Are We Already in a Recession? + Financial Market Update + 7.19.22

Fear of an economic slowdown has been growing as the Federal Reserve tightens monetary policy to combat inflation. A few market pundits have gone as far as to say the economy has already slipped into a recession. What exactly is a recession? Is it likely that we are already in one? And what are the implications for investors if we are?

A popular definition of a recession is at least two consecutive quarters of negative GDP growth. While there is likely considerable overlap between that simple definition and past recessions, it’s not actually the way they are determined. Instead, an organization called the National Bureau of Economic Research (NBER) is tasked with identifying when one has occurred. They define a recession as a ‘significant decline in economic activity that is spread across the economy and lasts more than a few months.’ Using a wide swath of economic data points, a committee of economists within NBER gets the final say on when an economic contraction is considered a recession. This suggests there is far more subjectivity at play than a simple formulaic rule of thumb might suggest.

The most recent recession was unusually brief and would not have met the consecutive negative quarters definition. In fact, it seems to contradict NBER’s own definition, which stipulates that the contraction must last longer than a few months. Ultimately, NBER labeled it as a recession anyway, given the severe magnitude of the contraction in economic activity.

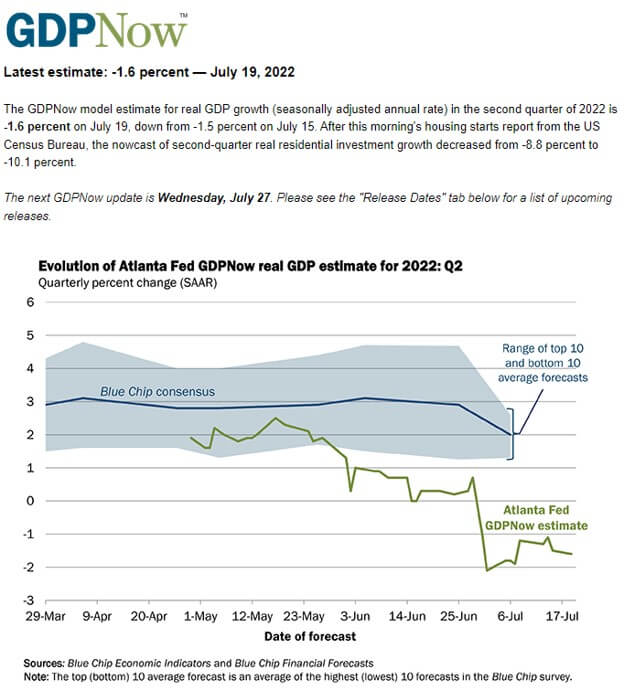

Those that contend we are already in a recession highlight the fact that GDP fell at an annualized rate of -1.6% in Q1 and point to expectations it will be negative again in Q2. According to the widely followed GDPNow model produced by the Federal Reserve Bank of Atlanta, the economy is currently projected to fall by another annualized -1.6% (as of 7/19). As discussed above, even if the current model projection proves to be accurate when the Bureau of Economic Analysis (BEA) publishes its preliminary Q2 GDP estimate next week, it doesn’t necessarily mean we are currently in a recession.

There are a variety of broad indicators that might suggest we are not currently experiencing a significant decline in economic activity. First, the labor market has continued to be strong. The U.S. has added 375 thousand jobs on average over the last three months, which represents robust job growth relative to the 10-year average of 150 thousand per month. Additionally, the unemployment rate has hovered at 3.6% since March, which is very near the lowest level since the 1960s.

There are other major indicators that corroborate the idea that the economy has continued to expand in 2022. For example, the Institute for Supply Management (ISM) publishes monthly readings on manufacturing and non-manufacturing activity. Throughout the year, both of these indices have maintained levels that are consistent with robust growth.

I’ll add the usual disclaimer here that I obviously don’t have a crystal ball and cannot say definitively that we are not currently in a recession. It just seems difficult to contend we are currently experiencing a significant decline in economic activity based on prevailing information. The data DOES support the idea that growth is decelerating, however. This makes the prospect of a recession occurring in the near-term seem like a very real possibility.

The three-month average of job gains, while currently elevated, has been trending lower for several months. Additionally, initial jobless claims, which are commonly used as a proxy for layoffs, have started to trend higher. Jobless claims are considered a ‘leading economic indicator,’ as changes in its trend have tended to presage shifts in economic momentum. Even the two ISM indices discussed above have displayed signs of slowing growth (not to be confused with an outright contraction) in recent months.

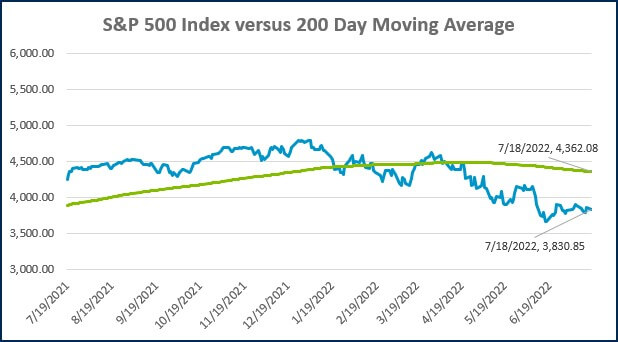

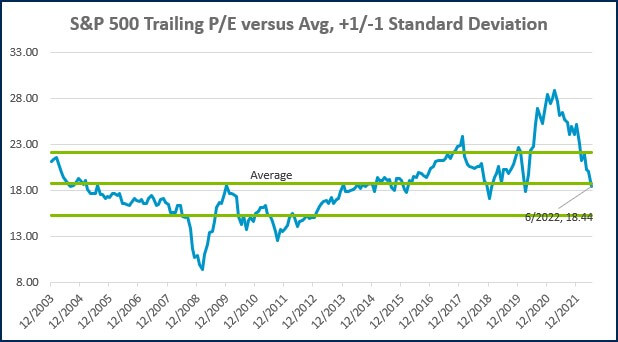

Another major leading economic indicator is the stock market itself. With the S&P 500 down nearly 20% year-to-date as of this writing, it has clearly taken note of the signs of deceleration. While economic data is backward-looking and is often reported with a considerable time lag, it is critical to understand that markets are forward-looking. Asset prices do not wait for the economic contraction to officially be announced before pricing it in. As a result, a disconnect between what appears to be happening in the real economy and what is happening with asset prices often arises. The chart below from Dimensional Fund Advisors provides a clear illustration of this.

Source: Dimensional Fund Advisors. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Business cycle peak and recession announcement dates sourced from the National Bureau of Economic Research. US market represented by the Fama/French Total US Market Research Index.

The chart highlights the last six recessions. The first column represents the month that economic growth peaked, with the implication that the following month was the beginning of a recession. The announcement month represents the month in which NBER officially declared that the economy had entered a recession. Notice the considerable lag time between the beginning of a recession and when the announcement finally came. Finally, the third column reflects when the stock market reached its low. This is the punchline of the chart. In four out of the last six recessions, the market had already bottomed by the time it was officially known the economy was even in one.

The main takeaway for investors is that stocks are forward-looking and often fall ahead of an economic contraction. This experience is uncomfortable because no matter how bad things get, it always feels like things will continue to get worse. Fortunately for investors, the flip side of the forward-looking coin is also true. Stock prices often see the light at the end of the tunnel and begin recovering long before the economy regains its footing.

WEEK IN REVIEW

- Data published last week showed inflation accelerated further in June, with the Consumer Price Index rising to 9.1% on a year-over-year basis. Core CPI, which excludes the volatile food and energy segments, increased at a 5.7% rate. The Federal Reserve’s next monetary policy meeting will conclude next Wednesday (7/27). The market is currently pricing in another 0.75% hike to the Federal Funds rate.

- Earnings season kicked off last week with a few of the nation’s largest banks reporting results. As of 6/30, earnings growth was projected to be 4% YoY, according to FactSet. With 7% of S&P 500 companies reporting Q2 results thus far, the growth rate for companies that have reported blended with the estimates for companies that have yet to report is currently 4.2%.

- Economic data to be published later this week includes initial jobless claims and the Index of Leading Economic Indicators on Thursday and a preliminary reading on July Manufacturing and Service sector activity on Friday.

HOT READS

Markets

- Payrolls Increased 372,000 in June, More Than Expected, as Jobs Market Defies Recession Fears (CNBC)

- Inflation Rose 9.1% in June, Even More than Expected, as Consumer Pressures Intensify (CNBC)

- Fed Officials Preparing to Lift Interest Rates by Another 0.75 Percentage Point (WSJ)

Investing

- Balancing Internal vs External Benchmarks (Morgan Housel)

- The Longest and Shortest Bear Markets (Ben Carlson)

- Hoarding Cash? Don’t Swing at Every Yield Pitch (Jason Zweig)

Other

- It Goes by the Name ‘Bedtime Procrastination’ and you Can Probably Guess What It Is (Scientific American)

- The $10 Billion Webb Telescope Has Been Permanently Damaged, Say Scientists (Forbes)

- As a Teen He Filmed His ‘Mighty Ducks’ Scenes at the LA Kings’ Arena. In His 30s He Slept on the Ground Outside (Sports Illustrated)

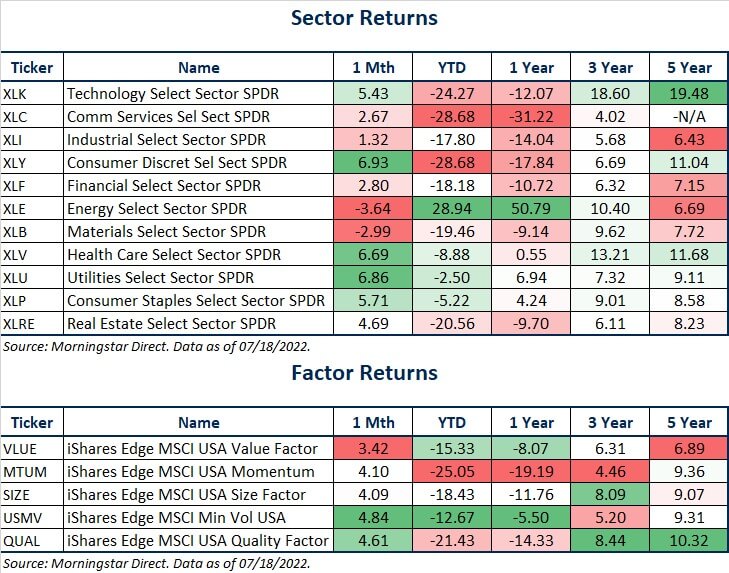

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

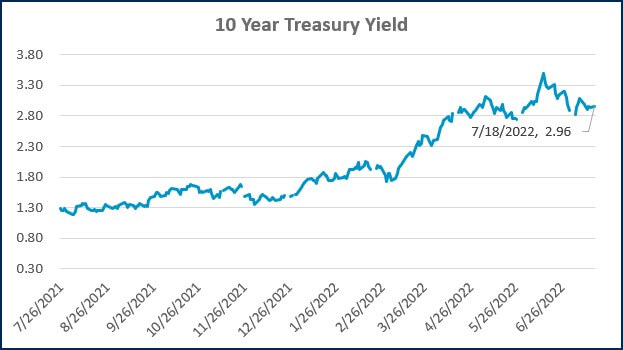

Source: Treasury.gov

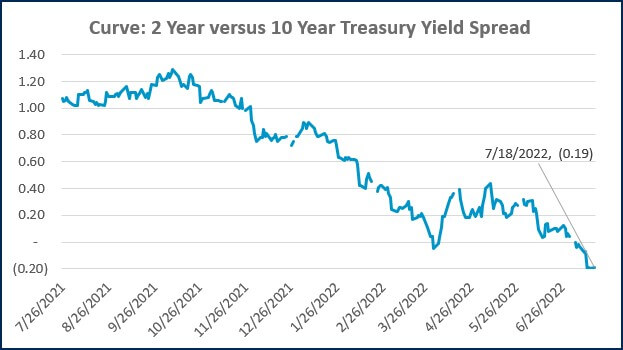

Source: Treasury.gov

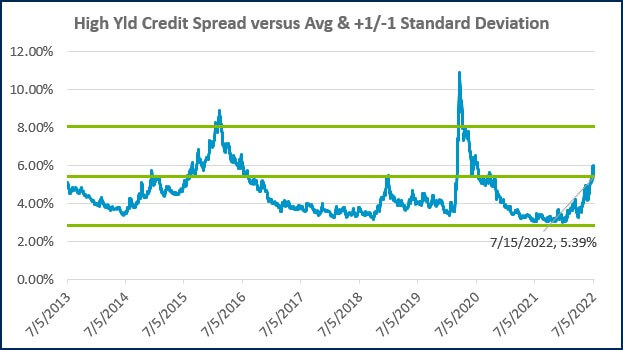

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

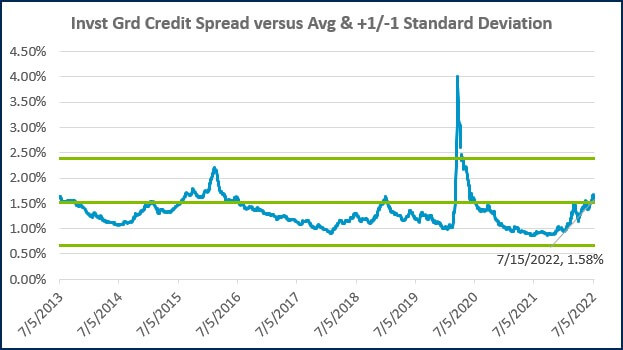

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

ECONOMIC CALENDAR

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)