2.1 trillion as of this writing. So, at their peaks, Apple and all the cryptocurrencies were worth roughly the same value.

So, in conclusion, the crypto market may seemingly catch a disproportionate amount of headlines for the size it really is. It is still a very large marketplace and contains some legitimized companies directly related to crypto (Coinbase, Robinhood, Microstrategy, etc.). However, putting it in perspective, it would be the size of one of the biggest companies in the United States. So, while it could contain some knock-on effects to the broader economy, it probably lacks a systematic concern because of its relative size in relation to the broader economy.

WEEK IN REVIEW

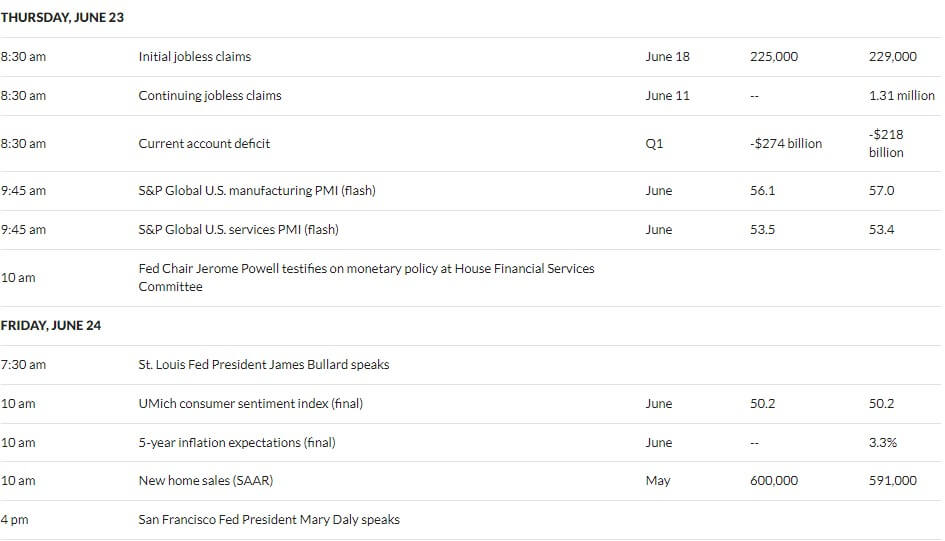

- The top story from last week came from the Federal Reserve’s 0.75% interest rate hike, which ranks as the largest single rate hike since 1994. The move increased the target range on the federal funds rate from 0.75%-1.00% to 1.50%-1.75%.

- The Federal Reserve had been signaling to the market that a 0.50% hike was likely, but that changed following the publication of the Consumer Price Index (CPI) report a few days ahead of the Fed Meeting.

- The CPI report revealed that inflationary pressures had not peaked as many had expected. Instead, it accelerated to a new 40-year high of 8.6% YoY. This caused the market to begin pricing in a 0.75% rate hike in the days leading up to the meeting.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Powell Vows that the Fed is ‘Acutely Focused’ on Bringing Down Inflation (CNBC)

- Fed Hikes its Benchmark Interest Rate by 0.75 Percentage Point, the Biggest Increase Since 1994 (CNBC)

- Inflation Collides With Growth Fears to Trigger Big Swings in the Bond Market (WSJ)

Investing

- A Quick Story About Athletes and Investors (Morgan Housel)

- How Long Does it Take For Stocks to Bottom in a Bear Market (Ben Carlson)

- How to Stand Up to a Bear Market (Jason Zweig)

Other

- Summer Solstice 2022: What to Know About the Longest Day of the Year (WSJ)

- Here Comes the Sun-to End Civilization (Wired)

- Why You Can’t Remember Being Born: A Look at ‘Infantile Amnesia’ (Scientific American)

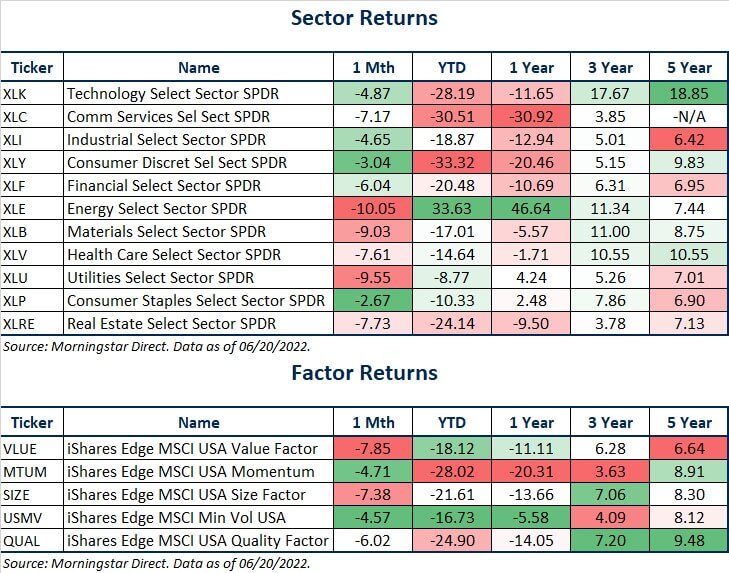

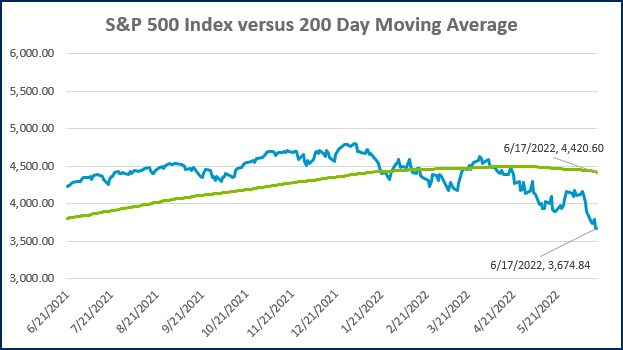

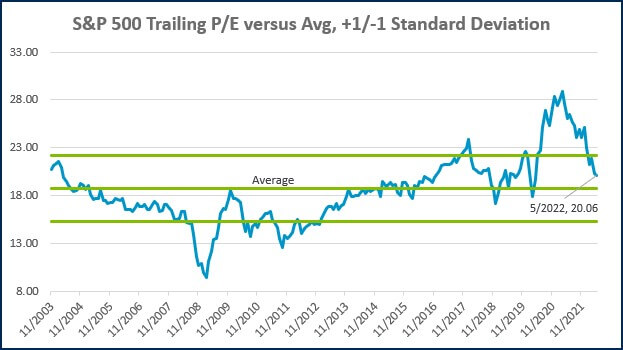

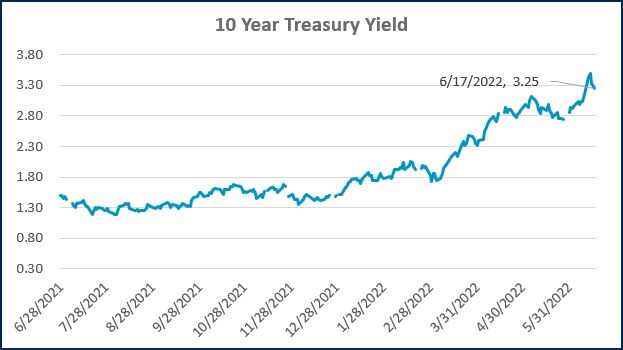

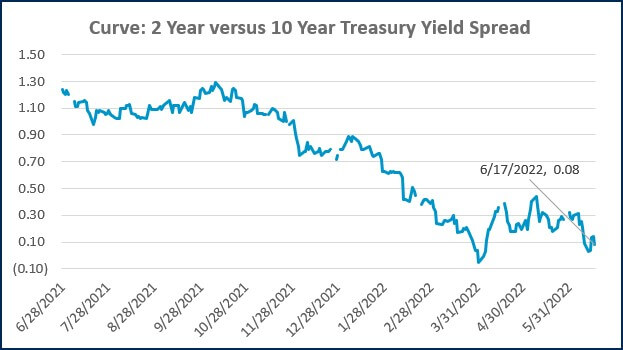

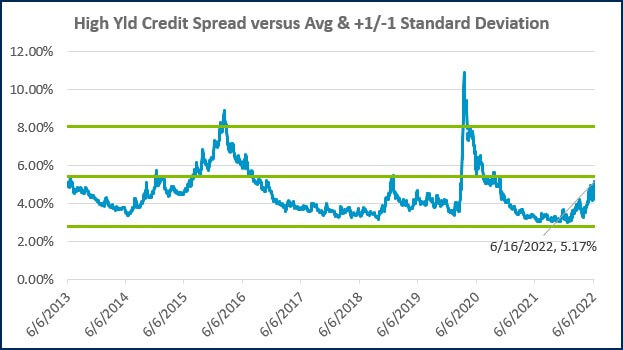

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

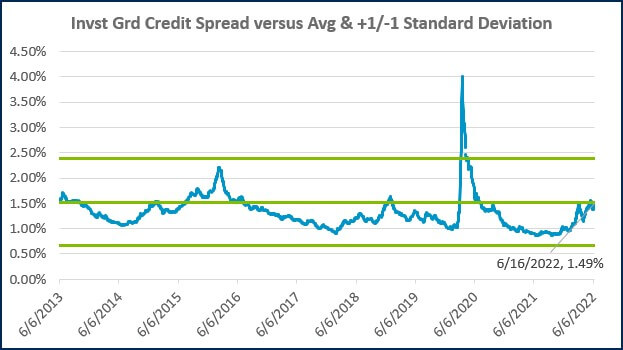

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)