Important Tax Changes and Cost of Living Adjustments for 2023

The Internal Revenue Service and other government agencies have made several recent announcements regarding changes to many tax provisions, schedules, and other adjustments in recent weeks. Below we will provide a summary of the major changes that will affect everyone in some way. As always, it is best to consult your tax professional as to how they directly relate to you!

Marginal Income Tax Brackets

While the marginal income tax rates will remain the same for 2023, the income thresholds for those brackets have jumped roughly across all brackets for 2023. The increase in income brackets is roughly 7% across all brackets except the very lowest end from 2022’s income levels.

| Marginal rate | Individual income | Married couples filing jointly |

| 10% | $11,000 or less | $22,000 or less |

| 12% | $11,000 to $44,725 | $22,001 to $89,450 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 |

| 35% | $231,251 to $578,125 | $462,501 to $693,750 |

| 37% | $578,126 or more | $693,751 or more |

Data: IRS

Standard Deduction

The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 from $25,900 in 2022. For single taxpayers and married taxpayers filing separately, the standard deduction rises to $13,850 this coming year versus $12,950 in 2022. *Remember, any individual over age 65 will also get the elder additional $1,850 deduction, so a married couple both over age 65 will receive a standard deduction of $31,400.

Earned Income Tax Credit

For 2023, the maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers who have three or more qualifying children, up from $6,935 a year prior. This credit has a table providing the amount for other family numbers, income thresholds, and phase-outs beyond the scope of this writing.

Annual and Lifetime Estate and Gift Tax Exemptions

The annual exclusion for gifts increases to $17,000 for 2023, up from $16,000 during 2022.

Estates of individuals who pass away during 2023 have an estate exclusion amount of $12,920,000, which is up from a total of $12,060,000 for those individuals who passed in 2022.

Earnings Subject To FICA Tax

The maximum amount of earnings subject to the Federal Insurance Contributions Act (which funds Social Security) – or FICA tax – will increase to $160,200 in 2023 from $147,000.

Alternative Minimum Tax

The AMT exemption amount for 2023 is $126,500 for married couples filing jointly and begins to phase out at $1,156,300. Alternatively, for individuals, the amounts begin at $81,300 and start to phase out at $578,150.

Social Security Cost of Living Increase

Social Security and Supplemental Security Income benefits will increase by 8.7% across the board for all beneficiaries beginning in 2023. This amounts to roughly an additional $140 benefit per month on average starting in January.

401(k), SIMPLE IRA, and IRA/Roth IRA Contribution Limits

The 2023 401(k) employee contribution limit will be $22,500, which is up from $20,500 in 2022. The change also applies to 403(b) plans, 457 plans, and the government’s TSP plan. Those over age 50 will be able to contribute an extra $7,500 to the same plans, which is up from $6,500 this year.

Simple IRA contribution limits will increase to $15,500 for 2023, a $1,500 increase from 2022. There is a catch-up component for individuals over age 50 for a total contribution limit of $19,000.

IRA contributions will also be increasing to $6,500 for 2023 versus the $6,000 level for 2022. However, the catch-up contribution for those over 50 years of age to an IRA will remain at $1,000.

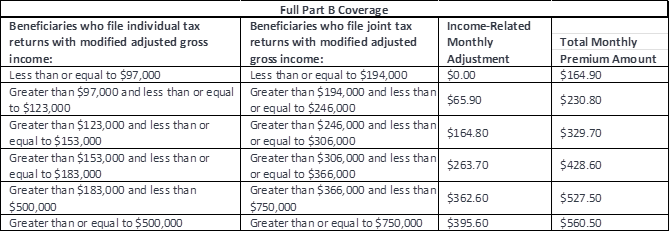

Medicare Premiums

After a sharp increase in 2022, Part B Medicare monthly premiums will decline to $164.90 in 2023 from $170.10 in 2022. The Part B deductible will also decline to $226 in 2023 from $233 in 2022, according to The Centers for Medicare and Medicaid.

The Center for Medicare and Medicaid also announced that the income brackets and adjustments for Medicare Part B premiums for 2023 will be adjusted higher as well.

Data: www.cms.gov

If you have immediate questions or concerns, please contact Lutz Financial today.

- Analytical Strategic Consistency Includer Input

Justin Vossen, CFP®

Justin Vossen, Investment Advisor and Principal, began his career in 1997. With extensive experience in finance, banking, and investment management, he brings comprehensive expertise to his role advising high-net-worth clients and foundations. As a member of the Lutz Financial Board his leadership extends beyond client relationships to shaping the firm's direction.

Leveraging his background in bond trading and portfolio management, Justin focuses on providing comprehensive investment and planning services. He develops tailored financial strategies across wealth management, retirement planning, and estate planning. Justin values creating solutions that give clients peace of mind about their financial situations.

At Lutz, Justin establishes unshakeable trust through his analytical mindset and strategic approach to investment management. He takes time to understand what truly matters to each client—whether it's retiring early or successfully transferring a business—and then builds comprehensive financial strategies to help them get there.

Justin lives in Omaha, NE. Outside the office, he can be found spending time with his wife, Nicole, and their children, Max and Kate.

Recent News & Insights

Update: Tax Highlights of “The One, Big, Beautiful Bill”

From Seed to Scale: Tax & Operational Strategies for AgTech Startups

Case Study: A Smarter 401(k) Strategy for a Busy Doctor's Office

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)