The Fed Speech That Sparked a Market Selloff + Financial Market Update + 8.30.22

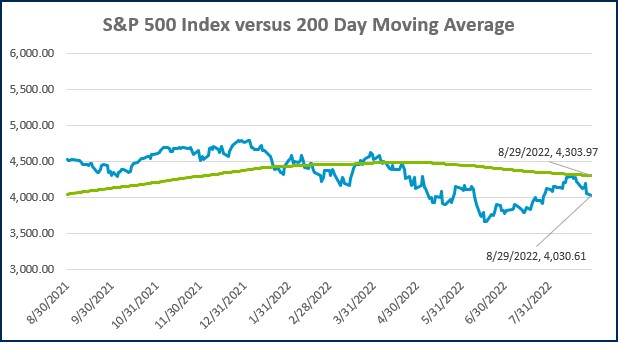

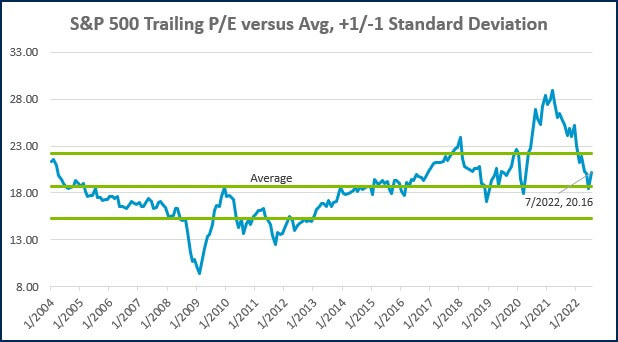

The stock market ended the last week on a sour note, with the S&P 500 falling -3.4% on Friday. The sizeable drawdown largely appears to have stemmed from a speech made by Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Symposium last week. A narrative in the market had been building recently that a slowdown in economic activity was going to induce the Fed to pivot from tightening policy to combat inflation towards moving back to an accommodative stance. During his speech, Powell poured cold water on that narrative by reaffirming the Fed’s resolve in doing whatever it takes to restore price stability.

Powell discussed three lessons that the Fed had learned in past periods of excessively high and low inflation and how they are influencing the policy moves we are seeing today. Below are the Three Lessons he spoke about:

1. Central banks can and should take responsibility for delivering low and stable inflation.

While it seems obvious now that excessive inflation is very detrimental to the economy and asset prices, this wasn’t always firmly agreed upon. Powell explained that during the high inflation of the 1970s and 80s, many central bankers and others questioned the need and ability to pursue stable prices. He went on to note, “Today, we regard these questions as settled. Our responsibility to deliver price stability is unconditional.”

2. The public’s expectations about future inflation can play an important role in setting the path of inflation over time.

The Federal Reserve doesn’t just look at ‘realized inflation,’ which is a backward-looking measure of how prices changed in the past. The Consumer Price Index (CPI) and Personal Consumption Expenditures Index (PCE) are popular measures of realized inflation. As lesson number two suggests, inflation expectations also play a critical role. This is because when consumers and businesses begin to expect that high levels of inflation will persist, they begin to make economic decisions that actually cause higher inflation. A common example of this relates to wages. If workers expect the prices of the goods and services they consume to rise rapidly, they become more forceful in their demand for higher wages. This increased cost of labor is then passed by businesses on to consumers through higher prices, creating a vicious self-perpetuating cycle.

The Fed monitors a variety of surveys and market-based estimates of inflation expectations and is constantly looking for signs that the current bout of high inflation is becoming entrenched in people’s minds. Currently, the evidence suggests that inflation expectations remain ‘well anchored,’ which essentially means that people expect inflation to return to the target of around 2%. This is especially important because of lesson three.

3. History shows that the employment costs of bringing down inflation are likely to increase with delay as high inflation becomes more entrenched in wage and price setting.

Powell noted that there were multiple failed attempts to cool the pace of price increases during the roughly 15 years of the Great Inflation. “A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

Those lessons are guiding the Fed’s fight against inflation. Powell was very direct in their intentions: “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent.” He later noted, “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

Powell’s speech was as brief as it was direct. In all, it lasted just 10 minutes, but it clearly had the desired effect. The narrative that the Fed would buckle under pressure and begin to ease policy as signs of slowing economic momentum emerge has all but disappeared (at least for now). This has been accompanied by a selloff in risk assets as the market has repriced higher rates for longer. It’s unclear how much longer the selling will continue. Luckily there have been some signs that inflation pressures have peaked and are beginning to abate. The July CPI report, for instance, showed that prices actually declined during the month. While one reading isn’t enough to suggest the fight is over, a continuation of that trend would certainly be a good sign.

WEEK IN REVIEW

- The top story from last week clearly came from the Jackson Hole Symposium, the annual conference for central bankers hosted by the Kansas City Fed. Jerome Powell’s short speech reinforced the notion that the Fed intended to continue its fight against inflation, even if it required some economic pain along the way.

- Last week, we got another update on inflation. The Personal Consumption Expenditures Index (PCE) is the Fed’s preferred gauge for measuring price changes. Similar to the previously reported July CPI figure, PCE also declined during July. Headline PCE fell from 6.8% year-over-year to 6.3%. Meanwhile, core PCE, which strips out the volatile food and energy categories, declined from 4.8 to 4.6%.

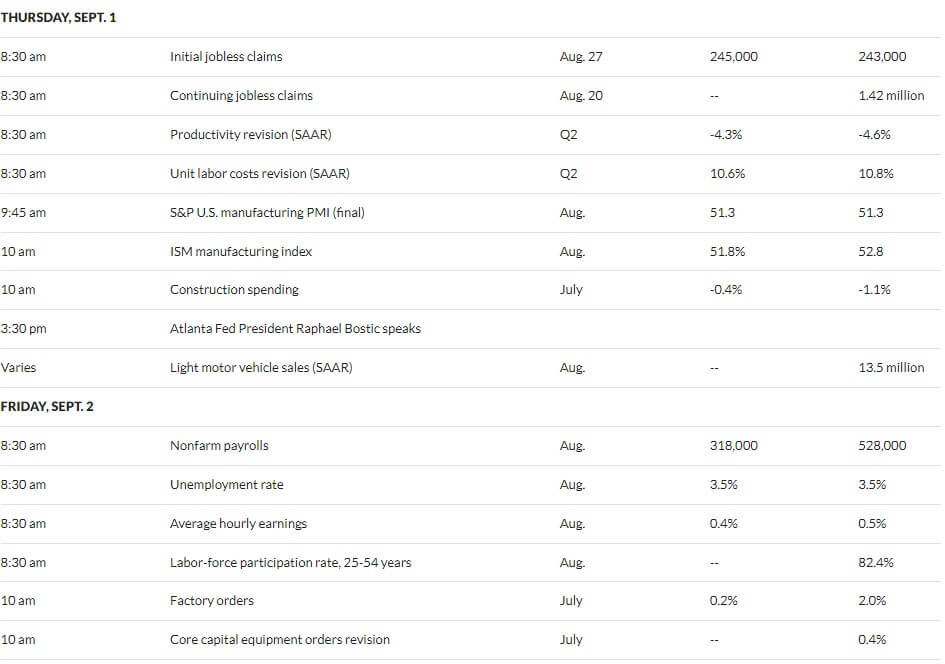

- Later this week, we will get an update on initial jobless claims (layoffs) and manufacturing activity. The week of economic data will be punctuated by the Jobs report to be published on Friday. Last month, the report surprised to the upside with a much stronger than expected 528,000 new jobs for July. Economists are expecting 318,000 new jobs for August.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Jerome Powell’s Dilemma: What If the Drivers of Inflation Are Here to Stay? (WSJ)

- Job Openings Top 11.2 Million in July, Well Above Estimate and Nearly Double the Available Workers (CNBC)

- Nobel Prize Winner Says the U.S. Needs a 1950s-Style Productivity Boom (CNBC)

Investing

- Monetary Policy and Price Stability (Jerome Powell)

- Big Beliefs (Morgan Housel)

- Tough Talk from the Fed (Ben Carlson)

Other

- Cameron Smith Leads New Wave of Defectors to LIV Golf (WSJ)

- A New Approach to Car Batteries is About to Transform EVs (Wired)

- Deliberate Practice (Humble Dollar)

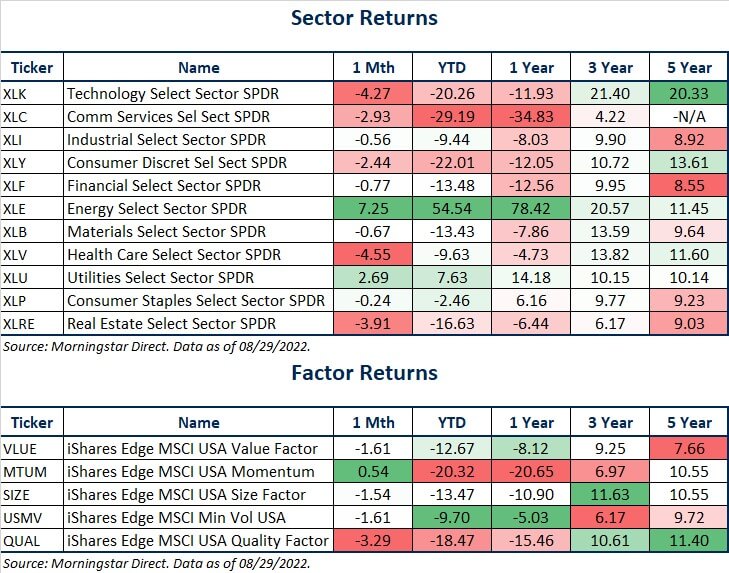

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

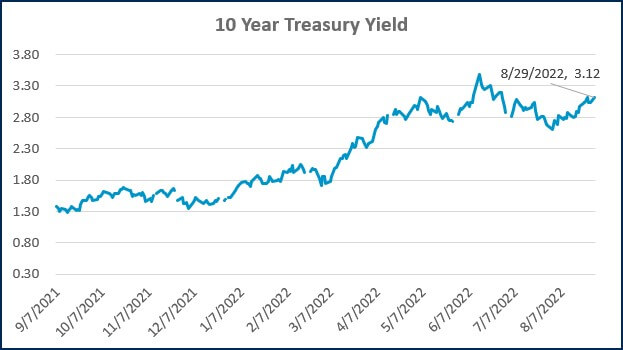

Source: Treasury.gov

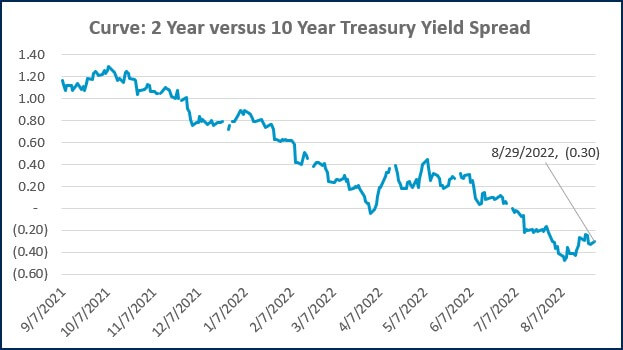

Source: Treasury.gov

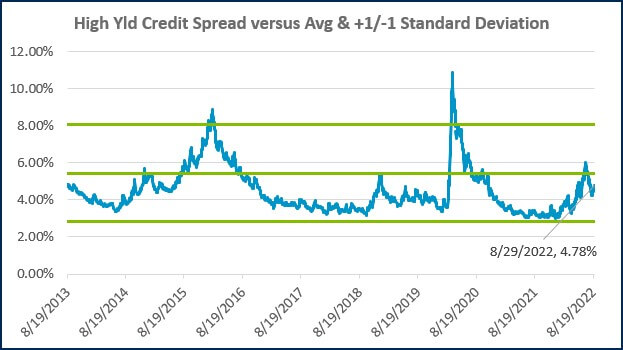

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

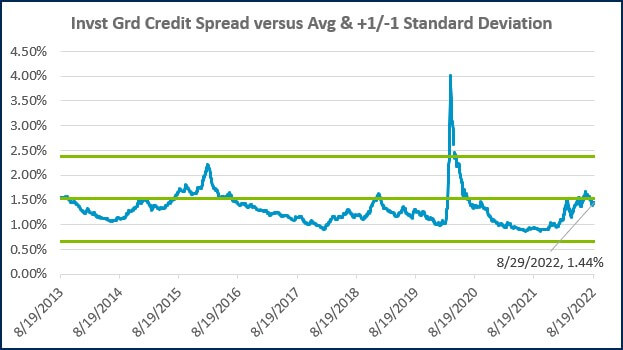

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Update: Tax Highlights of “The One, Big, Beautiful Bill”

From Seed to Scale: Tax & Operational Strategies for AgTech Startups

Case Study: A Smarter 401(k) Strategy for a Busy Doctor's Office

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)