Are Rising Yields Bad for the Bond Market? + Market Update + 8.2.22

It has been a challenging year for investors thus far, and it’s not all due to the stock market. Other asset classes have similarly experienced elevated levels of volatility in 2022. The bond market, for example, got off to one of the worst starts to a year in decades. Understandably, when an investment that typically has limited upside starts to experience some material downside, investors begin to question why they bother with it in the first place. Given the recent market turmoil, should investors rethink their bond allocations?

Spoiler alert… they most likely should not, as bonds play a critical role in a diversified portfolio. Bonds provide a crucial ballast to equity holdings as their return typically does not swing nearly as widely as stock returns. Additionally, they typically carry a very low, or even negative, correlation to stocks. This means that when one of the two zigs, the other often zags. The end result is a risk and return profile that generally becomes much more stable as the proportion of bonds to stocks increases. Combining these two asset classes allows an investor to calibrate the riskiness of their investments to match their unique situation.

The heightened volatility we have seen in the bond market this year has been a consequence of the Federal Reserve’s attempt to tamp down inflation. The Fed’s actions have pushed interest rates much higher very quickly. Bond prices move inversely with yields, so the rapid rise in yields has led to a startling decline in the value of bond portfolios.

Fortunately for investors, short-term pain in the bond market typically leads to long-term gains. The benefit comes from the fact that bondholders get to reinvest their ongoing interest payments at the increased yield levels. Over time, this benefit should more than compensate for the initial decline in value. The reverse is also true. While investors often cheer the impact of falling yields on their portfolio because, in the near term, their bonds are increasing in value, their future return prospects are also falling.

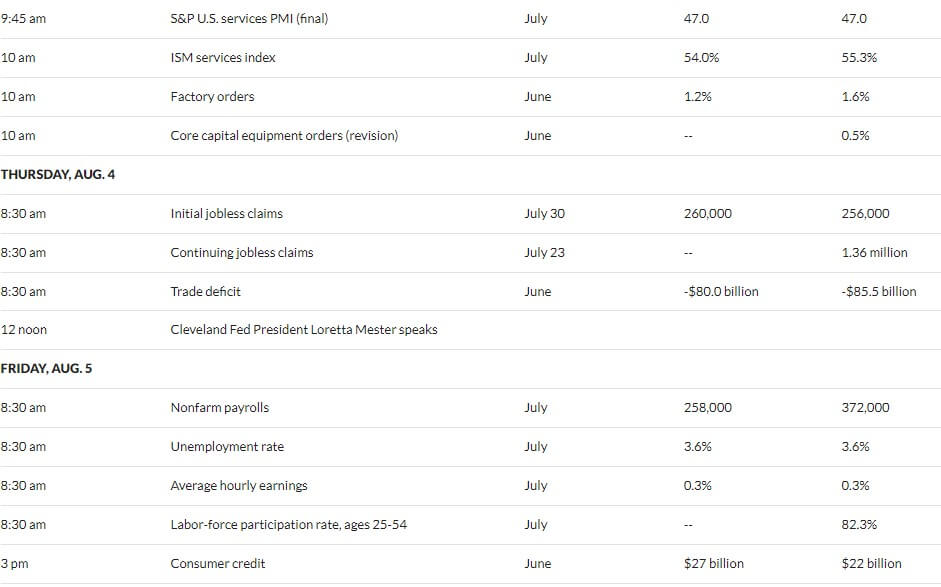

As the chart below illustrates, the relationship between changes in yield and the future return on bonds is quite strong. The blue line represents the yield on 5-Year Treasury bonds going back to the start of 1962. The green line represents the annualized return over the subsequent five years. While the lines are not perfectly in sync, they are clearly closely tied to each other. As the yield line rises (falls), the return over the next five years also increases (decreases).

Source: Morningstar Direct & the FRED database. The Yield is based on the Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, quoted on an investment basis. The 5-Year Forward Return is based on the IA SBBI Intermediate Term Bond Index.

The main takeaway is that investors should not fear rising rates. They should instead cheer them. Admittedly, the loss of value upfront can be painful, so this may be a little easier said than done. Still, the ability to reinvest at those new higher yields should ultimately make that initial drawdown worthwhile. Because of this, bonds are often referred to as the self-healing asset class.

WEEK IN REVIEW

- The second quarter earnings season continues to press on, with 56% of S&P 500 companies having reported results, according to FactSet. The blended earnings growth rate, using actual data from companies that have reported and expectations for those that have yet to report, has increased to 6.0%. Entering earnings season, earnings were expected to increase by 4.0%.

- Data published last week showed the economy generated negative GDP growth for the second consecutive quarter. While this meets a common (simplistic) definition of a recession, it does not definitively mean we are already in one. Additionally, the Bureau of Economic Analysis (BEA) published July’s reading of Personal Consumption Expenditures (PCE), which represents the Federal Reserve’s preferred gauge of inflation. Both the headline and core (which excludes the volatile food and energy categories) indices came in higher than expected.

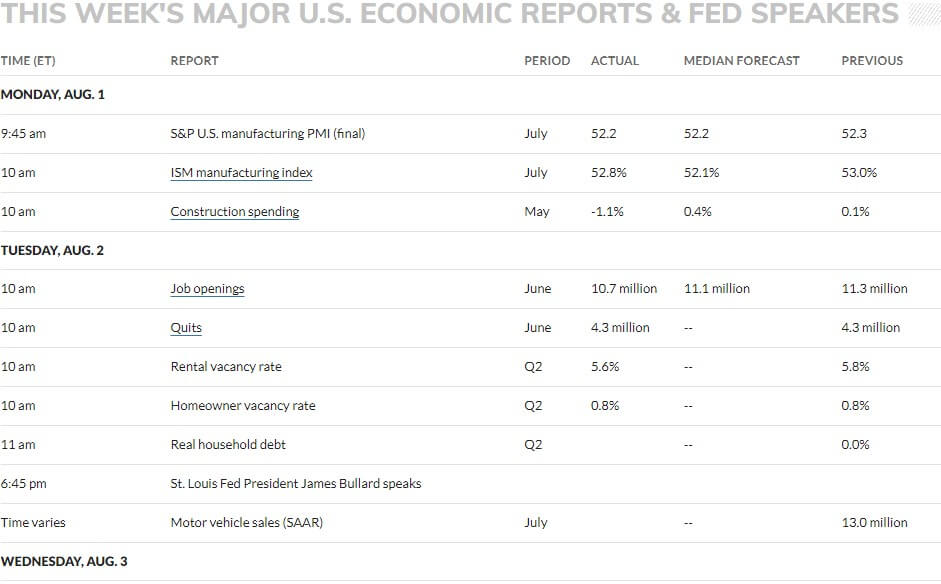

- Major economic data points to be published later this week include an update on activity within the services sector and factory orders on Wednesday. On Thursday, we will get initial jobless claims. Headlining the week of data is the jobs report that will be published Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Inflation Figure That the Fed Follows Closely Hits Highest Level Since January 1982 (CNBC)

- The Disastrous Record of Celebrity Crypto Endorsements (Bloomberg)

- Demand for Workers Fell in June to Lowest Level in Nine Months (WSJ)

Investing

- Tails You Win (Morgan Housel)

- Staying Rich (Adam Grossman)

- Investing in Home Renovations vs. Investing in Stocks (Ben Carlson)

Other

- So Is the LIV Golf Product Any Good? Here’s Analysis After Three Events (Sports Illustrated)

- The Best Family Board Games (Wired)

- Pickleball Is Booming. Not Everyone Is Happy About That (GQ)

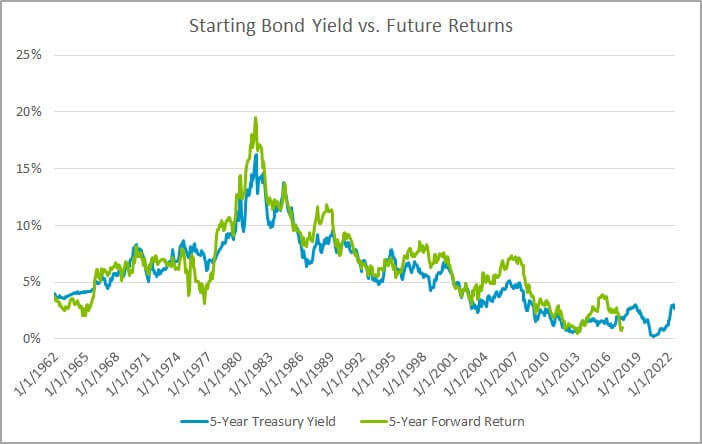

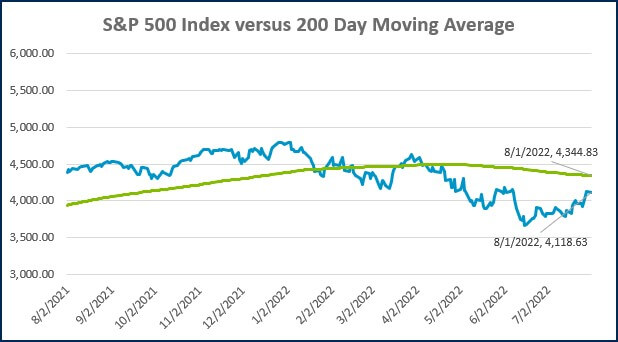

MARKETS AT A GLANCE

Source: Morningstar Direct.

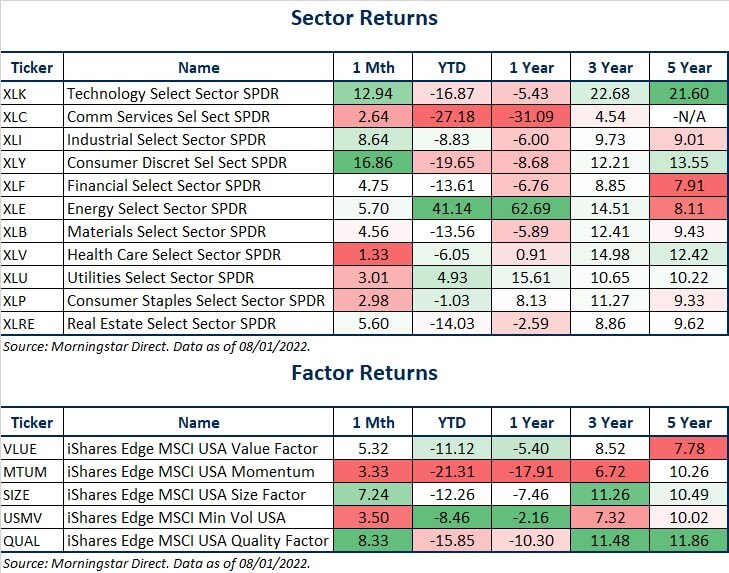

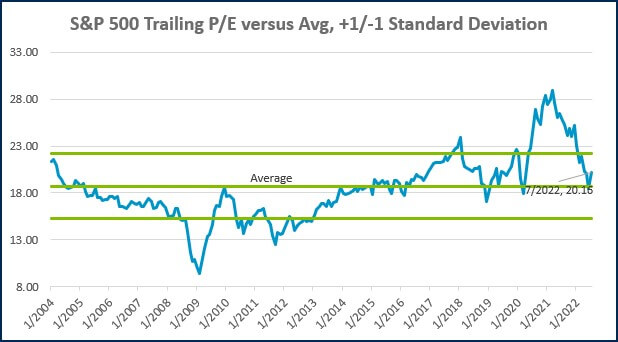

Source: Morningstar Direct.

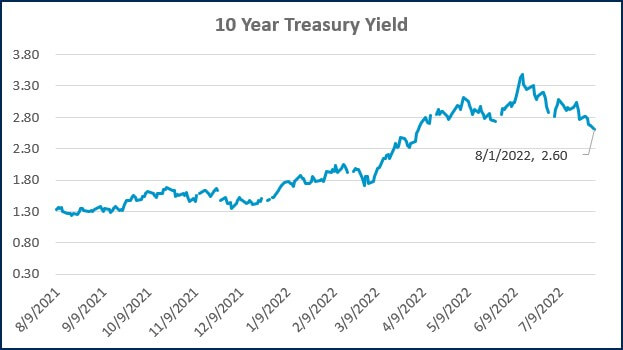

Source: Treasury.gov

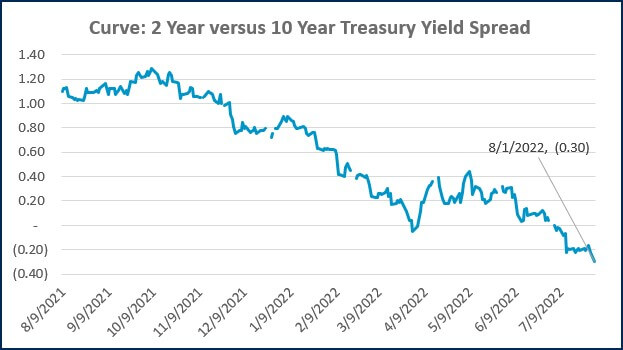

Source: Treasury.gov

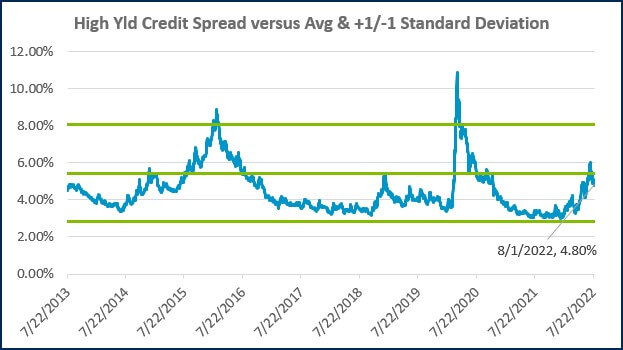

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

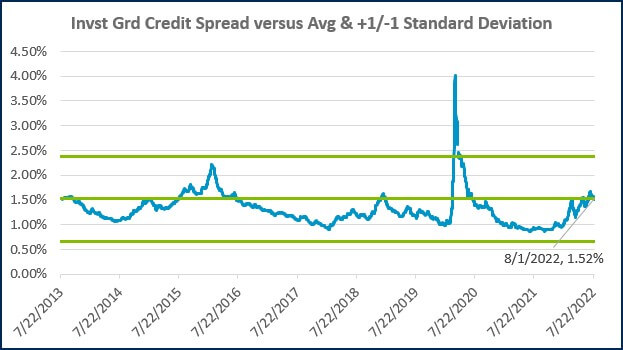

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)