Highlights from the Latest Tax Proposal + Market Update + 9.14.21

House Democrats via the Ways and Means Committee spelled out detail on the proposed tax increases on corporations, investors, high-income individuals and business owners on Monday. The proposed draft of a bill is 881 pages long in its current form and would still have to pass both chambers of Congress and be signed by President Biden. It could be passed as is, scrapped completely, or radically modified for passage. Investors should note some important changes being proposed that may apply to them. We will focus on those highlights as the entirety of the bill detail would encompass multiple blog entries.

- Shifts the current 35% tax bracket to $400,000-$450,000 and moves the 37% bracket to 39.6% for anyone earning more than $450,000 (married filing jointly).

- The highest long-term capital gains rates will move to 25% and apply to taxable years ending after the introduction of the act. Any gains prior to 9/13/2021 still are applied at the 20% capital gain rate.

- Surcharge of 3% on adjusted gross income in excess of $5,000,000 jointly

- Cryptocurrency would be subjected to the wash sale rules.

- Elimination of all Roth IRA conversions for those making more than $450,000 effective in taxable years after December 31, 2031.

- Effective 2022, after-tax amounts in retirement accounts will no longer be eligible for conversion to Roth accounts.

- An individual will not be able to invest IRA funds into a company in which they own greater than a 10% share.

- IRAs would be prohibited from owning private placements, even if it is a third-party investment.

- Termination of the increase in the unified credit against estate and gift taxes, reverting the credit to its 2010 level of $5,000,000 per individual, indexed for inflation as of 2022. (This inflation adjustment would make it slightly more than $6,000,000 for 2022, but less than the current $11,700,000 exemption for 2021)

- For family farms and family business for estate tax purposes, property can be valued on actual use instead of fair-market value subject to a maximum reduction of $11,700,000.

- Grantor trust proposed changes are numerous and focus on control of the assets and eliminates valuation discounts on non-business assets. Details on these current changes, as well as how they could relate to prior trusts, should be discussed with an attorney in further detail.

This is just a basic list of major changes that are inside of the proposal. It is important to note that this has a long way to go to become law as party margins in the House and Senate are razor-thin. Obviously, some of these proposals will probably be omitted, amended, or expanded on if and when a bill is ratified.

Additionally, there are some glaring omissions inside of this proposal that have been discussed by the Biden administration before. Specifically, the taxation of carried interest in private equity funds, the step-up in basis at death, state and local tax deduction caps, and Social Security solvency. These items may be addressed in future forms of the bill, but this proposal is the best indication to this point of what a new tax bill will look like.

WEEK IN REVIEW

- Economic data published this morning showed inflation remains elevated, despite easing from the prior month. Headline CPI increased 0.3% MoM, vs. expectations of a 0.4% increase and a 0.5% increase the prior month. Year-over-year inflation fell from 5.4% in July to 5.3% for the twelve months ending in August. Core CPI, which strips out the volatile food and energy components, increased by 4.0% YoY, compared to 4.3% the prior month.

- Core CPI was the lowest it has been since February, leading some economists to believe the pace of price increases has peaked. Components of the index that had previously been pushing the metric higher, including used car prices and transportation services, saw their prices decline during August.

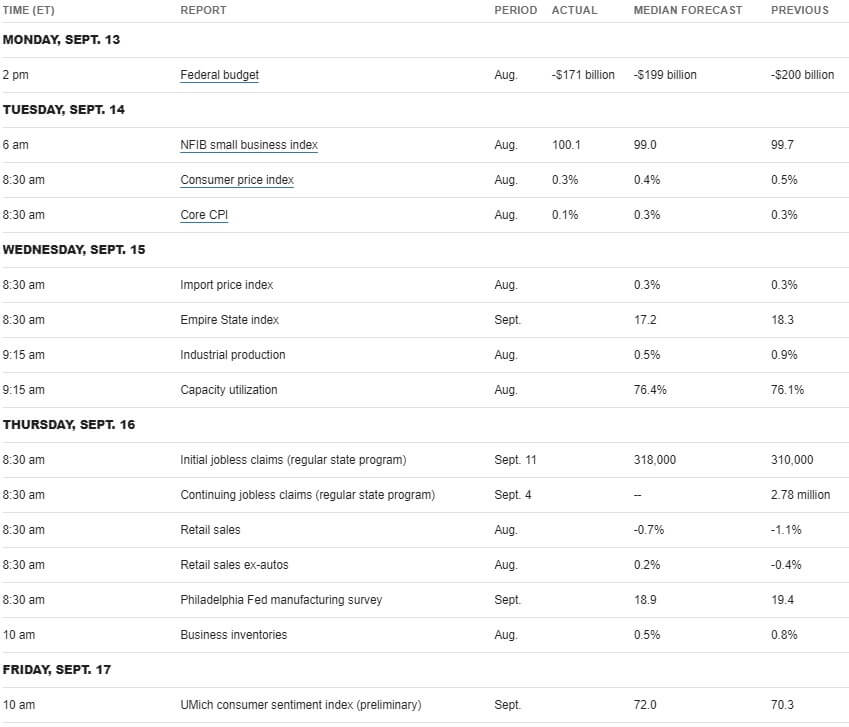

- Other economic data to be published this week includes industrial production and capacity utilization on Wednesday, jobless claims and retail sales on Thursday, and consumer sentiment on Friday.

ECONOMIC CALENDAR

Source: MarketWatch

HOT READS

Markets

- Inflation Eased in August, Though Still High (WSJ)

- Businesses are Feeling Stronger Inflation and Paying Higher Wages, Fed’s ‘Beige Book’ Says (CNBC)

- Weekly Jobless Claims Post Sharp Drop to 310,000, another new Pandemic Low (CNBC)

Investing

- Every Forecast Takes a Number From Today and Multiples it by a Story About Tomorrow (Morgan Housel)

- Why Financial Manias Persist (Ben Carlson)

- What You’ve Lost in This Bull Market (Jason Zweig)

Other

- Facebook Knows Instagram Is Toxic for Teen Girls, Company Documents Show (WSJ)

- Facebook Allows Prominent Users to Break Rules (Axios)

- ‘Is This My Life Now?’: Clemson Defensive End Justin Foster’s – and My – Struggle with Long-Haul Covid (ESPN)

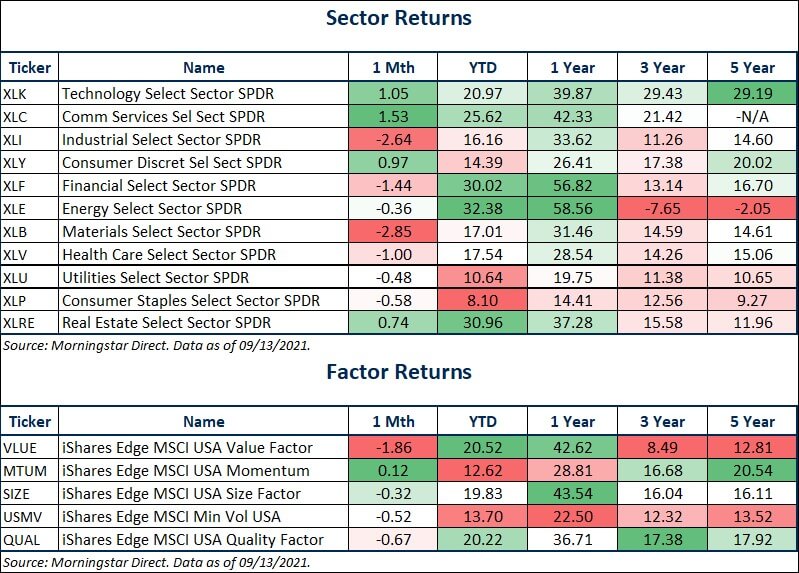

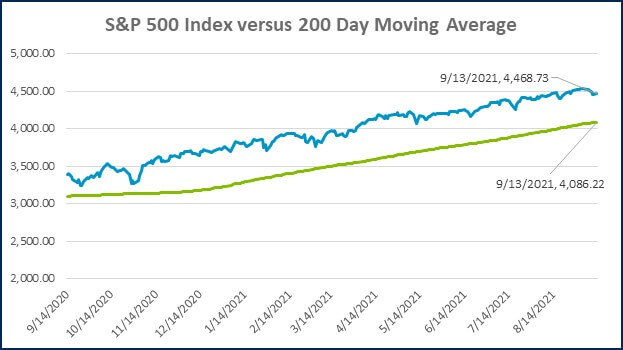

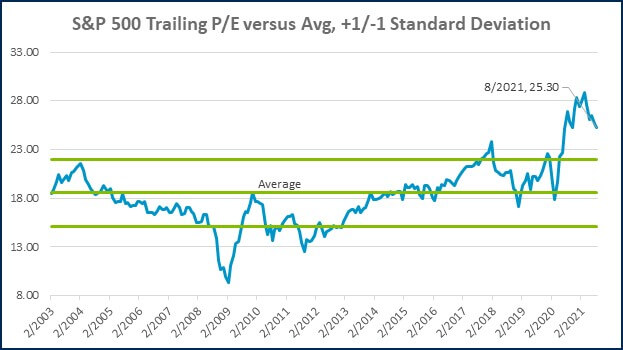

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

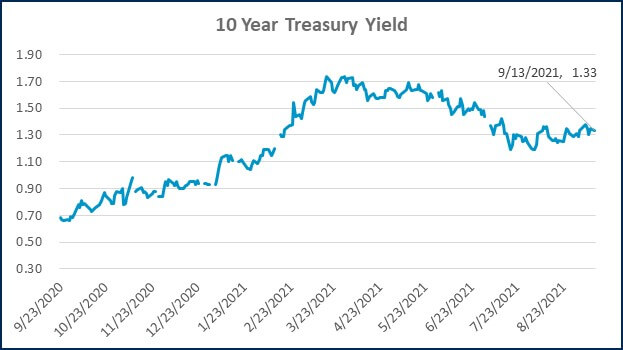

Source: Treasury.gov

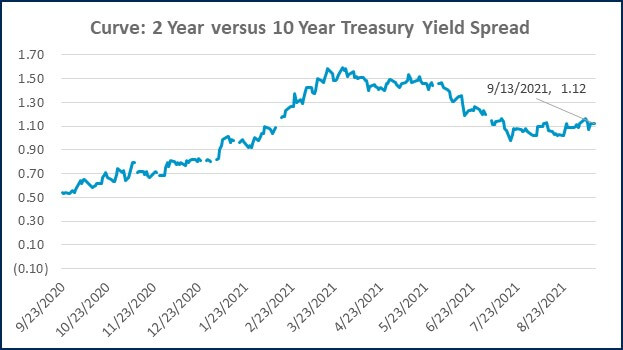

Source: Treasury.gov

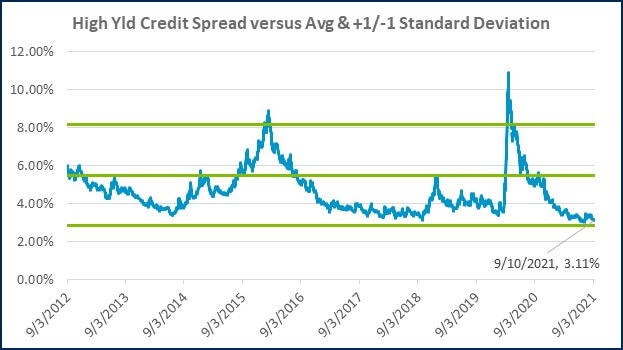

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

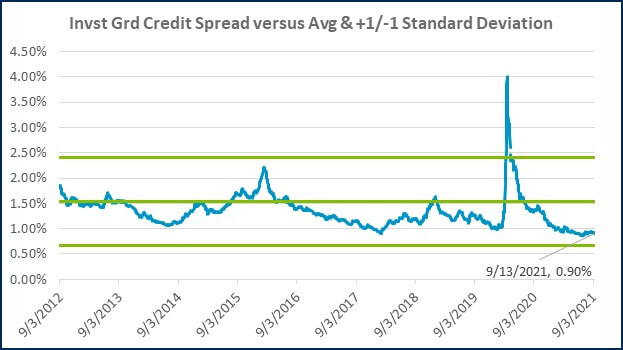

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)